By Christian Cross

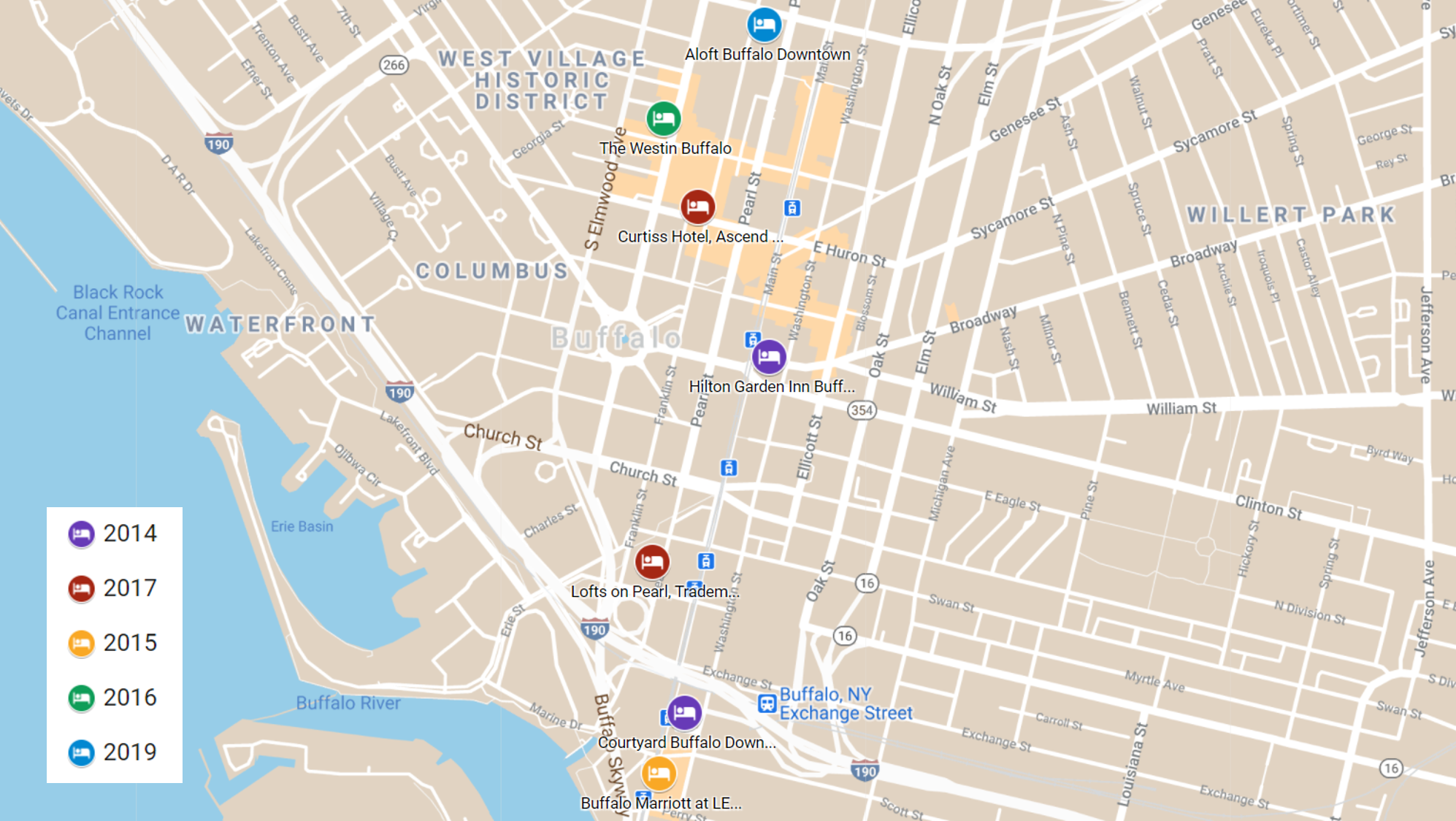

Like so many markets throughout the United States, the decade of growth following the Great Recession benefited the Buffalo metropolitan market. Developers started to take notice of the strength of this market, and new supply began to increase. While hotels were being built throughout the country, the increase in supply within this market was notable, especially in the upscale and upper-upscale segments. Since 2014, supply has increased more than 45%, with the following hotels having entered the relatively small Downtown submarket:

Source: HVS

In addition to all the new supply, the former Comfort Suites was renovated and rebranded as a Holiday Inn Express (May 2016), and the historic Hotel at The Lafayette became affiliated with Wyndham’s Trademark Collection (Sep 2017). Prior to the opening of the Courtyard by Marriott in 2014, two hotels, the Buffalo Grand Hotel (originally built as a Hilton, later operating as the Adam’s Mark) and the Hyatt Regency, made up more than 50% of the total inventory in the Downtown submarket. Despite the significant amount of new supply entering the market, occupancy levels remained in the 70s throughout the decade, and average daily rate (ADR) continued to increase. The market was able to absorb the new supply relatively easily given that key performance metrics were strong. The notable exceptions, however, have been the two aforementioned big-box convention hotels, as they have been affected by their aging facilities and large room counts, the increase in local supply, and the reduced convention demand due to an increase in competition from other regional convention centers in recent years.

2020

Not surprisingly, the COVID-19 pandemic caused a notable decline in both occupancy and ADR, prompting many hotels within this market to temporarily cease operations. Notably, the 396-room Hyatt Regency remains closed and is not expected to reopen until at least March 2021. Upon reopening, this hotel will no longer operate as a Hyatt Regency; whether it becomes affiliated with a different brand or operates independent of a brand remains undetermined at this time. Of all the lodging markets in New York State, the Buffalo metropolitan market was the second hardest hit in terms demand decline, following only New York City. While the average decline through the third quarter of 2020 for the state was around 40%, the demand decline in the Buffalo metropolitan area was closer to 50%. The Buffalo metropolitan market has performed worse than many comparable markets within the state, such as Rochester, Syracuse, and Albany, due in large part to the closure of the U.S./Canada border.

Throughout the year, leisure demand, while still reduced, served as the backbone for many lodging markets. The Buffalo metropolitan area has historically benefited from many Canadian leisure travelers crossing the border to shop in the Unites States or attend sporting events (both youth sports and professional sports). With the border closed during the pandemic, this leisure demand has dissipated. Furthermore, many families sought out drive-to destinations for their summer trips, and many hotels in other markets benefited from lodging demand related to guests spending a night on their way to another destination. Given Buffalo’s location nestled along the Canadian border, that type of demand did not materialize. Finally, throughout the country, we have seen lower-priced hotels withstand the pandemic better than the higher-priced, select- and full-service hotels, which make up so much of this market’s supply.

The Immediate Future

The distribution of both the Pfizer-BioNTech and the Moderna vaccines is ramping up in the United States and Canada, which offers some encouragement that the border may reopen soon. Once this happens, it is expected that there will be an instant demand uptick for this market, as many family and friends on both sides of the border have been separated throughout the pandemic; the Peace Bridge border crossing has historically created significant stay-over demand in Buffalo. In addition to the vaccines and the reopening of the border, the recently passed second round of government stimulus is anticipated to have a positive impact the hotel market, as will the currently proposed stimulus bill if it is passed. However, RevPAR levels are expected to remain depressed, relative to 2019 levels, for a couple of years as the economy recovers.

The More Distant Future

Many developers that were considering building a new hotel have put their plans on hold because of the pandemic. For example, The Trico Building redevelopment’s plan included an extended-stay hotel component as part of the larger mixed-use project; however, given the current climate, ownership is considering removing the hotel component and expanding the number of apartments to be offered. Ellicott, the development team behind the recently opened Aloft Hotel, is considering developing an Element by Westin hotel near Buffalo General Medical Center, but this hotel is still in the early planning stages. As the market recovers, we would expect developers’ interest in new lodging facilities to increase.

The Buffalo Niagara Convention Center no longer attracts the events it previously had and will need an infusion of capital to become competitive with other similar sized cities. Furthermore, upgrades are needed at Bills Stadium (formerly New Era Field and home of the NFL’s Buffalo Bills). There has been serious discussion about building a new stadium in Downtown Buffalo; however, renovations of the current stadium remain on the table. Despite vocal support for both a new stadium and a renovation of the convention center, no decisions have been made on either project. The financing for each of these projects was a concern prior to the impact of COVID-19 pandemic, and the full impact of related economic recession on these projects is not yet known. If either or both projects move forward, the impact on this lodging market would be notable.

For more information on the Buffalo market, contact Christian Cross.