By Russell Kett, Charles Carpentier

In the past year, Israel’s hotel sector has continued to demonstrate its resilience and its ability to withstand the impact of COVID-19, similar to the way it has bounced back from so many previous adversities. The domestic tourism market has been a saviour – achieving growth in excess of 2019’s levels by the end of 2022 – and there are now signs that international visitation is recovering strongly, and we are confident that, barring any unforeseen challenges, this could have recovered to 2019 levels by the end of 2023.

Israelis have an unquenchable thirst for travel, and the opportunities created by the signing of the Abraham Accords, nearly three years ago as I write this (June 2023), have resulted in huge numbers exploring the charms of the United Arab Emirates in particular, with the other main signatory countries – Bahrain and Morocco – welcoming more Israelis.

During 2022, HVS formed an alliance with the Abraham Accords Peace Institute (AAPI), a non-partisan, non-profit US organisation dedicated to supporting the implementation and expansion of the historic Abraham Accords peace agreements, to advise on ways in which tourism between the countries can be expanded, thereby enabling growth in each country’s GDP.

We published our first report – Leveraging the Abraham Accords to Stimulate Tourism Growth – earlier this year. The objective of this report was to identify those opportunities, through the growth of tourism, that will deepen the relationships and cultural understanding between the people of the countries which are signatories of the Accords and build tourism’s contribution to the GDP of each country. Once successful, this will strengthen the value of the Accords amongst the existing countries and demonstrate concrete benefits to other countries that are considering becoming part of this historic opportunity.

The report included a detailed analysis of tourism opportunities for each of the Abraham Accords (AA) countries along with some of their key neighbours. Among our many recommendations for Israel, we encouraged the creation of a special department in the Ministry of Tourism responsible for using the AA as a catalyst to (1) grow tourism to Israel from the member nations and (2) create and promote regional initiatives to grow tourism from all the member nations. Additionally, Israel should develop a robust marketing plan for each member nation, allocate VIP accreditation to bona fide travellers from AA nations to ensure a smooth and safe travel experience, and establish an eVisa facility for nations that offer such options to Israeli travellers.

Such is the importance of the visa situation that we have just published a follow-up paper with AAPI – Easier Visas Lead to Tourism Growth and Increased GDP – which indicates that improved visa procedures would expand the movement of tourists among AA member nations, resulting in potential economic growth and stronger people-to-people ties. The reduction in barriers to increased tourism is an integral component in enabling regional trade and economic partnerships. In general, countries that have a more traveller-friendly policy regarding entry visas benefit from expanded tourism growth, which has a positive effect on their GDP.

My colleagues and I hope that this annual review of the Israel Hotel Market will assist investors, developers, owners and operators of hotels in Israel – both within the country and from abroad – to be part of the opportunity to grow the country’s hotel sector and the consequent improvement in its GDP as the travel and tourism sector increases its prominence within the Israeli economy.

Country Highlights

A Resilient Economy

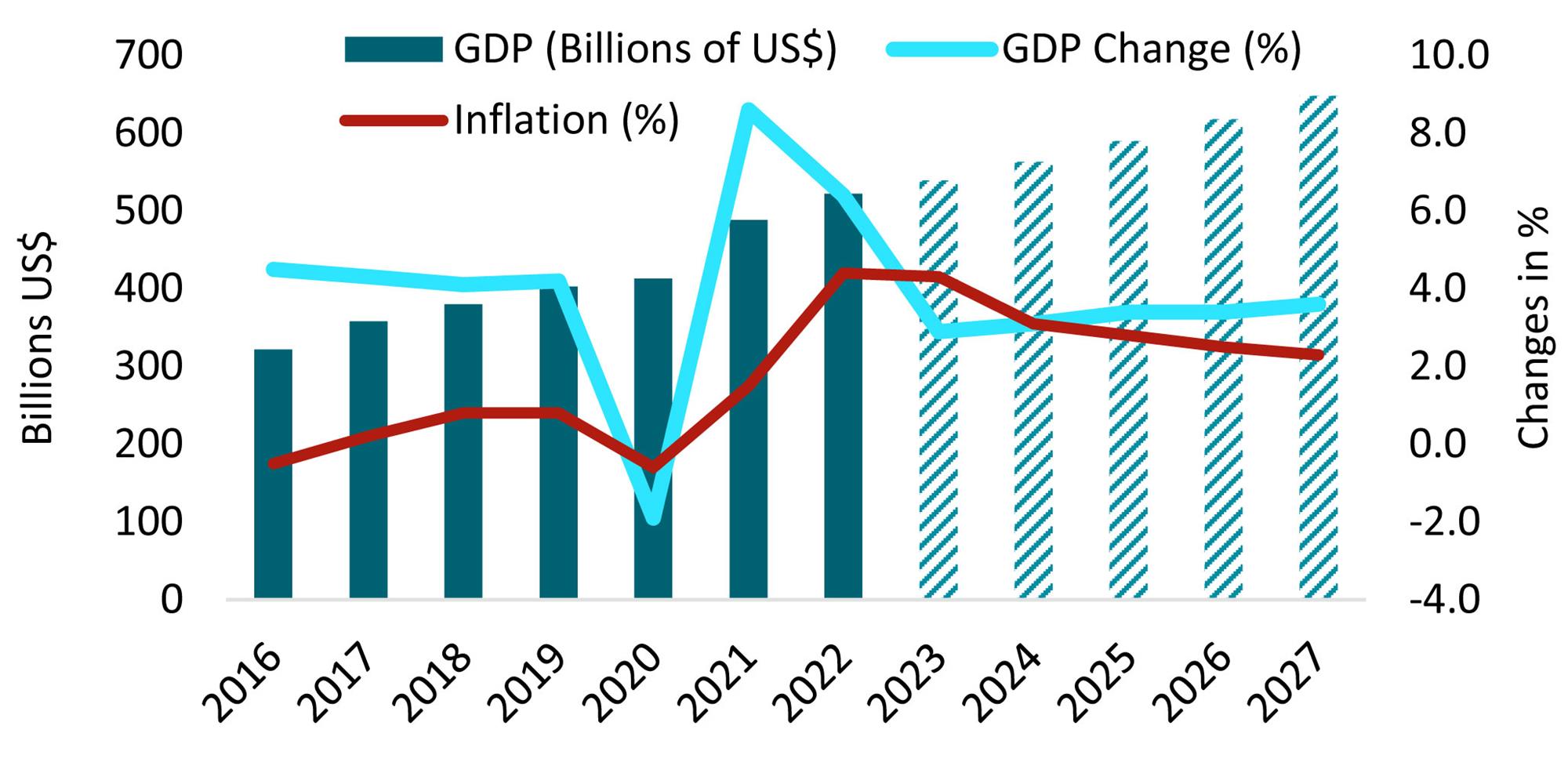

The Israeli economy experienced a decade of flourishing growth, positioning itself as one of the top performers among OECD countries with an impressive GDP compound annual growth rate (CAGR) of 6.0% between 2010 and 2019. However, 2020 marked a significant downturn for the economy, with a contraction of 1.9% in GDP, the first decline since 2002. Despite this setback, the Israeli economy has exhibited a robust recovery following the COVID-19 pandemic, aided by a successful vaccination campaign. It has also demonstrated strength in the face of the repercussions of Russia’s war on Ukraine, driven by its resilient economic sectors such as high-technology, industrial manufacturing, energy, financial services, tourism and agriculture.

