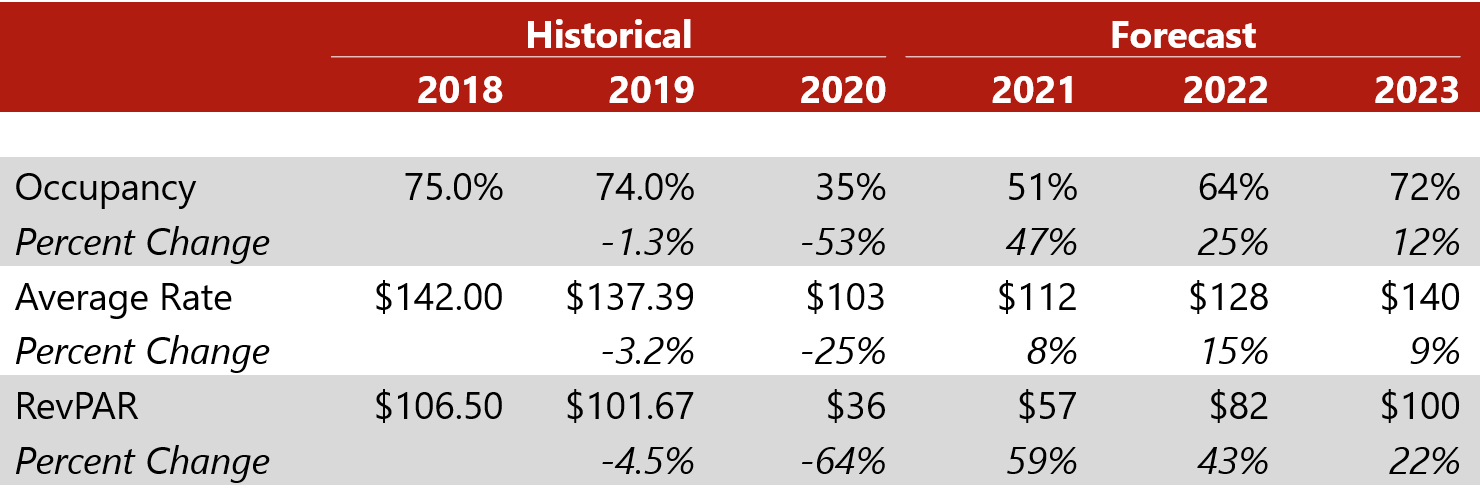

February 2, 2021 – Amid a worldwide pandemic, the lodging industry is facing a downturn that is greater than the past two lodging-market declines combined. Our estimate is that local occupancy declined from the 2019 benchmark of roughly 74% to 35% in 2020, reflecting a 53-point correction, while ADR declined 25% ($137 to $103).

Source: STR (Historical Years) and HVS (Forecast)

2020 Major Factors

- Virtually all significant corporate travel dissipated in 2020 because of the widespread impact of the COVID-19 pandemic. While most businesses began reopening in late May 2020, major employers such as Nike and Intel, as well as other major corporations, allowed employees to continue working remotely, and restrictions on non-essential travel extended through December 2020. Moreover, in July 2020, Nike implemented changes that are anticipated to result in 700 layoffs and approximately $250 million in employee termination costs, as the company restructures to streamline operations. Reportedly, the company was in the planning stages of restructuring prior to the pandemic.

- The Oregon Convention Center (OCC) effectively remains closed for business. After suspending operations in March 2020 due to the pandemic, a portion of the OCC was converted to a homeless shelter for the city of Portland and expanded its offering to those displaced by wildfires in September 2020. As of January 2021, the center has been converted to a vaccination site, with hopes that roughly 7,500 vaccinations will be administered there daily. While Multnomah County entered Phase I reopening in June 2020, indoor events were limited to only 50 people and excluded all social events; therefore, the OCC essentially remained closed. In November 2020, a surge in COVID-19 cases resulted in a two-week freeze, including the closure of all indoor event venues. Following the freeze and under new framework, Multnomah County was designated as an “extreme risk” county; indoor gatherings were prohibited through the end of 2020. Reportedly, all major events at the convention center have been canceled through June 2021. The widespread distribution of the vaccine will help instill confidence as organizations look to rebook future meetings once it is safe to do so.

- The city’s budget/economy and extended-stay hotels performed better than other hotel types, showing some resiliency during the pandemic. Hotels located along Interstate 5 and near Portland International Airport are also experiencing less severe occupancy declines. We expect this foundation to stay in place, with extended-stay and lower-priced demand representing the majority of room nights to be generated in the January 2021 through April 2021 period, in particular.

