By Mandeep S Lamba and Dipti Mohan

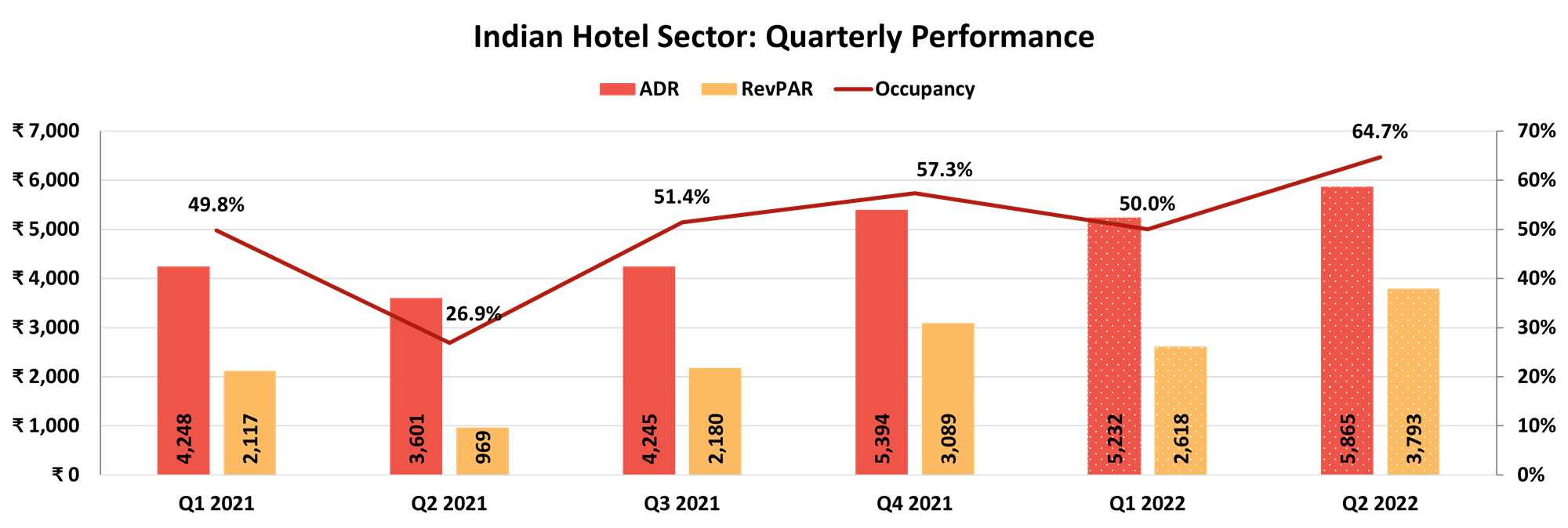

The Indian hotel sector made steady progress in the first half of the calendar year 2022 (1H2022). Nationwide occupancy was in the 56-58% range, 21-23 percentage points (pp) higher than 1H2021, and only 8-10 pp lower than 1H2019. The strong recovery in demand is driving steady increases in average room rates, with hotels, particularly in the leisure sector, outperforming their pre-pandemic average rates. Commercial markets are also gradually improving as corporate travel and large-ticket conferences and events return. As a result, the country’s average rates in 1H2022 were 44-46% higher than 1H2021, while still remaining 7-9% lower than pre-pandemic levels. The strong recovery in occupancy and average rates has helped India-wide RevPAR to reach INR3,100-3,300, reflecting growth of over 130% compared to 1H2021.

The year 2022 began with renewed concerns about the pandemic as the country went into a third wave due to the emergence of a new more virulent COVID strain, Omicron. The reintroduction of travel restrictions across states threw the Indian hospitality sector into an upheaval once again. Except for critical and urgent travel, other leisure and business travel plans were put on hold as people exercised caution. The low demand during the quarter resulted in occupancy of 50%; however, average rates continued to improve year on year and remained above the INR5,000 mark.

Due to the lower severity and hospitalization rate of the Omicron variant compared to the earlier Delta strain, as well as the country’s higher vaccination rate, travel demand in India began to roar back to life in March 2022. Another factor that aided in improving travel sentiment was the government’s quick response to curb the virus’s spread, as well as the quick relaxation of restrictions when cases subsided. After a two-year hiatus, India also resumed all regular international flights with full capacity at the end of March 2022. As a result, total air traffic in the country increased by 61% year-on-year between January and May 2022, reaching nearly 76% of the traffic recorded between January and May 2019.

This upbeat travel sentiment helped the Indian hotel sector to close the second quarter of 2022 on a high note. The nationwide hotel occupancy of 64.7% during Q2 2022 was 1.2 pp higher than in Q2 2019. The faster-than-expected recovery in demand has resulted in significant improvements in average rates to INR5,865, up 6% from Q2 2019, while RevPAR reached INR3,793, a rise of 8% from Q2 2019.

Despite the strong increase in demand, the sector is likely to be impacted by global economic headwinds in the year’s second half. Many countries are experiencing high inflation because of a combination of factors such as rising fuel prices, ongoing supply disruptions, strong demand, and the Russia-Ukraine war. While central banks around the world are raising benchmark interest rates to try to control the situation, inflation is likely to remain high in the near term, which may have an impact on future travel sentiment. There is also a growing concern that the US and Europe may slip into recession by the end of the year. Rising tensions between China and Taiwan, as well as an increase in Monkeypox cases worldwide, which has been declared a global health emergency by the World Health Organization, are additional factors that may have an impact on the global economy and travel and tourism industry in the future.

The global volatility would most likely have a negative impact on the Indian economy and hotel market performance in the second half of the year. Rising raw material costs, high labor costs, and now higher borrowing costs due to rising interest rates will all weigh on hotel operations and GOP, and companies must build flexibility and the ability to adapt quickly to changing market conditions.