By Jon Fletcher

Valuation professionals specializing in hotels commonly receive questions about the impact of Airbnb’s growing popularity on the established hotel industry. For years, many within the profession shrugged off Airbnb as an outlier or a fad that would come and go like so many companies that are no longer with us. But Airbnb has demonstrated its staying power so far and recent reports are hailing the company as a “disruptor” and one of the most valuable startups in the world.

As Airbnb looks at the possibility of a blockbuster IPO in 2017, the time to look into the impact of this company has arrived. Its currently ski season and to narrow the focus a bit for more meaningful results, this analysis seeks to understand the effect of Airbnb on the ski resort market in Colorado.

HOW AIRBNB STACKS UP AGAINST HOTELS

Before examining the impact on Colorado ski resorts, some overall perspective on Airbnb vs. the hotel industry will be useful. As of July 2016, Equidate reported an estimated market value of $29.6 billion for Airbnb, up from $13 billion in October 2014 with more than $2 billion in capital raised during that timeframe. Recently, the Wall Street Journal reported a market valuation of $31.0 Billion due to an additional $150 million in raised capital. Their report suggests the new funding may allow Airbnb to remain private, rather than going public. Regardless, Airbnb’s value is now higher than the market capitalization of any other major hotel chain.

The data above is both startling and compelling — but to what extent will the impact of Airbnb’s growth be felt? To answer this question, Smith Travel Research (STR) performed a study on the Airbnb phenomenon in 13 global markets. They summarize several key points from their research illuminating:

- Airbnb occupancy was the highest in markets where hotels had high occupancy.

- Hotel occupancy was significantly higher than Airbnb occupancy.

- While Airbnb’s share of total accommodation supply (i.e., Airbnb units and hotel rooms) was growing, its share of market demand and revenues was generally below 4% and 3%, respectively.

- Airbnb guests typically stayed longer than the average hotel guest, with roughly half of Airbnb room nights coming from trips of seven days or longer.

- Airbnb’s share of business travel was substantially smaller than its share of leisure travel.

- Hotel average daily rates (ADR) were generally higher than Airbnb rates. For example, the average hotel rate was $16 higher than Airbnb rates in the seven U.S. markets included in the study.

- Hotel ADR increased in all but one market (Paris) in the year ending July 2016. Airbnb rates decreased in eight markets and increased in five over that time period.

In general, the key findings of this report show that comparing traditional hotels with Airbnb is a bit of an apples-and-oranges comparison, particularly since Airbnb availabilities are often larger accommodations with longer stays than the typical hotel supply.

But do these same trends apply to ski resorts where visitors often travel in large groups over extended periods of time?

EXAMINING THE AIRBNB EFFECT

The State of Colorado offers endless outdoor recreation options for weekend warriors — from camping to rafting to biking to mountaineering. But skiing surpasses them all in terms of economic impact on the Centennial State.

However, ask anyone from the Denver Metro area about going skiing and they will likely groan about the traffic on Interstate 70 on the way to the resorts. To avoid this mess, many Coloradans and skiers from all over the world have invested in condos, time-shares and homes near their favorite ski resorts. Others seek out hotels or other rental accommodations, which has led to notable growth in demand for lodging near ski resorts.

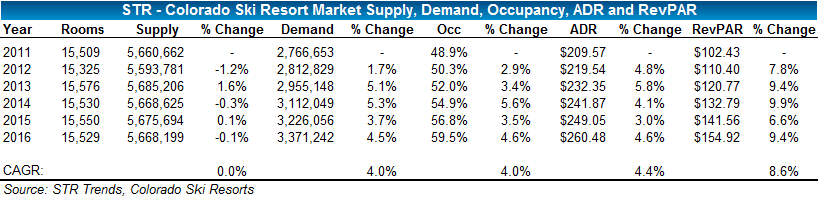

This demand is demonstrated by the January 2017 STR Trends report on the Colorado ski area:

This data shows that the supply of surveyed rooms has remained relatively unchanged since 2011, but demand has seen a compound annual growth rate (CAGR) of 4% and revenue per available room (RevPAR) has grown at a CAGR of 8.6%. This could be due in part to a lack of incoming supply, as investors have been cautious about development in resort areas after the losses incurred in 2008–2010.

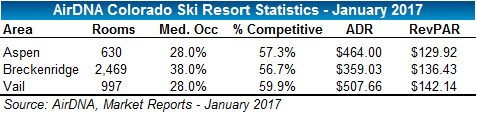

Next, are the AirDNA for statistics on Airbnb markets in Aspen, Breckenridge and Vail. One weakness of this data is that it is reflective of peak market conditions in January 2017 and does not represent a full year of reporting like the STR data above.

While these three areas do not cover all the ski resorts examined in the STR Trend report, they do encompass the largest resorts and make up 26% of the potential hotel rooms in the market as reported by STR. Further, listings on Airbnb for shared rooms or 3 Rooms + (including entire homes) make up less than 60% of the total room supply reported in these markets that would realistically compete with hotel rooms in the STR report.

None of the markets highlighted by the AirDNA data show Airbnb occupancy above 40%, compared to the 59.5% average for hotel rooms reported by STR. In contrast to the global STR study, the Airbnb ADRs are considerably higher than hotels’ in the Colorado ski resort markets — however this data does include off-season rates. Regardless, the data shows that in the Colorado ski resort markets, Airbnb rates are generally higher than hotels’ and Airbnb units also experiences lower occupancy.

DISRUPTION LIKELY TO REMAIN MINOR IN COLORADO SKI RESORT MARKETS

Overall, the data from STR and AirDNA show little support for the claim that Airbnb is a disruptive force in the Colorado ski resort hotel industry. Despite the large supply available on Airbnb, this likely represents a consolidation of rental homes and condos that have historically competed with the hotel industry.

In the past, these daily, weekly or monthly rentals would have been handled by traditional services such as brokers and property management companies. However, Airbnb is now becoming the preferred method for homeowners to market their properties. Nearly 40% of these offerings would not be competitive with the hotel market as they are for entire homes rather than hotel rooms and suites. The smaller Airbnb offerings that do compete with hotels feature pricing that exceeds traditional hotel rates.

Similar trends have been noted in markets where Airbnb rates are higher than traditional hotels. This leads us to believe that in some markets, the desire of Airbnb hosts to achieve maximum rates may prevent any significant negative impact on the traditional hotel industry. This is demonstrated by lower occupancy levels at large homes that do not rent on a regular basis vs. hotel rooms. All of these factors point to a limited negative impact on the hotel industry from Airbnb unless hosts lower prices and increase the supply of smaller, directly competitive accommodations.