By John Burke

With the start of the new year, many of us take stock of where we are and what 2018 holds in store.

The status of the U.S. hotel industry partly depends on the lens you’re looking through—whether you’re a franchise company, developer, owner, operator or investor. While the opportunities and strengths of one perspective could be a threat or weakness to another, these items contribute to the big picture, regardless of your role in the industry.

Strengths Record occupancy: U.S. hotel occupancy of 65.9% in 2017 is the highest since STR began recording U.S. lodging performance in 1987.

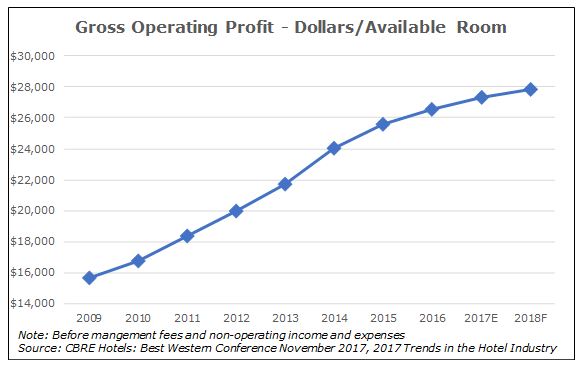

Gross operating profit: GOP per available room before deductions for management fees and non-operating income and expenses has increased almost 70% from 2009 through 2016 to $26,520. CBRE projects an increase of 3% for 2017 and 1.8% for 2018.

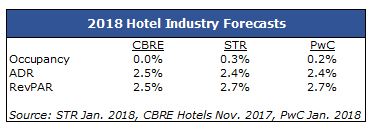

2018 forecast: Revenue per available room is projected to increase in 2018, which would be the ninth straight year of growth.

Low interest rates: Even though the Federal Reserve raised interest rates three times (0.75% total) in 2017 to a target of 1.25% to 1.5%, rates are historically low and contribute to a favorable financing environment for development and acquisitions. Per the Federal Reserve Bank of St. Louis, the midpoint of the projected target range for the federal funds rate is 2.1% in 2018, 2.7% in 2019 and 3.1% in 2020. Since 1990, the federal funds rate has been as high as 8.25%.

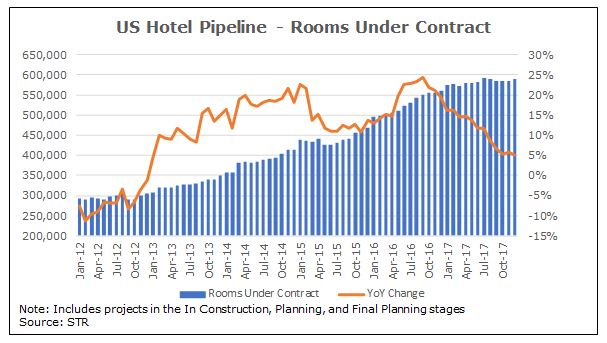

Robust development pipeline: There were 588,645 rooms under contract in December 2017, which includes those in the in construction, planning and final planning stages. This is only 0.5% from the high of 591,865 in July 2017 and 100.8% higher than in January 2012.

Weaknesses Robust development pipeline: While a large pipeline is good for franchise companies and developers, it can negatively affect existing hotels by causing market occupancy to decline.

Decelerating development pipeline: Even though the development pipeline is robust, the growth rates for the number of rooms under contract and those in construction (included in under contract rooms) have been in downward trends since September 2016. While rooms under contract continue to increase year-over-year, October 2017 marks the first year-over-year decline in the rooms in construction since late 2011. In December 2017, rooms in construction declined year over year at 3.7%.

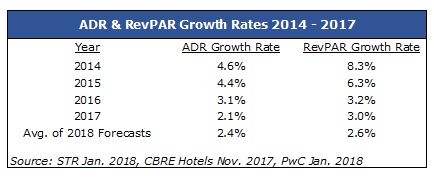

Waning RevPAR growth: The RevPAR growth rate has declined each year since 2014 and is projected to continue its downward trend in 2018.

