By Thomas Mielke

The Financial Times this weekend reported on the trillions of dollars that have been wiped out thus far due to the coronavirus disease 2019 (COVID-19) outbreak. According to the newspaper, stocks in hospitality companies have been particularly hit, having fallen by a reported 19% in Europe compared to last week – one of the strongest declines for the sector since the terror attacks of 9/11. The still-growing number of countries, and companies, enforcing travel bans is exasperating the situation. Reuters reported, for example, global giant Nestle suspending all international business travel. Other companies operating across the globe, such as Amazon, BP and Estee Lauder, have equally suspended or deferred travel to and from the affected countries. Large gatherings have been banned in many countries, and major business events and trade fairs, such as the Barcelona Mobile World Congress, the Geneva Motor Show as well as the IHIF, ITB and MIPIM, have all been cancelled.

For the laymen it is at times difficult to judge – are the markets right? It would seem it is a balancing act between panic and denial.

HOTEL COMPANIES SEE STOCKS PLUMMETING

There is no doubt the hospitality industry is going through rough times. It is already by default highly perceptive to changes in the socio-political environment as well as the world economy – Brexit, the US-China trade tensions and the recent Hong Kong unrests, coupled with terrorist threats and even volcanic eruptions, have certainly not made it any easier for hotel companies to predict performance. With the World Health Organisation (WHO) having declared that the outbreak has reached the highest level of risk, hotel stocks last Friday (Feb. 28) recorded some of their worst performances.

