By Patrick S. Bursey and Aaron Solaimani

Downtown San Diego is considered the heart of San Diego County, and given its excellent accessibility attributes, there are a variety of options for travel in and around the city. Three of the county’s nine major freeways flow through the city, Downtown is located only two miles southeast of the airport, and there are several ridesharing and public transportation options that can easily connect tourists to the area’s primary sources of lodging demand.

San Diego benefits from a diverse mix of demand generated by local corporations, government entities, meeting and group business, and leisure-related activity. Compression resulting from large conventions held at the San Diego Convention Center produces a significant number of room nights in the market on an annual basis. Furthermore, the Little Italy and the Gaslamp Quarter neighborhoods are home to an array of restaurants, bars, nightclubs, and other tourist-oriented businesses that attract leisure guests and serve as amenities to convention attendees. Popular leisure attractions throughout the area continue to attract strong fly-in and drive-in demand. The local economy continues to expand, with tech start-ups, residential development, increases in military spending, and record high levels of visitation. One of the most up-and-coming areas of the city is its East Village neighborhood.

The downtown San Diego area can be divided into eight neighborhoods: Columbia, Core, Cortez Hill, East Village, Gaslamp Quarter, Horton Plaza, Little Italy, and the Marina District. Each neighborhood contains a unique mix of cultural and distinct demand generators, which, to some extent, may preclude the hotels from competing for the same business. Downtown San Diego’s primary economic districts are the Core (office space), Horton Plaza (shopping), Gaslamp Quarter (restaurants and entertainment), and Marina (waterfront and convention center). Many residential, retail, office, and other commercial developments are occurring in the market. Most of the high-rise buildings that have recently been completed or are currently under construction represent high-end condominiums and hotels. Most of these projects are on sites near the waterfront or in East Village, consistent with the overall civic redevelopment plans for San Diego. We have outlined a few of these projects below.

• Pacific Gate: Vancouver, B.C.-based Bosa Development Corp is currently amid developing a new condominium building called Pacific Gate; the 41-story property will contain 215 residences, 16,000 square feet of retail space, and 460 parking stalls within three below-grade levels. Bosa has played a major role in creating many of San Diego’s upscale, high-rise residences and landmarks; other completed Bosa developments in Downtown San Diego include Horizons, Park Place, Discovery, The Grande, and Electra.

• Manchester Gateway: This project is being developed by Manchester Financial Group, a prominent San-Diego based development firm. The complex will occupy a three-million-square-foot site to be improved with a mixed-use development including the following components: a four-star hotel and four-and-a-half-star hotel, totaling 1,360 guestrooms; more than 1.2 million square feet of office space among three Class-A office buildings, one of which is being built solely for use by the U.S. Navy; a 391,000-square-foot retail development; and a public waterfront park. The site represents one of the largest, if not the largest, undeveloped urban waterfront sites located along the California coast, located in San Diego’s Central Business District and within walking distance of the convention center. Given the large size and scope of this project, as well as its location on the San Diego waterfront, this development represents one of the most prominent and unique development opportunities on the West Coast.

• Seaport Village: Seaport Village is a waterfront retail and dining complex that opened in 1980 on the site of the San Diego-Coronado ferry landing. Operated by Terramar Retail Centers, Seaport Village represents yet another tremendous waterfront redevelopment opportunity. Various developers have expressed interest in the site; the most recent proposal is a $1.2-billion project that includes three hotels; retail and restaurants; a 480-foot observation tower; a partially underground aquarium; 30 acres of new parkland, beach, and promenades; and upgraded facilities for commercial fishing fleets and pleasure craft on more than 70 acres.

• Ballpark Village: A 37-story apartment tower and retail development is under construction on a site located directly east of the Petco Park baseball stadium. With an anticipated opening date slated for the third quarter of 2018, the $250-million project is anticipated to include 439 luxury apartments, 274 low-rise residential units, 45,000 square feet of retail and restaurant space, a 12,000-square-foot open-air plaza, an above-grade walkway, and over 900 parking spaces. The developer is also proposing a 1,600-room hotel; however, the hotel component is contingent upon a convention center expansion. The developer noted that the projects could represent more than $1.5 billion of additional construction activity in Downtown San Diego.

