By Dancong ‘Dannie’ Li , Jingjianxiong ‘Charlie’ Shi , Monique Rosszell

Introduction

Once considered the ‘underdog’ in the world of real estate investing, the hotel sector has experienced a remarkable resurgence over the past decade, with a particularly significant upturn since 2021, driven by the surge of pent-up demand resulting from the pandemic. Hotels were often perceived as risky investments due to their seasonality and reliance on short-term leases (i.e., daily rentals). In comparison, the multifamily and office sectors have often been considered safer real estate investments due to the stability of rental income, their resilience during economic downturns, predictable expenses, and long-term appreciation. However, in the wake of the pandemic, the world witnessed the emergence of several ‘new normal’ trends, most notably the surge in remote work options. This paradigm shift had a notably adverse impact on the office sector, and many experts doubt whether the sector will ever return to its pre-pandemic position.

For the multi-family sector in Toronto, the continuous influx of new residents and students, coupled with a shift towards remote and hybrid work arrangements, has driven the need for rental properties. Despite these strengths, multi-family assets in Toronto also face notable challenges, including rent controls, rising operational costs, an increasing supply of new developments, lengthy application processes, and the pressures to maintain and upgrade older properties to meet tenants’ expectations.

To fully appreciate the appeal of lodging investments, it is essential to evaluate the revenue-generating performance of this asset class, understand its unique characteristics, and identify market opportunities. Hotels offer a distinctive combination of income potential and value-add to the surrounding development, making them a highly attractive investment option.

Asset performance comparison

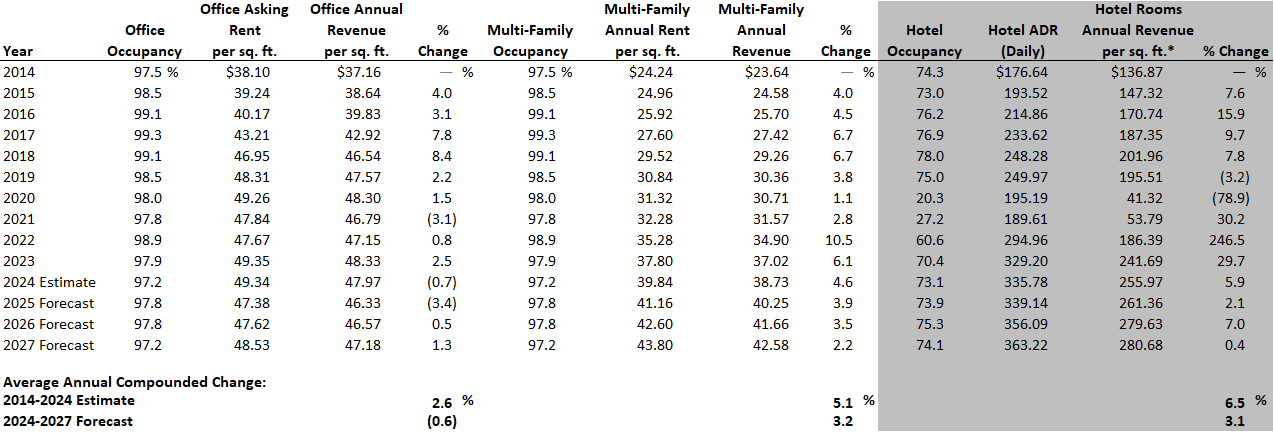

The table below compares the historical and projected performance data of these three asset classes (Office, Multi-Family, and Hotel) in downtown Toronto. The performance metrics have been adjusted to reflect annual revenue per square foot, ensuring a consistent basis for comparison. Historical metrics for all three asset classes and projections for the office and multi-family sectors are based on CoStar data. Projections for the hotel sector are based on HVS data.

Source: CoStar for historical data as well as projections for office & multi-family

While it is commonly recognized that the performance of the hotel sector is cyclical, its growth potential becomes particularly attractive when the asset’s holding period is extended (typically 7 – 10 years). Over the past decade, hotel revenues in downtown Toronto have experienced an average annual compounded growth rate of 6.5%, outpacing the performance of other asset classes. Furthermore, the hotel sector is projected to continue growing at a rate above inflation in the coming years, driven by population growth, increasing travel demand, and urban revitalization efforts.

In comparison, the multi-family sector is expected to remain robust, benefiting from consistent demand for rental housing and stable returns, particularly attributed to the population growth. However, the outlook for the office sector is less optimistic, given the more or less permanent shifts in workplace dynamics stemming from the rise of remote work. These changes have led to a sustained decrease in demand for traditional office spaces, compelling landlords and investors to reconsider their strategies and adapt to new market realities.

Benefits of hotel investments

Office conversion opportunities

The Greater Toronto Area (GTA) is currently grappling with underutilized office space, a challenge that is expected to persist for the next two decades. This insight comes from Altus Group Economic Consulting in their report titled “Office Needs and Policy Direction in the GTA,” commissioned by the NAIOP Greater Toronto Chapter. The oversupply is largely driven by the rise of hybrid work models and remote work, which have fundamentally changed office space requirements. As businesses adapt to these new work patterns, the demand for traditional office environments has significantly diminished, leaving a large portion of the existing office stock underutilized.

According to projections, a considerable amount of office space in Toronto will remain vacant for the foreseeable future. The report suggests that millions of square feet could sit idle until at least 2041, as companies continue to reassess their spatial needs in a post-pandemic world. This long-term oversupply will likely put downward pressure on rental rates and may even lead to the repurposing of some office buildings for alternative uses, such as residential or mixed-use developments, in order to mitigate the economic impact of this underutilization. City councillors are pushing for and proposing to convert older and under-used office buildings into apartments or condos to fight the city’s housing crisis. However, converting office buildings into residential or mixed-use developments also faces challenges, as purpose-built offices have different floorplans and layout needs than residential buildings, making these conversion projects costly and complex. Nevertheless, there have been successful conversions to hotel uses throughout North America. Most conversion projects have been undertaken in major U.S. cities, such as New York, Chicago, and Boston. In Canada, Calgary has been a leader in providing incentive programs for the adaptive reuse of vacant office space. These initiatives have led to the opening of the Westley Calgary Downtown, Tapestry Collection by Hilton Hotel, and the development of an Element Hotel by Westin. The City of Toronto is currently undertaking a study to assess the benefits and risks of office conversions. A few office conversion projects are already underway, including 88 Queen Street East, which is being converted into a hotel, and a mixed-use development at Victoria and King Street East, originally planned as office space, now with a proposed hotel component. We expect more projects to be announced given the abundant vacant office space.

Closing thoughts

In a rapidly changing real estate investing landscape, the hotel sector has emerged as a surprising and promising investment option. The sector’s resilience during the COVID-19 pandemic, adaptability to market trends and inflation, and innovation in the industry have contributed to its outperformance compared to other asset classes, especially that of office. However, it is essential to conduct thorough research and consider individual investment goals and risk tolerance when deciding to invest in the hotel sector. As the real estate industry continues to evolve, hotel is a dynamic and intriguing sector worth exploring for both seasoned and new real estate investors.

.png)