By Robert Mandelbaum

As the pace of revenue growth continues to decelerate for U.S. hotels, the capability of hotel operators to control costs will determine the ability of a property to increase profits from year to year. According to the 2018 edition of Trends® in the Hotel Industry, total operating revenue increased by just 2.0 percent in 2017 for the average hotel in the survey sample. Fortunately, by limiting the growth in operating expenses to 1.9 percent, managers at the Trends® properties realized an increase in gross operating profits (GOP) for the year.

Unlike 2016, it was non-labor related costs that were the primary driver of expense growth in 2017. Labor related costs accounted for just 48 percent of the expense growth from 2016 to 2017. This compares to 90 percent of the change from 2015 to 2016.

Further, within the labor costs, it was the benefit component that drove the rise in this metric, as opposed to the payroll costs. In 2017, the combined total of payments made for salaries, wages, service charges, contract labor, and bonuses (payroll costs) increased by 1.8 percent. This is less than the 2.0 percent rise in payroll-related expenses (i.e. employee benefits). This is a reversal of the recent trend of payroll increases exceeding benefit growth.

To examine how U.S. hotel controlled payroll costs in 2017, we examined the individual components of payroll. The CBRE Trends® survey tracks five payroll sub-categories within each operating and undistributed department of a hotel. The sub-categories are consistent with the 11th edition of the Uniform System of Accounts for the Lodging Industry (USALI). They are:

- Salaries and Wages: Non-Management

- Salaries and Wages: Management

- Service Charge Distribution

- Contract, Leased, or Outsourced Labor

- Bonuses and Incentives

A sixth sub-category is used by CBRE to track other compensation data that is not identified, but this totals just 0.6 percent of payroll costs.

The following paragraphs summarize our analysis of the 2017 labor cost data from 4,512 properties in the Trends® sample that provided detailed labor cost information in conformity with the 11th edition of the USALI. For the purposes of this analysis, we refer to the entirety of non-benefit compensation as “payroll.”

Payroll Components

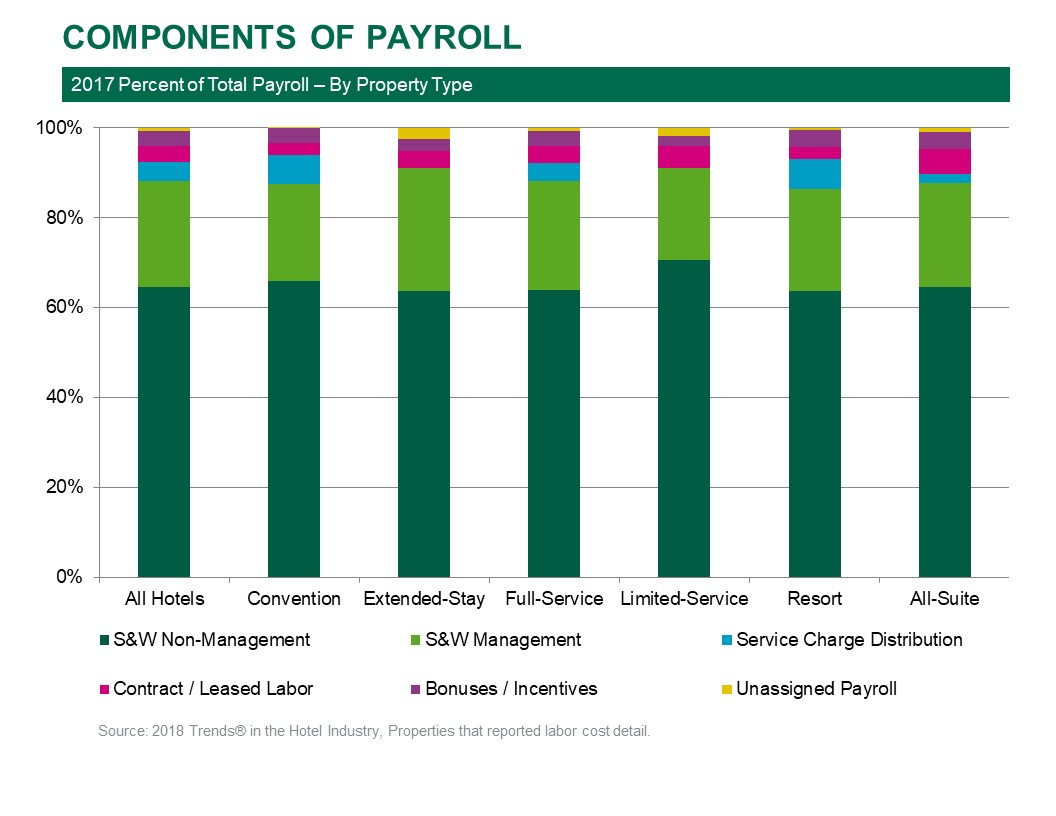

The salaries and wages paid to non-management personnel comprised 64.5 percent of payroll in 2017, followed by the salaries and wages paid to management (23.5%). The remaining 12.0 percent consisted of service charge distributions, payments to contract/leased labor, bonuses, and unassigned payroll.

