By Peggy Lee, Chariss Kok Xin, Hok Yean CHEE

Key Highlights in 2020

The Republic of Singapore is a metropolitan city-state and island country in Southeast Asia with a total land area of an estimated 714.3 square kilometres. It is situated at the southern tip of the Malayan Peninsula, between Malaysia and Indonesia. With an economy supported by its growing population of approximately 5.7 million people, Singapore has witnessed remarkable record of sustained economic growth throughout the years and bolsters its role as a global commerce, finance and transportation hub.

Due to the impact of the Covid-19 pandemic, Singapore’s overall economy contracted by 5.4% in 2020. Although the services sector contracted by 6.4% in 2020, the services sector is forecasted to remain the largest contributor to Singapore’s Gross Domestic Product (GDP) from 2021 to 2025. The recovery is projected to be led by financial services and logistics activities.

Tourism remains an important pillar in driving economic growth in Singapore. According to the Department of Statistics Singapore, the accommodation sector contributed 0.4% to Singapore’s nominal GDP in 2020.

In 2020, tourism arrivals have slumped to 2.7 million from 19.1 million in 2019 due to the travel disruption caused by Covid-19. Activity in the hotel investment has also been soft in 2020, with only two inbound hotel transactions, contributing to an investment volume of 539 million amidst the global economy uncertainty.

Economic Outlook

In 2020, the global economic growth was impacted by the Covid-19 pandemic which has resulted in countries going on lockdown and stock markets to plunge. Activities around the world had seemingly come to a halt with travelling restricted and work-from-home becoming a new normal. US-China political tension continues to be uncertain, along with the plans for Brexit. With growing uncertainties in the geopolitical landscape and global market pressures, international trade and investment activities have softened and is expected to remain subdue. According to the World Bank, global economic growth is projected to expand at 4% in 2021, albeit a slow recovery from 4.3% contraction in 2020.

Figure 1: Economic Outlook

Source: Economist Intelligence Unit, March 2021

Economic Performance & Outlook

Given the reliance of Singapore’s economy on global economic outlook, the weakening of the global economy due to the Covid-19 pandemic has resulted in a 5.8% contraction in real GDP in 2020. Recovery is expected in 2021 with an expansion of 5.1% as economic activities gradually resumes and consumer sentiment improves with the implementation of a city-wide vaccination programme. Nonetheless, external demand is likely to remain weak as access to vaccine remains uneven in other parts of the world.

Currency Exchange Outlook

In April 2020, the Monetary Authority of Singapore (MAS) has set the rate of appreciation of the nominal effective exchange rate (NEER) policy band at zero percent per annum, starting at the then-prevailing level of NEER. Economist Intelligence Unit (EIU) expects the Singapore dollar to experience a marginal appreciation in 2021 on the back of a weaker greenback, reaching S$1.36:US$1 in 2021 compared to S$1.38:US$1 the year before.

Inflation

Due to the pandemic, consumer price inflation has declined marginally by 0.2% in 2020. Moving forward, EIU expects inflation rate to increase to 1.6% in 2021, owing to partial recovery in consumer demand, as well as global energy and non-energy prices. EIU forecast that inflation will rise by an annual average of 1.3% in the next four years from 2022 to 2025. However, inflation for tourism-related services is projected to remain weak as restrictions on international travellers stays.

Interest Rates

As at December 2020, the 3-month Singapore Interbank Offered Rate (SIBOR) was recorded at 0.41%, a significant decrease from the previous year which recorded at 1.77% as of December 2019. According to EIU, the lending interest rate remained stable at 5.3%. The reduction in SIBOR is attributable to the rate cuts by the US Federal Reserve (Fed). In 2020, the Fed cut interest rates to near zero, and has brought about USD120 billion in government-backed debt to cushion the pandemic’s impact on businesses.

