Hoteliers Need to be on Their Toes to Keep RevPAR Momentum

NEW YORK – January 28, 2015 – Hotels in major North American markets experienced strong growth in rate across all travel segments according to data from the January 2015 TravelClick North American Hospitality Review (NAHR). With average daily rate (ADR) growth of 4.5 percent for the next 12 months, ADR will drive revenue per available room (RevPAR) performance in 2015, continuing on the momentum from last year.

“As we enter the cold winter months of the New Year, hoteliers need to carefully monitor meeting, convention and large group events within their market in order to sustain positive RevPAR,” said John Hach, Senior Vice President, Global Product Management at TravelClick. “Beyond maintaining strong group business, hoteliers need to also keep an eye on the pace of business bookings as they appear to be softer than in months past.”

12 Month Outlook (January 2015 – December 2015)

For the next 12 months (January 2015 – December 2015), overall committed occupancy* is up 2.8 percent when compared to the same time last year. ADR is up 4.5 percent based on reservations currently on the books.

Transient bookings (individual reservations made by business and leisure travelers) are up 0.9 percent year-over-year and ADR for this segment is up 5.4 percent. When broken down further, the transient leisure (discount, qualified and wholesale) segment is showing occupancy gains of 2.4 percent and ADR gains of 4.5 percent. Transient business (negotiated and retail) segment occupancy is down 0.9 percent but ADR is up 6.4 percent. Group segment occupancy is ahead by 3.4 percent and ADR is up 2.7 percent, compared to the same time last year.

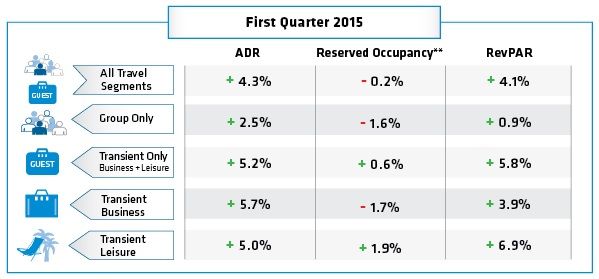

Hach continued, “Given that occupancy is slightly down or relatively flat in Q1 it’s important that hoteliers have a confident outlook as they begin the New Year. While occupancy numbers are weaker than we’ve seen in some time, the good news is that they appear to strengthen as we look out into Q2.”

The January NAHR looks at group sales commitments and individual reservations in the 25 major North American markets for hotel stays that are booked by January 4, 2015 from the period of January 2015 to December 2015.

*Committed Occupancy – (Transient rooms reserved + group rooms committed)/capacity

**Reserved Occupancy – Total number of rooms reserved/capacity

The first quarter is composed of forward looking data (January-March)