Non-management salaries and wages measured as a percent of payroll was greatest at limited-service hotels (56.4%), while management salary and wage payments were the most at extended-stay hotels (21.4%). Given the high incidence of mandatory gratuities, it is not surprising that service charge distributions made up the greatest percentage of payroll at resort (4.8%) and convention (4.4%) hotels. All-suite hotels allocated the greatest percent of their payroll dollars to contracted/leased employees (4.4%).

The two property types that achieved the greatest gains in revenues and profits in 2017 appear to have rewarded their employees for these accomplishments. During the year resorts (2.9%) and all-suite hotels (2.8%) spent the greatest percentage of their payrolls on bonus and incentive payments.

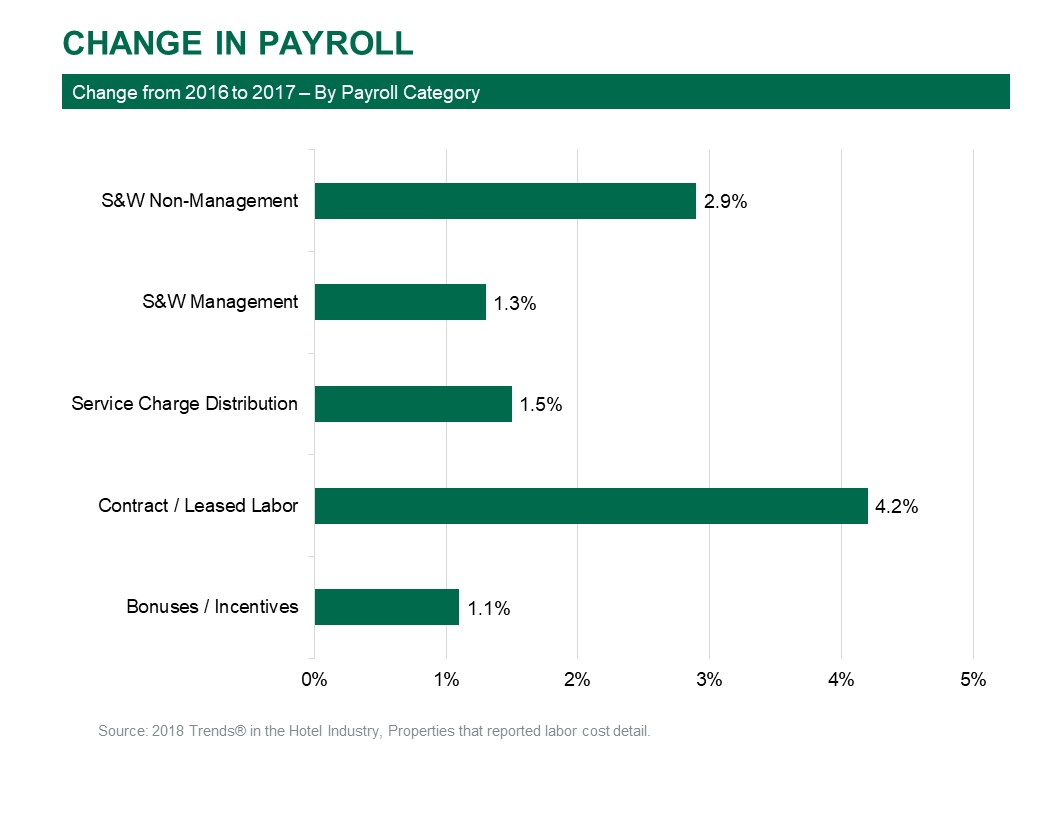

From 2016 to 2017, the payroll component that saw the greatest percentage increase was contract/leased labor (4.2%). As noted later in this article, the incidence of hotels using contract/leased labor also rose during the year. Elsewhere in payroll, service charge payouts increased by 1.5 percent, while bonuses and incentives grew by 1.1 percent.

In 2017, the salaries and wages paid to non-management employees (2.9%) grew at a greater pace than the salaries paid to managers (1.3%). By combining Bureau of Labor Statistics data with the results of our Trends® survey, it appears that the increase in occupancy did cause a need for greater hours among non-management personnel. To offset the rising cost of non-management payroll, it appears that increases to management salaries were limited.

Incidence of Components

Contract, Leased or Outsourced Labor

The use of contract/leased labor is frequently cited by operators as a tactic that can be implemented to overcome labor shortages, and potentially control the rising costs of compensation. In 2017, 46.2 percent of the properties in the study sample reported payments made to contract/leased employees in at least one of their departments. This is an increase from 45.3 percent of properties in 2016.

Given the difficulties hotels are having finding qualified employees, it is logical that the highest incidence of contact/leased employees was observed at the property types in need of the greatest number of employees. Resorts (73.0% of hotels) and convention hotels (62.7%) reported the highest percentages of payments made to contract/leased employees. On the other end of the spectrum, extended-stay hotels, with the lowest staffing requirements, reported the least incidence of payments to contact/leased employees (35.5%).

