By Robert Mandelbaum and Mark Whitney

According to the March 2022 edition of CBRE’s Hotel Horizons® national forecast report, the total revenue for a typical U.S. hotel is not expected to return to pre-COVID 2019 nominal dollars until 2023. Accordingly, hotel owners and operators continue to seek ways to control expenses.

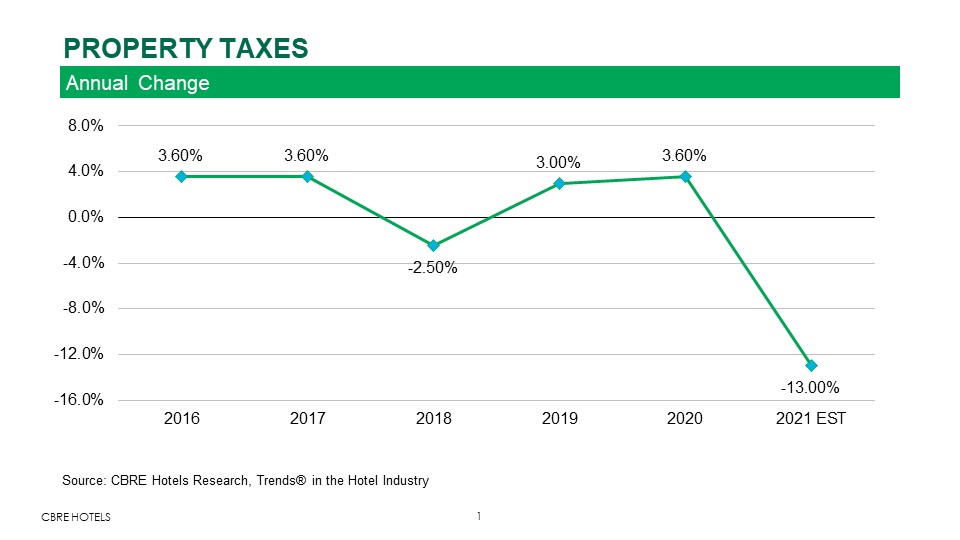

One potential reduction opportunity is property taxes. Based on a sample of 3,400 hotels from CBRE’s Trends® in the Hotel Industry database, U.S. hotel property tax expenditures declined by 13.0% from 2020 to 2021. This decline put 2021 property taxes 9.9% below 2019 levels. Unfortunately, this compares unfavorably to the 41.3% decline in revenues and 57.4% falloff in profits during the same period. For this analysis, profits are defined as earnings before interest, taxes, depreciation, and amortization, or EBITDA.

Relationship to Profits

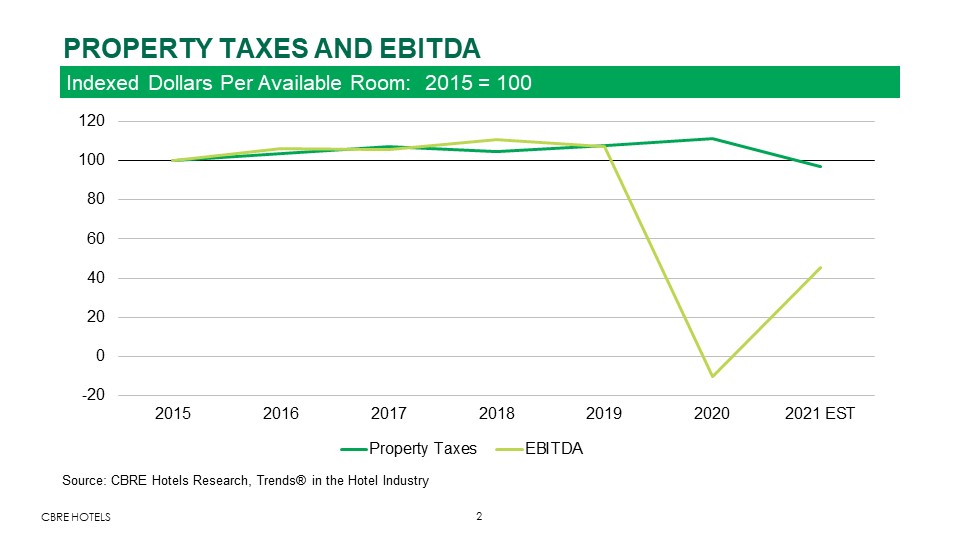

Compared with other forms of real estate, hotel financial performance is relatively volatile. Because of the lack of long-term leases, hotel revenues and profits will react almost instantaneously to changes in the economy. This was evident during 2020 when we observed a sudden 64.3% drop in revenues along with a 109.4% decline in EBITDA in reaction to the pandemic.

Property taxes are based on the assessed value of a property, which is typically the fair market value of the asset. Since profits heavily influence the value of a hotel, the volatility in hotel profitability leads to frequent and instantaneous changes in value.

Regrettably, changes in assessed values do not occur as quickly. Many municipalities will assess a property based on the prior year’s market conditions, or property performance. Some jurisdictions value less frequently, which puts hotel properties, with volatile performance, at a disadvantage when compared with its peers. Accordingly, while profits at the hotels in our sample dropped over 100% in 2020, these hotels’ property taxes increased by 3.6% during the year.

After suffering through the worst year of performance in the history of the U.S. lodging industry, many hotel owners used these results as grounds to reduce the assessed value of their properties. Based on the 13.0% reduction in property tax payments during 2021, these property owners are beginning to see some relief.