• UCSD Extension Project: UC San Diego and Holland Partner Group recently broke ground on a $275-million, 34-story apartment building and a UC San Diego cultural and education hub, which is expected to feature 426 apartments, a 53,000-square-foot office and classroom building, a historic restaurant facility, and a 3,200-square-foot outdoor amphitheater. Officials anticipate the project to be completed in 2021.

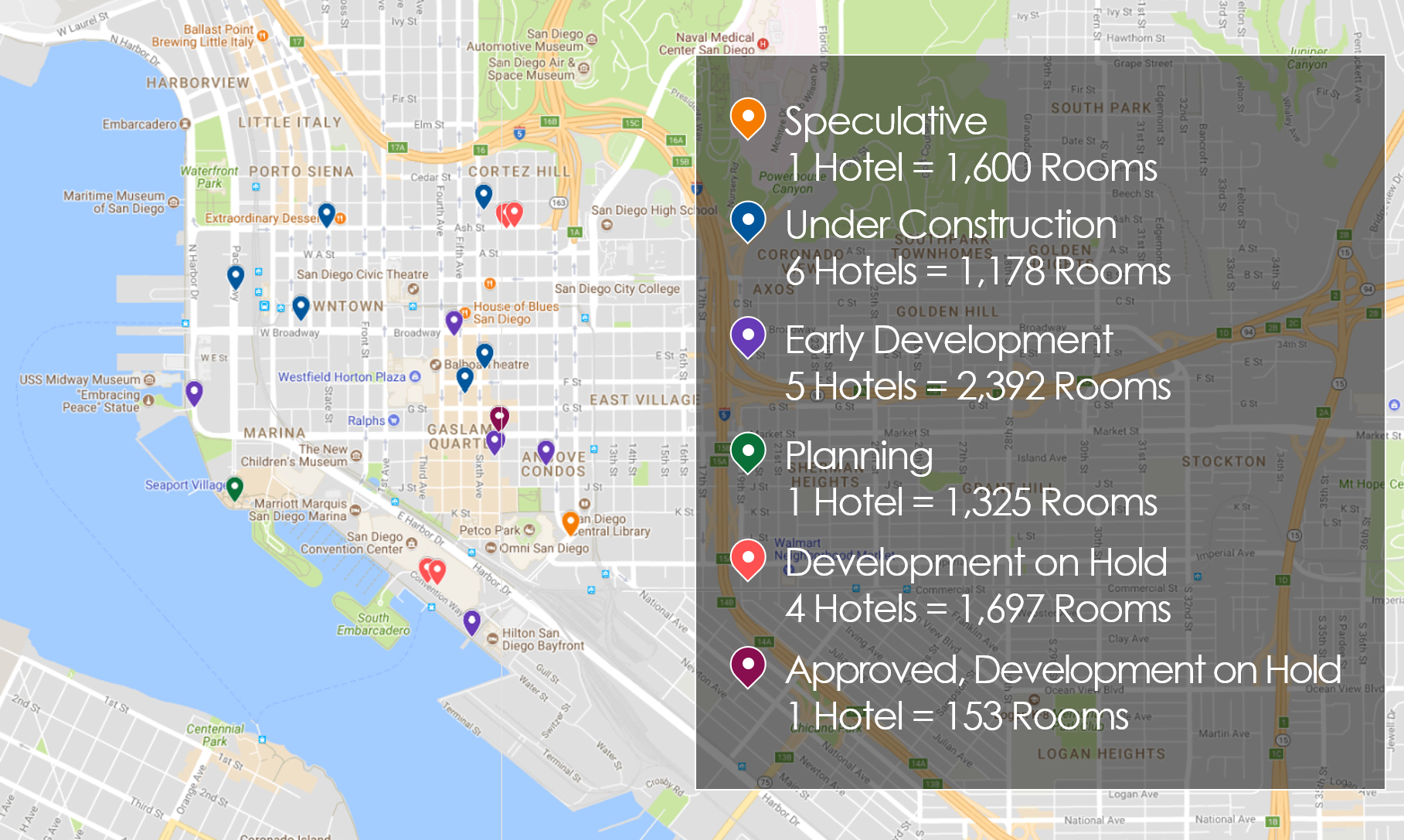

The following table illustrates new and proposed hotel supply in Downtown San Diego.[1]

Source: HVS

A summary of a few of these projects has been provided below.

