MCLEAN, VA – Hilton Worldwide Holdings Inc. (“Hilton” or the “Company”) (NYSE: HLT) today reported its fourth quarter and full year 2022 results. Highlights include:

- Diluted EPS was $1.21 for the fourth quarter and $4.53 for the full year, exceeding the high end of guidance

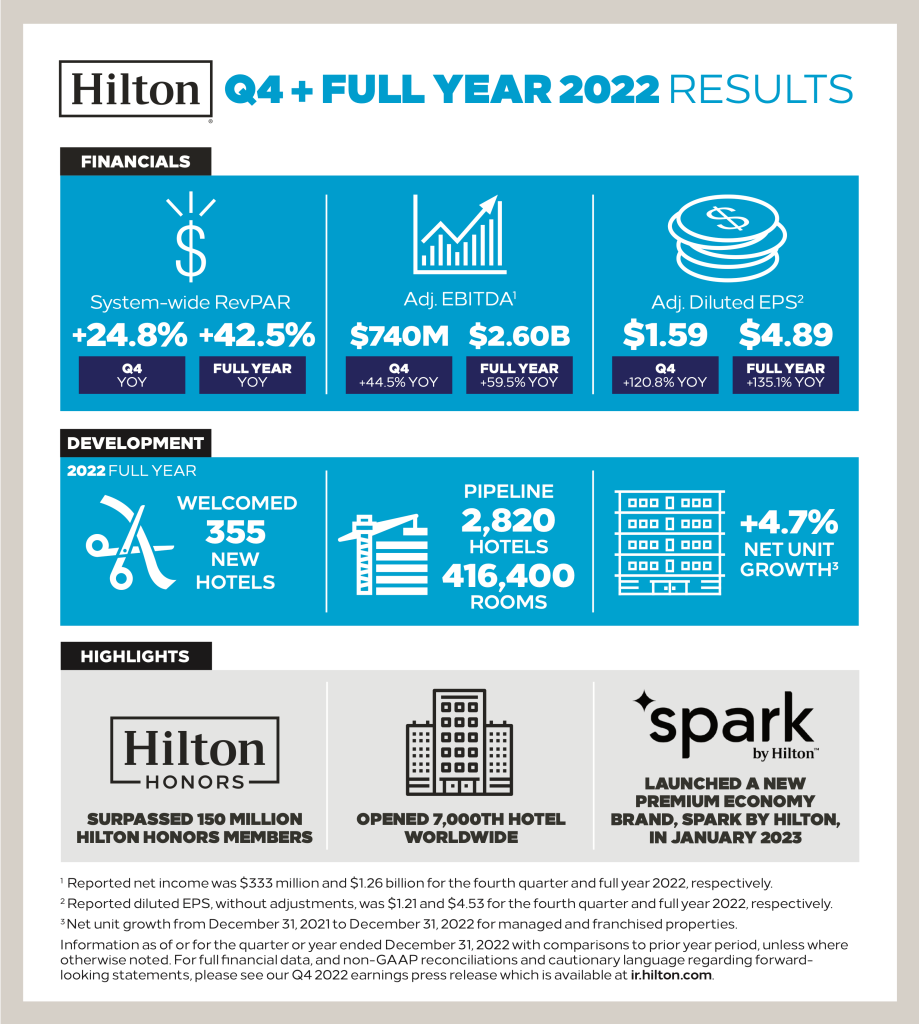

- Diluted EPS, adjusted for special items, was $1.59 for the fourth quarter and $4.89 for the full year, exceeding the high end of guidance

- Net income was $333 million for the fourth quarter and $1,257 million for the full year, exceeding the high end of guidance

- Adjusted EBITDA was $740 million for the fourth quarter and $2,599 million for the full year, exceeding the high end of guidance

- System-wide comparable RevPAR increased 24.8 percent and 42.5 percent, on a currency neutral basis, for the fourth quarter and full year, respectively, compared to the same periods in 2021

- System-wide comparable RevPAR increased 7.5 percent and decreased 1.3 percent, on a currency neutral basis, for the fourth quarter and full year, respectively, compared to the same periods in 2019

- Approved 24,400 new rooms for development during the fourth quarter, bringing Hilton’s development pipeline to 416,400 rooms as of December 31, 2022

- Added 17,700 rooms to Hilton’s system in the fourth quarter, resulting in 48,300 net additional rooms in Hilton’s system for the full year, contributing to net unit growth of 4.7 percent, with fourth quarter hotel openings modestly lagging prior expectations due to the ongoing COVID-19 environment in China

- Full year 2023 net unit growth is expected to be between 5.0 percent and 5.5 percent

- Repurchased 3.8 million shares of Hilton common stock during the fourth quarter, bringing total capital return, including dividends, to $542 million for the quarter and more than $1.7 billion for the full year

- Launched a new premium economy brand, Spark by Hilton, in January 2023

- Full year 2023 system-wide RevPAR is expected to increase between 4 percent and 8 percent on a comparable and currency neutral basis compared to 2022; full year net income is projected to be between $1,382 million and $1,454 million; full year Adjusted EBITDA is projected to be between $2,800 million and $2,900 million

- Full year 2023 capital return is projected to be between $1.7 billion and $2.1 billion