dorma+kaba to become one of the global top 3 companies in the security and access solutions market, with pro-forma sales exceeding CHF 2 billion (EUR 1.9 billion)

- Leading product and services offering from a single source thanks to complementary portfolios, value chain and geographic footprint in all key markets

- Excellent growth opportunities and significant synergy potential to create substantial added value for Kaba shareholders; planned special dividend of CHF 50 per share

- Dorma owner family to increase its entrepreneurial commitment by acquiring 9.1% stake in Kaba and together with Kaba family shareholders to form strong, long-term oriented anchor shareholder for the combined group

- As the SIX-listed dorma+kaba holding company, Kaba to hold 52.5% and the Dorma family owners to hold 47.5% of combined Dorma and Kaba business

- Kaba Extraordinary General Meeting on 22 May 2015 for approval of the merger; completion of transaction planned for third quarter 2015

- Media/analyst conference in Zurich with live webcast at www.kaba.com/webcast in German today at 10:30 am CEST; telephone conference for analysts in English today at 3:30 pm CEST

Kaba Holding AG (SIX: KABN), headquartered in Rümlang (Switzerland), and family-owned Dorma Holding GmbH + Co. KGaA, headquartered in Ennepetal (Germany), plan to merge to become the dorma+kaba group. A corresponding transaction agreement was signed April 29.

Dorma is a provider of access solutions and related services, and a global market leader in door closers, automatic door systems and glass fittings. Kaba is a global leader for access control, enterprise data collection and key systems. Ulrich Graf, Chairman of Kaba: “The combination of the two strong brands Dorma and Kaba will result in the creation of a leading company in our industry. The anchor shareholders will ensure long-term orientation, which represents another true competitive advantage in our dynamic sector.”

With pro-forma sales of over CHF 2 billion, around 16,000 staff and locations in 53 countries, dorma+kaba will move up into the global top 3 in the highly fragmented market for security and access solutions. Dr. Hans Gummert, Chairman of Dorma: “By merging our two globally established companies, we will significantly strengthen our market position. Not only do we share over one hundred years of entrepreneurial tradition and the same values, but our strategies also largely correspond with one another.”

Dorma and Kaba – an excellent fit

Dorma and Kaba’s technological expertise, products as well as distribution channels complement each other very well. The shared distribution and service networks, cross selling, and the positioning as a one-stop-shop for security and building access solutions open up significant added growth potential for the merged company. Thomas P. Wagner, CEO of Dorma: “Together with Kaba, we are taking a big step forward. We will broaden our offering, strengthen our global presence and increase our innovation power. This will allow us to better and more quickly take advantage of opportunities that arise through megatrends such as urbanization and digitalization.”

dorma+kaba will have production facilities in all of the industry’s key markets and will accelerate global expansion through its strengthened presence in particular in Europe, the Americas and Asia-Pacific.

Substantial value enhancement through considerable growth and synergies potential

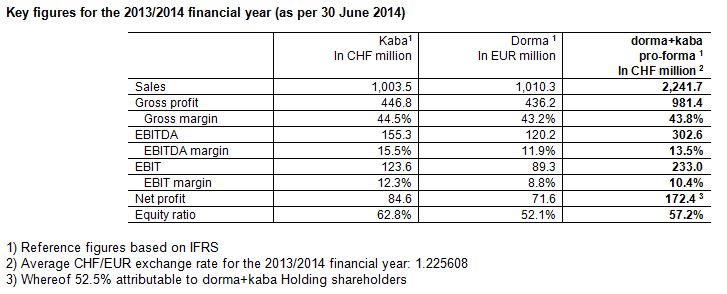

On a pro-forma basis, the combined group generated sales of CHF 2,242 million for the 2013/2014 financial year (as per 30 June 2014) and an EBITDA of CHF 303 million. The pro-forma EBITDA margin was 13.5%.

