By Chelsey Leffet

The Washington, D.C. lodging market has historically been one of the most stable of the major U.S. markets given its status as the hub of national political affairs and the center of governmental action and policy, while also playing a major role in international affairs. Aside from the government-related activity, numerous industries and institutions have contributed to and supported the region, including finance, education, healthcare, and scientific research. While typically insulated from recessions and tourism declines, Washington, D.C. was not spared amid the ongoing worldwide pandemic in 2020.

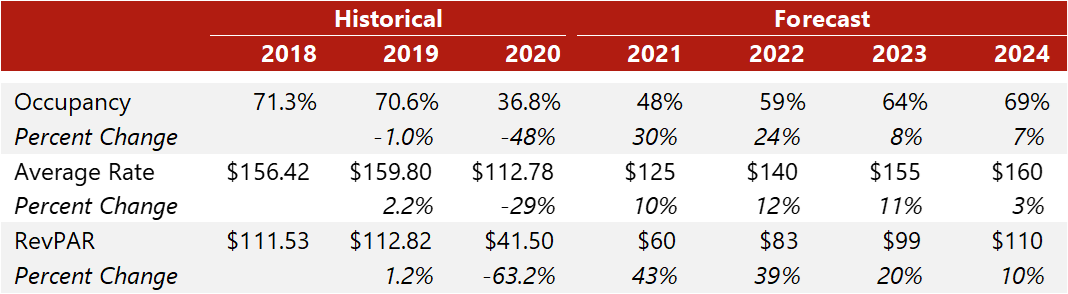

Washington, D.C. 2021–2023 Forecast

Source: STR (Historical Years) and HVS (Forecast)

Major factors contributing to the market’s performance and our forecast are summarized as follows:

- In 2019, Washington, D.C. welcomed 24.6 million visitors,[1] a record for the area at that time, and while overseas visitors represented only 7.0% of the total number, these same visitors represented 27% of visitor spending for 2019. According to Tourism Economics, overseas visitation is not expected to fully rebound until 2024.[2] However, Washington, D.C. is located in a densely populated area of the country, within driving distance of tens of millions of people. As the vaccine distribution continues and safety concerns subside, Washington, D.C. is anticipated to benefit from increased domestic travel, especially as regional residents with reduced discretionary income may drive to the Washington, D.C. market to enjoy the many free attractions.

- School groups and educational travel to Washington, D.C. usually peaks during the spring months. The spring and early summer months will continue to be challenged, as demand from these sources will be minimal. To illustrate the depth of decline in tourism to Washington, D.C., the Smithsonian visitor data provide a simple and poignant reference point. Since 1980, visitation numbers to the numerous Smithsonian attractions throughout the metropolitan area had never fallen below 20 million, reaching a high point in 2001 at 31.7 million visits; however, only 3.3 million visits were recorded in 2020.[3]

- While convention and meeting demand has historically been strong during the fall, this demand was almost nonexistent in 2020. Meeting and group demand levels in October typically result in convention center compression, with demand overflow accommodated throughout the metropolitan area. For example, in October 2019, RevPAR averaged roughly $143, whereas October 2020 RevPAR averaged $37 (rounded). We considered the continued restrictions and the recent rollout of the vaccine in our market growth rates for 2021 and 2022, as group demand will remain suppressed throughout the near term and corporate/government travel is not anticipated to return until late spring of 2021.