Among all departments, the greatest use of contract/leased employees in 2017 occurred in the food and beverage department (32.2%) and rooms (32.2%) departments. Staffing levels in these departments vary with business volumes. Therefore, managers have found it more prudent to operate these areas “on demand” with temporary employees provided by staffing agencies.

Service Charge Distribution

Overall, the incidence of paying service charges grew from 17.6 percent of the sample in 2016 to 18.3 percent in 2017. Resorts (63.5% of hotels) with mandatory resort fees, and convention hotels (49.2%) with mandatory banquet charges, are the property types most likely to pay service charges to their employees. As expected, the distribution of service charges was most frequently observed in the food and beverage department (38.4%).

Bonuses and Incentives

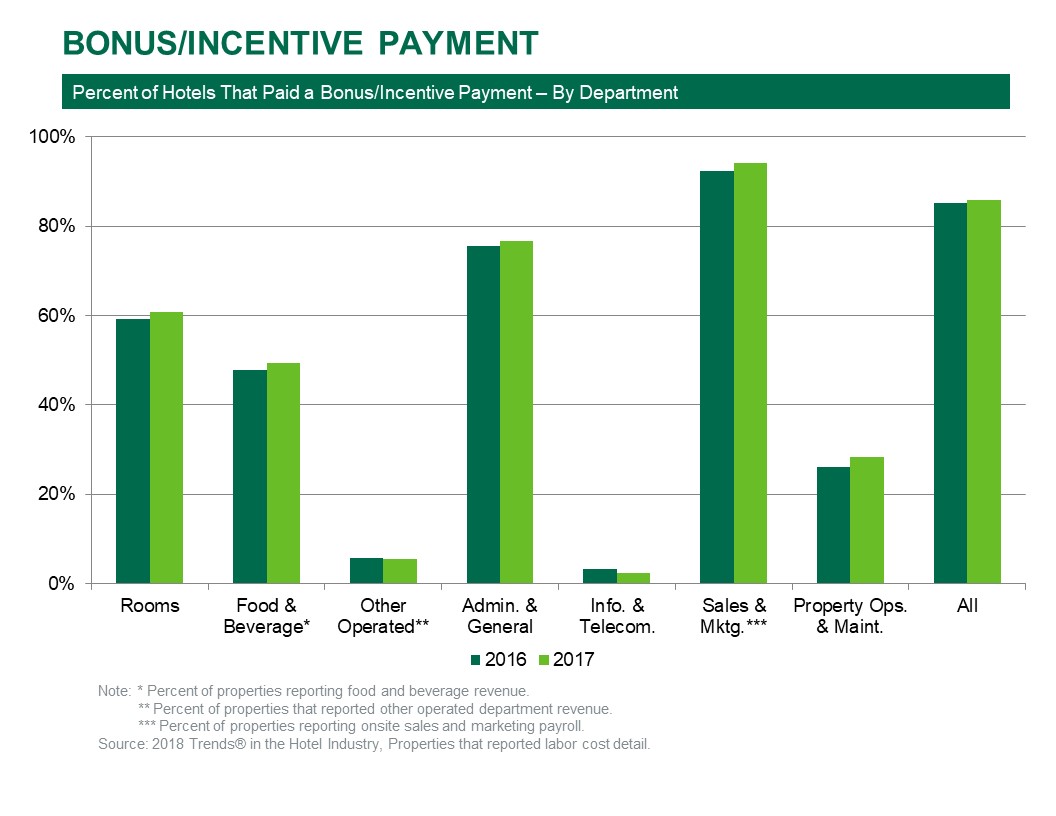

The aggregate dollar amount of bonus payments increased by 1.1 percent from 2016 to 2017, while the number of hotels that paid bonuses during the year rose by 0.6 percent. On average, GOP at the 4,512 properties in the study sample grew by just 1.4 percent. The changes in bonus payments are commensurate with the lackluster improvement on the bottom line.

Employees in the sales and marketing (94.1% of hotels) and administrative and general (76.7%) departments were mostly likely to be paid a bonus. This is consistent with the typical compensation agreements for general managers, as well as sales personnel. Least likely to receive a bonus in 2016 were employees in the other operated and information and technology departments.

Payroll Pressure

The U.S. labor market is very tight, especially in the leisure and hospitality industry. According to the Bureau of Labor Statistics (BLS), the current level of open jobs in the sector equates to 5.3 percent of the total personnel currently employed. This is the highest level since 2000 and indicative of the difficulty hospitality managers are having finding qualified employees. Further, the tight labor market puts upward pressure on salary and wage rates.

Not only is labor the largest single expense within a hotel, it has become the most difficult operational element to manage. The ability of operators to creatively find staff, satisfy employees, improve productivity, and continue to provide quality guest service will go a long way towards maintaining growth in profits.