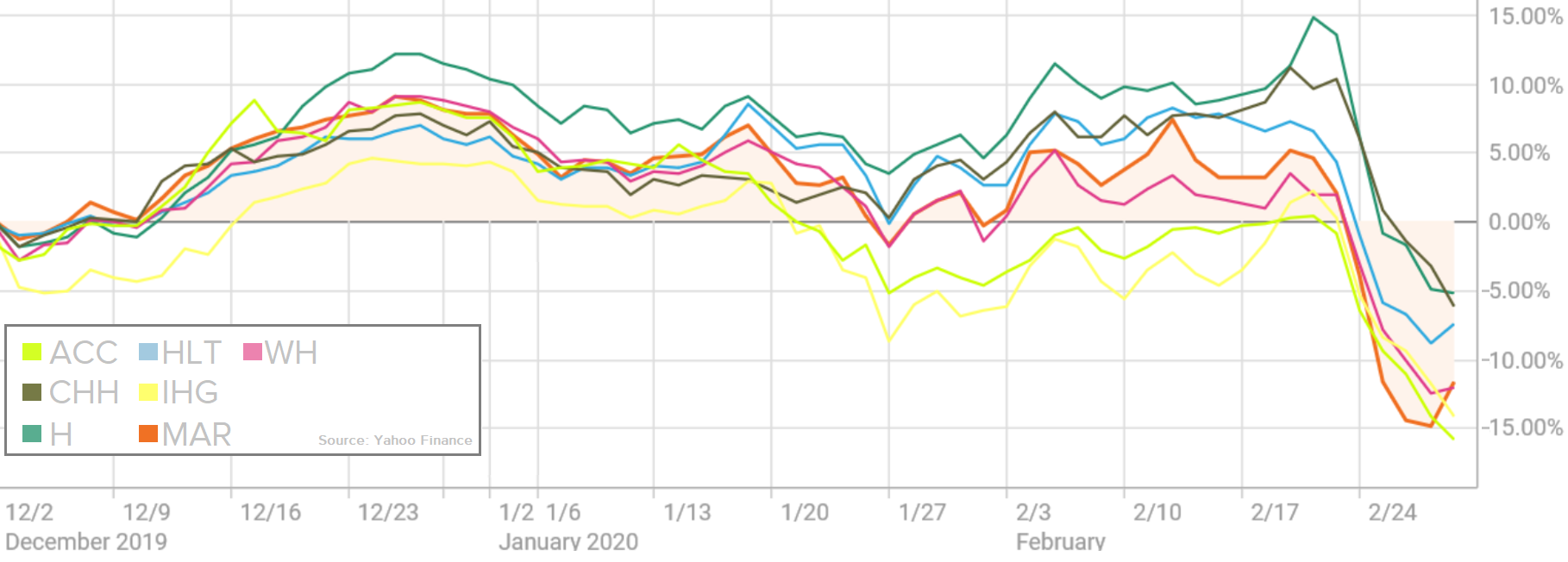

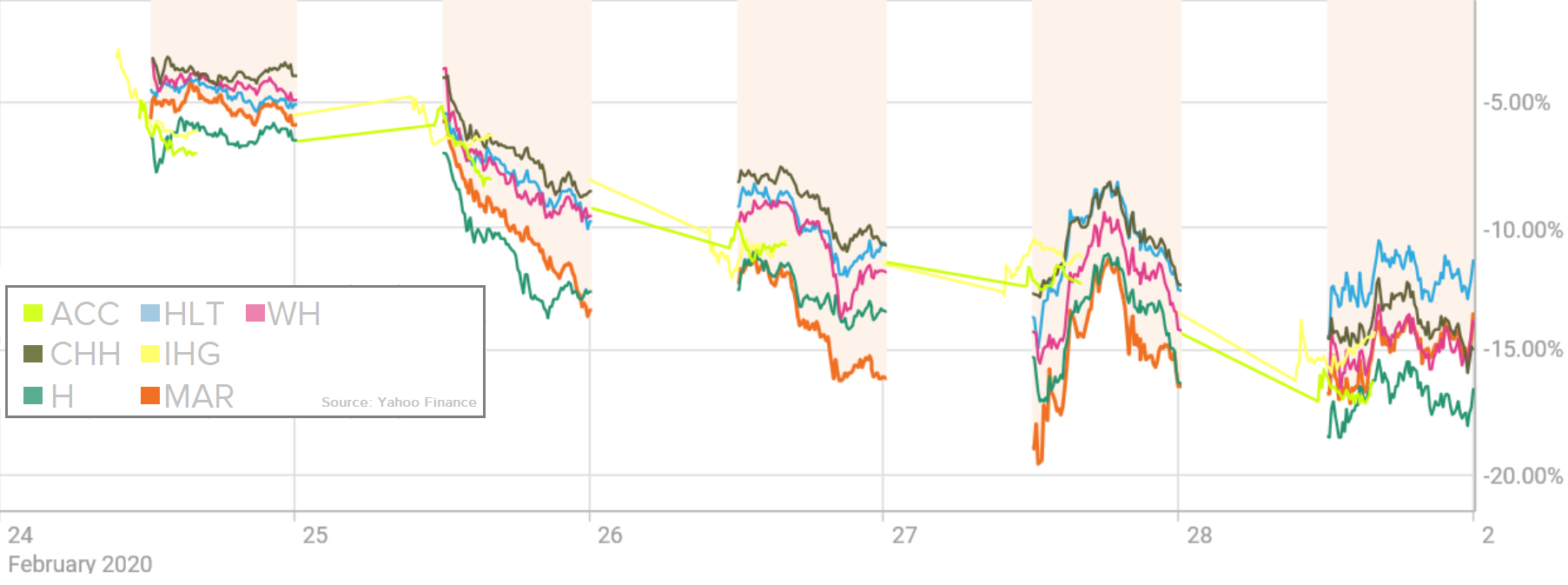

Since the initial outbreak approximately three months ago, the stock from publicly listed hotel companies such as Marriott, Hilton, Hyatt, Wyndham, Choice, IHG and Accor have fallen, on average, between a little more than 5% (Hyatt) and up to almost 16% (Accor) – see chart above. Many of the bigger losses, though, have been incurred within the last week of February – see chart below. Hilton ‘only’ lost a little more than 11%, whereas Hyatt and Accor both saw their share prices fall by more than 16%.