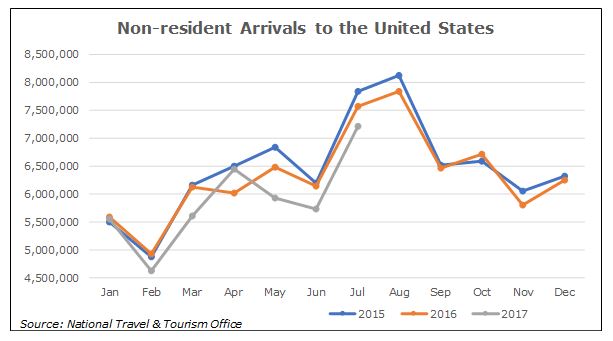

International travel: The latest available statistics on nonresident arrivals to the United States show a decline of 2.1% in 2016 and 4% as of YTD July 2017. Prior to 2016, the last year nonresident arrivals declined was in 2009 (5%). Many in the industry attribute the decline to President Donald Trump’s travel ban and immigration crackdowns.

Opportunities Industry consolidation: Consolidation will provide hotel companies more leverage when negotiating commissions with online travel agencies, greater economies of scale with vendors, and increase the number of participants in their loyalty programs.

Technology: Hotel companies are finding ways to incorporate technology that improves operations and enhances guests’ experiences. Hilton’s “Connected Room” and Marriott’s “Internet of Things” room are scheduled to roll out in 2018 and will offer amenities such as digital keys and the ability to use a smartphone to control room temperature, lighting, TV, etc. Guests will even be able to swap out wall art with family photos for a more personal stay.

Taxes: A study completed for the American Hotel & Lodging Association in November 2017 projects the federal government’s tax policy changes to increase direct hotel guest spending (onsite and ancillary at local businesses) by $57 billion over the next five years, and GDP growth to be 3% in 2018. An Oxford Economics study projected the federal tax bill to increase GDP growth in 2018 by approximately 40 basis points for an overall GDP growth of 2.8%.

New brands: Several hotel companies launched new brands in 2017, including Hilton’s Tapestry Collection, Wyndham’s Trademark Collection, Best Western’s Signature Collection, Hard Rock’s Reverb, and InterContinental Hotels Group’s Avid. Hilton previously announced it is working on four new brands—including the Hilton Plus (a higher-level Hilton), an urban microbrand and a luxury soft-brand collection—that are likely to debut in 2018. Additional brands allow franchise companies to target different customer segments and enter markets where their other brands are already represented while giving developers more options.

Threats New brands: While adding new brands brings opportunity, it also creates a greater level of competition between existing hotel owners. By creating new ways to segment the customer base, existing brands might no longer find themselves the best fit for certain customers.

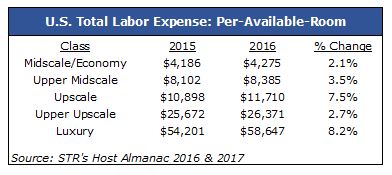

Rising minimum wage: Twenty-one states increased their minimum wage in 2017 and 18 states will increase minimum their minimum wage in 2018. To combat the rising minimum wage, owners are likely to increase the rate of adoption of technology to increase operational efficiency and reduce the numbers of employees needed to operate their property. In addition to mobile check-in and digital keys, hotel companies have already started experimenting with robots to deliver items to rooms and act as a concierge.

Sharing economy: According to a report by Morgan Stanley, hotel cannibalization from Airbnb is estimated at 51% in 2017 and is expected to increase to 54% in 2018. However, adoption growth rates for the platform are shrinking. Morgan Stanley lowered its adoption growth rate forecast for 2018, 2019, and 2020 to 28%, 30%, and 31%, from 31%, 37% and 43%, respectively.

The high occupancy, low interest rates, robust development pipeline, and projected RevPAR growth in 2018 indicate the U.S. hotel industry remains strong, and there are still many opportunities in the coming year. However, wise owners and investors will keep their eye on the changing horizon when creating strategic goals for their assets since renovations may be needed to maintain market share against new supply and declining growth rates often translates to lower values.

This article was originally published by Hotel News Now and is reprinted with permission of the authors.