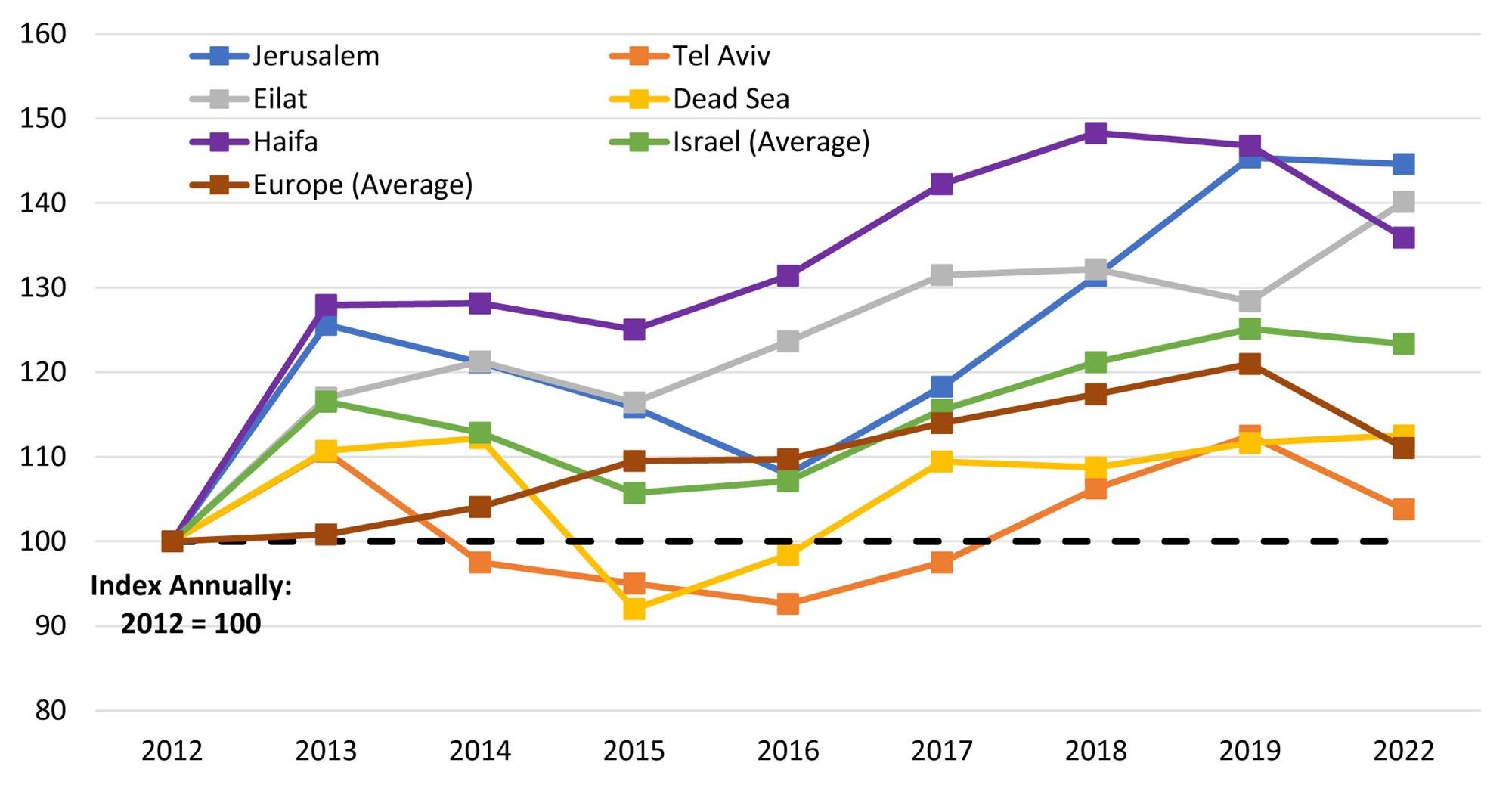

Although inflationary pressures have emerged, Israel has managed to maintain relatively better control than many European and global nations, primarily due to its self-sufficiency in natural gas. Looking ahead, Israel’s GDP growth is expected to be moderate in the short- to medium-term, but it is anticipated to remain substantial and robust, as illustrated in Figure 1.

Figure 1: Israel’s GDP Proving Real Growth

Source: International Monetary Fund, April 2023

Undeniably, the travel and tourism sector plays a significant role in contributing to Israel’s GDP. It serves as a vital economic pillar, generating revenue, creating jobs and attracting foreign exchange. It contributed US$16 billion (3.0%) to GDP in 2022, according to the WTTC, which remains 28% short of the 2019 contribution to GDP of US$22 billion (5.6%) but shows a significant 66% increase over the lowest contribution in 2020.

Two Years of the Abraham Accords

The historic signing of the Abraham Accords in August 2020 has presented an unparalleled opportunity to reshape the Middle East by fostering unity and moving beyond longstanding conflicts. Originally established between Israel and the United Arab Emirates (UAE), the Accords have expanded to involve several other nations, including Bahrain, Kosovo, Sudan and Morocco.

