By Breanna Smith

Boise is closing in on the ranks of the top ten cities in which to live in the U.S., according to the 2017 survey by U.S. News & World Report. The reasons for the elevated ranking—number 12, as of this year—include affordability, job prospects, and overall quality of life. This reflects Boise’s ascendance in other spheres, including population, visitation numbers, and the number of proposed hotels, especially in the city’s downtown corridor.

The ongoing development boom compares to the Grove Plaza-centric boom of the late 1980s and ’90s,[1] when architectural staples of Downtown Boise arose, including the Wells Fargo building, the Grove Hotel, and the Boise Centre convention center.

The following HVS Market Pulse article details recent events in the Boise economy and the dynamics of supply, demand, and performance for the city’s hotels.

The Market

The Boise economy, while having diversified over the past two decades, is still predominated by food processing/distribution, heath care, and higher education. Albertsons, Inc. was one of Boise’s top employers before a substantial portion of the company was sold and relocated in 2006, affecting its headquarters operations in the city. The recession of 2008/09 intensified the strain on Boise’s economy, and by 2013, the Albertsons portfolio had shrunken to 192 stores nationwide.

Albertsons began to rebuild with the purchase of several grocery store brands, including Safeway Inc., in January 2015. Albertsons now operates approximately 2,300 stores nationwide under 18 banners. This has led to 26,000 new jobs across the nation, specifically tied to the Safeway Inc. acquisition, and has contributed to expanding the Boise corporate office from 200 to 600 workers.

St. Luke’s Health Systems, Boise’s top employer, continues to invest in its facilities and locations in the greater metro area. In June 2016, St. Luke's Boise Medical Center received approval for a $400-million expansion and renovation; the 576,000-square-foot expansion is expected to include a new children's medical center, medical office buildings, a parking garage, and a medical tower. Furthermore, St. Luke's Health has entered a purchase agreement for approximately 600,000 square feet of additional office space, including all buildings in Washington Group Plaza, to house all administrative offices and accommodate further expansion as part of the facility's Master Plan.

Higher education is expanding, as well. Boise State University reported that its fall 2016 total enrollment increased 8% over the same period the previous year. The growth included first-time degree-seeking students from both within Idaho and out of state.

The proposed Idaho College of Osteopathic Medicine (ICOM) will be located at the Meridian Health Science Center at Idaho State University (ISU), just outside Boise. The privately funded ICOM will be independent of the university, however, and separately licensed. In May 2017, the proposed ICOM received pre-accreditation status, and construction of the roughly 96,000-square-foot, $31-million building is expected to begin once the school receives provisional accreditation.

Other developments in the Boise market include the recently opened JUMP (Jack’s Urban Marketplace), a community and interactive creative center; the new, nine-story J.R. Simplot headquarters’ building in Downtown Boise, which opened earlier this year; Saint Alphonsus’ $80-million hospital in Nampa; several multi- and single-family housing projects under development; various new restaurants; and 13 hotels.

Overall, development across the greater Boise market supported a 24% increase in jobs between September 2015 and September 2016, a higher percentage than any other metro area in the nation.

What’s Behind the Boise Boom?