The Lane Field South site is currently under construction with a 400-room InterContinental Hotel, set to open in early 2019. The project is part of an ongoing effort to redevelop the waterfront; the recently developed dual-brand Residence Inn/SpringHill Suites by Marriott hotel is located on the site adjacent to the north, while the proposed Manchester Gateway development is across Broadway to the south.

A $270-million project, set to include an 831-room convention headquarters hotel and a 160-room boutique or “shared accommodations” lower-cost hotel, is proposed for development on the Fifth Avenue Landing site. Of important note, this is the same site that would house the contiguous expansion of the convention center, if approved. The project came about because of the City of San Diego’s default on purchasing the premise for the Convention Center Expansion and the corresponding lease obligations of Fifth Avenue Landing (FAL).

A 500-room expansion to the existing Hilton Bayfront has been proposed by its owner, Sunstone Hotel Investors. The added rooms would be located adjacent to the existing building and would include a 34,500-square-foot ballroom, 12,000 square feet of meeting rooms (92 square feet of meeting space per room in total), and a 7,500-square-foot fitness center and spa. The project is estimated to cost $200 million and is currently being planned and entitled with the expansion of the convention center.

Tourism

Tourism is an important factor for San Diego area hotels. San Diego's numerous beaches and beach towns, including Mission Beach, Pacific Beach, Ocean Beach, and La Jolla, attract large numbers of visitors annually. Aside from the sun-soaked beaches, three major attractions bring families to the greater San Diego market. SeaWorld is a marine animal theme park featuring animal shows and a variety of rides. In September 2016, SeaWorld officials announced the investment of $175 million on new attractions at SeaWorld Florida and SeaWorld San Diego, which are anticipated to open in 2018; a new documentary-style orca encounter is planned for SeaWorld San Diego. LEGOLAND is a theme park that focuses on Lego bricks, a popular children's toy. Balboa Park is a 1,200-acre, urban, horticultural and cultural resource park containing vast open spaces, natural vegetation zones and green belts, gardens, and walking paths. It contains 15,000 trees and 14 specialty gardens; nearly 100 arts, education, recreational, social, and sports organizations; 17 museums and cultural institutions; the San Diego Zoo; and Old Globe Theatre. There are also many other recreational facilities, including a golf course and several gift shops and restaurants, within the boundaries of the park. It entertains more than 10 million visitors per year. Although present year-round, the peak season for tourism in this area is from May to September. Leisure demand is typically strongest during key weekends and during the summer vacation season.

Convention Center

The San Diego Convention Center (SDCC) is the premier facility for conventions and trade shows in San Diego, hosting nationally and internationally renowned events such as San Diego Comic-Con International, the American College of Cardiology Scientific Session, the National Safety Council Expo, Cisco Live, and the Esri User Conference. Operated by the San Diego Convention Center Corporation, the venue attracts national and international associations and corporate events. The SDCC opened in 1989 and underwent an expansion that roughly doubled its size in 2001. The facility spans 2.6 million square feet, including 615,701 square feet of total exhibit space, 284,494 square feet of lobby and pre-function space, 204,114 square feet of meeting space, and 184,514 square feet of outdoor space. The remainder of the space comprises hallways, kitchens, executive offices, and other back-of-the-house facilities, as well as parking. During fiscal 2017, the SDCC achieved a 76% occupancy and generated a $1.1-billion regional economic impact, with nearly 844,382 estimated hotel room nights.[2] Given the significant amount of meeting and group demand in the market, proposals to expand the center have been brought forth; however, the last two expansion attempts have not received enough support from the citizens of San Diego to secure the appropriate amount of funding. Continued efforts to expand the center are expected; If the expansion is passed in the November 2018 election, it could be completed by 2021, at the earliest.

Airport

San Diego International Airport (SAN) is the busiest single-runway airport in the United States and occupies the smallest land footprint of any commercial airport in the country (661 acres). With no plans for future runway expansion, current airport forecasts suggest that arrivals and departures at the airport will increase to 260,000 annually between 2018 and 2022. August 2013 marked the completion of the $900-million "Green Build" expansion project of Terminal 2, which was completed $45 million under budget. The project, which was the largest in the airport's history, included ten new jet gates; additional shopping and dining options; expanded concessions; enhanced curbside check-in capacity; a new security checkpoint; a new, 25,000-square-foot check-in lobby with 32 airline counters and ten self-service kiosks; and a dual-level roadway to separate arriving and departing passengers. In April 2014, the airport became the first in the world to achieve LEED Platinum certification. The next part of the airport's Master Plan phase includes determining what improvements are necessary for the airport to accommodate demand through the year 2035. The primary project for consideration at this time is the demolition of Terminal 1 and construction of a new, 1,500,000-square-foot, 30-aircraft-gate facility that is anticipated to extend up to 150 feet above the ground. Airport officials have indicated that the project could open as early as 2020.