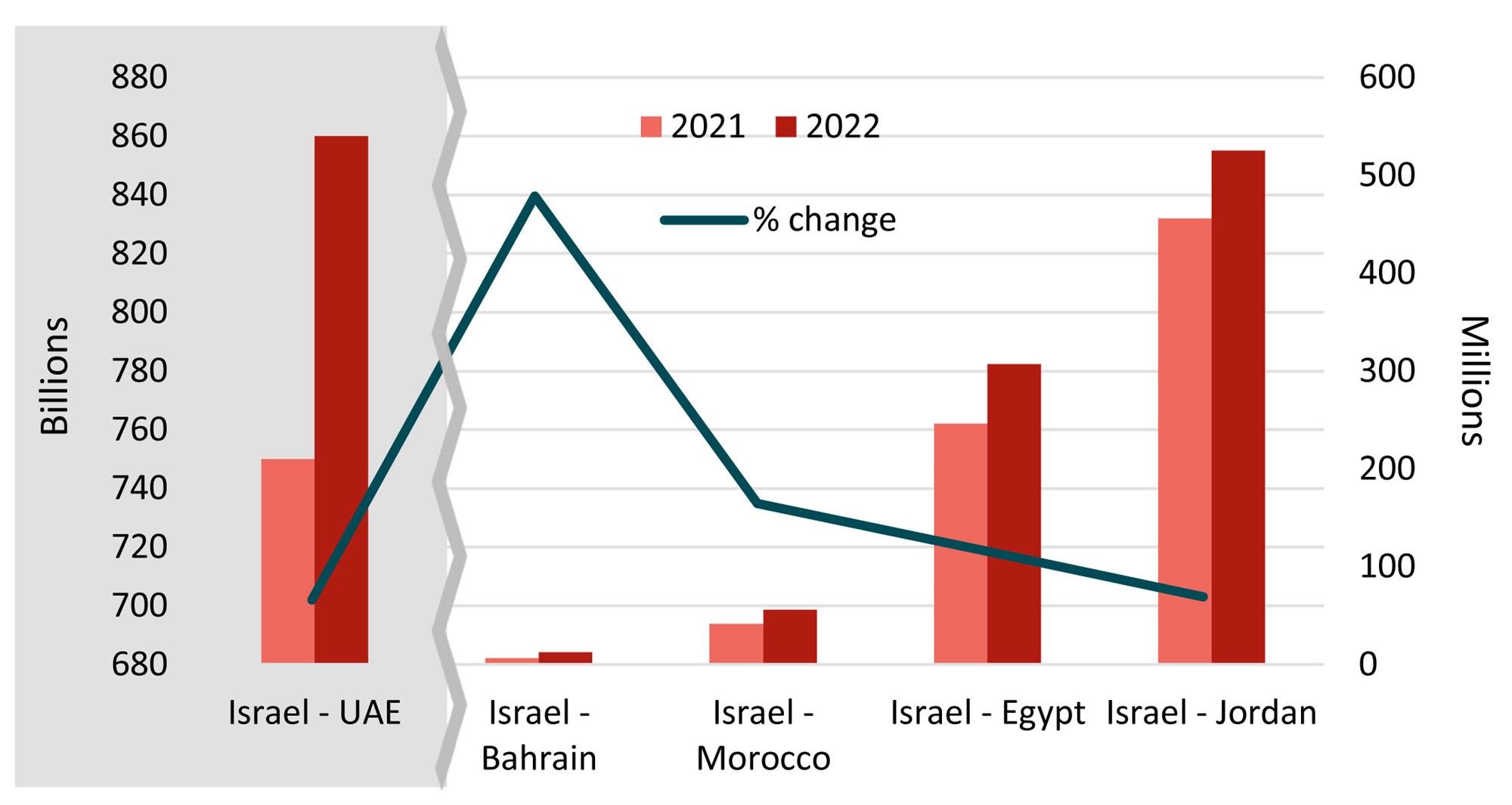

Figure 2: 2022 Trade Numbers with Israel Show Significant Increase Over 2021 Levels

(% increase over trade activity in 2021)

Source: Abraham Accords Peace Institute, 2022

This expansion has unlocked the potential for growth by facilitating regional coordination in crucial economic areas such as trade and tourism, thus aiding the recovery of the tourism sector, which has been impacted by the COVID-19 pandemic. The strategic focus and collaboration among these nations hold immense potential for generating substantial economic gains and sociocultural benefits throughout the region.

Significant progress has been made in the first two years since the Accords’ signing, particularly in deepening diplomatic relations between the participating governments. This progress is evident through the opening of embassies, the appointment of first-ever ambassadors and some bilateral visits involving prime ministers and foreign ministers.

The Abraham Accords have contributed to Israel’s economic growth by facilitating trade among the member nations. This potential is expected to expand further as relations between these nations continue to strengthen. The 2022 trade numbers between Israel and the AA members are presented in Figure 2. A focus has now been placed on expanding the people-to-people ties between AA member nations. The involved countries will work to increase tourism and cultural collaboration with Israel, notably by introducing new airline routes between capital cities.

Inbound Tourism on the Rise Again

Between 2016 and 2019, prior to the pandemic, Israel’s tourism industry experienced remarkable growth in terms of tourist arrivals, with a CAGR of 16.2%. This growth was attributed to targeted marketing efforts, visa regulation facilitation and an increase in the number of air routes, thanks to the implementation of the Open Skies agreement.

Data for 2020 and 2021, on the other hand, saw consecutive declines in foreign tourist visits to Israel. Due to the pandemic, Israel closed its borders to foreign visitors and only permitted entry to fully vaccinated tourists in November 2021, a decision overturned four weeks later in response to the spread of the Omicron variant. From March 2022 onwards, all tourists, vaccinated or not, were allowed entry by providing pre- and post-flight PCR tests, aimed at supporting the struggling tourism industry. All pandemic-related entry restrictions were then lifted later in October. As discussed in our last Israel Hotel Market Overview, countries and markets with a greater reliance on international demand and air travel are likely to experience a longer tourism recovery curve.