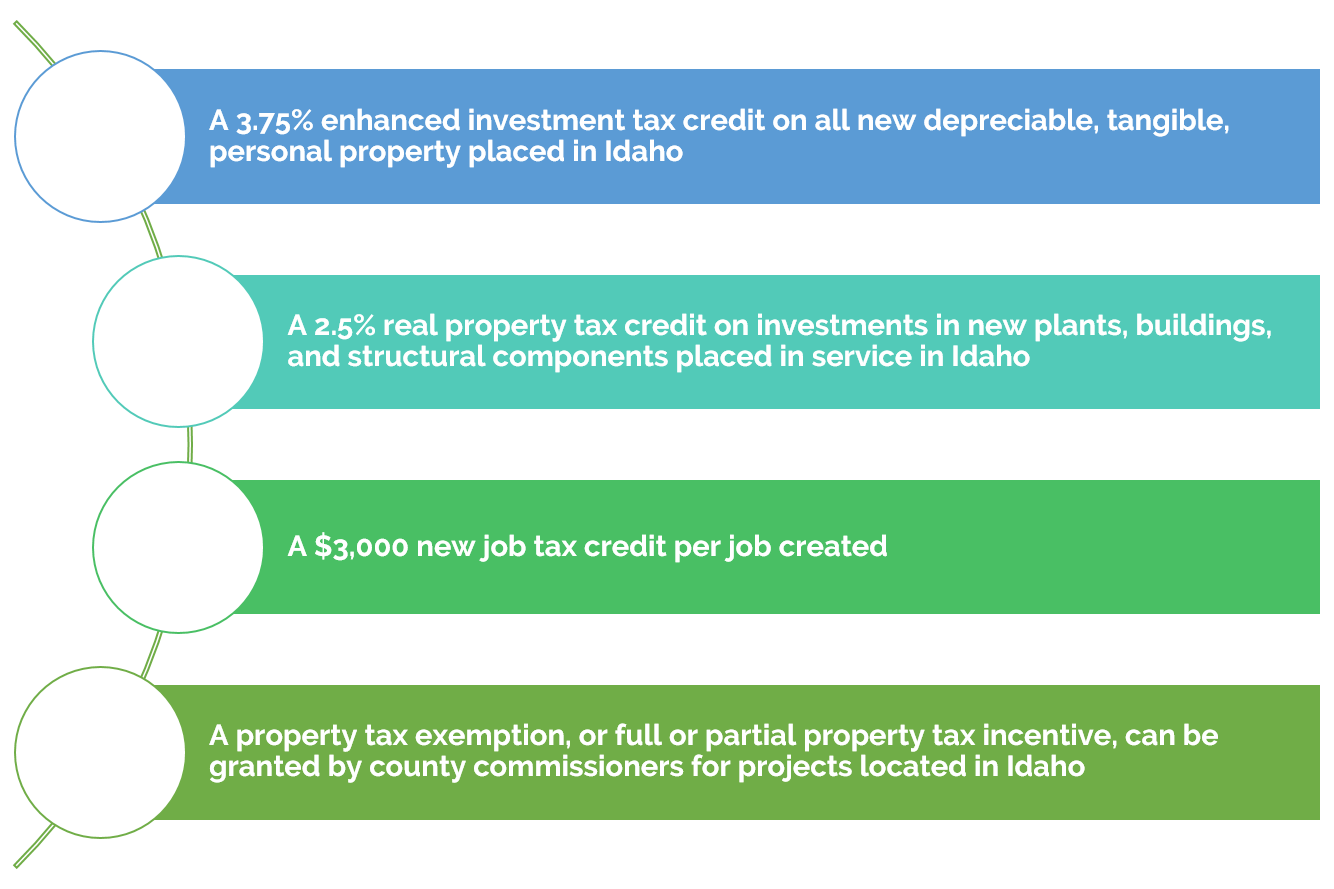

Idaho’s favorable business climate, including an inviting tax structure and business incentives, has been very successful in bringing new businesses to Boise. In 2012, the state lowered both personal and corporate income taxes. The following year, the state exempted more than 90% of Idaho’s businesses from paying personal property tax. Other commercial incentives in Idaho include:

According to the Idaho Department of Labor, the state is projected to register the sixth-fastest job growth in the nation through 2024, growing 20% from 2014 through 2024, with jobs across diverse industries and sectors.