In early February, Hilton’s CEO Chris Nassetta commented on an earnings call on the company temporarily closing 150 of its hotels in China and its expectation to lose between USD $25 million and USD $50 million in its full-year adjusted EBITDA due to the impacts of COVID-19. Keith Barr, CEO at IHG, observing the trading performance said, “there will clearly be some impact on our business, which we started to see coming through in late January. […] We are currently seeing less travel in the region, which is leading to reduced occupancy, and around 160 of our 470 hotels are closed or partially closed.” Accor’s Deputy CEO and CFO Jean-Jacques Morin commented along the same lines, stating that 200 of its 370 Chinese hotels were (for the time being) no longer taking bookings and that RevPar was down 90% in the Greater China region. Wyndham decided to close 70% of its hotels in China and saw a drop in occupancy in those properties still operational of approximately 75%. Its CFO Michele Allen shared on an investor call that the company expected a decrease of between 200 and 400 basis points in RevPar, resulting in an up to USD $5 million decrease in the first quarter’s EBITDA and between USD $8 million and USD $12 million in adjusted EBITDA for the full year. Also, Marriott – having closed nearly 25% of its hotels in China – said it could lose considerable fee revenues if trading conditions were to persist. Skift referenced Leeny Oberg (EVP and CFO), who commented that the Asia-Pacific region’s gross fees represented approximately 12% of Marriott’s global gross fee revenue in 2019 (with Greater China generating approximately half of those fees). “Our base case model assumes Asia Pacific and fees in 2020 will total roughly USD $500 million to USD $510 million, with greater China fees, again, constituting about half of that amount. […] We estimate the region will earn roughly USD $25 million less in fees and EBITDA per month as compared to our 2020 base case.

HOTEL CEOS OFFER A STEADY HAND

The situation has long since impacted other regions, too, and it is no longer China where confirmed cases are being reported – hence, the recent negative performances at the stock markets. We have read about hotel properties being temporarily closed, staff being redeployed elsewhere or sent on training courses (or [unpaid] leave), compensation programs deferred, and supplier contracts being renegotiated. Depending on the operating agreement, leadership teams will no doubt have sit-downs with hotel owners to assess what can be done to alleviate the financial stresses and conversations will take place centred around payment reliefs, deposit protections and cancellations. Every stakeholder must do its bit to help.

From interviews and conversations with CEOs and regional leaders, AETHOS has observed time and again the importance of ‘leading from the front’ as it relates to ‘steadying the waters’. In other words, during times of crisis, it is vital not only to lead but to be seen publicly taking ownership of the situation. Company CEOs have hereby reliably pursued a predictable pattern:

- Assume ownership and demonstrate responsibility for the areas that one can impact

- Acknowledge limitations of own position and secure buy-in from other interrelated parties

- Define goals and act with one common mission

- Build flexibility and adaptability into the decision-making process

- Collaborate effectively across parties to enable impactful decisions ‘on the ground’

- Act decisively and deal with ambiguity, acknowledging the inevitability of imperfections

- Constantly adapt strategies and tactics and align resources as required

The solace for investors is that hoteliers have had to deal with somewhat similar scenarios, albeit on a very different scale, in the past. They are thus able to balance expertise with intuition. In late 2002, early 2003, for example, the industry grappled with SARS. According to research by Daniel Morris, Senior Investment Strategist at BNP Paribas, hotel and leisure businesses were amongst the most affected during the SARS outbreak in which Hong Kong’s overall index fell by 8% from peak to trough. Yet, recovery followed within a few quarters and long-term profitability of the companies initially affected remained relatively unchanged.

Investors, and the world in general, are rightfully nervous. However, in this instance, and unlike in past (economic or political) crises, central banks are unlikely to be able to help businesses – this is a consumer confidence and demand issue. When looking at the C-suite of hotel companies, there should therefore be some comfort in the fact that these are experienced and tried-and-tested CEOs. AETHOS’ CEO study, which tracks CEO turnover since 2014, shows that the industry is currently enjoying a very stable period characterised by consistent and experienced leadership – approximately 40% of those currently in the C-suite previously have held a comparable position. More than 60% of the incumbent CEOs at publicly listed hotel companies can be considered ‘insiders’, having previously been with the firm in a different function (thus bringing on board valuable ‘institutional knowledge’ about the ‘inner workings of the organisation), and nearly 80% bring on board prior hospitality experience. The average tenure of the incumbent CEOs stands at more than seven years – with some, such as Chris Nassetta at Hilton and Mark Hoplamazian at Hyatt, easily beating that benchmark.

From the outside, at least, it would appear hotel CEOs have been successful in the recent past to satisfy their investors – to deliver on growth targets but also to manoeuvre through very tough crises that they certainly have had to face. It is understandable that investors are ‘jittery’, but they should find confidence in the fact that the CEOs have the steady hand to navigate the current situation. Most importantly is hereby communication – to build trust and confidence with internal and external stakeholders. As Marriott’s Arne Sorenson put it, “while this is still guesswork to some extent, we know one thing with confidence — this will pass […] and when it does, the impact to our business will quickly fade.” Share prices of hotel companies at some point will recover and return to their long-term intrinsic value.