By Chelsey Leffet

The Norfolk-Virginia Beach MSA comprises several cities aside from Norfolk and Virginia Beach, including Chesapeake, Suffolk, Newport News, Hampton, Portsmouth, and Williamsburg. The region’s economy revolves around the federal government, the military, the aerospace industry, and the transportation, construction, and healthcare sectors.

Norfolk-Virginia Beach MSA vs. Top 25 U.S. Markets

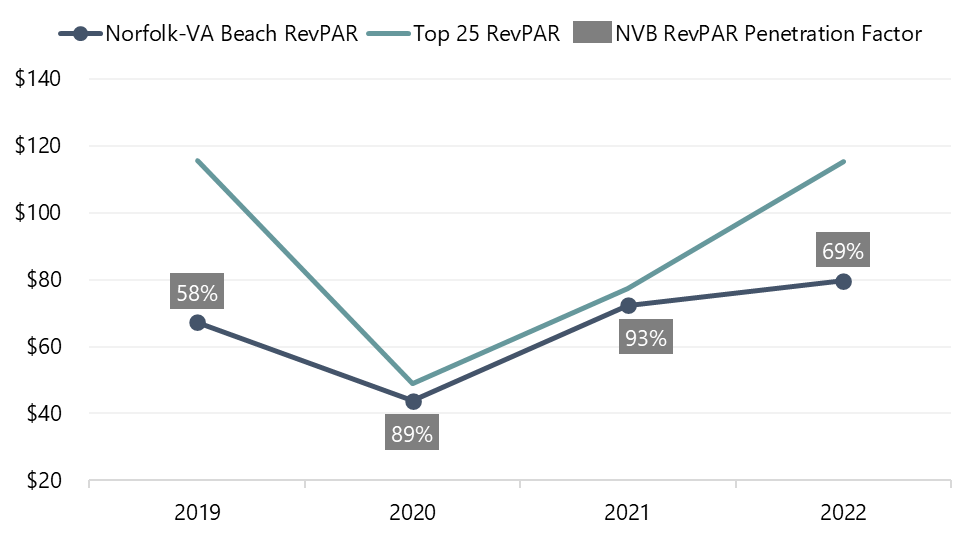

Historically, this MSA has performed roughly 50% below the top 25 U.S. markets in RevPAR. However, in 2020 and 2021, the market was able to outperform many other top 25 markets and closed the gap substantially in RevPAR performance, as illustrated on the table below. While tourism has always been a cornerstone of the market, the COVID-19 pandemic highlighted the strength of this industry for Norfolk-Virginia Beach, bolstered by government and military demand.

Norfolk-Virginia Beach MSA RevPAR in Comparison to Top 25 Markets’ RevPAR

Source: STR Global, STR Monthly Hotel Review

RevPAR levels in the Norfolk-Virginia Beach market surpassed 2019 metrics by roughly $5 in 2021. The performance in 2022 illustrates the widening, or normalization, of the gap in RevPAR performance between the top markets and the Norfolk-VA Beach market. We expect that this normalization will continue in the near term as the top 25 markets stabilize.

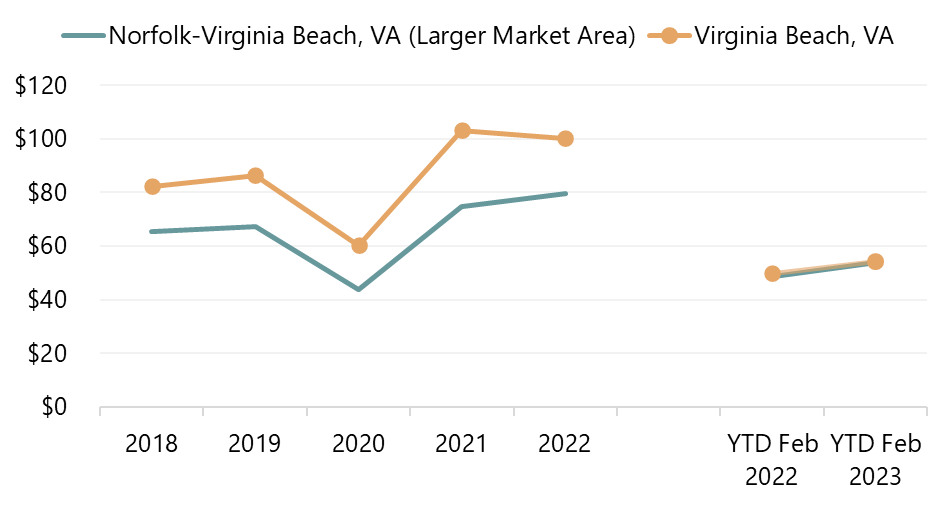

Virginia Beach vs. Norfolk-Virginia Beach MSA

Looking more directly at the Virginia Beach market as it compares to the trends of the greater Norfolk-Virginia Beach MSA, ADRs moved fairly in tandem in 2019 and 2020. However, a slight widening and then tightening of RevPAR occurred during 2021 and 2022, respectively, as shown in the table below. When leisure demand spiked in 2021, Virginia Beach was able to capitalize on higher rates, while occupancy remained strong. During 2022, however, the slight drop in Virginia Beach RevPAR was largely created by an occupancy decline of roughly 3%, as ADR continued to grow.