Riet Cadonau, CEO of Kaba: “Dorma and Kaba are ideal partners in every respect and a compelling strategic fit. The planned merger will create additional opportunities for sustainable profitable growth – thereby providing added value to our clients, partners, employees and shareholders.”

Over the next four years, dorma+kaba aims to achieve sales growth, including revenue synergies, of 6-7% per year (in local currencies). Based on higher purchasing volumes, optimized infrastructure costs and efficiency gains, annual cost synergies of CHF 60-70 million are projected, which should come into full effect in the fourth year after the merger. Total one-off implementation costs are expected to reach the full cost synergies for one year.

Upon reaching the full synergy potential, an EBITDA margin of 18% is aimed for. The merger is expected to be double-digit (percentage) accretive to earnings per share. With regard to the future dividend, dorma+kaba is targeting a payout ratio of at least 50% of consolidated net profit after minority interests.

Transaction structure

Following approval of the merger by Kaba shareholders, the Dorma owner family Mankel/Brecht-Bergen will subscribe to 380,000 registered shares with a par value of CHF 0.10 each from Kaba authorized capital. The price is CHF 178.4 million, corresponding to the 90-day volume weighted average Kaba share price of CHF 519.45 as per 28 April 2015 after market close (Bloomberg) minus CHF 50 per share in compensation for the ineligibility of the new shares for receipt of the planned special dividend. Following this capital increase, the Mankel/Brecht-Bergen family will hold 9.1%, and the existing Kaba family shareholders 18.2% of Kaba Holding.

Upon completion of the merger, Kaba Holding will contribute its operational business into today’s Dorma Holding, where the operational business will be merged, and will receive a 52.5% controlling stake thereof. Accordingly, the Mankel/Brecht-Bergen family will hold a stake of 47.5% in today’s Dorma Holding (i.e. the combined business). The group will operate under the name dorma+kaba. The SIX-listed Swiss dorma+kaba Holding, as the holding company of the new group, will be responsible for its strategic, operational and financial leadership and will fully consolidate the combined business.

Valuation

To begin with, Dorma and Kaba warrant the same valuation. As a result of the agreed transaction structure, Dorma is contributed into the combined company at an EV/EBITDA multiple of 10.1 and Kaba at 12.2. Taking into account cash and cash equivalents of approximately CHF 190 million remaining at Kaba Holding, the ownership interests in the combined business will amount to 52.5% for Kaba and 47.5% for the Mankel/Brecht-Bergen family. An independent fairness opinion conducted by N+1 Swiss Capital on behalf of the Board of Directors of Kaba Holding confirms that the envisaged ownership interests are fair and balanced from a financial point of view.

In exchange for relinquishing the majority in its business, the Mankel/Brecht-Bergen family will have the right to acquire further stakes in today’s Dorma Holding at market value, in order to regain the majority should there be a change of control at dorma+kaba Holding. Shareholders of dorma+kaba Holding can rescind this right with a three-quarters majority until the end of 2018, and with a simple majority from 2019 onward, should such a change of control be forthcoming.

Strong anchor shareholder group, governance

The family shareholders of Dorma and Kaba, who will jointly hold 27.3% of dorma+kaba Holding, will form a strong anchor shareholder group and have signed a long-term pool agreement. Among others, they have granted each other preemption rights and have also agreed that the sale of a block of shares of 27% or more to a third-party buyer would require this buyer to launch a public takeover offer to all public shareholders at the same price per share.

Christine Mankel and Stephanie Brecht-Bergen (née Mankel), shareholders of Dorma: “We recognize our responsibility as family business owners and look forward to supporting the new dorma+kaba group as long-term oriented anchor shareholders. By subscribing to new Kaba shares, we are also increasing our commitment to the business. In doing so, we are seizing this unique opportunity to create a leading global company in our industry.”

Ulrich Graf, Chairman of Kaba, will chair the Board of Directors of the combined company. The CEO of Kaba, Riet Cadonau, has been nominated CEO. Bernd Brinker, who is CFO of Dorma, is the designated CFO. Representation on the group’s management bodies is to be as balanced as possible.

