Analysis by Shiori Sakurai

July room rates stand out

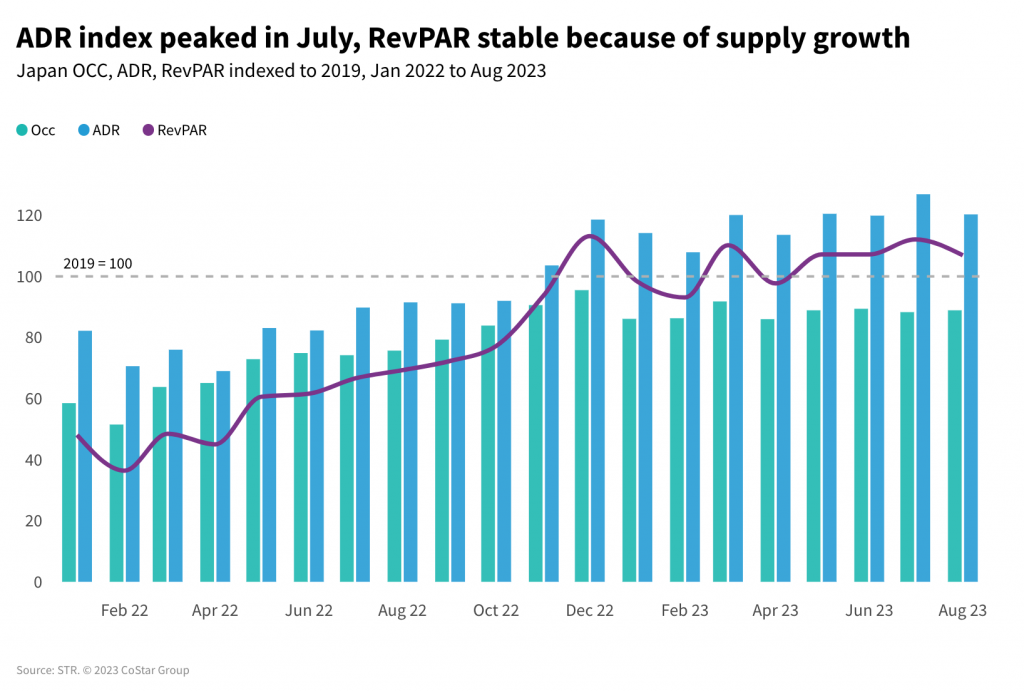

Even though room rates remained flat in comparison with 2019 during the first half of the year, Japan posted elevated average daily rate (ADR) of JPY18,507.46 in July. That level was 126.9% of what was seen in the comparable month of 2019. Japan’s hotel occupancy is still yet to reach full recovery, with July’s 73.4% average coming in at 88.3% of the pre-pandemic comparable. When looking at daily data, the highest occupancy level was on Saturday, 15 July (at 89.2%), which was the first day of Marine Day, a three-day-long national holiday in Japan. That occupancy level was the highest in Japan since 15 December 2019.

August ADR and RevPAR recovery did not exceed July figures. The country posted ADR of JPY19,438.40 (120.3% of what was seen in 2019) and RevPAR of JPY14,717.34 (107.0% of 2019).

On the other hand, August occupancy recovery rates exceeded July figures, with Japan hotels posting a level of 75.7% (88.9% of the pre-pandemic comparable). The highest occupancy level was seen on Saturday, 12 August (at 87.2%), the night before the beginning of the Obon wee and the second day of the three-day-long Mountain holiday.

August hotel performance recovery was also impacted by Typhoon No.7, which hit the country on Tuesday, 15 August, resulting in a month-over-month decrease in both the occupancy and ADR recovery for the rest of the month.

Luxury and Upper Upscale Hotels lead ADR recovery

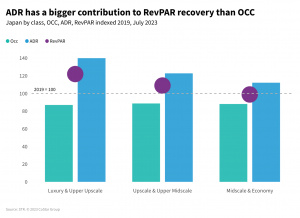

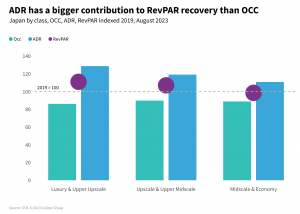

Following patterns in place since 2022, luxury and upper upscale class hotels led the way in ADR recovery in both YTD July and August, surpassing the 2019 comparables by 40.3% (to JPY36,546.10) and 28.8% (to JPY38,472.46), respectively. Such a significant increase in luxury and upper upscale ADR was driven predominantly by the combination of global inflation and the peak summer holiday period.

In July, the highest occupancy recovery levels were seen among the midscale and economy classes, where hotels posted occupancy of 71.6% (recovery rate of 88.1%). In August, occupancy recovery rates were led by the upscale and upper midscale classes, which recorded occupancy of 78.2% (89.9% recovery).

Before the pandemic, occupancy-driven revenue management was more noticeable among midscale and economy classes, but since mid-October last year, ADR levels in the economy and midscale to upper midscale and upscale classes have increased. Although a shift to rate-driven strategy has become more of a trend, the steepest increases in ADR, especially during the busy summer season, remain among luxury and upper upscale classes.

Osaka keeps up with Tokyo’s ADR and RevPAR recovery pace

Looking at two key markets in the country, Tokyo and Osaka, we saw the same pace in ADR and RevPAR recovery in both July and August. After a slight decline in June, recovery was helped by a boom in international demand from South Korea, Taiwan, and Hong Kong.

Looking ahead

Both domestic and international demand is experiencing strong recovery, resulting in an optimistic sentiment in Tokyo. The market’s occupancy levels are continuing an upward trajectory.

Overall for Tokyo, the combination of international revenge travel and JPY’s depreciation have helped performance growth. With the summer holidays ending, it is likely that revenge travel will start to slow. Also of note, China’s slow return, because of both visa complications and airlift, remains at less than 50% of pre-pandemic levels. The double-slowdown will likely continue to stymie recovery from that front.