By Hok Yean CHEE

Transactions in Asia Pacific

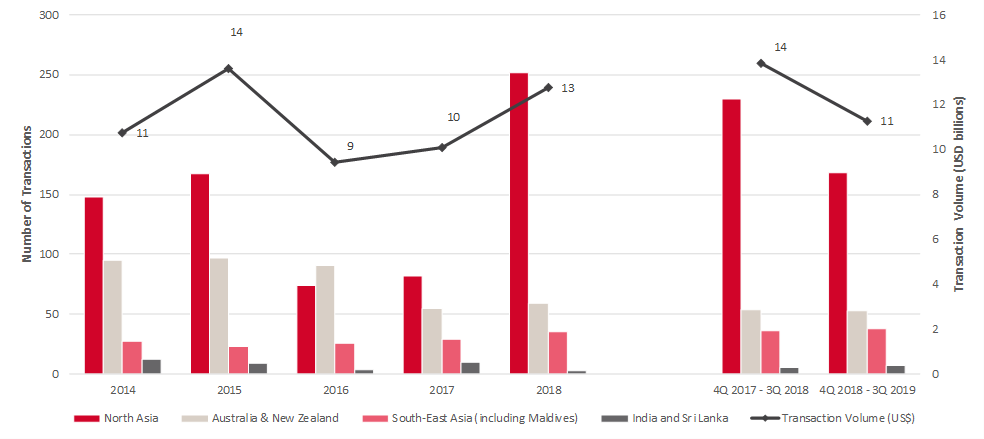

In 2018, transaction activity in Asia Pacific continued its strong momentum from 2017 and achieved transaction volume of approximately USD12.8 billion worth of hospitality assets, indicating a 26.6% increase year-on-year. From 4Q2018 to 3Q2019, transaction activity in Asia Pacific has slowed down. Despite the reduced transaction activity, growing interest in hospitality assets continue to be observed in regions such as Australia & New Zealand, India & Sri Lanka and specific markets in the North Asia and South-East Asia regions.

For some markets, the slowdown can be attributed to various factors including political instability, weakening market performance and a cautious macro economical outlook with uncertainties brought about by the China-United States trade war. However, for other markets, interest remains strong and is curbed by limited investment opportunities and the mismatch in pricing expectations between investors and sellers.

Transaction History in Asia Pacific (2014 – 3Q 2019)

Source: RCA Analytics & HVS Research

*Number of Transactions for North Asia in 2017 declined as compared to APAC Snapshot 2018 as Dalian Wanda Portfolio is completed by Jan 2018 and will be recorded in 2018 going forward.

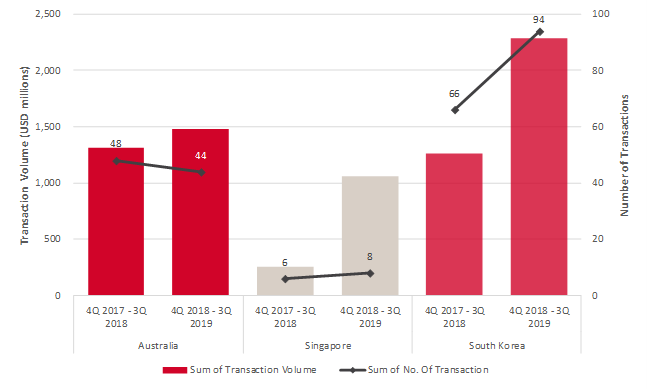

Top Three Most Active Markets (4Q 2018 to 3Q 2019)

Strong investors appetite for hospitality assets is observed over the last four quarters (4Q 2018 – 3Q 2019) in Australia, Singapore and South Korea. Transaction volume for the three identified markets has seen an increase over the previous four quarters, alongside an increase in the number of transaction in all markets except Australia. In particular, South Korea has seen transaction volume soared from USD 1.3 billion to USD2.3 billion with 94 hospitality assets having traded hands.

