By Thomas A. Hazinski, Joseph Hansel

Introduction

The COVID-19 crisis consumed the United States for approximately three-quarters of the past year. In December 2020, the U.S. Food and Drug Administration issued emergency use authorization for the Pfizer-BioNTech COVID-19 vaccine.[1] The development and distribution of an effective COVID-19 vaccine, alongside other public health measures, should allow us to combat the health effects of the global pandemic. With certainty coalescing around the health solutions to the pandemic, attention must turn to economic solutions.

The economic impact of COVID-19 is seen in almost all economic indicators, which show sharp contractions in economic activity beginning in mid-March 2020 with recovery extending into 2021. The sharp economic contraction spurred by COVID-19 resulted in two economic stimulus packages, as described below. A third relief package has been proposed by the Biden administration. This article discusses the impact federal stimulus has on the travel industry and what effect future stimulus may have on recovery of this key sector of the economy.

The Success and Failure of the CARES Act

In March 2020, in rapid response to the COVID-19 pandemic, the CARES Act was signed into law, providing necessary economic relief to businesses and individuals. Unfortunately—and largely out of necessity—the passage of the CARES Act ignored key sectors of the economy; namely, the travel and tourism industries. The U.S. Travel Association, in tandem with Tourism Economics, projects cumulative losses since the beginning of March totaling $500 billion for the travel industry.[2]

The economic stimulus provided in the CARES Act did help state and local governments, but key considerations—such as excluding 501(c)(6) organizations like DMOs from receiving Paycheck Protection Program funding—left travel industry stakeholders without direct economic stimulus.[3] As described in our June 2020 article, “The Case for Targeted Federal Aid to DMOs and Tourism Agencies,” among the top 20 DMOs, on average, 81% of their funding comes from the public sector and in most cases, funding for public sector agencies relies on taxes on services related to tourism—car rentals, accommodations, and other tourism taxes. While economic stimulus provided in the CARES Act allowed businesses to retain employees and individuals to shore up their financial situation, public health measures and limitations on gathering sizes limit the ability for much of the direct benefit of economic stimulus to flow through to public sector participants in the tourism industry.

The success of the CARES Act was its expeditious impact during the financial fallout spurred by the pandemic. The failures of the CARES Act, specifically through the lens of the travel industry, are shown through exclusion of key industry participants and the contradiction between economic stimulus and public health measures limiting the ability to host entertainment events, conventions, and sporting events.

The Second Round of Stimulus

After approximately nine months without further economic stimulus, Congress agreed to the Consolidated Appropriations Act, 2021, which included approximately $900 billion in economic stimulus aimed at addressing the COVID-19 pandemic. Key provisions of the December stimulus act include additional $600 payments to some Americans, $15 billion in funding for shuttered venue operators (the Save Our Stages component), $325 billion in funding for small businesses (including $284 billion in Paycheck Protection Program funds, now available to non-profits), and $15 billion for air carriers to restore service and return employees to work.[4]

- The Associated Press described the complete stimulus package as follows: Unemployment insurance ($120 billion). Revives supplemental federal pandemic unemployment benefits but at $300 per week—through March 14—instead of the $600 per week benefit that expired in July. Extends special pandemic benefits for “gig” workers and extends the maximum period for state-paid jobless benefits to 50 weeks.

- Direct payments ($166 billion). Provides $600 direct payments to individuals making up to $75,000 per year and couples making up to $150,000 per year—with payments phased out for higher incomes—with $600 additional payments per dependent child.

- Paycheck Protection Program ($284 billion). Revives the Paycheck Protection Program, which provides forgivable loans to qualified businesses. Especially hard-hit businesses that received PPP grants would be eligible for a second round. Ensures that PPP subsidies are not taxed.

- Vaccines, testing, health providers ($69 billion). Delivers more than $30 billion for procurement of vaccines and treatments, distribution funds for states, and a strategic stockpile. Adds $22 billion for testing, tracing, and mitigation, $9 billion for health care providers, and $4.5 billion for mental health.

- Schools and universities ($82 billion). Delivers $54 billion to public K-12 schools affected by the pandemic and $23 billion for colleges and universities; $4 billion would be awarded to a Governors Emergency Education Relief Fund; nearly $1 billion for Native American schools.

- Rental assistance ($25 billion). Provides money for a first-ever federal rental assistance program; funds to be distributed by state and local governments to help people who have fallen behind on their rent and may be facing eviction.

- Food/farm aid ($26 billion). Increases stamp benefits by 15% for six months and provides funding to food banks, Meals on Wheels, and other food aid. Provides an equal amount ($13 billion) to farmers and ranchers.

- Child Care ($10 billion). Provides $10 billion to the Child Care Development Block Grant to help families with child-care costs and help providers cover increased operating costs.

- Postal Service ($10 billion). Forgives a $10 billion loan to the Postal Service provided in earlier relief legislation.[5]

As seen in the list above, the stimulus package covers a variety of industries and targets a variety of issues presented by the pandemic. For example, rental assistance intends to help prevent mass evictions stemming from late or missing rent payments. In addition to solving individual and societal dilemmas, the second round of stimulus provides more direct assistance to the tourism industry. The following list details how components of the December stimulus package help the tourism economy.

- Shuttered Venue Operator Grants

- Per the National Independent Venue Association (“NIVA”), “ninety percent of NIVA members reported they could be forced to close forever without meaningful federal relief; hundreds have already permanently shuttered, never to return again.”[6]

- After passage of the Save Our Stages Act as part of the Consolidated Appropriations Act, “the majority of the 3,000 venues that comprise the National Independent Venue Association” should be kept in business through the remainder of the pandemic.[7]

- The specifics of the Save Our Stages Act allows for 45% of 2019 gross revenues (up to $10 million) in grants aimed at paying for payroll, mortgages, and other business expenses.[8] Knowing that capacity limitations and other public health measures will limit the ability to host concerts and other entertainment events, the Save Our Stages Act will help keep venues afloat and prevent mass closures.

