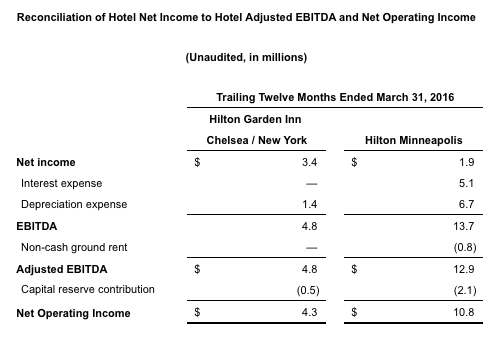

BETHESDA, Md., July 14, 2016 — DiamondRock Hospitality Company (the "Company") (NYSE: DRH) announced today that it completed the sale of the 169-room Hilton Garden Inn Chelsea / New York City for $65 million to an affiliate of a China-based entity. The sale price represents a 13.5x multiple on the Hotel's adjusted earnings before interest, taxes, depreciation and amortization ("Adjusted EBITDA") for the trailing 12-month period ended March 31, 2016 and a 6.6% capitalization rate on the Hotel's net operating income ("NOI") for the trailing 12-month period ended March 31, 2016. Additionally, the hotel is subject to a property improvement plan by Hilton that requires a corridor and rooms renovation. JLL served as the broker on this transaction and conducted a full marketing process.

The Company also announced today that it completed the sale of the 821-room Hilton Minneapolis for total consideration of approximately $143 million. The total consideration represents a 7.6% capitalization rate on the hotel's NOI for the trailing 12-month period ended March 31, 2016 and an 11.0x multiple on the Hotel's Adjusted EBITDA for the trailing 12-month period ending March 31, 2016. The opportunistic sale resulted from a reverse-inquiry from a private equity firm that has a longstanding relationship with the Company.

"The sale of the Hilton Garden Inn Chelsea / New York City moves the Company towards an even more diversified portfolio by reducing the Company's allocation to New York City by approximately 150 basis points. The Company also improved its portfolio quality with the recent sales of the Hilton Minneapolis and the Orlando Airport Marriott, which ranked at the bottom of the portfolio as measured by average RevPAR. Furthermore, the three sales in 2016 have enhanced DiamondRock's balance sheet and the Company now expects to end the year with a projected cash balance in excess of $200 million and with no outstanding borrowings on its $300 million senior unsecured credit facility. This expanded investment capacity creates a number of value creation opportunities for the Company going forward," stated Mark W. Brugger, President and Chief Executive Officer of the Company.

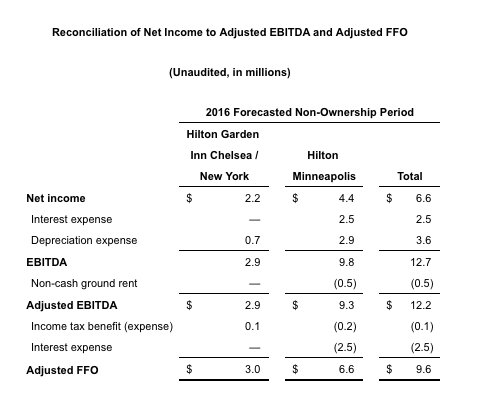

The sales of the Hilton Garden Inn Chelsea / New York City and the Hilton Minneapolis will collectively reduce the Company's full year 2016 Adjusted EBITDA by approximately $12.2 million and Adjusted FFO by $9.6 million.

Excluding the three dispositions, the Company's 2015 comparable portfolio EBITDA margin increases by approximately 50 basis points and the 2015 comparable portfolio RevPAR increases by approximately $8. The sales also increase the Company's third-party operated hotels to over 50% of the portfolio.