MCLEAN, Va. – Hilton Worldwide Holdings Inc. (“Hilton” or the “Company”) (NYSE: HLT) today reported its first quarter 2022 results. Highlights include:

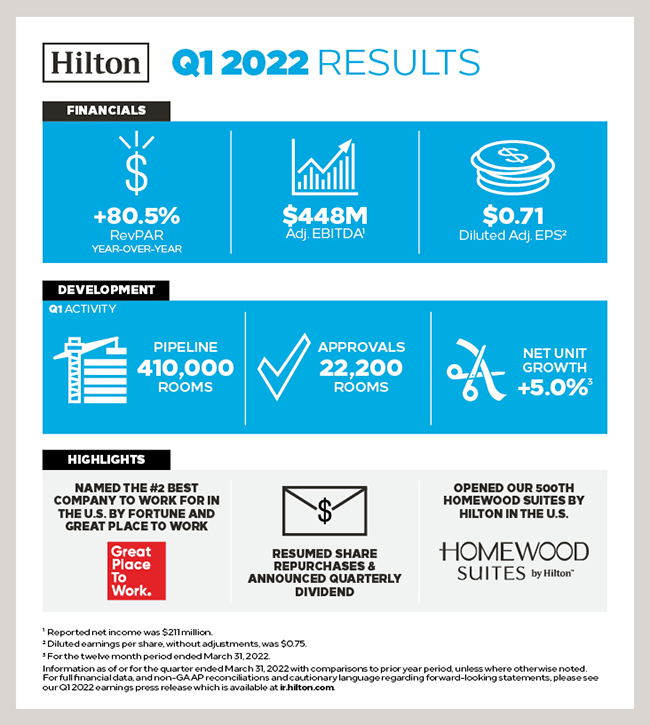

- Diluted EPS was $0.75 for the first quarter, and diluted EPS, adjusted for special items, was $0.71

- Net income was $211 million for the first quarter

- Adjusted EBITDA was $448 million for the first quarter

- System-wide comparable RevPAR increased 80.5 percent, on a currency neutral basis, for the first quarter compared to the same period in 2021

- System-wide comparable RevPAR was down 17.0 percent, on a currency neutral basis, for the first quarter compared to the same period in 2019

- Approved 22,200 new rooms for development during the first quarter, bringing Hilton’s development pipeline to more than 410,000 rooms as of March 31, 2022

- Added 13,200 rooms to Hilton’s system in the first quarter, contributing to 7,800 net additional rooms in Hilton’s system during the period, which represented 5.0 percent net unit growth from March 31, 2021

- Resumed share repurchases in March 2022 and repurchased 907,000 shares of Hilton common stock for approximately $130 million in the first quarter and 1.8 million shares for approximately $265 million through April

- Declared a $0.15 per share quarterly cash dividend in May 2022

- Full year 2022 capital return is projected to be between $1.4 billion and $1.8 billion

Overview

Christopher J. Nassetta, President & Chief Executive Officer of Hilton, said, “We are happy to report solid first quarter results, with all segments driving better than expected top line performance in March. Our results in the quarter, coupled with our confidence in continued recovery throughout the year, enabled us to begin returning capital to shareholders earlier than we had anticipated. In March, we resumed our share repurchase program and, in the second quarter, we declared a quarterly cash dividend. Our team members worked hard to effectively navigate the pandemic and position the Company for the future, and we are excited for the growth opportunities that lie ahead.”

For the three months ended March 31, 2022, system-wide comparable RevPAR increased 80.5 percent compared to the same period in 2021, due to increases in both occupancy and ADR, and fee revenues increased 79 percent compared to the same period in 2021. For comparison to pre-pandemic results, system-wide comparable RevPAR for the three months ended March 31, 2022 was down 17.0 percent compared to the three months ended March 31, 2019.

For the three months ended March 31, 2022, diluted EPS was $0.75 and diluted EPS, adjusted for special items, was $0.71 compared to $(0.39) and $0.02, respectively, for the three months ended March 31, 2021. Net income (loss) and Adjusted EBITDA were $211 million and $448 million, respectively, for the three months ended March 31, 2022, compared to $(109) million and $198 million, respectively, for the three months ended March 31, 2021.

