The feasibility of a new hotel is driven by a number of factors, foremost among them – the availability of sites, the costs to build, the price and accessibility of financing, and the demand for hotel rooms at a rate point that supports all these and other elements. With several of these items falling into place in many markets across the U.S., hotel construction continues to accelerate.

Cushman & Wakefield’s Hospitality & Gaming practice provides consulting and valuation services for new and existing hotel properties across the country. In recent years, the majority of new hotel projects we have worked on fall into the Smith Travel Resources (STR) chain scales defined for Upper Midscale, Upscale and Upper Upscale brands. As of December 2015, according to STR, there were 888,843 Upper Midscale, 660,640 Upscale and 583,906 Upper Upscale rooms in the Pipeline. These rooms represent 42 percent of all the hotel rooms proposed in the U.S. The Upscale and Upper Midscale products represent almost 70 percent of the hotels under construction at the close of 2015.

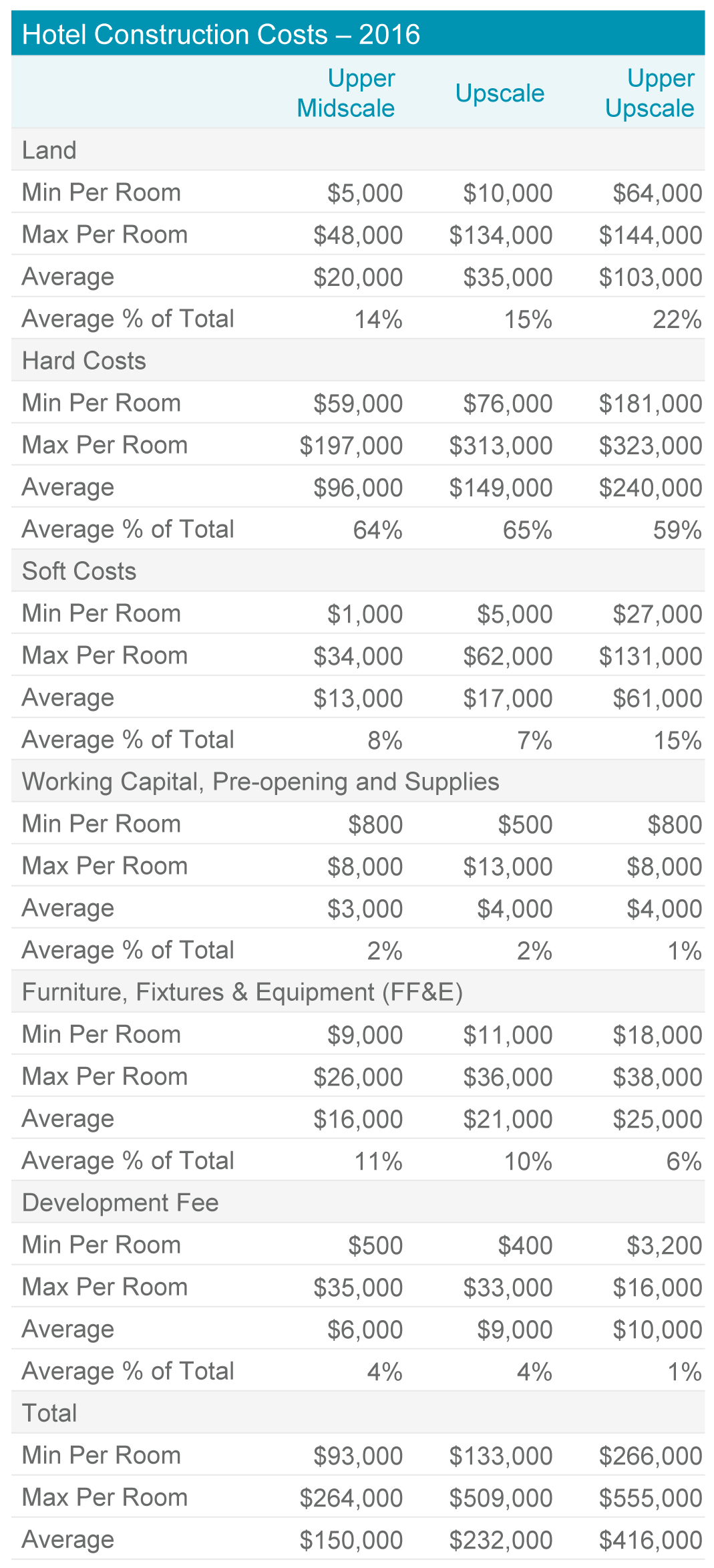

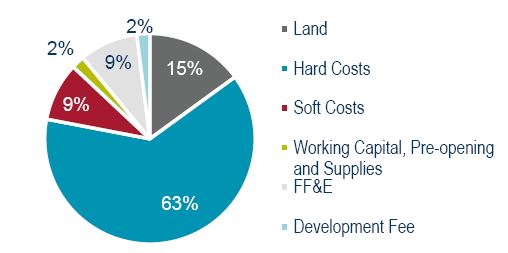

Using project data from actual budgets and other industry sources, Cushman & Wakefield has compiled per-room project costs for the three most prolific STR Chain Scale properties in six major categories: (1) Land, (2) Hard Costs, (3) Soft Costs, (4) Working Capital, Pre-Opening and Supplies, (5) Furniture, Fixtures, & Equipment (FF&E), and (6) Development Fee. Composite budget data from recent hotel projects is shown in the chart to the right.

The data represents broad category ranges and should be used as a general guide only. Specific amounts from project budgets are harder to validate as developers account for items in different categories and geographical costs can vary over 100 percent from one part of the country to another. In addition, we are provided with development budgets that include a variety of line items. Without consistent cost budget categories, some items, such as equipment and fixtures, can bleed from one component to another. Materials or fixtures may be included in certain categories by developers based on their expected depreciation. We have established a consistent allocation of them to the representative categories summed in the following chart