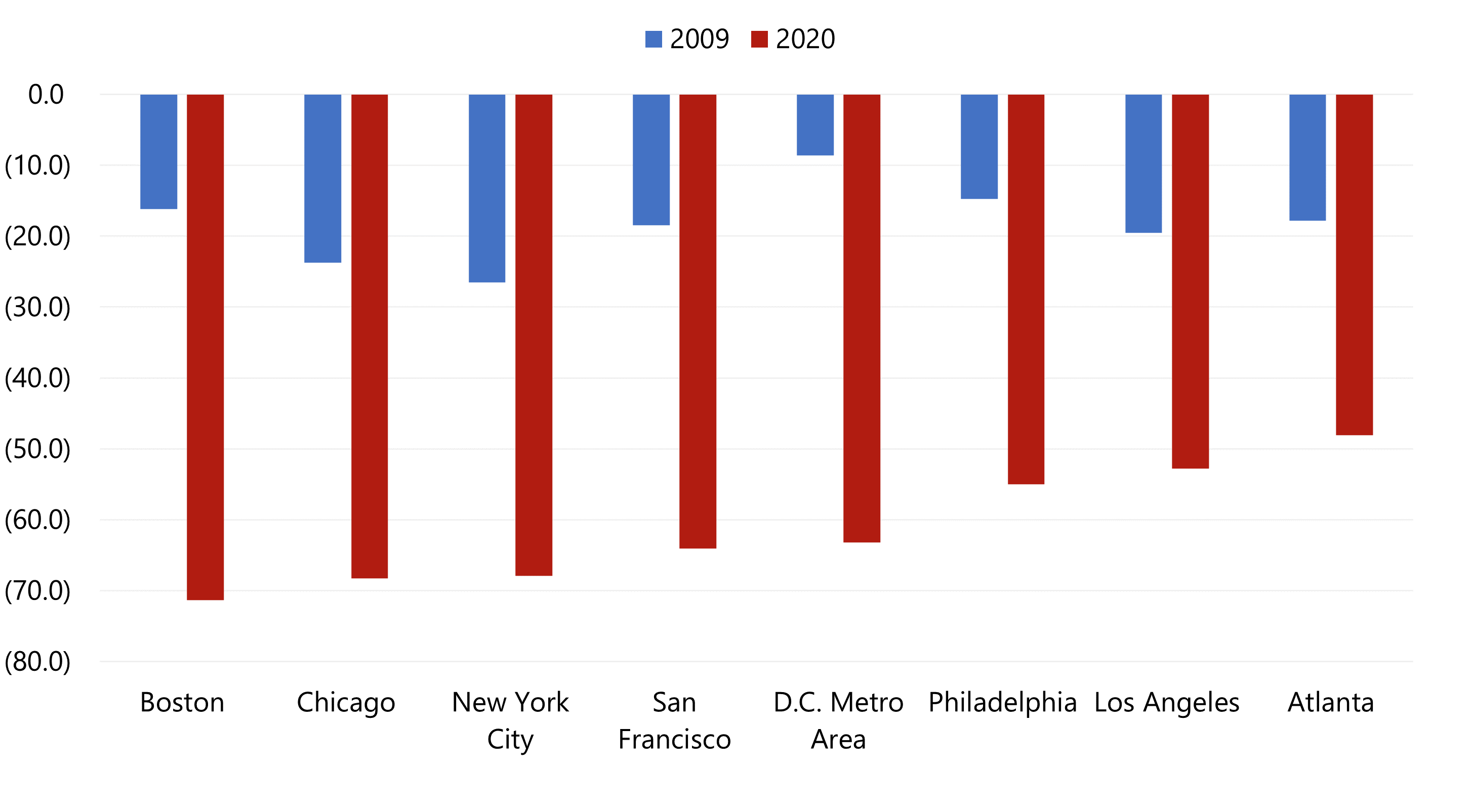

- The Washington, D.C. metropolitan area has historically been one of the most resilient regions in the nation, with economy-propelled business and professional service sectors, as well as substantial economic stability provided by the federal government. During the worst of the Great Recession in 2009, RevPAR for the top 25 U.S. metropolitan markets declined 19%; however, the D.C. metro area experienced only an 8.6% decline. The stable demand and sound economy was not able to spare lodging performance during this pandemic. The following chart illustrates the RevPAR comparison in 2009 versus 2020 for a number of major metropolitan areas.

Major Markets — Percentage of RevPAR Decline

Source: STR

- Aside from the declines attributed to the effects of the pandemic, the opening of new hotels is expected to continue to constrain overall market-wide occupancy growth. Much of the new supply, including several conversion projects, especially within in the District, generally fall into the luxury or upper-upscale chain scales that typically operate at higher ADRs; this should help to mitigate ADR declines and influence suburban market rates once compression resumes.

- Many proposed hotel projects throughout the market have been put on pause, and there have been some plans to convert existing hotel properties to multi-unit residential use, which would also benefit demand recovery and absorption rates while the new hotel supply enters the market.

- Hotel transactions in the metropolitan D.C. area have been limited; roughly 20 assets transacted in 2020, compared to the 50 hotel sales in 2019. Of the 20 hotels that sold in 2020, only seven occurred after March 2020. To narrow the reference point even further, only four of these sales did not have a buyer by the name of JBG Smith or Amazon. This suggests that although business travel is at a standstill and many people are still working from home, the area’s development projects, such as Amazon’s HQ2 plans, seem to be moving ahead.

The effects of recent protests and periods of civil unrest, such as the Black Lives Matter protests in 2020, the pro-Trump protests, and the Capitol riot in early 2021, on future demand trends remain uncertain at this time; however, our experience suggests that investors will continue to perceive Washington, D.C. hotels as an attractive long-term investment. Despite the impact of the COVID-19 pandemic, the unique role that Washington, D.C. plays as the seat of national government, the growing private sector, the rollout of the vaccine, and the expected resurgence of convention and meeting business, as well as a rebound in corporate, leisure, and government travel, position this market well for a recovery.

For more information, contact Chelsey Leffet, Senior Vice President and leader of the HVS Washington, D.C. team, and/or Anne R. Lloyd-Jones, MAI, CRE, Senior Managing Director and a Director of Consulting & Valuation at HVS.