However, Deceleration of Business Travel Creates Increased Dependency on Leisure Bookings

NEW YORK – January 28, 2016 – As hoteliers kick off the New Year, properties in major North American markets are experiencing strong increases in bookings, with 19 of the top 25 (76 percent) markets showing committed occupancy* growth compared to last month. However, as business demand pace has slowed, there is an increased dependency on leisure and wholesale bookings with lower average daily rates (ADR) to drive occupancy, according to new data from TravelClick’s January 2016 North American Hospitality Review (NAHR).

“While total committed occupancy for 2016 is off to a strong start, led with a significant increase in new group bookings added within the past 30 days, business demand pace has slowed, creating greater dependency on hoteliers to offset the slowing pace with discounted leisure and promotional bookings,” said John Hach, TravelClick’s senior industry analyst. “As a result, hoteliers must ensure that they are measuring and monitoring local advance booking trends across all channels to reach their 2016 revenue per available room (RevPAR) objectives.”

Twelve-Month Outlook (January – December 2016)

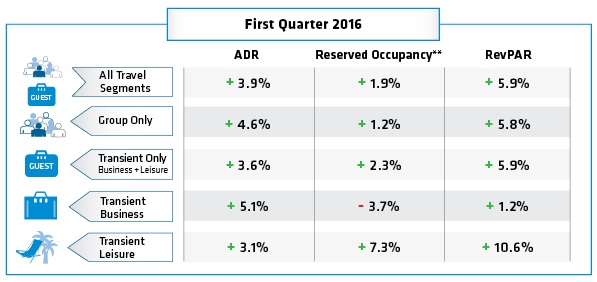

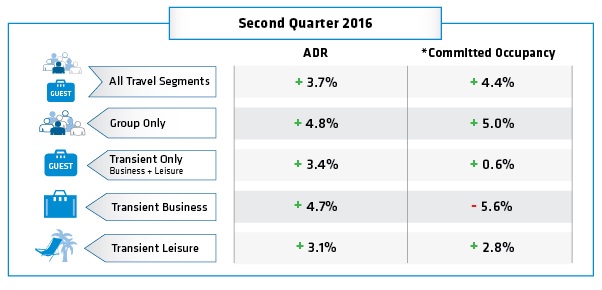

For the next 12 months (January – December 2016), transient bookings are up 2.0 percent year-over-year, and ADR for this segment is up 3.6 percent. When broken down further, the transient leisure (discount, qualified and wholesale) segment is showing occupancy gains of 6.1 percent, with ADR gains of 3.2 percent. The transient business (negotiated and retail) segment is down -3.6 percent, but ADR is up 5.2 percent. Lastly, group bookings are up 3.5 percent in committed room nights over the same time last year, and ADR is up 4.7 percent.

“The good news is that the dispersion of the newly added group bookings will continue throughout the New Year, providing a viable foundation of advance reservation business,” added Hach. “This bodes well for hoteliers to continue their focus on increasing ADR in 2016.”

The January NAHR looks at group sales commitments and individual reservations in the 25 major North American markets for hotel stays that are booked by January 1, 2016, from the period of January to December 2016.

*Committed Occupancy – (Transient rooms reserved + group rooms committed) / capacity

The first quarter is comprised of forward-looking data from January through March 2016.