The majority of the projects considered in the Upper Midscale and Upscale categories of the chart represent wood-frame construction, generally three to four stories high. The properties are developed to standards issued by the brands. Most developments in less dense and suburban locations have surface parking; though some in more urban locations have parking agreements with nearby garages or parking companies. Data of Upper Midscale and Upscale products have consistent contributions of each of the components to the total budget to build a new hotel while the Upper Upscale projects have higher proportional land costs. These projects, which represent complex construction, are being built in denser and more competitive markets where land is intrinsically more expensive. The land may have been purchased and held for some time before development was imminent. Land may also be recognized in some projects based on its current value, not necessarily its acquisition costs, and can include closing and holding costs. In financing some of these projects, the land can become a critical component of the developer’s equity contribution. Soft costs are also higher for the Upper Upscale projects as entitlement, pre-development and financing costs can require more financial resources for larger projects than for less complex properties.

Hotel costs continue to escalate, particularly in major urban areas. With competition from other types of real estate development, including residential and office construction projects, sourcing construction labor, particularly skilled labor, continues to be challenging and costly. Pricing of some construction materials, such as cement, gypsum products and plywood, is increasing above inflation. The cost of other materials, including steal and sheet metals, is growing more modestly. The drop in energy prices has caused some expenses to decline in regional markets and is tempering prices of some materials and transport. The lower cost of transport has been favorable for the FF&E component as well.

We are also including a category for Development Fee. More and more, we are seeing an allocation of the project budget directly to the development team. The fee accounts for the costs of the ground work and administering of the project including payroll, technical services, travel and other expenses. The development fee is not related to any entrepreneurial incentive expected upon the successful completion of the construction.

Hotels, multi-unit residential and entertainment venues are anticipated to be some of the most active sectors of the construction industry in the next couple of years. Overall, at least 865 hotels with 103,230 rooms, are under construction and plan to open in 2016, according to STR. While the hotel industry is notoriously cyclical, with the expectations of strong occupancy and rate growth this year, the volume of new hotel development is being driven by its expected feasibility in many markets throughout the country.