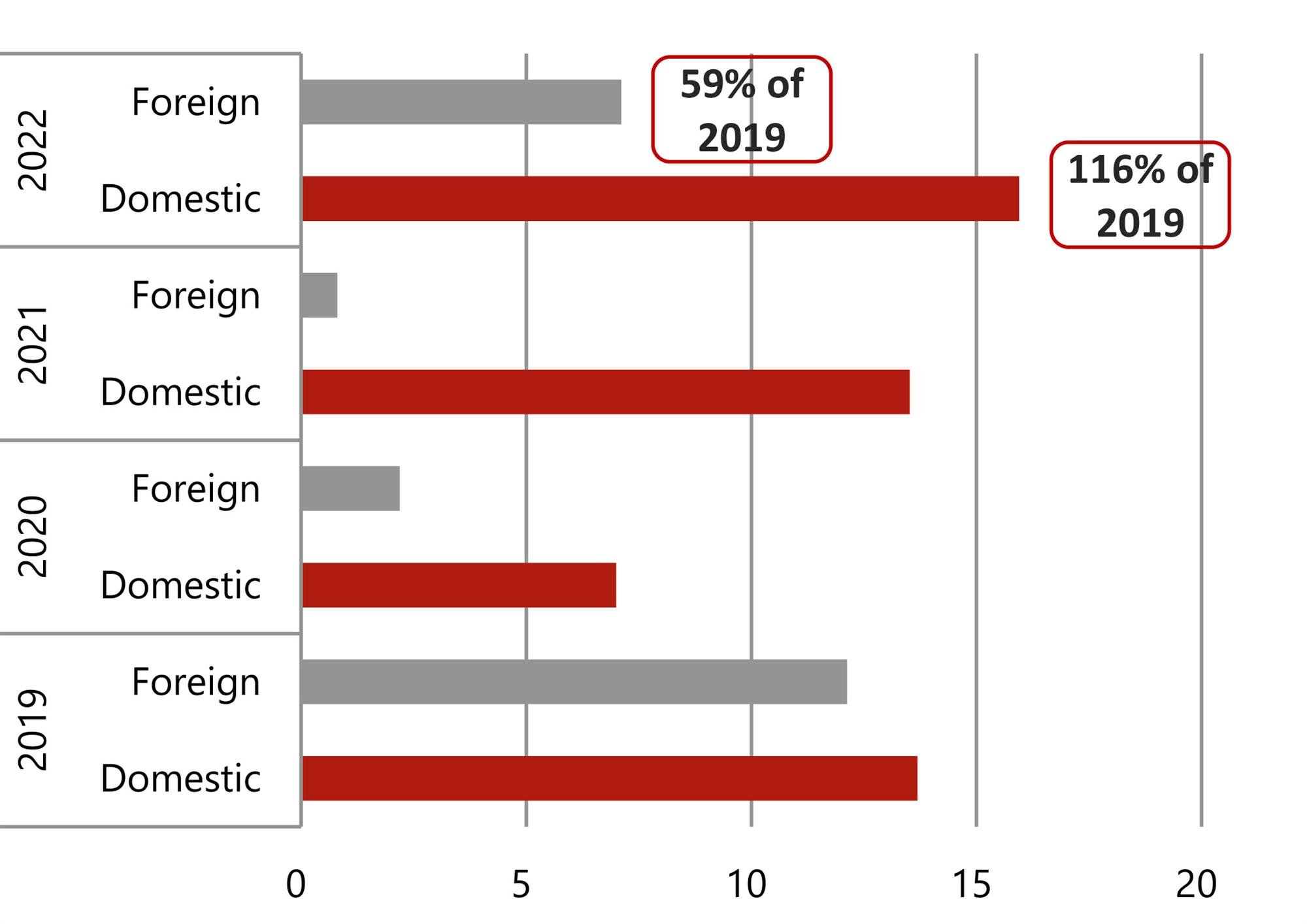

While domestic tourism dominated the share of room nights spent in Israel in 2022 (accounting for 69%), it is expected that foreign travellers will soon regain their 2019 share of around 47% and even surpass domestic traveller numbers. This projection takes into account Israel’s significant efforts in promoting tourism, the current increase in attractiveness of certain cities and regions, and the successful development of regional, cultural and religious tourism driven by the Abraham Accords.

Figure 3: Domestic Bednights Recovered Faster in Israel (millions)

Source: Central Bureau of Statistics

Domestic Tourism at an All-Time High

The domestic tourism sector in Israel reached an all-time high in 2022 with close to 16 million domestic travellers recorded, reflecting the changing travel landscape amidst the pandemic. With international travel restrictions still in place early in the year and several geopolitical uncertainties, Israelis continued opting to explore their own country, leading to a surge in domestic tourism, otherwise known as ‘staycations’.

As shown in Figure 3, domestic bednights in 2022 were equivalent to 116% of 2019 levels and grew by 18% over 2021. As detailed later in this report, all destinations in Israel benefitted from this trend in 2022, some more than others, helping to drive hotel occupancy levels and average rates upwards during the recovery.

Figure 4 provides an overview of the change in room nights arising from domestic guests in 2022 versus 2021 (in red) and 2019 (in blue). The data show that all major markets in Israel generated domestic demand figures over full-year 2019 results.

Not only does domestic tourism provide an opportunity for Israelis to discover and appreciate their own heritage and culture, but it also contributes significantly to the local economy, supporting businesses and employment in the tourism sector. The rise in domestic tourism is testament to the resilience and adaptability of the industry, and it showcases the enduring appeal of Israel as a captivating destination for both domestic and international travellers.

Figure 4: 2022 Domestic Bednights were 16% Higher than 2019 Levels, on Average

Source: Central Bureau of Statistics

More Hotels Than Ever Before

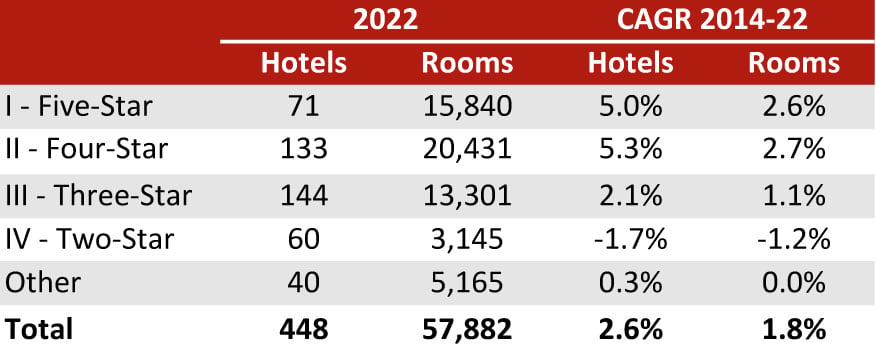

The number of hotels in Israel has witnessed steady growth over the last several years, with a current supply of around 58,000 rooms (448 hotels), of which 27% are Level I (defined as five-star by the Central Bureau of Statistics), 35% are Level II (four-star), 28% are Level III (three-star); the remaining 10% being split between two-star, serviced apartments and hostels. It is interesting to highlight that 18 new hotels have opened their doors since early 2020, during the COVID-19 pandemic, demonstrating the resilience and determination of Israel’s tourism industry in the face of challenging circumstances. And these hotels have not opened at a substantially different scale, as the average number of rooms per hotel has remained at 129 in the country since 2019.

