By David R. Bone

The Eagle Ford Shale market has faced rising costs, a frenzy of mergers and acquisitions, and recessionary concerns since late 2022. Nevertheless, drilling activity within the area has become profitable again for most oil and gas operators and lodging properties that house oilfield workers.

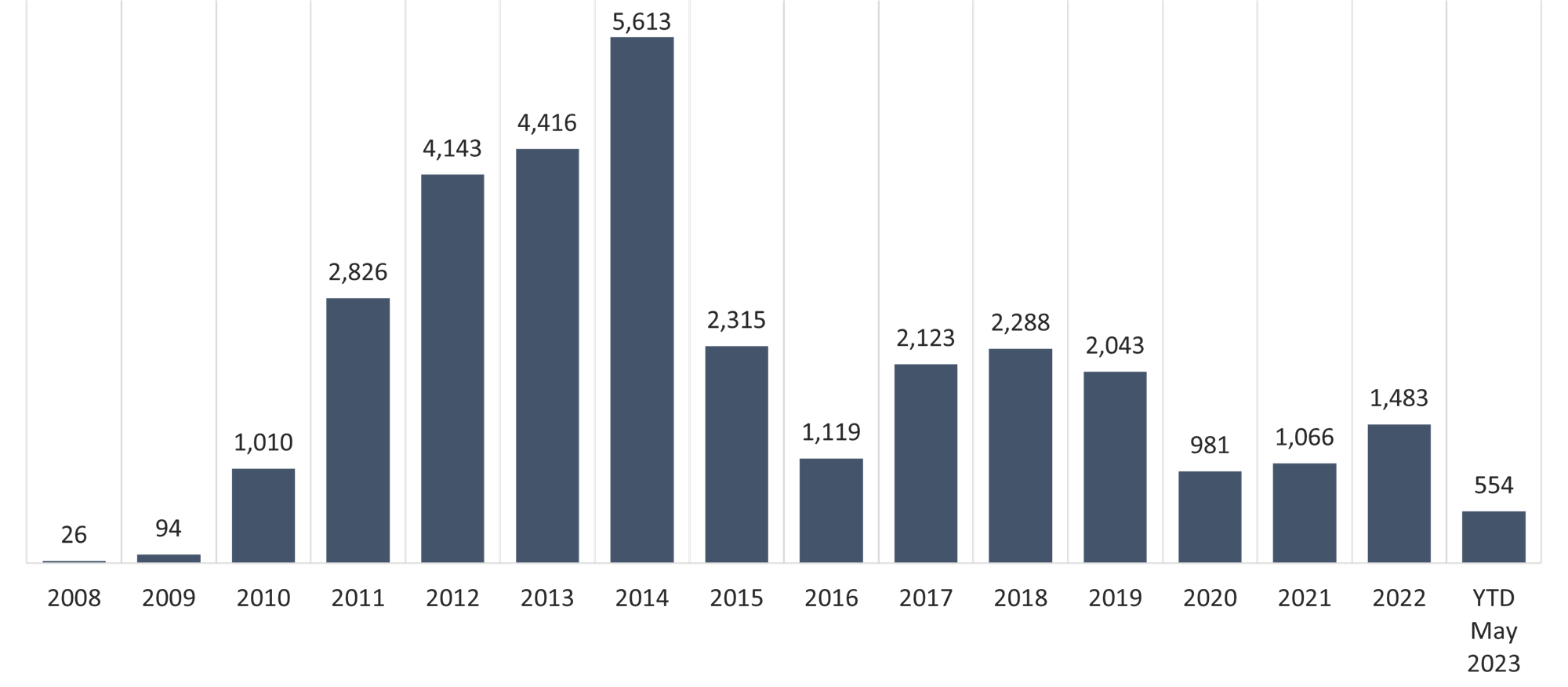

The number of drilling permits issued for the Eagle Ford Shale between 2017 and 2019 averaged approximately 2,150 per year. Following the effects of the COVID-19 pandemic, this number plummeted to under 1,000 by year-end 2020. Similar trends were noted at hotels within the Eagle Ford Shale, with RevPAR registering significant declines as hoteliers struggled to fill rooms. The relocation of several oilfield “man camps” from the Eagle Ford Shale to the West Texas Permian Basin provided a boost for existing hotel owners and operators.