Tourism

Boise Centre

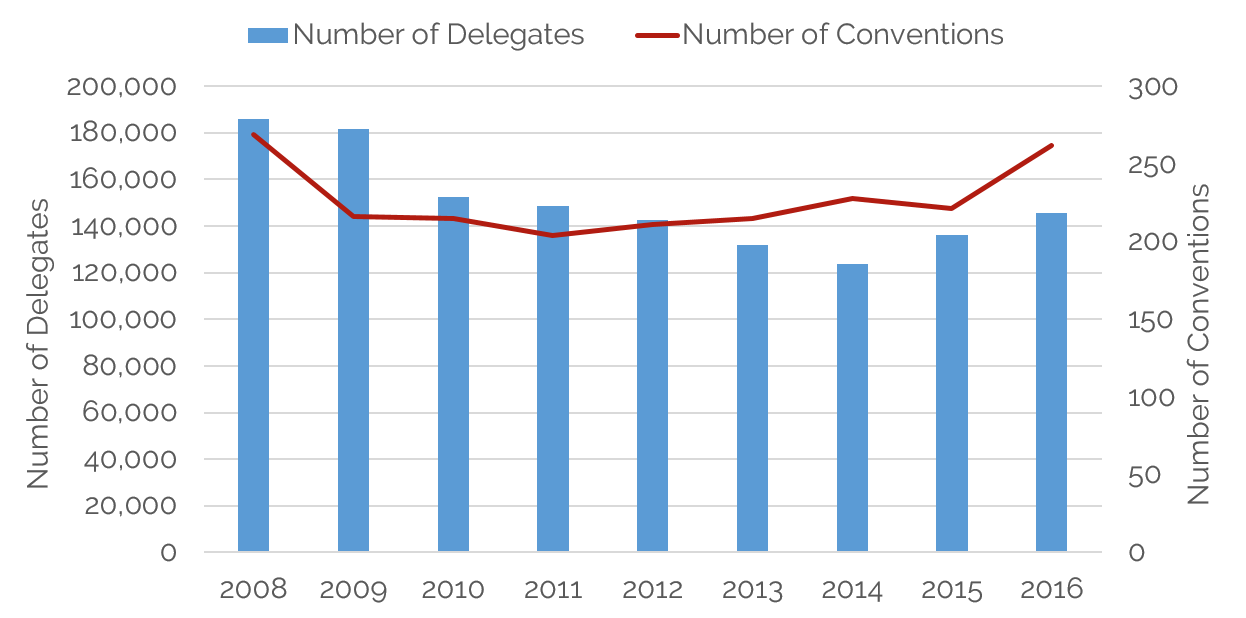

The Boise Centre expansion has already resulted in large gains, with an increase of approximately 19% in the number of conventions and 7% in the number of delegates in 2016 versus the previous year. Expectations are set even higher for 2017. Just this June, Boise Centre hosted the annual convention of the Council of State and Territorial Epidemiologists. With approximately 1,400 attendees and an economic impact estimated at $2.5 million,[2] this was the largest conference in the city’s history. Hotel supply in Boise was a major factor in attracting this conference. At the time of booking, the Boise Convention & Visitors Bureau helped secure guestrooms at several hotels that were still under construction yet set to open by June. Looking forward, Boise Centre has secured the Football Bowl Association in 2018 and the Industrial Asset Management Council in 2020.

Boise Centre Realizes Strong 2016 Gains in Both Conventions and Delegates

Hotel Supply

From 2006 to 2008, approximately twelve new hotels entered the greater Boise market. The new supply, coupled with the 2008/09 recession and the downsizing of Albertsons, dealt a blow to hotel performance in Boise. While several hotels in the market changed flags over the next several years, no new hotels opened in Boise until June 2016. The lack of new supply from 2009 to 2016 resulted in substantial growth in both occupancy and rate for existing hotels, especially as Boise entered back into a period of economic growth.

