By Michael Smithson, McKenna Luke

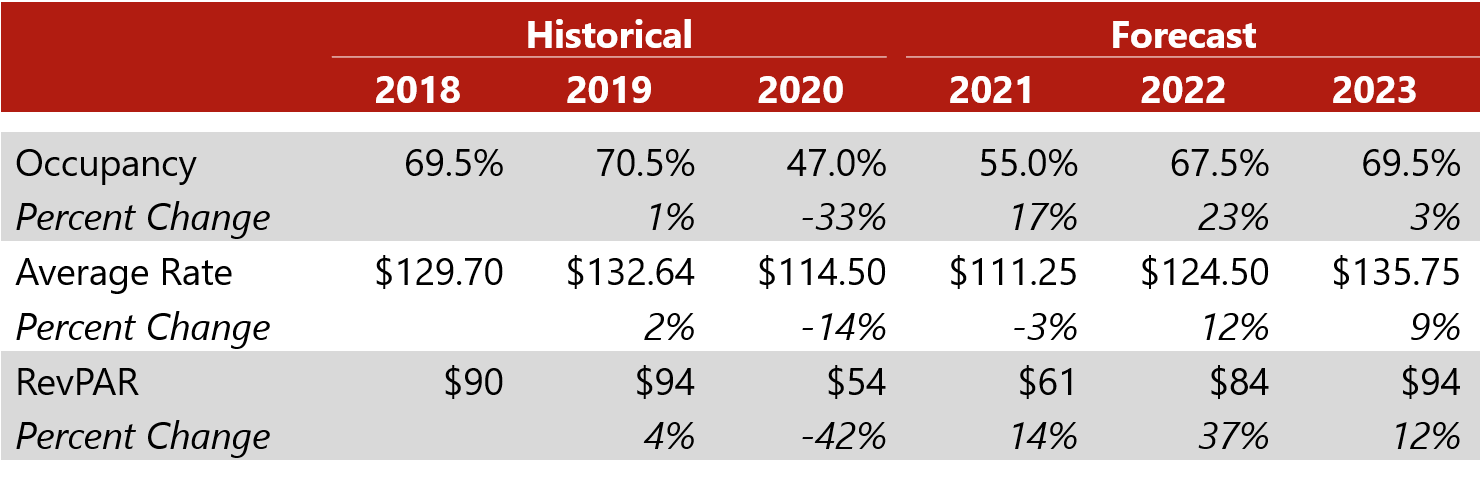

During the Great Recession, Metro Phoenix’s[1] occupancy fell nearly 16 points from its pre-recession peak of 68.2% in 2006 to 52.4% in 2009. However, occupancy fell from the 2019 peak of 70.5% to 47.0%[2] in 2020, reflecting roughly a 24-point correction. Although average daily rate (ADR) declined 19% from a pre-recession peak of $124.80 in 2008 to a low of $100.94 in 2010, ADR only fell 14% in 2020, from $132.64 in 2019 to $114.44 in 2020. The impact of the COVID-19 pandemic on Phoenix has been two-fold. The first quarter is peak season in Phoenix; as such, some of the strongest months out of the year had passed prior to the onset of the pandemic. On the other hand, peak season for a majority of the top 25 markets is spring and summer. Furthermore, business- and travel-related restrictions related to COVID-19 have been less strict in Phoenix than in other markets, allowing for tourism and group business.

This seasonality provides for a unique forecasting situation in which ADR is expected to be highly affected in 2021, as the peak season early in the year will be impacted by the ongoing COVID-19 pandemic, whereas ADR growth is forecast for a majority of the other top 25 markets given that the first quarter of the year typically represents a low season. For Phoenix, the full impact of the pandemic will not be realized until after the first quarter of 2021.

Major factors contributing to the 2020 data are summarized as follows:

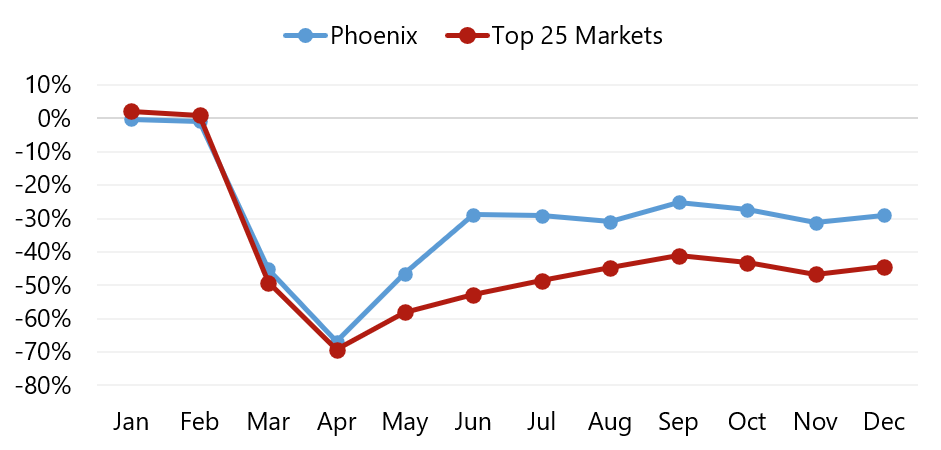

- The Phoenix area has fared significantly better than most top 25 metros given its seasonality patterns, heavy base of leisure demand, and proximity to a large drive-in demand base. Although Phoenix performed similarly to the top-25 market index through April, it outperformed the index during the summer months. June through August is the slowest period for meeting/group demand (followed by December) in Phoenix; thus, the lack of this type of demand did not affect the market to the same extent as many others. Furthermore, domestic tourism increased given the ability for many people to work remotely (from anywhere), thus drawing Americans from other states to Arizona, compounded by international travel restrictions.