Top Three Most Active Markets (4Q 2018 – 3Q 2019)

Source: RCA Analytics & HVS Research

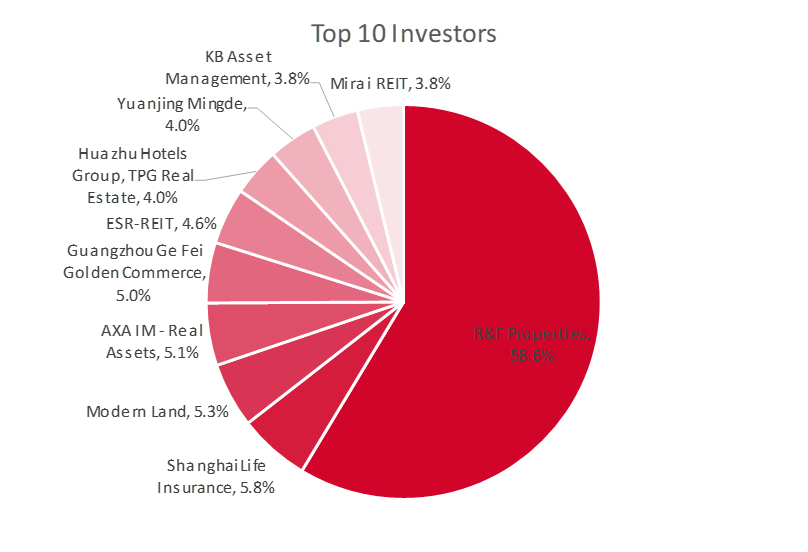

Major Investors in Asia Pacific

In 2018, transaction activity from the top ten investors in Asia Pacific accounted for approximately USD4.6 billion or 37.7% of total transaction volume. Majority of the transaction volume by the top ten investors are local investments (investment in country of origin), representing approximately USD4.4 billion. This indicates that local investors have been active in their home markets. However, Japan has seen an increasing interest from foreign investors: Singapore and the United States (US), in 2018. Similarly, Australia had witnessed foreign investor interests from Hong Kong, Japan, Singapore and the US. AXA Investment Managers (IM) – Real Assets had invested in Australia with three properties in Sydney and one in Canberra. Out of these top ten investors, six of them are based in China. R&F Properties emerges as the top investor upon the acquisition of Dalian Wanda’s portfolio of 73 properties in 66 cities in China.

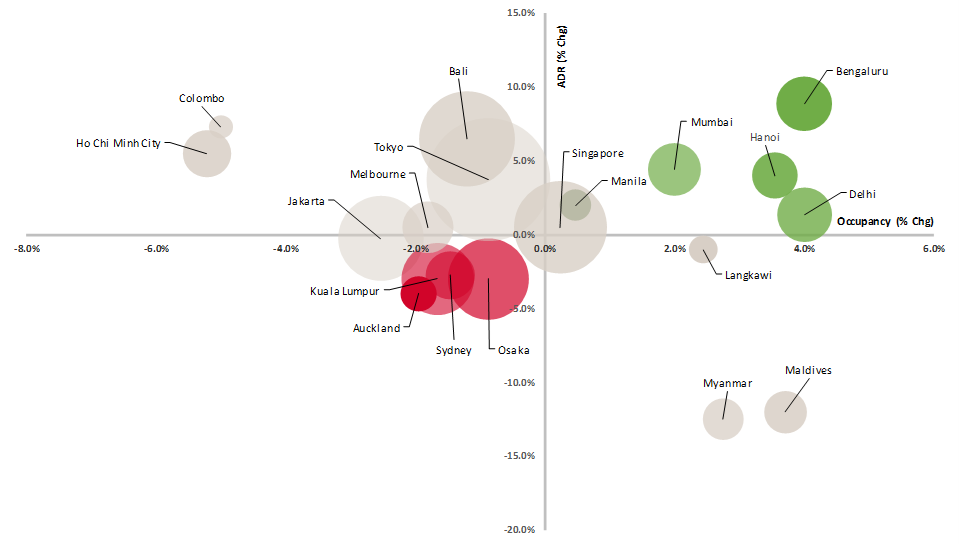

Hotel Performance in Asia Pacific (2019)

Overall hotel performance across the tracked markets experienced mixed sentiments for 2019. Despite growth in tourism arrivals, the ever-changing political climate, mercurial global economical conditions and growth in accommodation supply are few of the many reasons that continue to put downward pressure on several markets. Despite the headwinds, the underlying dynamics behind demand growth is observed to be resilient, and is expected as such going forward.

While most markets are affected due to the supply-demand dynamics, the following few markets have unconventional factors that affect the forecast for 2019. Despite strong demand growth in Maldives, the increase of midscale properties being tracked resulted in an overall decline in average rates. While growth in accommodation supply in Ho Chi Minh City is limited, the introduction of apartments affected demand for the extended stay segment.

Click here to view each of the twelve markets highlighted.

Notable contributions were made by Chee Hok Yean, Mandeep S. Lamba, Ho Mei Leng, Akash Datta, Dipti Mohan, Jeremy Teo, Kok Xin, Cindy Lim and Peggy Lee.