Both Rümlang and Ennepetal will remain important locations for the merged company. The domicile of dorma+kaba Holding will be Rümlang, and Ennepetal will be the domicile for the future “Access Solutions DACH” division, which will be responsible for the business in the German-speaking countries.

Extraordinary General Meeting of Kaba and swift completion of the transaction

Kaba will hold an Extraordinary General Meeting on 22 May 2015 for approval of the merger. Shareholders, and non-anchor shareholders in particular, are invited to confirm that no mandatory offer must be submitted as part of this transaction (opting-out limited to the envisaged transaction). The Board of Directors of Kaba will also propose the abolition of the existing 5% share transfer and voting rights restrictions, as well as other amendments to the Articles of Incorporation. Furthermore, the Board of Directors proposes the payment of a special dividend from capital contribution reserves of CHF 50 per registered share. This corresponds approximately to the inflow of capital resulting from the capital increase from authorized capital.

Christine Mankel and Stephanie Brecht-Bergen, shareholders of Dorma, and Dr. Hans Gummert, Chairman of Dorma, will be proposed for election as additional Board members of dorma+kaba Holding. Thomas Pleines, who has been a Member of the Board of Directors of Kaba since 2011, has agreed to step down from his role.

The resolutions passed at the Extraordinary General Meeting will come into effect upon completion of the merger, which is envisaged for the third quarter of 2015, subject to approval from share-holders and the competition authorities, as well as other customary requirements being met.

Media/Analyst conference and telephone conference

A media and analyst conference will be held in German today, 30 April 2015, at 10:30 am CEST in the Large Hall of the Metropol at Fraumünsterstrasse 12 in Zurich. The conference will be broadcast live by webcast at www.kaba.com/webcast.

A telephone conference for analysts will be held in English at 3:30 pm CEST. Dial-in numbers: +41 58 262 07 22 (Switzerland); +44 203 370 57 19 (UK); +1 646 381 08 89 (US). Please select access code 407238.

A digital playback will be available from approximately one hour after the telephone conference for 14 days under the following numbers: +41 58 262 07 77 (Switzerland); +1 646 385 73 41 (US). Please select access code 495329.

The presentation for press and analysts and further information can be found at www.kaba.com.

Disclaimer

This communication contains certain forward-looking statements, e.g. statements using the words “believes”, “assumes”, “expects”, or formulations of a similar kind. Such forward-looking statements are based on assumptions and expectations which the company believes to be well founded, but which could prove incorrect. They should be treated with appropriate caution because they naturally involve known and unknown risks, uncertainties and other factors which could mean that the actual results, financial situation, development or performance of the company or Group are materially different from those explicitly or implicitly assumed in these statements. Such factors include:

- The general economic situation

- Competition with other companies

- The effects and risks of new technologies

- The company’s ongoing capital requirements

- Financing costs

- Delays in the integration of acquisitions

- Changes in operating expenses

- Fluctuations in exchange rates and raw materials prices

- Attracting and retaining skilled employees

- Political risks in countries where the company operates

- Changes to the relevant legislation

- Other factors named in this communication

If one or more of these risks, uncertainties or other factors should actually occur, or if one of the underlying assumptions or expectations proves incorrect, the consequences could be materially different from the assumed ones. In view of these risks, uncertainties and other factors, readers are cautioned not to place undue reliance on such forward-looking statements. The Company accepts no obligation to continue to report or update such forward-looking statements or adjust them to future events or developments. The Company emphasizes that past results and performances cannot lead to conclusions about future results and performances. It should also be noted that interim results are not necessarily indicative of year-end results. Persons who are unsure about investing should consult an independent financial advisor. This press release constitutes neither an offer to sell nor a call to buy securities.

Kaba®, Com-ID®, Ilco®, La Gard®, LEGIC®, SAFLOK®, Silca® etc. are registered brands Kaba Group.

Country-specific requirements or business considerations may mean that not all Kaba Group products and systems are available in all markets.