Occupancy Change by Month (2019 vs. 2020)

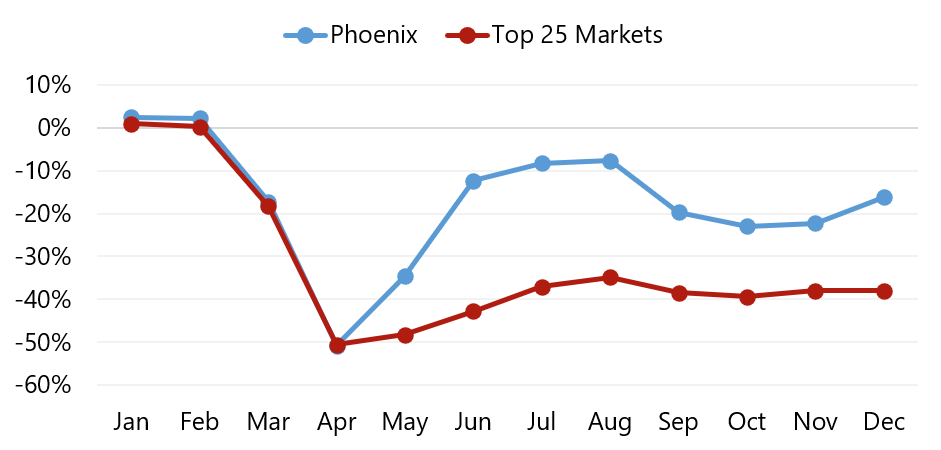

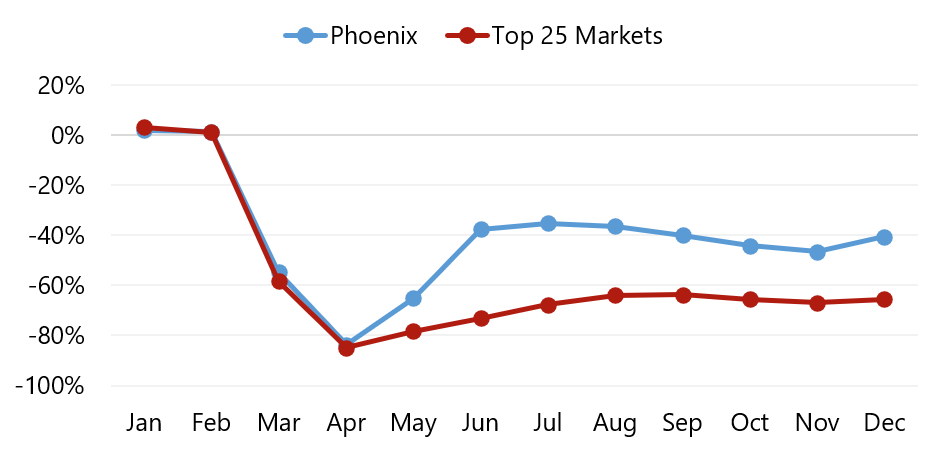

- Furthermore, the 2020 RevPAR decline of about 40% (rounded) in Phoenix was lower than the roughly 60% (rounded) drop for the top-25 market index, due primarily to ADR decreasing at a notably lower pace given the already lower rates during the summer off-season in Phoenix; moreover, transient demand represented a higher portion of overall demand (at higher rates than meeting/group demand).

- An interesting dynamic has come into play at higher-end resorts where a notable gap in rates between leisure and meeting/group business typically bolsters occupancy at the expense of overall ADR. During the pandemic, the lack of large groups has allowed more last-minute bookings at a notably higher rate for leisure travelers, thus mitigating the ADR decline. During the summer months, total ADR in some markets, such as Scottsdale, increased by over 20% compared to 2019 given the increased mix of transient demand that can exceed group overall rates by $50 during those months. We have considered this factor in our forecasts, as transient rates during the peak season (first quarter of the year) typically exceed group rates by $100.

- Meeting/group demand was virtually non-existent from April through June of 2020. A minimal amount of group business returned to the market during the second half of the year in the form of weddings and board meetings. These smaller groups are typically accommodated at a higher ADR than larger conferences but have a modest impact on occupancy recovery.

- In addition, the leisure segment has been buoyed by Arizona’s relatively limited restrictions, attracting leisure travelers from states with more restrictive mandates, like California, especially around three-day weekends. As an additional result of Arizona’s more lenient restrictions, many sports leagues out of Southern California have relocated tournaments to Arizona. Furthermore, “snowbirds” visiting from the Midwest remain a source of demand, with many of these visitors maintaining their annual trips.

