By Brett Testa

Pre-Pandemic

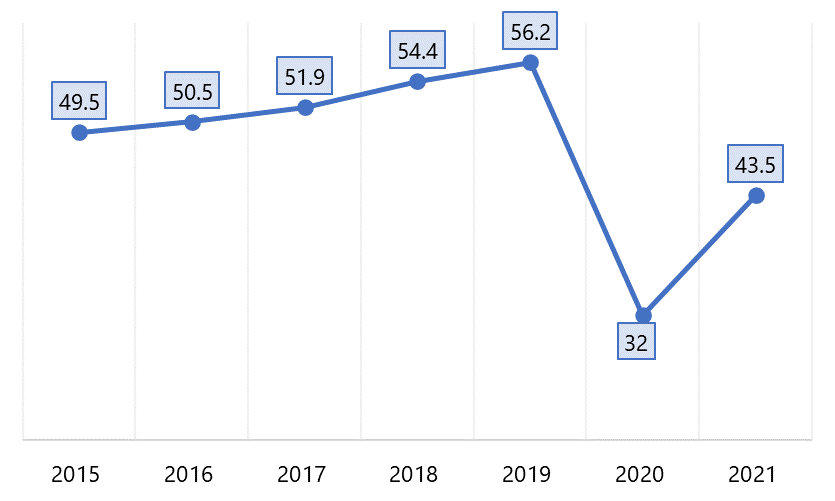

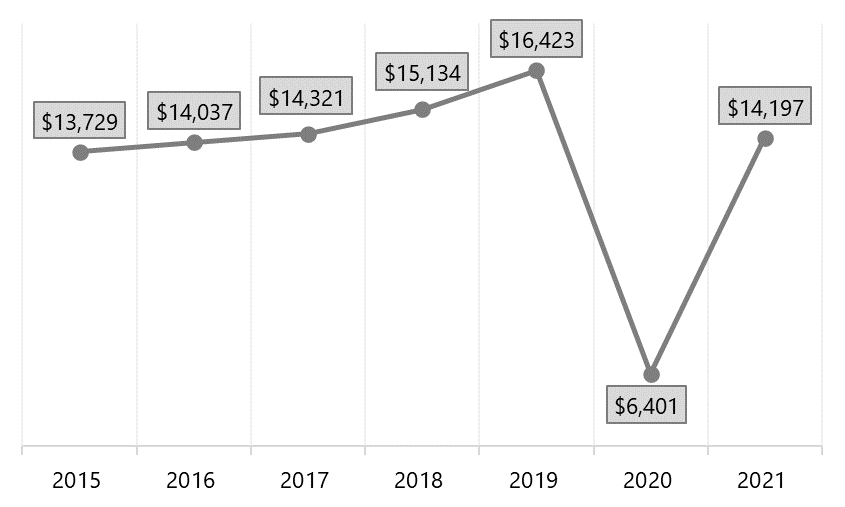

Atlanta’s rise in reputation as the event and convention hub of the southeast, a vision first ignited by the hosting of the 1996 Olympics, reached a zenith in 2019 with the hosting of Super Bowl LIII, marking Atlanta’s second time hosting the Super Bowl in the last 20 years. The data below, provided by the Atlanta Convention & Visitors Bureau, illustrate the steady growth in visitors to the city and their spending in the years preceding the COVID-19 pandemic. The August 2017 opening of the Mercedes-Benz Stadium, which hosts games for both the Atlanta Falcons football team and the Atlanta United soccer team, marked a notable increase in tourism to the city.

Atlanta Visitor Volume – Guests Welcomed (Millions)

Source: Atlanta Convention & Visitors Bureau

Atlanta Visitor Volume – Revenue Generated (Millions)

Source: Atlanta Convention & Visitors Bureau

This growth in visitation also bolstered Atlanta’s lodging market, according to data provided by STR. While occupancy remained relatively stable near 70.0% from 2015 through 2019, supply grew 6.3% and average daily rates (ADR) increased by nearly 17.6%, resulting in RevPAR gains of nearly 19.3% during that period.

Trends in 2020 and 2021

In 2020, according to STR, overall demand declined by approximately 31.0% in the Atlanta market, while the ADR decline was roughly 24.0%, resulting in a RevPAR drop of nearly 47.5%. This RevPAR decline was less severe than the average RevPAR loss across the top 25 markets in the United States, which was 57.6%; Atlanta’s downturn was mitigated by the relatively short duration of its stay-in-place restrictions, which were lifted in June 2020.

By the spring of 2021, occupancy and average rate increased significantly following the removal of most regional and national COVID-19 restrictions. Pent-up leisure demand drove much of the growth as retailers and restauranteurs regained their labor supply and were able to fully reinstate their operations. Notably, transient leisure and contract guest numbers in 2021 surpassed historical levels, though demand totals were below historical levels due to group event venues taking time to ramp up operations and re-engage in marketing campaigns.