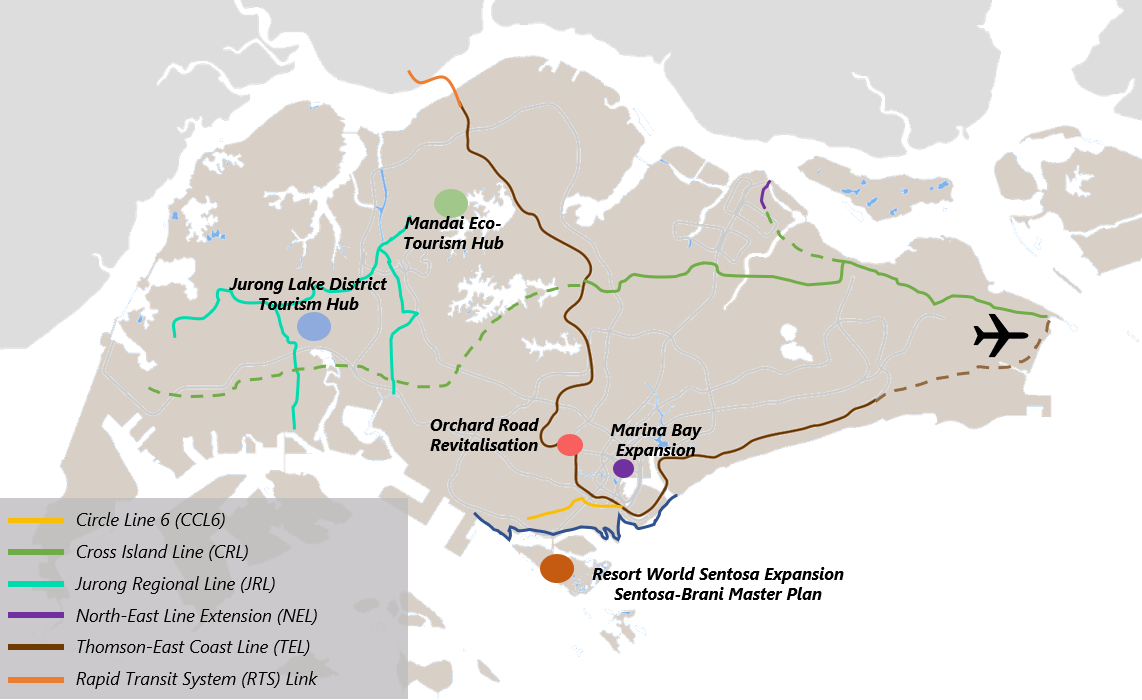

Infrastructure Developments

2021

- TEL Phase 2: Addition of 6 new stations from Springleaf to Caldecott.

- New Museum of Ice Cream Singapore in Dempsey area will feature multi-sensory installations themed around the dessert. The attraction is slated to open in the second half of 2021.

- New adrenaline ride, Slingshot, located in Clarke Quay next to current attraction GX-5 Extreme Swing. The Slingshot will be the tallest in Asia and see riders being catapulted almost 70-metres into the air, reaching a speed of 160-kilometres per hour.

2022

- TEL Phase 3: Addition of 13 stations to provide direct access to the CBD and Marina Bay, from Mount Pleasant to Gardens by the Bay.

- Sentosa-Brani Master Plan Phase 1: Addition of Sentosa Sensory, a linkway connecting Resorts World Sentosa and the southern beaches.

- Mandai Eco-Tourism Phase 1: Opening of the new Bird Park.

- New SkyHelix Sentosa, an open-air rotating gondola that will ascend 35-metres above ground and offer views of Singapore’s southern coast.

2023

- TEL Phase 4: Addition of 8 stations connecting Founders’ Memorial to Bayshore.

2024

- Extension of Downtown Line with two stations – Xilin and Sungei Bedok. Enable direct connection to East-West Line and TEL.

- Mandai Eco-Tourism Hub: new Rainforest Park and eco-resort.

- NEL: Addition of New Punggol Coast Station.

Beyond 2024

- CRL Opening: Including 12 stations from Aviation Park to Bright Hill.

- Greater Southern Waterfront (Next 5-10 years).

- Ongoing revitalization of Orchard Road to enhance its attraction as a lifestyle destination.

- 4-km RTS Link from Woodlands North to Johor Bahru, Malaysia expected to be operational in 2026.

- 4-km CCL6 will close the loop with the addition of 3 stations, connecting Harbourfront to Marina Bay.

- Jurong Lake District Tourism Hub will feature a commercial node, mixed use precinct, complementary leisure and recreational precinct, and International Business Park.

- 24-km JRL to complete in 2028.

- Marina Bay Sands expansion to add 15,000-seat indoor entertainment arena and a fourth tower which will feature about 1,000 all-suite hotel rooms and other facilities.

- Resort World Sentosa to add Minion Park and Super Nintendo World to Universal Studio. It will also add a new waterfront lifestyle complex and two new destination hotels with up to 1,100 rooms.

- Sentosa-Brani Master Plan will roll out in phases over two to three years, featuring five distinct zones: Vibrant Cluster, Island Heart, Waterfront, Ridgeline and Beachfront.

- Changi Airport Terminal 5 with a handling capacity of 50 million per annum (delayed beyond 2030 due to COVID-19).

Figure 2: Infrastructure Developments

Source: HVS, Land Transport Authority

Singapore Tourism Landscape

International Visitor Arrivals

According to Singapore Tourism Board (STB) figures, international visitor arrivals has increased for four consecutive years to reach a record of 19.1 million in 2019 before decreasing by 85.7% to 2.7 million in 2020 due to the travel restrictions brought about by Covid-19.

In 2020, overnight visitors number decreased by 85.1% from approximately 15 million visitors to 2 million visitors. Exhibiting a similar trend is the number of visitor days, which has decreased by 81.7% from approximately 64.1 million days to 11.8 million days.