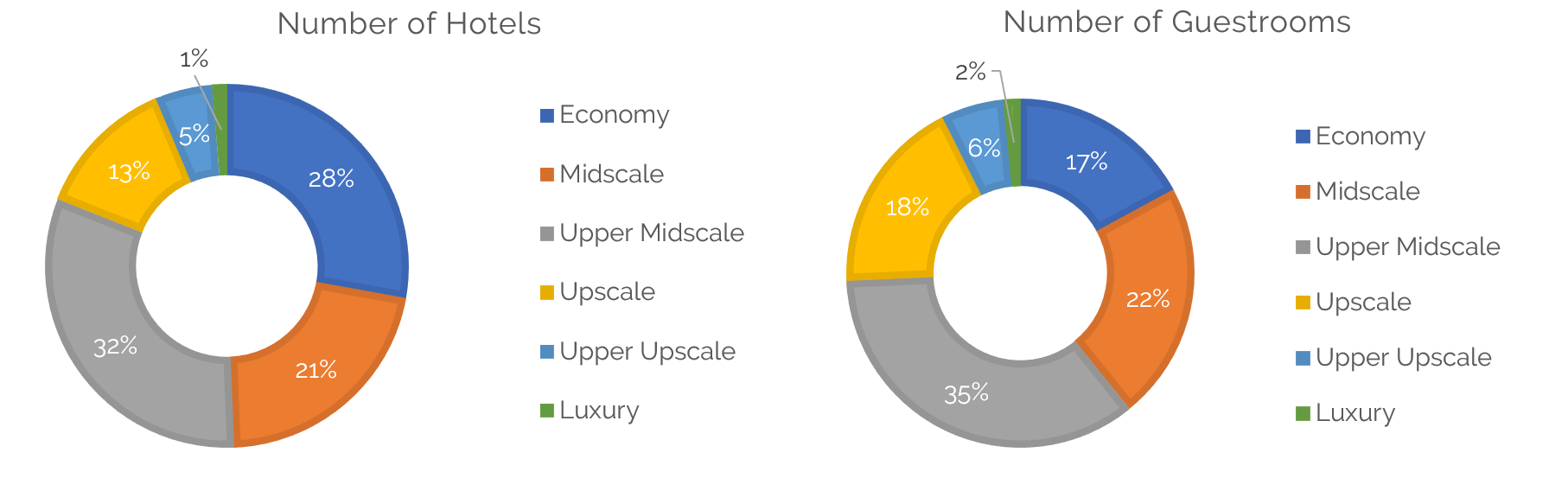

Existing guestroom supply in the greater Boise market, including the cities, towns, and communities of Caldwell, Eagle, Meridian, Nampa, Garden City, and Atlanta, consists of the following chain-scale percentages: 2% Luxury, 6% Upper Upscale, 18% Upscale, 35% Upper Midscale, 22% Midscale, and 17% Economy.

Upper-Midscale Hotels Dominate the Boise Market, while Luxury Represents Just 1%

In January 2017, The Inn at 500 Capitol was the first luxury hotel to open in Downtown Boise. That opening was followed by the Hyatt Place Boise/Downtown, which opened in May 2017; moreover, the proposed Residence Inn by Marriott Downtown is scheduled to open in September of this year.

Following the opening of the Holiday Inn Express Hotel & Suites Boise Airport in 2016, the proposed Comfort Inn & Suites broke ground in May 2017 at Boise Airport. In the surrounding market, three hotels have also opened in 2017, including the My Place Hotel Meridian, the Best Western Plus Peppertree Inn Nampa Civic Center, and the Holiday Inn Express Hotel & Suites Nampa – Idaho Center.