Year-to-Date 2022 Trend and Future Outlook

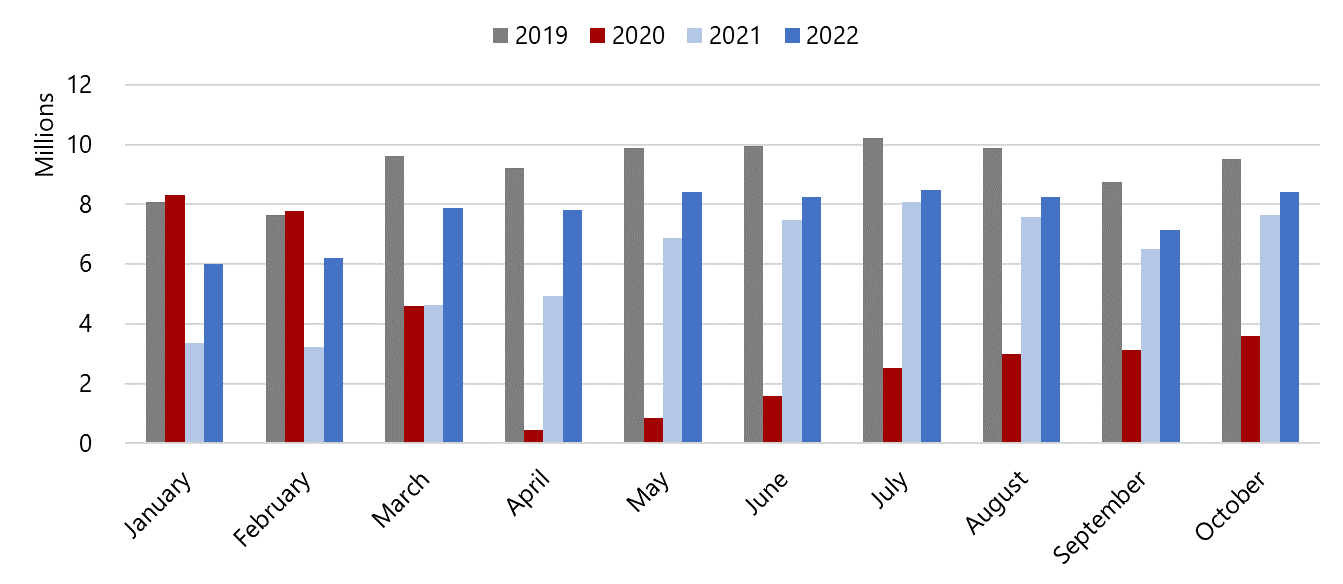

One key metric used to track the recovery in Atlanta is activity at Hartsfield-Jackson Atlanta International Airport. As shown in the graph below, the swift recovery that began in the summer of 2021 has continued through the majority of 2022. Atlanta’s airport, which briefly lost the title of “Busiest Airport in the World” in 2020 during the pandemic, regained that crown in 2021, according to the Airports Council International’s Annual World Airport Traffic Report, 2022 edition. However, there is still room to grow; around 75 million passengers used the Atlanta airport in 2021, compared to the peak of 110 million in 2019.

Hartsfield-Jackson Atlanta International Airport Monthly Passenger Statistics, January–October

Source: Hartsfield-Jackson Atlanta International Airport

Robust demand recovery has continued through 2022, as Atlanta remains a popular international and domestic tourist destination. ADR growth for the 2022 year-to-date period through July was nearly 35% from the same period of 2021, and ADR for full-year 2022 is projected to increase 24% from 2021. Moreover, the return of full-capacity conferences and events in 2022, including two of Atlanta’s largest annual events (America’s Mart in January and Dragon Con in September), have supported stronger demand.

In July 2022, FIFA confirmed that Atlanta’s Mercedes-Benz Stadium would host games for the 2026 World Cup. Many of the new hotels in the pipeline are positioned to support this event. Notably, the 975-room Signia by Hilton, located adjacent to the stadium within the Georgia World Congress Center Authority campus, is expected to open in the fourth quarter of 2024 and will be the sixth largest hotel in the market by room count. Additionally, over 600 new hotel rooms are slated for construction in the Centennial Yards mixed-use development, which broke ground in November 2022.

The return of corporate and leisure events at the Georgia World Congress Center, sports events held at the Mercedes-Benz Stadium and State Farm Arena, and the expectation that employees will return to offices and corporate travel will resume to some extent should support ADR growth in the near future. More significant growth is expected in 2023 as the business mix shifts to higher-rated corporate demand and as new hotels elevate ADR for the market. When accounting for the unusually high ADR in 2019, as a result of demand generated by the Super Bowl, ADR in the market has returned to pre-pandemic levels. Above-inflationary ADR growth is also expected in 2024 as the new hotels ramp up operations and occupancy bases strengthen.

For more information or to inquire about a specific hotel project, contact Adam Lair, MAI, or Brett Testa, Jr. with our Atlanta team.