As presented in Figure 5, Israel has experienced a particular growth in four- and five-star accommodation, with CAGRs over the 2014-2022 period of 5.3% and 5.0%, respectively. The rising demand for high-end experiences and the influx of international tourists seeking more luxurious amenities have driven this trend. The hospitality industry in Israel has recognised the importance of catering to upscale travellers, leading to the development of more luxury hotels across the country.

Figure 5: Luxury Hotels Have Grown Faster than Others in Israel

Source: Central Bureau of Statistics

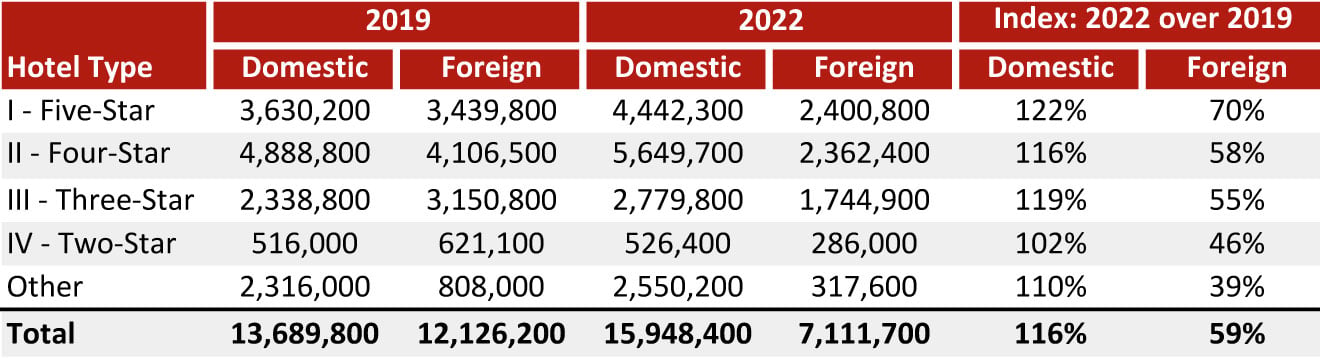

The growth in the number of luxury hotels signifies the country’s ability to position itself as a premium tourism destination. Israel’s commitment to providing luxurious accommodation aligns with its efforts to enhance its global image and attract a wider range of visitors, including affluent travellers and business professionals. As presented in Figure 6, the 2022 bednights that recovered the most to 2019 levels in Israel and per hotel type were those spent in five-star hotels, even with not fully recovered foreign bednights.

Overall, the increasing number of luxury hotels in Israel reflects the country’s dedication to meeting the evolving needs and preferences of tourists while elevating its status as a sought-after destination for luxury travel experiences.

Figure 6: While Domestic Bednights Have Surpassed Their 2019 Levels,

Foreign Bednights Have Recovered Just Over Half of Them

Source: Central Bureau of Statistics

Hotel Market Performance

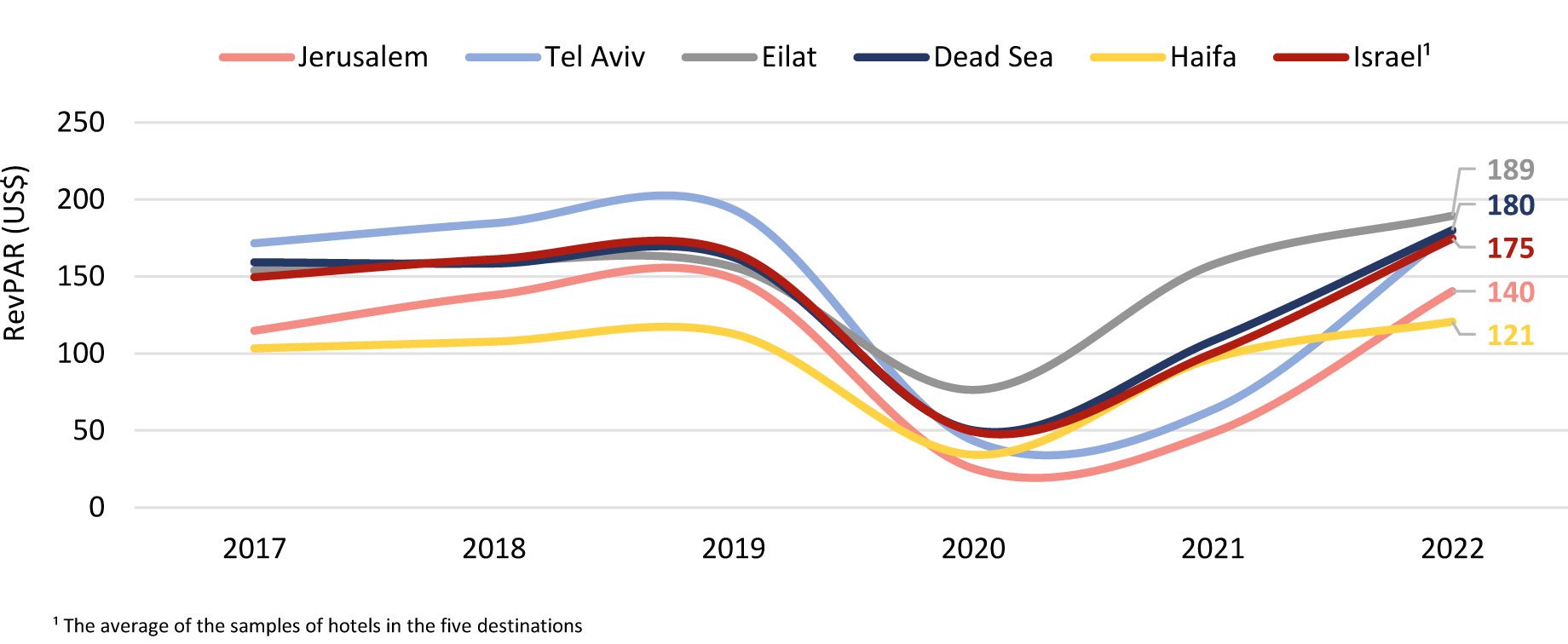

Much in line with the rest of the world, Israel’s hotel industry suffered severely in 2020 and 2021 with plummeting RevPAR levels, as reflected in the data presented in Figure 7. The majority of hotels across the country remained closed for a large part of 2020 and, for those remaining operational, occupancy levels declined substantially. Average rates also suffered significantly, resulting in an overall RevPAR decrease of 70% for the total Israel market in 2020.