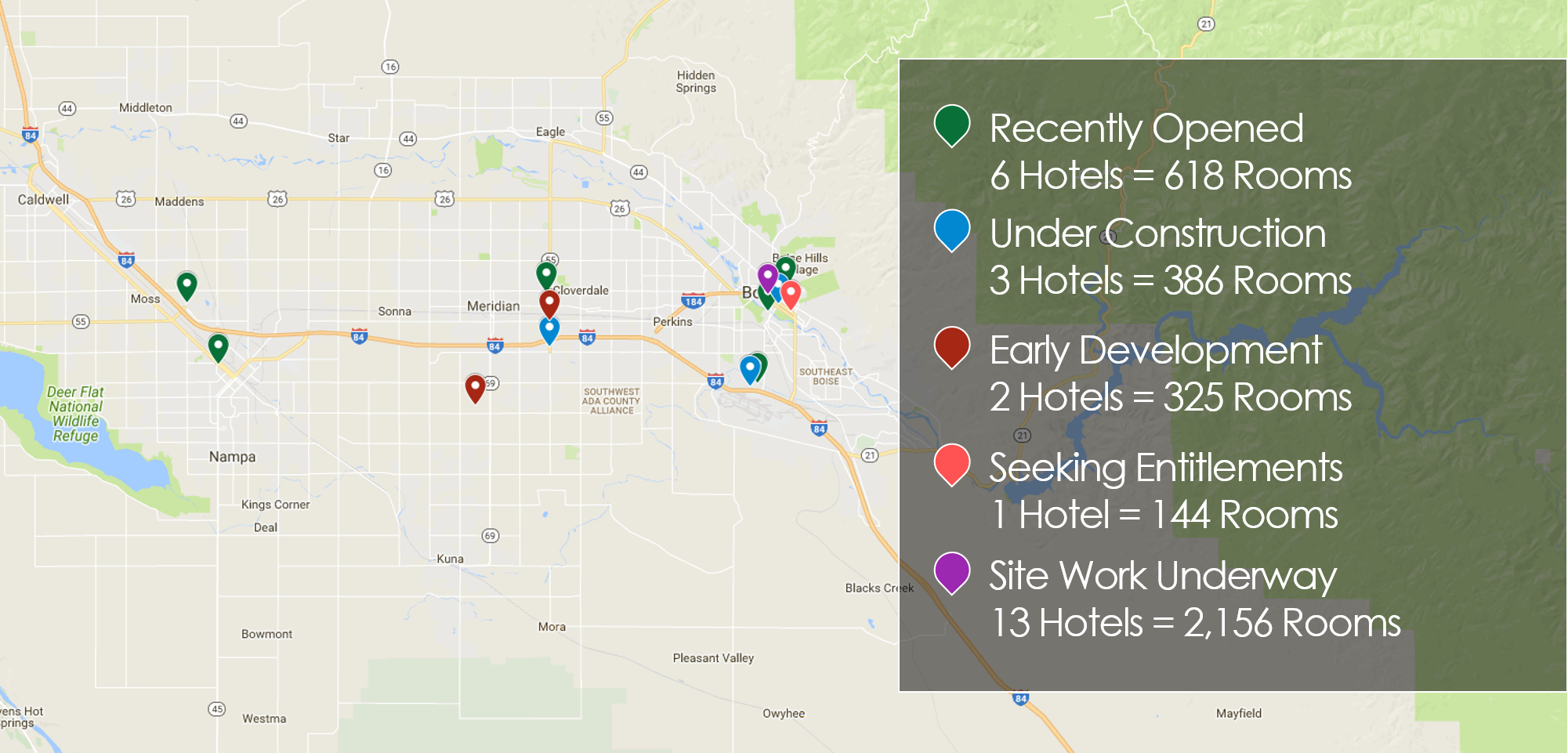

The following table illustrates new and proposed hotel supply in the Boise market.

Seven New Hotels Are in the Pre-Development or Development Stages in Greater Boise

City officials report that businesses and convention authorities welcome the new supply of hotels in Boise, as large conventions were formerly turned away for lack of rooms. This is especially true after the convention center’s expansion, which is expected to attract more and bigger events in the future. On the other hand, hoteliers express some concern that the influx of new supply, unprecedented since 2006 to 2008, could undermine the trend of performance growth in the market.

Given that most of the new supply is located within the downtown corridor, the surrounding submarkets could experience a reduction in overflow demand related to compression; however, these submarkets are also realizing demand growth that is not directly associated with the downtown market, such as the proposed Idaho College of Osteopathic Medicine in Meridian and the Saint Alphonsus’ hospital in Nampa.

The Outlook

Although Boise has not experienced a period of full-steam development since the Grove Plaza-centric boom in the 1980s and ’90s, the economic growth is well balanced among commercial, residential, and leisure projects. As new supply enters the market over the next two years, occupancy is anticipated to soften in the near term; however, given the growing strength of the Boise economy, a quick recovery is expected. Overall, the outlook for Boise is optimistic.

[1] http://www.idahostatesman.com/news/local/community/boise/article62376822.html [2] Boise Convention & Visitors Bureau