Drilling permit activity increased nominally in 2021, before registering a 39% improvement in 2022. This rise in drilling activity, coupled with improving leisure demand trends, resulted in significant RevPAR gains. Occupancy for a group of limited-service hotels in Karnes County illustrated a 99% increase from 2020 to 2021, with occupancy surpassing 73% in 2022. Similarly, ADR for these hotels experienced a 16% increase from 2021 to 2022.

Thus far in 2023, the number of drilling permits issued has remained relatively stable compared to the same period in 2022. EOG Resources Inc., the top producer in the Eagle Ford Shale with about 170,000 barrels of oil per day, is in the lead. This company has 112 approved permits for new horizontal wells this year. RevPAR for the same set of hotels in Karnes County increased approximately 11% through March 2023.

Several hotels throughout the Eagle Ford Shale have transacted within the past year, following a period of few hotel sales. Notable transactions include the Holiday Inn Express in Kenedy, which reportedly sold in June 2023 for $4,200,000 ($62,000 per key) and the Microtel Inn & Suites by Wyndham in Gonzales, which transacted for $2,800,000 ($53,000 per key) in June 2023.

Texas Eagle Ford Shale Drilling Permits Issued 2008 though May 2023

Source: Texas Railroad Commision Drilling Permit Query (Includes New Drill and Re-enter Permits)

Recent mergers and acquisitions of companies that operate in the Eagle Ford Shale are detailed below.

- Marathon Oil acquired the assets of Ensign Natural Resources in late 2022 for $3 billion. This all-cash deal involved 130,000 acres in the core of the Eagle Ford Shale and significantly expanded Marathon’s footprint in the shale play to 290,000 net acres. Additionally, Marathon estimates it gained 600 undrilled locations and 700 existing wells, representing significant redevelopment potential.

- In February 2023, Baytex Energy Corporation agreed to acquire Ranger Oil Corporation for approximately $2.5 billion. The Ranger inventory represents about 741 net undrilled locations and roughly 12–15 years of oil-weighted drilling opportunities. Baytex believes it can grow production modestly from the acquired assets with two rigs and about 50–55 net wells per year. Moreover, the deal adds approximately 162,000 net acres to Baytex’s portfolio.

- In September 2022, Devon Energy Corporation completed its acquisition of Validus Energy for a total cash consideration of $1.8 billion. This acquisition secures 42,000 net acres adjacent to Devon’s existing leasehold in the basin. Current production from the acquired assets is approximately 35,000 barrels per day, which is expected to increase to 40,000 barrels per day on average.

- Chemical maker INEOS agreed to purchase assets in the Eagle Ford Shale from Chesapeake Energy Corporation for $1.4 billion. The deal, which was expected to close by the end of June 2023, involves approximately 172,000 net acres with average net daily production of about 36,000 barrels of oil.

The rising cost of materials and labor have contributed to restrained profits and production in recent years. Notably, the cost of steel, coupled with a shortage of frack pumps, hampered growth at many of the major producers in the Eagle Ford Shale. However, in the past few months, oil and gas drillers have reported seeing some relief from the rising costs. According to an April 2023 article in the Midland Reporter-Telegram, multiple oil company CEOs stated that costs have been stable or declining in recent months. As reported in the article, “Paramount Resources Limited CEO Jim Riddell said […] that services and other costs have started to decline, though they’re unlikely to tumble back to the lows reached during the early days of the COVID-19 pandemic.” [1]

While recessionary concerns continue to loom, drilling activity, production, lodging trends, and mergers and acquisitions continue at a healthy pace in the Eagle Ford Shale. Major shale play producers continue to post generally positive results. And the counties with the largest footprint in the play—Karnes, Gonzales, De Witt, and La Salle—are experiencing a much-needed economic boost following the COVID-19 pandemic. Hoteliers in the Eagle Ford Shale report a lack of new hotel supply and increased drilling activity as positive attributes for the recent uptick in lodging trends. The improvements and RevPAR gains have piqued investor interest and resulted in several hotel sales in the past year.

For more information on the Eagle Ford Shale lodging market and hotel trends, please contact David Bone with the HVS San Antonio office.