2021 data reflect some of the positive upsides taken from the boost in the staycation trend, as previously discussed. Hotels, especially in resort destinations such as the Dead Sea and Eilat, which in years unaffected by COVID already relied more on domestic visitation, took advantage of the situation and boosted both average rates and occupancy levels, resulting in impressive RevPAR recoveries and managed to further improve in 2022 to reach record-high RevPAR levels of US$180 and US$189, respectively. Jerusalem and Tel Aviv continued to struggle in 2021 with very low occupancy rates, reflecting the cities’ heavy reliance on international visitation. With the easing and later lifting of international travel bans in 2022, both cities started a steep recovery and benefitted from the high-rate environment globally to yield better results. In 2022, Jerusalem and Tel Aviv remained the areas with RevPARs below their 2019 levels (-6% and -7%, respectively) in nominal terms, while all other markets achieved between 7% (Haifa) and 21% (Eilat) above their respective 2019 levels.

Figure 7: Resort Destinations in Israel Show the Most Rapid RevPAR Growth Since the COVID-19 Pandemic

Source: HVS Research

RevPAR Recovered to 2019 Levels

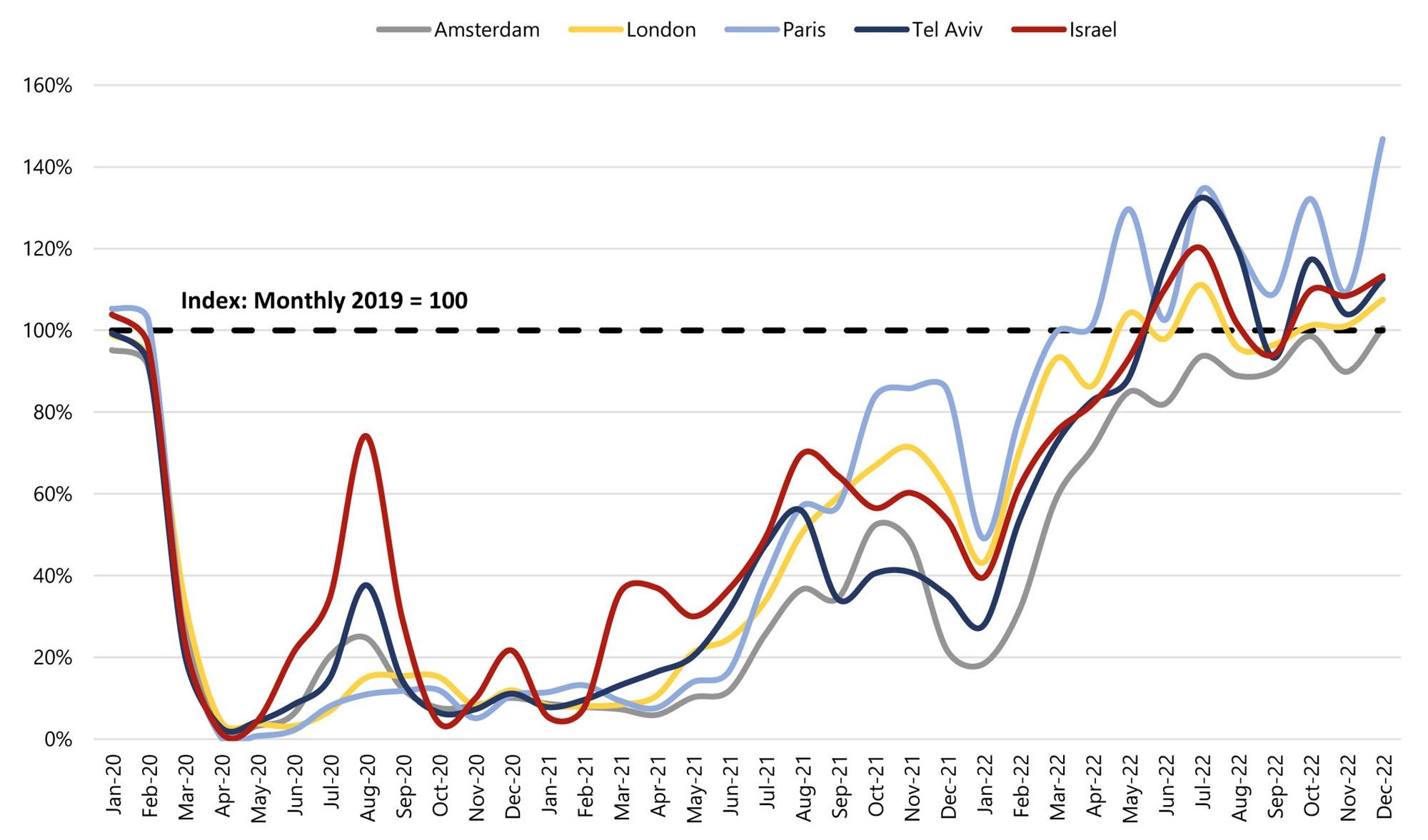

Across Europe, most major cities followed similar trends, as presented in Figure 8, which shows the RevPAR progression from the beginning of 2020 to the end of 2022, in US$ indexed to 2019, as per data from STR.

The Israel hotel market stood at 6.0% above its 2019 RevPAR levels in 2022, in nominal terms, at US$175. In real terms (by taking out the IMF inflation for Israel), that means the country’s RevPAR has recovered to its 2019 level of US$165. Only a few months after international travel resumed, this is a significant achievement and a positive indication of the overall health of the tourism industry in Israel. It indicates a strong recovery in demand for accommodation, increased traveller confidence, successful marketing efforts, increased occupancy rates, improved pricing strategies and hotels’ ability to adapt to changing market conditions, all of which contribute to higher revenue generation for hotels.

Global Conditions

The global hospitality industry has been significantly impacted by various external factors, including the COVID-19 pandemic, the Russian invasion of Ukraine, inflationary trends and labour shortages. The pandemic caused a severe decline in travel and business activity, while the conflict in Ukraine created economic and political uncertainty. Rising energy prices and disrupted supply chains have contributed to inflation, and labour shortages have affected hotel operations. Although recovery and mitigation efforts are underway, there remains a level of uncertainty influencing the market and the economy.