Figure 3: International Visitor Arrivals (2015-2020)

Source: STB

Purpose of Visit

With favourable weather all year round and the range of tourism offerings, majority of the international travellers visit Singapore for holiday purposes, making up 58% of the visitors in 2019. This is followed by visiting friends and relatives (15%) and for general business purposes (9%). More than half (51%) of the total travellers are repeat guests to the island state.

Figure 4: Purpose of Visit (2019)

Source: STB

*2020 data is not available at the timing of writing

International Source Market

In 2020, Indonesia overtook China as the top international source market. This may be attributed to the restrictions imposed on Chinese visitors when the Covid-19 strain was first recorded in China in December 2019. All international source markets recorded double digit decline in arrivals, marking 2020 as the lowest performing year in terms of visitor arrivals to Singapore.

The top five international source markets to Singapore in 2020 were: Indonesia (16.6%), China (12.9%), Australia (7.5%), India (6.4%), and Malaysia (5.6%). The five markets made up almost half of the total visitor arrivals to Singapore in 2020.

Due to the travel restrictions imposed globally, Singapore has encouraged domestic tourism within the island state through several initiatives, such as the SingapoRediscovers vouchers, and other marketing campaigns.

Figure 5: Top Five International Source Markets (2020)

Source: STB

Average Length of Stay (ALOS) increased by 1.3 nights, reaching 4.7 nights in 2020 due to the 14-day quarantine requirement as a result of Covid-19. As of YTD Q3 2020, tourism receipts stands at SGD4.4 billion, a 78.4% decrease from last year.

Figure 6: Average Length of Stay and Tourism Receipts (2019-2020)

Source: STB

Singapore Hotel and Branded Service Apartment Market

Source: Unsplash

2020 is a quiet year for Singapore’s hotel supply growth, the room supply only grew at 0.5%. HVS noted the opening of Dusit Thani Laguna Golf Resort, which added 198 rooms to the market. Properties such as lyf Farrer Park Singapore and The Clan Singapore which were supposed to open in the year were delayed due to the pandemic.

Moving forward, HVS tracks the opening of three branded properties in 2021, which will inject 638 rooms into the market. Between 2022 and 2025, an additional 2,334 branded rooms are expected to be added to Singapore’s accommodation supply. The hotels slated to open are mainly positioned in the luxury and upscale segments.

In a bid to provide ample opportunities for developers to initiate additional supply of hotel rooms, the government periodically updates the list of hotel sites available for sale under the Government Land Sales (GLS). Only one site is available for hotel development under the 1H2021 GLS programme. The 1.02ha River Valley Road could yield up to 530 rooms and is estimated to provide 2,000 square metres of commercial space.

Hotels Opening in 2021:

- Citadines Raffles Place Singapore, 299 keys

- MGallery by Sofitel Bideford Hills Singapore, 166 keys

- Citadines Connect City Centre, 173 keys

Hotels Opening in 2022:

- Pullman Singapore City Hall, 350 keys

- Raffles Sentosa Resort & Spa, 62 keys

- Citadines Connect Rochester Singapore, 135 keys

Hotels Opening beyond 2022:

- Edition The Singapore, 190 keys

- Banyan Tree Mandai Park, 400 keys

- Marina Bay Sands Resort, 1,000 keys

Notable Changes in the Hotel Landscape

- Rebranding of 575-key Marina Mandarin to PARKROYAL COLLECTION on Marina Bay in late 2020

- Former Le Meridien to reopen as 191-key Oasia Resort Sentosa in Q2 2021

- Redevelopment of Pan Pacific Orchard, offering 347 rooms upon completion in 2021

- Rebranding of 1,077-key Mandarin Orchard to Hilton Singapore Orchard by 2022

Figure 7: Singapore Hotel Rooms Pipeline (2021 to >2024)

Source: Urban Redevelopment Authority

*Planned refers to projects that are not yet under construction but have planning approvals, written and provisional

Singapore Hotel Market Performance

Singapore’s hotel market performance has recorded a decline in 2020. This is attributable to the lockdowns and travel disruptions caused by Covid-19. Marketwide occupancy declined by 30.1 percentage points (p.p.) and Average Room Rate (ARR) decreased by 30.2%. Overall, RevPAR fell by 55.2%, the largest decline in the past four years.

Moving forward, with many countries still implementing travel restrictions, the tourism sector in Singapore is likely to be negatively impacted in the short-term due to its reliance on international visitors. Until a fully effective vaccine is proven, the uncertainty of resurgence in infections and reimposition of lockdowns will remain.

Figure 8: Singapore Overall Hotel Performance (2016-2020)

Source: STB

Note: On 29 January 2018, STB’s hotel performance statistics from 1 January 2007 onwards have been updated based on the revised methodology. Therefore, the above chart should not be compared with previously published data.