Norfolk and Virginia Beach RevPAR

Source: Virginia Lodging Report

Many local hoteliers believe the Virginia Beach Sports Center that opened in late 2020 adjacent to the Virginia Beach Convention Center helped float the area’s recovery following the depths of 2020, which is reasonable given the amount of youth and travel sports demand in the market. However, we note that there are reports of the complex not yet reaching profitability.

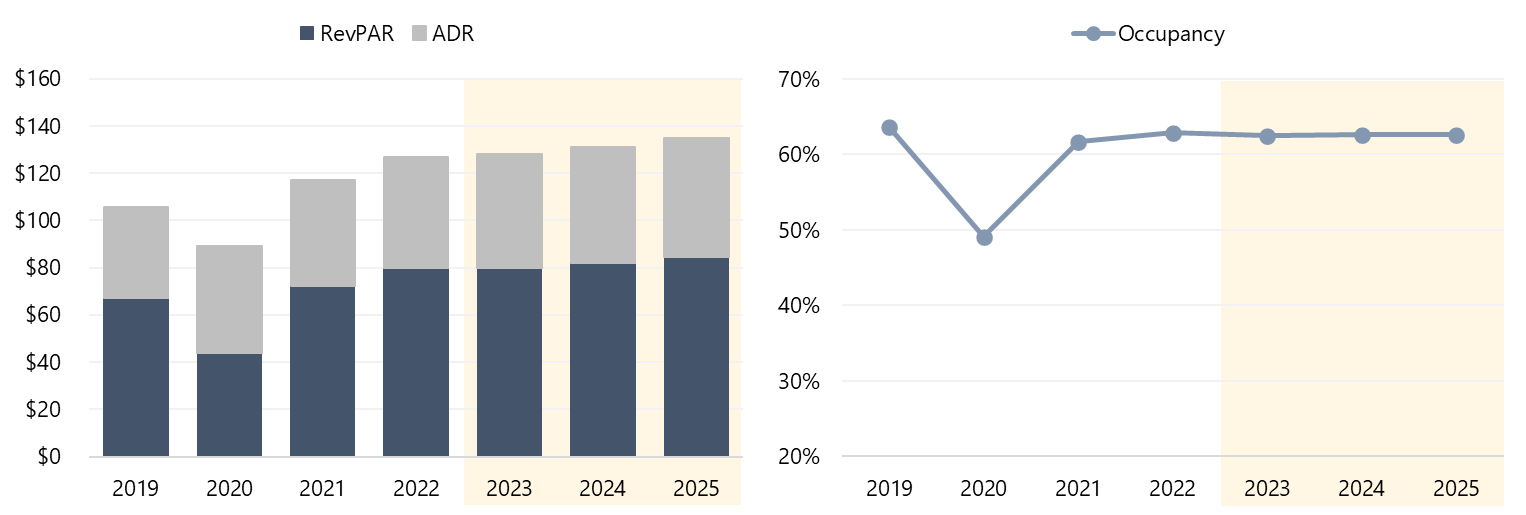

Source: STR (Historical) and HVS (Forecast)Hotel TransactionsEconomy hotels comprise roughly 20% of total supply in the Norfolk and Virginia Beach markets, whereas the bulk of the hotel assets, over 70% of roughly 16,000 rooms, fall into upper-midscale to upper-upscale class designations. Since 2020, roughly 35 hotel trades have occurred in the greater metro area of Norfolk and Virginia Beach MSA. Many of the most recent transactions have involved upper-midscale to upper-upscale hotel properties. For example, in 2022, the Courtyard by Marriott Virginia Beach Norfolk, Hampton by Hilton Norfolk Virginia Beach, and Delta Hotels by Marriott Virginia Beach Bayfront Suites all transacted.

The highest priced transaction in this market was the Delta Hotels by Marriott Virginia Beach Bayfront Suites, which sold for $82,000,000, or $277,966 per room. This hotel was purchased by a joint venture composed of BlackPearl Capital and Paceline Equity Partners in June 2022, following its comprehensive renovation, conversion, and rebranding that was completed in 2021. Based on historical information, the economy and midscale hotels typically trade between $50,000 and $120,000 per key in this market.

Conclusion

The outlook for the Norfolk-Virginia Beach MSA is optimistic due to its accessibility and robust tourism industry, coupled with the diverse economic factors that drive hotel demand and economic growth. Aspects that bode well for the market in the short and long term include the presence of the Virginia Beach Boardwalk and tourism throughout Norfolk, the local military bases, the strong government employment, and numerous higher-education institutions and healthcare entities.

For more information, contact Chelsey Leffet of the HVS Washington, D.C. office.