Figure 8: Tel Aviv and Israel are Well Placed in Terms of RevPAR Recovery (US$; Index: 2019 = 100)

Source: STR

Hotel Development

Despite having been significantly challenged in the last few years, Israel’s hotel industry has displayed remarkable strength, with continued robust entrepreneurial activity and increased levels of hotel investment. Prior to the COVID-19 pandemic, Israel’s hotel pipeline was at record levels and, despite the recent difficulties, the majority of planned projects have persevered and are moving forward, albeit with some inevitable delays. With support from government grants, the number of hotels currently in the planning stages or under construction totals several thousand new rooms.

The pipeline is led by several familiar and international operators/brands with a large share of developments due to enter the Tel Aviv market, supporting hoteliers’ belief that tourism will continue to grow there in the years to come.

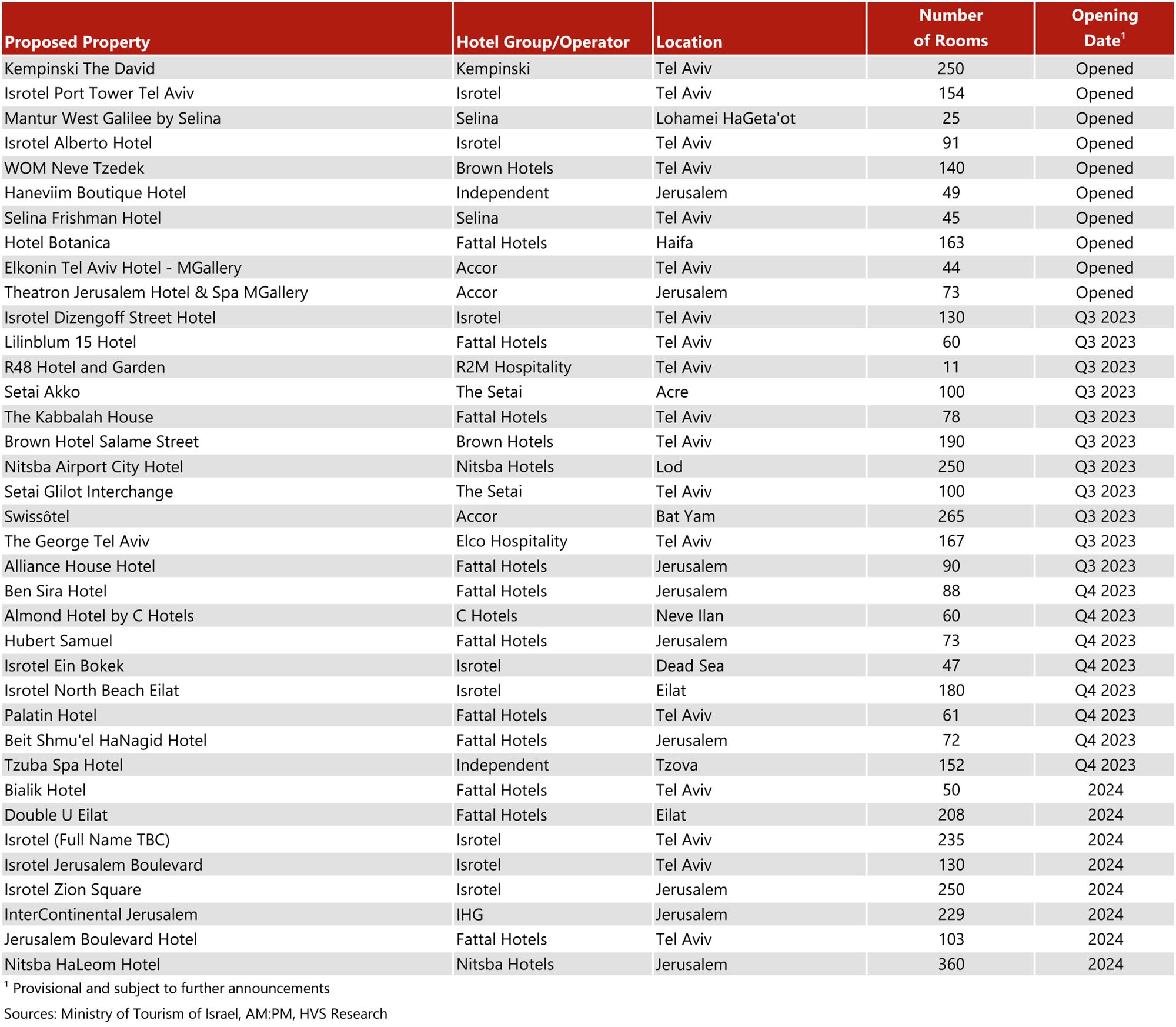

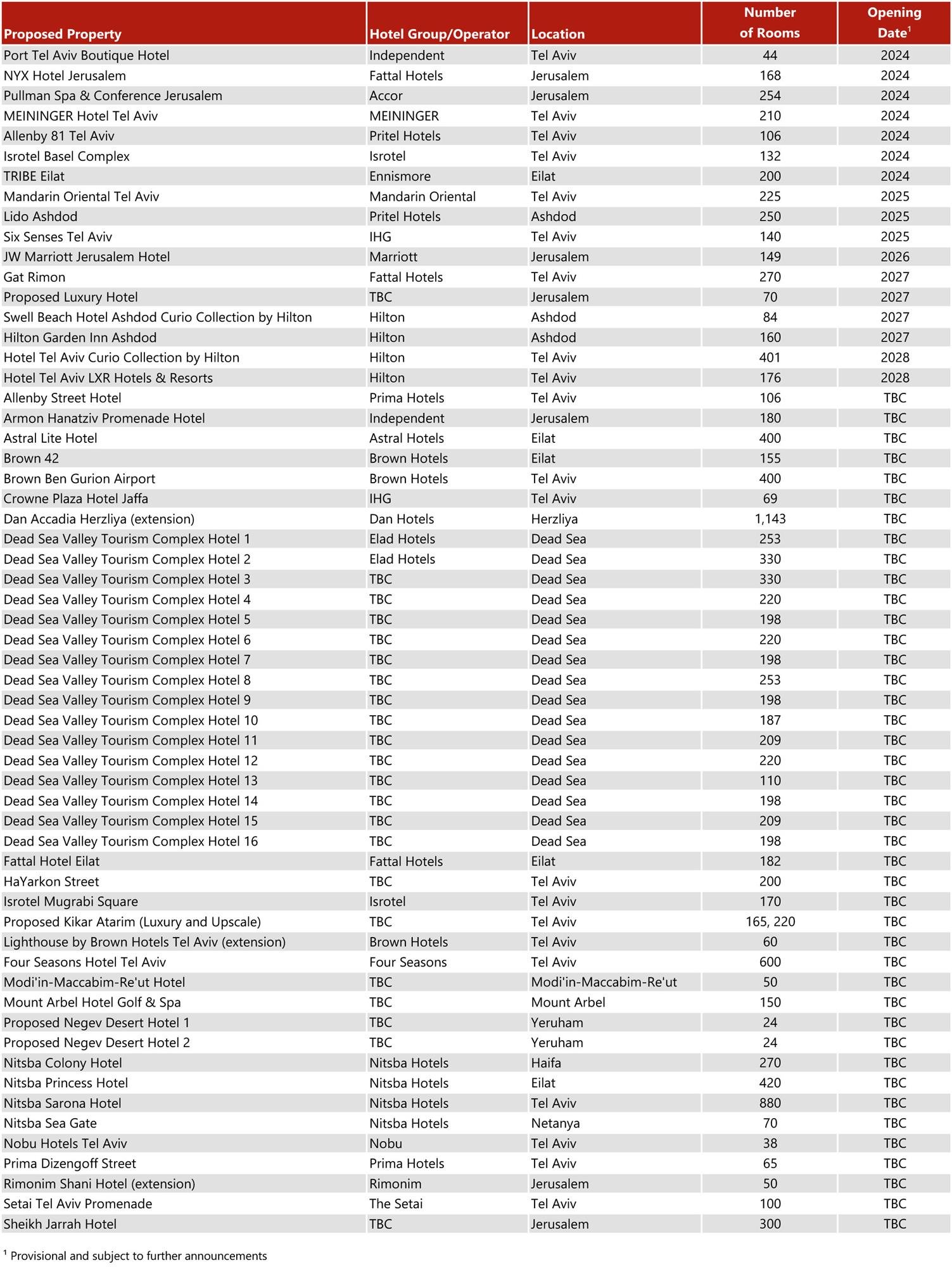

Figure 9 provides an overview of recently opened properties and proposed new supply in Israel. The opening dates exclude possible further delays caused by the current situation, and we expect more certainty around these projects to evolve over the next 12 months.

Figure 9: Recently Opened Properties and Proposed New Supply

Source: Ministry of Tourism, AM:PM, HVS Research

Figure 9: Proposed New Supply (continued)

Source: Ministry of Tourism, AM:PM, HVS Research

Hotel Values and Investment

Hotel Values Back to Pre-Pandemic Levels

While we had chosen not to publish any indications for changes in hotel values in Israel since the emergence of the pandemic, mainly due to the lack of hotel transactions in the country during this rather challenging period, we are now in a place to evaluate the value evolution between 2019 and 2022 for hotels in Israel.

Unsurprisingly, over the course of 2020, 2021 and the first trimester of 2022, travel restrictions, lockdown measures and reduced travel demand led to a decrease in hotel RevPAR levels, which contributed to lowering EBITDA levels and ultimately hotel values. Uncertainty about the recovery timeline and reduced investor confidence have somewhat dampened demand for hotel properties during this period, while the overall economic impact has made it challenging to sell or lease at favourable prices.

Since the second trimester of 2022, hotel performance has been on the rise and reverted to pre-pandemic levels, even exceeding them in some cases, and translated into a positive impact on hotel values in the country.

The indications for changes in hotel values in Israel (presented in Figure 10) are based on trading results from 2012 to 2022 and our view of trading prospects and investment appetite for the foreseeable future. The positive trend in hotel performance across the country and more widely within Europe in general, combined with an increasing level of confidence among investors and developers, but diminished by the rising cost of capital, led Israeli hotel values in 2022 to remain slightly under 2019 values, by 1.4% in nominal terms, while the overall European market remains at around 8.0% below 2019 hotel values, in nominal terms (please refer to our 2023 European Hotel Valuation Index report). Eilat and the Dead Sea recorded