Development

In the first quarter of 2022, Hilton opened 76 new hotels contributing to 13,200 additional rooms and achieved net unit growth of 7,800 rooms. During the quarter, Hilton celebrated the opening of the 500th Homewood Suites in the U.S., as well as other notable openings including the Hilton Singapore Orchard, Hilton’s largest hotel in the Asia Pacific region, and two new lifestyle hotels in destination cities under its Canopy by Hilton brand, the Canopy by Hilton Boston Downtown and the Canopy by Hilton New Orleans Downtown.

As of March 31, 2022, Hilton’s development pipeline totaled 2,730 hotels representing more than 410,000 rooms throughout 113countries and territories, including 27 countries and territories where Hilton does not currently have any existing hotels. Additionally, of the rooms in the development pipeline, nearly 200,000 of the rooms were under construction and over 245,000 of the rooms were located outside the U.S. Adding to Hilton’s development pipeline during the quarter were two notable international deals under its Curio Collection by Hilton brand, the Royal Palm Galapagos in Ecuador and the Palacio Bellas Artes San Sebastian in Spain.

Balance Sheet and Liquidity

As of March 31, 2022, Hilton had $8.8 billion of long-term debt outstanding, excluding deferred financing costs and discount, with a weighted average interest rate of 4.00 percent. Excluding finance lease liabilities and other debt of Hilton’s consolidated variable interest entities, Hilton had $8.6 billion of long-term debt outstanding with a weighted average interest rate of 3.97 percent and no scheduled maturities until 2025. No debt amounts were outstanding under Hilton’s $1.75 billion senior secured revolving credit facility as of March 31, 2022, which had an available borrowing capacity of $1,690 million after considering $60 million of outstanding letters of credit. Total cash and cash equivalents were $1,510 million as of March 31, 2022, including $78 million of restricted cash and cash equivalents.

In March 2022, the Company resumed share repurchases, which, along with dividend payments, had been suspended to preserve cash during the pandemic. The Company repurchased 0.9 million shares of its common stock in March 2022 at a cost of approximately $130 million and an average price per share of $143.89, and, in 2022, through April 29th, the Company had repurchased 1.8 million shares at a cost of approximately $265 million and an average price per share of $148.29.

In May 2022, Hilton’s board of directors authorized a quarterly cash dividend of $0.15 per share of common stock, which will be paid on or before June 24, 2022 to holders of record of its common stock as of the close of business on May 27, 2022.

Outlook

Share-based metrics in Hilton’s outlook include actual share repurchases to date, but do not include the effect of potential share repurchases hereafter.

Full Year 2022

- System-wide comparable RevPAR, on a currency neutral basis, is expected to increase between 32.0 percent and 38.0 percent compared to 2021, and to be down between 5.0 percent to 9.0 percent from 2019.

- Diluted EPS, before special items, is projected to be between $3.56 and $3.81.

- Diluted EPS, adjusted for special items, is projected to be between $3.77 and $4.02.

- Net income is projected to be between $1,001 million and $1,071 million.

- Adjusted EBITDA is projected to be between $2,250 million and $2,350 million.

- Contract acquisition costs and capital expenditures, excluding amounts indirectly reimbursed by hotel owners, are

expected to be between $250 million and $275 million. - Capital return is projected to be between $1.4 billion and $1.8 billion.

- General and administrative expenses are projected to be between $410 million and $430 million.

- Net unit growth is expected to be approximately 5.0 percent.

Second Quarter 2022

- System-wide comparable RevPAR, on a currency neutral basis, is expected to increase between 45.0 percent and 50.0 percent compared to the second quarter of 2021, and to be down between 5.0 percent to 10.0 percent from the second quarter of 2019.

- Diluted EPS, before special items, is projected to be between $0.89 and $0.94.

- Diluted EPS, adjusted for special items, is projected to be between $0.98 and $1.03.

- Net income is projected to be between $250 million and $264 million.

- Adjusted EBITDA is projected to be between $590 million and $610 million.

Click here to view the full report.