Manhattan Lodging Overview

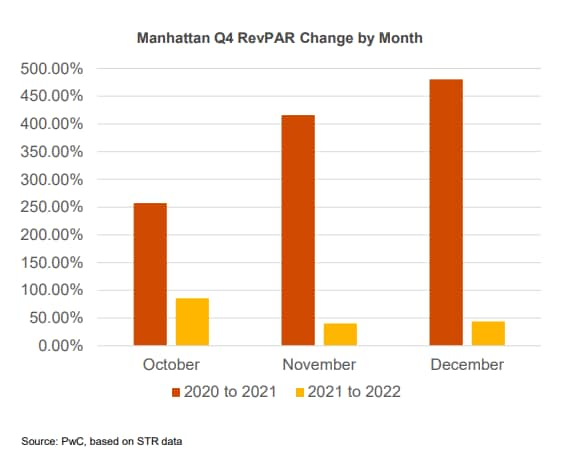

Increases in occupancy, ADR and revenue per available room (“RevPAR”) continued to accelerate across Manhattan during the second half of 2022. Q4 RevPAR experienced a year-over-year increase of 54.2 percent, with the strongest gains in October – up 85.8 percent. Q3 RevPAR increased 75.1 percent from the same period in 2021.

“RevPAR exceeded pre-pandemic levels at Manhattan hotels for the first time in 2H 2022, driven by outsized growth in average daily room rates. Hotels continue to struggle with replacing staff lost during the pandemic. With supply growth expected to be muted over the next several years, and a sluggish return of the business traveler continuing to place downward pressure on occupancy levels, hotel operators may begin to see heightened flow through to their bottom lines.”

— Warren Marr, Managing Director, PwC

RevPAR increased 54.2 percent year-over-year during the fourth quarter of 2022. Occupancy and average daily rate (“ADR”) continued to advance in a post-pandemic recovery as group and corporate travel patterns began to normalize and the market experienced its first holiday season with limited pandemic-related restrictions since 2019. Year-over year increases in occupancy were highest in October – up 32.1 percent. With overall occupancy for the quarter at 82.7 percent and ADR at $376.37, Manhattan RevPAR jumped from $201.90 in Q4 2021 to $311.23 in Q4 2022.

Of the four market classes tracked, upper upscale properties exhibited the most notable year-over-year increase in RevPAR – up 65.0 percent for the quarter, driven by a 30.1 percent increase in occupancy from 63.0 percent in 2021 to 82.0 percent in 2022, and a 26.8 percent increase in ADR from $281.11 to $356.51. For upper midscale properties, occupancy grew by 15.5 percent and ADR by 41.6 percent, resulting in a year-over-year RevPAR increase of 63.5 percent. Upscale properties experienced similar RevPAR growth, posting a 61.6 percent increase, driven by a 14.9 percent increase in occupancy and a 40.6 percent increase in ADR. Luxury properties posted the smallest increase in RevPAR of 37.9 percent, attributable to an 18.4 percent increase in occupancy and the lowest increase in ADR among all market classes – up 16.5 percent.

Of the five Manhattan neighborhoods, Midtown East had the largest increase in RevPAR – up 65.8 percent, driven by a 29.8 percent increase in ADR and a 27.7 percent increase in occupancy year-over-year. Midtown West RevPAR grew by 64.3 percent, largely driven by a 32.1 percent increase in ADR. Lower Manhattan and Midtown South posted RevPAR increases of 35.1 and 54.5 percent, respectively. Upper Manhattan had the smallest increase in RevPAR – still up 30.7 percent – with average daily rate growth moderating.

During the fourth quarter, growth in occupancy at full-service hotels outpaced limited-service hotels, with year-over-year increases of 21.1 and 15.1 percent, respectively. RevPAR increased 54.5 percent for full-service properties and limited-service hotels saw an increase of 53.3 percent over the same period.

For chain-affiliated and independent hotels, fourth quarter RevPAR grew by 56.7 and 48.4 percent, respectively. The improvement in chain-affiliated hotels was driven by stronger increases in both occupancy and ADR – up 20.9 and 29.6 percent, respectively.