the highest gains in terms of values per hotel room (+9% and +1% vs 2019, respectively), which is of no surprise considering the fantastic performance in occupancy and average rate in these resorts in recent months. On the other hand, Tel Aviv hotel values remain 8.0% below their 2019 levels, due to the city’s greater reliance on international tourism, as discussed earlier in this report. Haifa reported a similar trend to Tel Aviv, and Jerusalem has almost recovered at just 0.5% below its 2019 levels.

The analysis in local currency, thus removing the impact of currency fluctuations, indicates that hotel values in Israel remain short of 2019 hotel values by around 7.1%.

While indexed to 2012 (base 100), Jerusalem, Eilat and Haifa are the Israeli cities in which hotel values improved the most with 145, 140 and 136, respectively (Figure 11). On the other hand, Tel Aviv hotel values improved the least, with an index of 104. Overall, Israel hotel values have outpaced the European average over the studied period, with an index of 123 compared to 111, respectively.

Despite a significant improvement in performance, a growing hotel pipeline and a large amount of Israeli capital deployed in continental Europe, the hotel transaction market in Israel still lacks transparency, with limited information in the public domain about the very few transactions which have taken place. We would welcome receiving details of any transactions that our dear readers are familiar with.

Figure 10: Israel Hotel Values Remained 1.4% Short of 2019 Levels, On Average (Indexed to 2012, in US$)

Source: HVS Research

Figure 11: Israel Hotel Values Have Outpaced the European Average Since 2012 (Indexed to 2019, in US$)

Source: HVS Research

Conclusions

The Israel hotel market has demonstrated remarkable resilience in the face of challenges and has successfully rebounded to the pre-pandemic levels seen in 2019. Despite the heavy disruptions caused by the COVID-19 pandemic, the industry has shown adaptability and innovation in implementing health and safety protocols, ensuring guest confidence and a safe environment.

With the gradual return of domestic and international travel, initially leisure-driven but later complemented by business travellers, coupled with the country’s unique attractions and cultural significance, the Israel hotel market is well positioned for further growth and success. Looking to the future, the Israel hotel market holds great promise as the government’s commitment to attracting international and regional tourism as well as retaining domestic visitors remains steadfast with generous participation in new hotel developments via grants of up to 20% of development costs. Travellers can anticipate an exciting and vibrant hospitality landscape, making Israel an enticing destination for years to come.

With the uplift in performance already achieved and more yet to come, along with the return of investor confidence, hotel values in Israel have the worst behind them. Hoteliers need to focus on putting the right strategies in place to keep costs in check for a full recovery in all markets.

The opportunities generated following the signing of the Abraham Accords present further potential growth in visitors to Israel, thereby creating increases in hotel demand, profitability and ultimately hotel values.

.jpg)

.jpg)