Figure 9: Singapore Hotel Segment Performance (2020)

Source: STB

Though Singapore is not spared from the negative impacts of Covid-19, the industry managed to sustain itself by hosting essential travellers from regional green lanes, foreigners with air travel pass, quarantine guests and local staycation business.

Hotel Transactions and Investment

Hotel Investment Market Slowed in 2020

The Singapore hotel investment market has mostly been dominated by local investors. While no transactions were recorded in 2016, transaction volume picked up from 2017 to 2019. In 2019, the number of hotels transacted increased to twelve, with transaction volume spiking up to SGD2.57 billion, the highest over the past years.

However, in 2020, as the global economy has slowed, consumer sentiments have weakened, and the accommodation market was hit hard by travel disruption, the hotel investment market has been subdued with only two transactions in 2020.

Notable transactions in 2020:

- 403-key Novotel Clarke Quay at SGD375 million (SGD933,000/key)

- 197-key Somerset Liang Court at SGD163 million (SGD829,000/key)

Moving forward in 2021, the hotel investment market will possibly see more investment volume due to the recovery of investors’ sentiments and the growing interest in hotel investment post-Covid.

Figure 10: Singapore Hotel Transactions (2016 – 2020)

Source: HVS Research & Real Capital Analytics (RCA)

Outbound Hotel Investment Volume Shrunk

In 2020, outbound investment by Singapore investors have shrunk in volume, decreasing from USD2.36 billion in 2019 to USD1.64 billion in 2020, representing a 30.5% decline.

Approximately 75.1% of the total outbound hotel investments were made in Asia Pacific, while 14.8% of investments were made in the Europe, Middle East and Africa (EMEA). The remaining 10.1% were made in the Americas.

Figure 11: Singapore Inbound and Outbound Hotel Transactions (2020)

Source: HVS Research & RCA

Figure 12: Outbound Hotel Transaction Market (2020)

Source: RCA

Covid-19 Timeline

Figure 13: Outbound Hotel Transaction Market (2020)

Source: HVS Research

Source: Unsplash

Outlook

In 2020, Singapore witnessed its greatest decrease in international arrivals and worst hotel performance in recent years due to the travel restrictions brought upon by the Covid-19 pandemic. Singapore has recorded a decline of 30.1 p.p. in occupancy and a decrease of 30.2% in ARR, contributing to an overall dip of 55.2% in RevPAR. With many countries still implementing travel restrictions intended to control the spread of the coronavirus, the tourism sector in Singapore is likely to be negatively impacted in the short-term due to the lack of international visitor arrival. Until a fully effective vaccine is proven, the uncertainty of resurgence in infections and reimposition of lockdowns will remain.

As a prominent business events destination in Asia Pacific, Singapore has maintained a robust pipeline of events from world congresses to regional conferences in the past years. Despite the Covid-19 pandemic, Singapore has been selected to hold several high-key events in 2021. This includes the ATP World Tour 250 tournaments in February, the IISS Shangri-La Dialogue, and the World Economic Forum in August. This has demonstrated event organisers’ confidence and trust in the way that Singapore has handled the Covid-19 spread, moreover, Singapore is also one of the fastest country in the Asia Pacific region in terms of vaccinated people per dose.

In terms of supply pipeline, HVS notes that there will be ten branded hotels and serviced apartments in the pipeline by 2022, which will add 2,276 rooms into the market. Hotel market in Singapore is expected to benefit from the robust supply and demand fundamentals with the limited injection of supply into the market over the next few years when travel market recovers.

In 2020, transaction volume in Singapore dipped to SGD539 million, the lowest over the past four years. This illustrates investors’ reservation in hotel investment due to the ongoing uncertainty circling the global market and Covid-19 pandemic.

In a bid to bolster Singapore’s tourism market, the Singapore government has established several travel green lanes. In addition, the STB has launched several initiatives such as the SingapoRediscovers vouchers to incite domestic tourism spending, and sealed marketing partnerships with companies such as Mastercard and Studio Dragon Corporation to promote Singapore.

Singapore will also see the development of new destinations such as the Greater Southern Waterfront and Jurong Lake District, and the rejuvenation of existing destinations such as Orchard Road and Mandai precinct.

Moving forward, Singapore’s hotel market outlook is expected to be rocky in the short-term and will be dependent on the global recovery progress from Covid-19. Apart from measures to alleviate the immediate impacts, which include property tax waiver and license fee, the Singapore government will also continue to implement efforts to tide through the impacted periods such as the Connect@Changi facility being used to draw business travellers, and the topping up of SGD68.5 million into the Tourism Development Fund to support tourism enterprises amidst the pandemic. STB and relevant government agencies are also committed to fulfilling mid- to long-term tourism and national development plans to ensure that Singapore is set on the road of strong recovery when the situation improves.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)