Strong Group Booking Growth Provides Promise for North American Hoteliers

NEW YORK – March 30, 2016 – While new bookings are up at the start of the spring season, with 17 of the top 25 North American markets showing committed occupancy* growth compared to last month, the pace of those bookings is relatively flat. New commitments that have been added over the last month are down -0.2 percent, according to new data from TravelClick’s March 2016 North American Hospitality Review (NAHR). These numbers indicate a disjointed story for hoteliers as new booking pace is slowing going into the normally strong spring travel reservation season.

“March’s advance booking performance is showing signs of weakness, and there is also fragmentation of new booking pace that’s spreading into additional North American markets,” said John Hach, TravelClick’s senior industry analyst. “On a positive note, the pace of new group bookings is encouraging, growing by almost 7 percent, compared to last year. As a result, it’s becoming increasingly clear that the overall booking growth of recent years is now more challenging for many markets to sustain on a continued basis.”

Twelve-Month Outlook (March 2016 – February 2017)

For the next 12 months (March 2016 – February 2017), transient bookings are up 0.8 percent year-over-year, and ADR for this segment is up 2.4 percent. When broken down further, the transient leisure (discount, qualified and wholesale) segment is showing occupancy gains of 2.6 percent, with ADR gains of 2.6 percent. The transient business (negotiated and retail) segment is down -1.8 percent, but ADR is up 2.9 percent. Lastly, group bookings are up 5.0 percent in committed room nights over the same time last year, and ADR is up 3.4 percent.

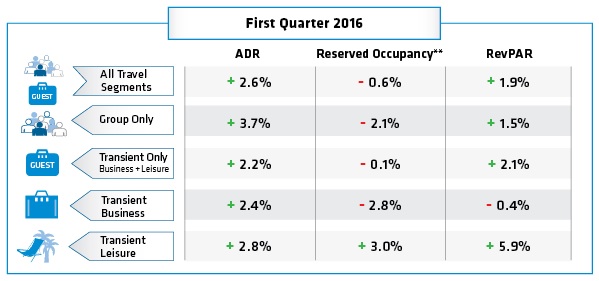

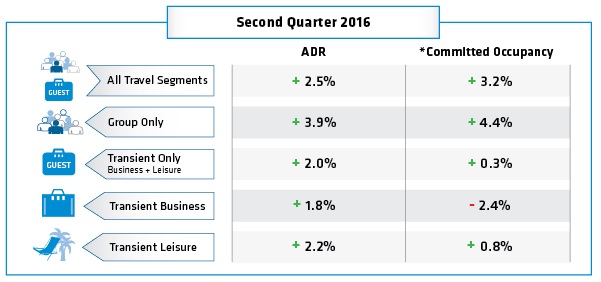

“We can see that ADR in most markets is continuing to increase in the first and second quarter of 2016, but the slowing new booking pace is creating new pressure on revenue per available room (RevPAR) performance, especially in markets that are experiencing contraction, like Chicago and Houston,” added Hach. “Thus, it’s paramount for hoteliers to become proactive in identifying and competing for incremental inbound market demand, especially during periods where there’s a lack of group business that’s coming into local markets.”

The March NAHR looks at group sales commitments and individual reservations in the 25 major North American markets for hotel stays that are booked by March 1, 2016, from the period of March 2016 to February 2017.

*Committed Occupancy – (Transient rooms reserved + group rooms committed) / capacity

The first quarter combines historical data (January and February) and forward-looking data (March).