It is important to note that several additional flight routes were added to San Diego International Airport in the recent past. In May 2017, new seasonal service between San Diego and Frankfurt, Germany, commenced. The new flight is operated by one of Germany’s most popular leisure airlines, Condor (DE), and is one of only three nonstop connections between San Diego and Continental Europe. With up to three weekly flights on Mondays, Thursdays, and Saturdays, the route operates on a Boeing 767-300ER aircraft. City officials stated that Germany is one of San Diego’s top partners for exports and foreign investments, and is rapidly becoming one of the economy’s most important international markets.

In June 2017, Edelweiss, an affiliate of Swiss International Airlines, launched a new nonstop route between Zurich and San Diego; the service runs seasonally through early November. San Diego marks Edelweiss’ first nonstop destination in California; the flights will reportedly bring approximately 15,000 visitors to San Diego each year, creating an estimated economic impact of $50 million.

In the spring of 2017, low-cost carrier Frontier Airlines announced nonstop service from Cleveland Hopkins International Airport to San Diego. Cleveland has not had a nonstop flight to San Diego since 2008. According to Cleveland Hopkins airport officials, San Diego was the largest unserved market from Cleveland, with just under 100 passengers a day traveling between Hopkins and San Diego International Airport; the new nonstop flight has significantly increased travel between the cities.

Lodging Metrics

Hotel demand and occupancy has been steadily rising since 2010, resulting in peak occupancy levels over 79% in 2016,[3] nearly 4.5 points above the prior peak of 74.7% in 2007.[4] Average rates (ADR) began rebounding in 2011, following the recovery in occupied rooms, and have increased year-over-year since then. In 2014, market-wide ADR growth reached levels not experienced since the prior demand peak of 2007; this strong performance was driven by an increase in the number of attendees at key annual conventions, such as Comic-Con International, and healthy tourism levels. Year-to-date data for 2017 illustrate a slight increase in occupancy. Specifically, we note that the increases in demand have been diminished by increases in new supply. Alternatively, ADR has increased moderately, thus, resulting in a moderate RevPAR gain. Given the diversity and depth of the local economy combined with the anticipated moderate increases in new supply, the outlook for the San Diego lodging market remains favorable.

Airbnb

A growing trend in the lodging industry is the use of Airbnb, an online marketplace and hospitality service that enables people to list privately-owned real estate as alternative lodging options to traditional hotel rooms. Airbnb does not own any lodging facilities; it acts as a brokerage service and receives service fees from both guests and hosts on every booking. Airbnb supply in San Diego has been consistently increasing over the past two years. Due to the different kinds of Airbnb accommodations and fluctuations in nightly inventory, is difficult to conclude to the exact number of lodging facilities available on average each night, but Airbnb supply is becoming an increasingly large component of the San Diego lodging industry. Due to San Diego’s large number of seasonal and absentee owners, the market is even more vulnerable to this trend. Airbnb provides additional supply during peak demand periods, which can be viewed as a positive impact, allowing more visitors to stay in the San Diego area when hotel supply is inadequate. In addition, a wide variety of units, including entire homes, are made available to the public, which increases the spectrum of lodging options. On the downside, when residential-unit owners put their units into the Airbnb rental program during peak compression periods, the pressure on existing hotels that allows them to charge peak rates is reduced. The profitability of hotels is positively affected by strong pricing during peak demand periods, and with more competitive supply available during times of compression, average rate and profit gains can be diluted. City officials are currently in the process of reaching an agreement on new rules that would limit the short-term rental of investor properties; negotiations are ongoing.

Conclusion

This report discussed a wide variety of economic indicators for the pertinent market area. San Diego is experiencing a period economic strength and expansion. The federal government and related entities will remain cornerstones of the market, while the tourism, health sciences, wireless technology, and biomedical engineering sectors should continue to expand. Given the anticipated increases in government funding of the area's military installations, the ongoing expansion throughout Downtown, a strong convention calendar, and other positive corporate news, the outlook is optimistic.