- Despite the impact of COVID-19 in the greater Portland market, the Oregon Coast has benefited from increased leisure travel since June 2020. Given that leisure travelers have relied on drive-to destinations during the pandemic, the Oregon Coast has been a popular option. According to hoteliers, properties performed better during the summer and fall months of 2020 than previous years.

- In addition to the impact of the pandemic, Portland was also affected by social injustice demonstrations. At Pioneer Square Courthouse, protests relating to the Black Lives Matter movement occurred from Mary 2020 through November 2020. In late July 2020, Portland’s protests gained worldwide attention, as protestors clashed with federal agents that were sent to the city in July. While most protest-related activities were peaceful, the occupation against police brutality was overshadowed by disruptive activities such as looting and tear-gas tactics from law enforcement. The activity portrayed an unwelcoming environment in Downtown Portland to leisure travelers, while most of the neighborhood businesses boarded their windows or closed during that time. While the social injustice demonstrations have largely ended since the presidential election, the full impact on the national perception of Portland has yet to be realized.

Looking Forward

- Corporate and transient travel generally declines in Portland during the coldest winter months, and the first quarter of 2021 is expected to be no different, limited to essential travel only. Restrictions on indoor dining and entertainment venues will limit staycation weekend travel. Accordingly, further ADR discounting is expected, as is typical for the market during the winter. The early spring months will also be challenged, as group demand will remain at bay, and corporate travel is not anticipated to heat up until late spring or early summer.

- Major companies in the greater Portland market continue to extend work-from-home policies. Reportedly, Nike and Intel extended their policies to allow employees to work from home through the end of the spring. These policies are largely anticipated to impact corporate-related travel, although vendors and contract workers associated with companies headquartered in the area have increased travel to/from Oregon. Furthermore, Nike plans to open two new buildings in 2021 on its headquarters campus, further consolidating its facilities there.

- A stronger market is expected for the summer of 2021, relative to 2020, as the nation is anticipated to emerge from pandemic restrictions, and the widespread distribution of the vaccine should be well underway. Given the impact of the pandemic on major metro areas and the social demonstrations, Portland’s occupancies did not exceed 40% during the summer months; in 2021, we expect summer occupancy to reach the high 60% range across the Metro Portland market. In a normal year, Portland experiences occupancies in the 80s during the summer, which would be anticipated to return by 2023.

- The recent and ongoing expansion at Portland International Airport should bode well for the return of passenger traffic. In July 2020, Concourse E’s $215-million expansion was completed and opened to the public; the concourse houses Southwest Airlines gates. The $100-million Concourse B expansion, new rental-car facility, and additional parking facilities are expected to open in 2021. Additional improvements will continue through 2025. Portland International Airport was named the best airport in the United States by Travel + Leisure from 2012 through 2019 and was ranked second in 2020.

- The key contributors of Portland’s demand segments, which include technology, sports-apparel industries, and healthcare, will again shine through once meeting/group and social-distancing restrictions are eased. Portland continues to be hub for high-technology startups given its diverse culture, temperate climate, and competitive cost of living. The city is also a popular leisure destination, home to a variety of cultural attractions, a variety of breweries and wineries, the OCC, and a plethora of outdoor attractions and points of interest, all of which contribute to lodging demand. Moreover, Portland’s attractions could be expanding for future years of demand. In November 2018, the Port of Portland and the Portland Diamond Project (PDP) signed an agreement to develop the Port’s 45-acre riverfront terminal to bring Major League Baseball to Portland. As of July 2020, the project was still moving forward, in the planning and funding phases of development.

- Demand should be further heightened in the summer of 2022 when Eugene, Oregon, will host the World Athletics Championships. This is the first time the event will be held in the United States, and the entire event, known as Oregon22, is estimated to generate $205 million. The event was originally slated for 2021 but was rescheduled for 2022 due to the delay of the 2020 Olympics caused by the coronavirus outbreak.

- The Hyatt Regency Portland opened in December 2019 before closing in March 2020; it is anticipated to reopen in March 2021. The Hyatt Centric opened in 2020. New hotel openings planned for 2021 include the Moxy in Downtown Portland and the Hotel Chamberlain in Portland’s Central Eastside neighborhood. The under-construction Ritz-Carlton Hotel & Residences is expected to open in 2023. A number of other hotels have been proposed for development; however, few are actively under construction.

We are confident the Metro Portland market will rebound upon the release and distribution of a vaccine, the retirement of group/meeting restrictions, the reopening of the convention center, and the resumption of corporate and government travel. We continue to watch the factors affecting Portland lodging, and our many consulting engagements throughout the metropolitan area allow us to keep our finger on the pulse of the market.

For more information, contact anyone on our Pacific Northwest team, based in Portland, Oregon: Kasia M. Russell, MAI; Breanna S. Smith; Lauren Reynolds; and Eileen Bosworth.