By Bethany Cronk

Introduction

Local government authorities use property tax revenues to fund services including police and fire protection, hospitals, transportation, and schools for municipalities. For tax purposes, property is considered residential or nonresidential, with nonresidential property constituting commercial businesses, farms, ranches, and oil/gas operations. In 1982, the Gallagher Amendment was implemented in Colorado to hold the proportion of taxable value derived from residential property at approximately 45%. According to the Legislative Council of the Colorado General Assembly, “Gallagher sought to protect homeowners from rising property taxes by maintaining a relatively constant ratio of residential and nonresidential property values in the statewide tax base.” The resulting fixed percentage for total nonresidential property has, therefore, been targeted at approximately 55%.

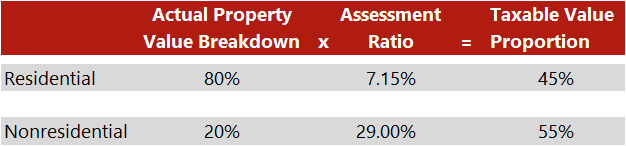

As government budgets for providing services have increased and property values have been on the rise, periodic measures have been implemented to maintain residential property at a fixed 45% of the total tax base; reductions in the residential assessment ratio have been put in place, with the ratio dropping to 7.5% in 2019 and 2020. The assessment ratio for the nonresidential tax base has remained at 29% for most types of commercial property, with mines and oil/gas lands assessed at different rates. Actual property values have not met the required ratios over time because residential property values have generally grown faster than nonresidential property values. Since the taxable portion of most nonresidential property values is fixed at 29%, the state legislature has historically adjusted the residential assessment ratio downward to maintain the required 45%–55% breakdown, as shown below.

Historical Assessment Rate Adjustments Under Gallagher Amendment

Source: Legislative Council of the Colorado General Assembly, 2020

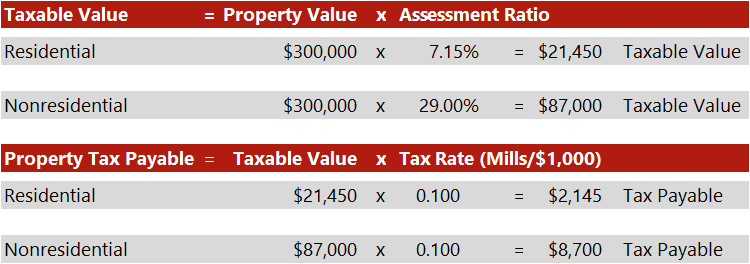

The property taxes paid by a property owner depend on three components: actual value, assessment ratio, and mill levy (tax rate). The actual value is determined by the county assessor or state property tax administrator. The portion of the actual value on which taxes are paid is the taxable value, also known as the assessed value. Taxable value is computed by multiplying the actual value by an assessment ratio. The 2020 assessment ratios for residential and nonresidential property were 7.15% and 29%, respectively. Tax payable is calculated by multiplying taxable value by the tax rate or mill levy, which varies by taxing jurisdiction. The amount of property taxes collected by local government for providing services is affected by changing any of these components. The following example illustrates the computations of taxable value and tax payable.

Tax Calculation Example

The residential assessment ratio had decreased from 21% in 1983 (when the Gallagher Amendment went into effect) to 7.15% in 2019 and 2020. With a fixed nonresidential assessment ratio of 29%, nonresidential property holders—including hotel/motel owners—paid an effective tax rate that was approximately four times higher than that of residential property owners. By 2020, the gap between nonresidential and residential assessment ratios had reached nearly 22%. Before the repeal of the Gallagher Amendment, the residential assessment ratio had been forecast to continue its downward trend, which would have exacerbated the disproportionate tax burden.

In response to the chasm between residential and nonresidential assessment ratios, many local governments passed laws to automatically increase local mill levies to supplant revenue losses from the Gallagher Amendment. These tax rate increases counteracted shrinking residential assessment ratios and resulted in a net property tax increases for nonresidential property owners. Thus, one effect of the Gallagher repeal could be the termination of these automatic mill levy increases that had been necessary to offset decreasing residential assessment ratios. Nonresidential taxpayers may receive lower tax bills if their taxing districts eliminate the automatic mill levy increases, while higher taxes could result for residential property owners given potential increases in the applicable assessment ratio. Furthermore, the repeal of the amendment may also prevent declines in government property tax revenue for necessary local services.

Conclusion

Colorado hotel and motel owners should monitor the impact of the Gallagher Amendment repeal over the next few years. With the repeal of Gallagher, there may be an easing of mill levies, resulting in a net benefit to commercial property owners. For more information, please contact Bethany Cronk, MAI, MBA, of HVS Denver.