- Paycheck Protection Program Extension

- As mentioned above, the exclusion of 501(c)(6) venues from the original Paycheck Protection Program under the CARES Act left key industry participants vulnerable and without stimulus for the majority of 2020. The December stimulus package extends eligibility to some 501(c)(6) organizations. Northstar Meetings Group describes the eligibility requirements that would allow a certain subset of tourism organizations to qualify for Paycheck Protection Program loans:

- “The CVB has to be registered as a 501(c) organization, a quasigovernment entity or a political subdivision of a state or local government;

- The organization must have 300 employees or fewer;

- Lobby activities can makeup no more than 15 percent of the organization’s activities; and

- No more than 15 percent of the CVB’s revenue can come from lobbying.”[9]

- The expansion of the Paycheck Protection Program to include non-profits, such as DMOs, opens a certain group of DMOs to receive forgivable loans aimed at subsidizing operating expenses for these organizations. The CEOs of NYC & Company and Discover Puerto Rico put it best: “If a DMO’s only survival option is to take on loans, every dollar that’s spent repaying those loans over the next few years will be one dollar less that’s spent on supporting small businesses.”[10]

- The long-term viability of DMOs and other promoters of tourism will be vital for the rapid recovery of the tourism industry when public health measures allow for unabated travel and tourism.

- As mentioned above, the exclusion of 501(c)(6) venues from the original Paycheck Protection Program under the CARES Act left key industry participants vulnerable and without stimulus for the majority of 2020. The December stimulus package extends eligibility to some 501(c)(6) organizations. Northstar Meetings Group describes the eligibility requirements that would allow a certain subset of tourism organizations to qualify for Paycheck Protection Program loans:

- Airline Worker Support Extension

- The CARES Act included some payroll reimbursements to airlines; however, after the expiration of these reimbursements, mass staffing changes occurred. The extension of the Airline Worker Support provision aims to hire back 32,000 workers to airlines.[11]

- The success of the airline industry is vital as destinations begin to market travel.

Compared to the CARES Act, the second round of economic stimulus provides more targeted relief to key industry partners in the tourism and travel industries. Despite the passage of desperately-needed relief funding for venues and organizations, VenuesNow reports “many questions remain over which venues are eligible for stimulus money, given the complexity of the legislation and labyrinth of restrictions tied to receiving federal dollars.”[12] The inclusion of some convention & visitors bureaus for relief—either through the Paycheck Protection Program or the Shuttered Venue Operator Grants—may provide direct relief to the facilities they operate. For other public assembly facilities, questions surrounding eligibility may prevent them from receiving direct stimulus.

Third Round – Proposed Relief Package

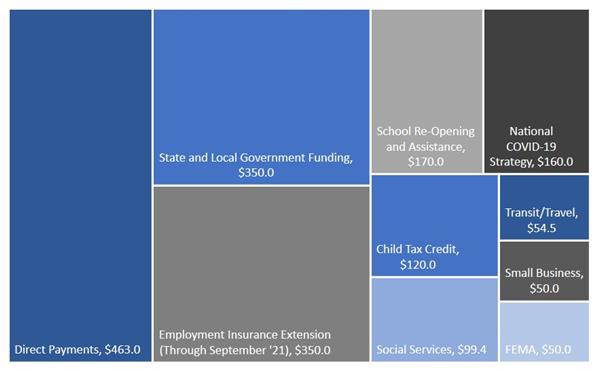

President Biden has proposed a $1.9-trillion pandemic rescue package. The House of Representatives is likely to approve the relief bill soon on a party-line vote and the US Senate appears to be ready to pass this legislation without significant amendments through a reconciliation process that requires only a simple majority. The relief package would provide direct payments to most Americans ($465 billion), unemployment insurance expansion ($350 billion), aid to local government ($350 billion), pandemic response funding ($160 billion), school reopening ($170 billion), child tax credit ($120 billion), small business assistance ($50 billion), and rental assistance, childcare and behavioral health (combined $74 million). The following figure summarizes the size of each portion of the proposed $1.9 trillion relief package.

Breakdown of Biden Administration Stimulus Plan (in Billions)

Combined with the prior $900 billion package, government spending would provide $2.8 trillion in economic stimulus. The greatest impact of this legislation on the hospitality industry would result from a faster economic recovery as the new government spending more than replaces the GDP lost due to the pandemic. Leisure and business travel is likely to resume faster in a healthy economy. Direct aid to state and local governments will allow them to continue or reinstate support for publicly funding convention centers and destination marketing organizations.

Future of Economic Stimulus and the Travel Industry

Epidemiologically and economically, the U.S. is still not clear of the effects of the COVID-19 pandemic. The inauguration of President Biden provides a new beginning and, potentially, a new approach to handling the health and economic effects of the virus. For the tourism industry, the U.S. Travel Industry recently projected a turnaround for the travel industry in the second quarter of 2021, assuming successful rollout of a vaccine and the potential for additional stimulus.[13]

Should President Biden’s proposed stimulus package, which includes $20 billion for a national vaccination program and $15 billion for additional small business grants beyond the PPP, the travel industry may be able to recover through a return to normalcy, the return of large public gatherings, and sustained financial support for key industry participants. [14] Of course, the future of economic stimulus for the travel industry lies in the hands of Congress. In the interim, travel industry stakeholders continue to wait, hopeful for a rapid return to health, travel, and normalcy.