- Similar to national trends, group-centric, full-service hotels are performing at the bottom of the range, while the impact on highway-adjacent, economy hotels has been minimal. CVB officials from around the Valley report that submarket performance is largely driven by the product available in each submarket. Scottsdale and Downtown Phoenix, with an abundance of luxury and upper-upscale resorts, as well as large convention hotels, have been among the more affected submarkets, whereas the Interstate 17 Corridor submarket has fared better

Major factors contributing to our forecast are summarized as follows:

- With widespread vaccine distribution not expected until summer, first-quarter 2021 performance is expected to be significantly depressed compared to the same period last year. Roughly 50% of the 2020 revenue was earned during the first quarter, despite the onset of the pandemic in the peak month of March. Although a larger proportional share of revenues was earned during the first quarter than a typical peak season, the effect was amplified during 2020. The full impact of the COVID-19 pandemic will be realized in 2021.

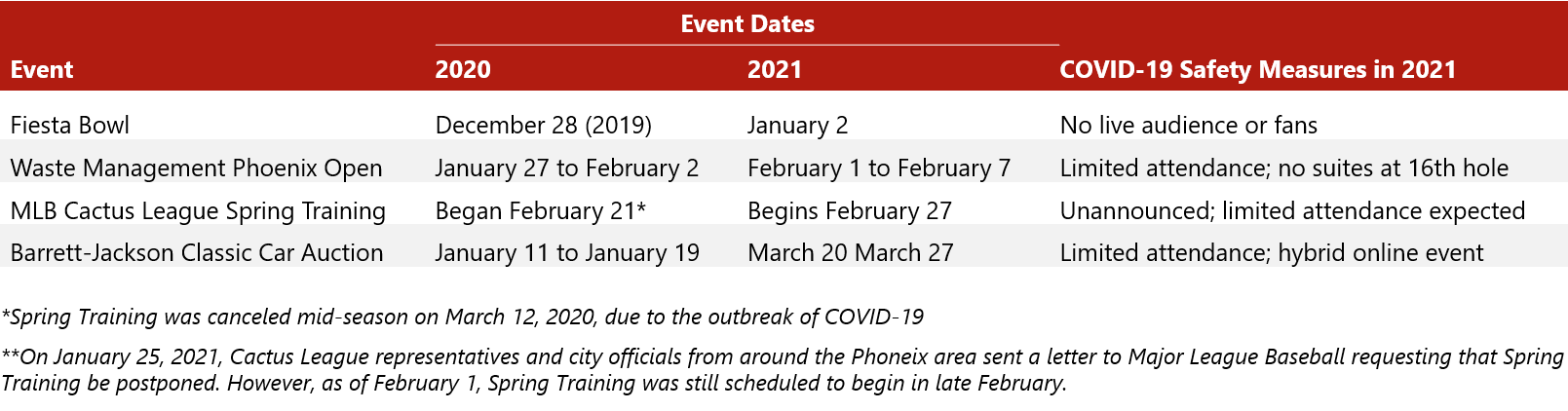

- In addition to reduced demand, especially among corporate travelers and groups, major peak-season events, such as the Waste Management Phoenix Open, are expected to implement reduced capacity and social-distancing measures. The following table illustrates changes made to each major event in the first quarter.

- According to Visit Phoenix, roughly one-third of groups that canceled conventions and events at the Phoenix Convention Center have rebooked for future convention cycles; additionally, the booking pace through 2027 is reportedly up. Many resorts and conference center hotels have reported a similar pattern for in-house bookings in 2022 and beyond.

- Group cancellations have continued through the first half of 2021; however, as the vaccine is widely distributed and travel levels increase, we anticipate meeting and group demand to rebound in the second half of 2021. The return of many events in late 2021 and early 2022 to full capacity should bolster group confidence to return to Phoenix. During the second half of 2020, groups were booking with a very short window (less than a week); thus, any pent-up demand is expected to be facilitated as soon as a vaccine or other medical therapies for the treatment of COVID-19 are readily available. Meeting/group demand is forecast to exceed 2019 levels by 2023, bolstered by this market’s attractive southwestern location and the depth of demand in the greater region.

- Because the Phoenix area’s peak season occurs in the first part of the year, Phoenix’s recovery will likely lag the nation’s recovery in 2021. However, occupancy is expected to recover by 2022, and elevated demand associated with the Super Bowl in 2023 and the Final Four NCAA basketball tournament in 2024 should contribute to ADR and RevPAR recovery in those years.

We are confident the Metro Phoenix market will rebound upon the return of normal travel as the distribution of the COVID-19 vaccine reduces the risk and rate of infections, the retirement of group meeting restrictions, the reopening of the convention center, and the resumption of corporate and group travel. We continue to watch the factors affecting Phoenix lodging, and our many consulting engagements throughout the metropolitan area allow us to keep our finger on the pulse of the market.

For more information, contact Michael Smithson and McKenna Luke, MAI, who are based in the city and the region, respectively.