Variances by Property Type and Geography

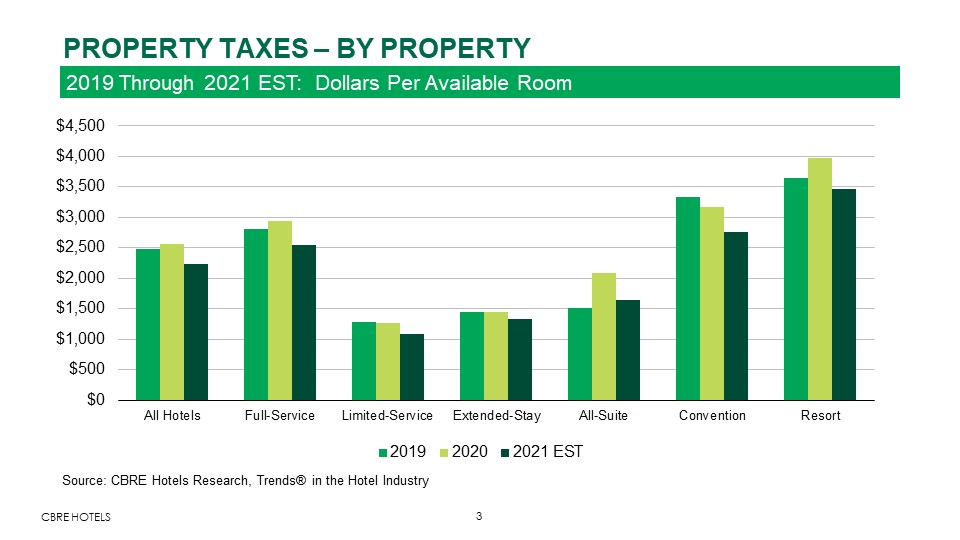

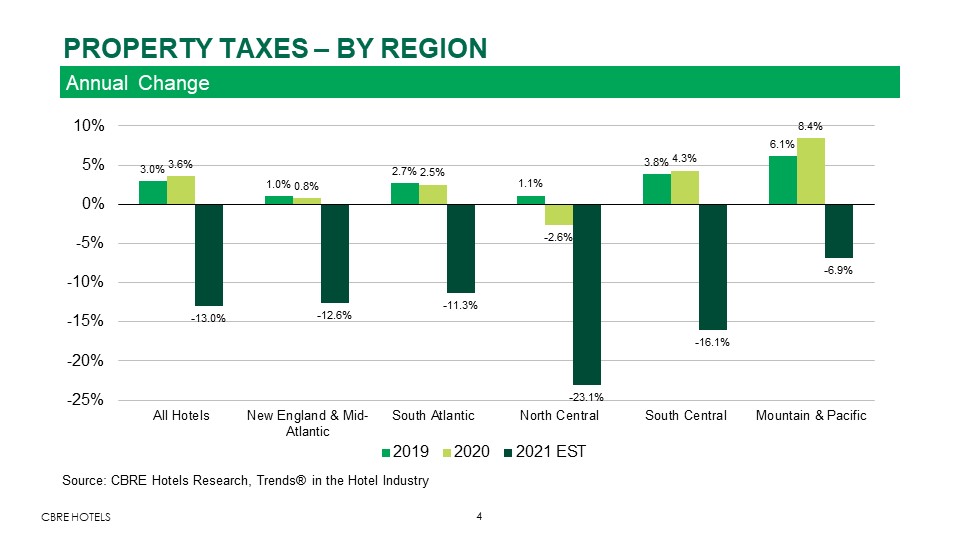

Because tax policy and rates are determined at the local level, there can be greater variations in the changes in hotel property taxes by geography versus property type.

Across the six hotel property category types tracked by CBRE, the declines in property tax payments made in 2021 did not vary much from the 13.0% overall average. This is curious, as property types did not perform equally during the pandemic. Limited service and resort hotels fared better than average during the pandemic and other types such as central business district (CBD) and convention hotels did not perform as well.

In 2021 hotels in the North Central region of the U.S. benefited from the greatest drop in property taxes. The 23.1% decline in taxes for hotels in this region followed a 2.6% decrease in 2020. On the other hand, hotels in the Mountain and Pacific region incurred the greatest increases in property taxes during 2019 and 2020, and then experienced the least decline among all regions during 2021. This is likely because values were closer to market value in the North Central region prior to the pandemic and further adjustment was needed. Pacific Region values tend to be lower than market and as a result, values were not likely adjusted to the same extent as those in the North Central region.

Guidance and Appropriate Relief

While the U.S. lodging industry is in the middle of a substantive recovery, hotel owners are still suffering from the dramatic decline in profits during 2020. Hotel owners should consider the following actions to continue to reduce, or at least control, their property tax payments in the years to come:

- Have your tax assessment reviewed every year.

- Have the review conducted by a competent property tax firm, one with local property tax professionals AND hotel valuation professionals, not just property tax professionals. Without both disciplines, assessed values will not be reduced to their lowest levels allowed.

- Periodically have a second review completed.

- For owners with personal property tax filing requirements, have these returns reviewed as well.

All a professional will need is:

- A copy of your tax bill, or assessment notice showing the parcels included in the assessment

- Your I&E statement for the prior and current year

- Your Fixed Asset listing

- Your Personal property filing (if applicable)

- The last personal property bill received (if applicable)

Remember, most tax assessments are based on mass appraisal techniques. The first time your tax assessment is reviewed in any detail is when you, or your designated professional reviews it!

This article was published in the May 2022 edition of Lodging.