By Anne R. Lloyd-Jones, McKenna Luke

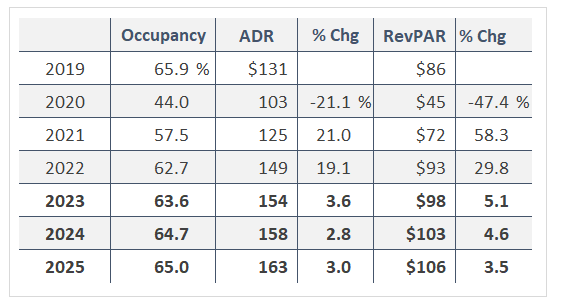

Despite persistent high inflation, an active Fed, and accelerating recessionary concerns, the lodging industry sustained the strong growth recorded in Q2 and Q3 of 2022 through the balance of the year. Transient demand continued to lead the recovery, surpassing 2019 levels in 19 of the past 21 months. The leisure segment remains a dominant influence, with business demand returning at a slower pace, although increasing levels of “bleisure” demand are blurring the distinction between these two sectors. Group demand rebounded to roughly 80% of 2019 levels; after the initial return of small to medium-size groups beginning in 2021, larger events and conventions notably increased in 2022, accelerating in the second half of the year. As a result, total demand exceeded 2019 levels beginning in September 2022. ADR and RevPAR surpassed pre-pandemic metrics throughout the year, as operators were able to leverage strong demand levels and inflationary trends to exert significant pricing power in both the transient and group segments.

Given the Omicron-influenced underperformance of Q1’22, the recent pace of growth is expected to continue through Q1’23, to complete a full year of recovery. The outlook is less certain thereafter, as recessionary headwinds intensify and the month-over-month comparisons get tougher. Uncertainties about the return of business travel and the sustainability of the higher ADR levels recorded in 2022 are key questions facing the industry. Strong convention center calendars, increased social and association event attendance, and in-the-year for-the-year bookings should drive both occupancy and ADR within the group segment, although the latter component may be somewhat vulnerable to the broader economic trends. Leisure demand is expected to moderate in response to inflation, as well as recessionary concerns, but should largely be replaced by further increases in business travel, as companies continue to backfill business connections and relationships after an extended hiatus. Further recovery of international travel should also offset declines in some domestic travel.

After reaching record ADR levels across virtually all segments and property types, the industry mentality has hopefully shifted focus onto driving revenue through ADR growth. Continued concerns about staffing costs and availability should reinforce this perspective. Some ADR softening can be expected as inflationary concerns tighten consumer purse strings and demand levels moderate, resulting in fewer peak/compression nights. Overall, ADR is forecast to grow below expected inflation levels in the last three quarters of 2023 given a shift in segmentation, modest normalization of leisure demand, and the recessionary headwinds.

On the investment side, the capital market shift that characterized the latter half of 2022 continues to influence the market. Interest rates remain sharply higher and mortgage capital significantly less available than during early 2022 due to more stringent underwriting, including lower loan-to-value ratios. These circumstances have had a direct impact on the transaction market, which slowed materially in Q4’22, with some under-contract deals being re-traded or abandoned in the face of rising capital costs. Fewer properties are currently being brought to market, reflecting both capital market conditions and the caution induced by the uncertain economic outlook. A disconnect between buyer and seller expectations is also a factor, as the pricing perspective of sellers continues to be influenced by the strong metrics evident in the first half of 2022, while buyers are facing the harsher realities of the current debt market. Nevertheless, there continues to be a strong appetite for high-quality deals, and hotels remain a popular investment asset class in the prevailing inflationary environment.

While the current stasis is likely to continue into Q2’23, the volume of undeployed debt and equity capital will put increasing pressure on market participants. These forces, combined with anticipated maturities of existing loans, should result in a notable return of both lending and transactions by mid-year. In terms of values, current market conditions have put downward pressure on values due to prevailing higher yield requirements. This factor has been somewhat offset by strengthening EBITDA levels driven by strong revenue growth. With more moderate revenue growth anticipated for 2023, we do not expect a significant shift in values until capital costs return to levels more consistent with long-term historical norms.

Thanks to Emil Iskandar of HVS Capital Markets and Eric Guerrero of HVS Brokerage & Advisory for their always valuable insights.