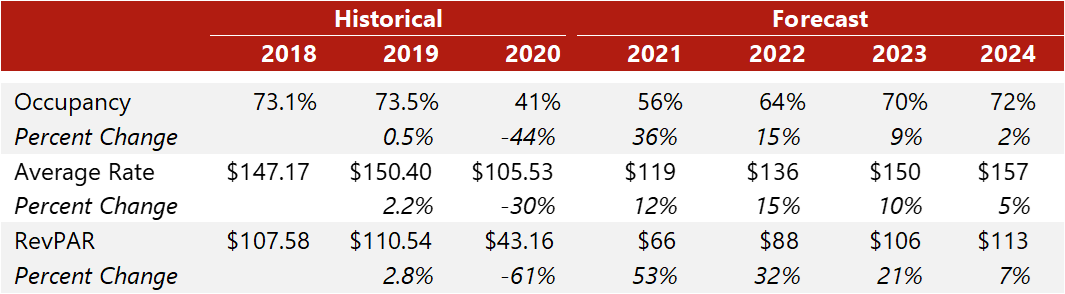

The COVID-19 pandemic was an unprecedented setback in Nashville’s growth, particularly within the lodging, convention, and tourism industries, similar to trends across the nation. According to STR, occupancy levels declined by 44% in 2020, while ADR contracted by 30%. This culminated in the lowest hotel performance metrics since STR began collecting data, with RevPAR dropping an extraordinary 61% in 2020. Full-service downtown hotels realized more precipitous drops in performance; occupancy levels plummeted to a low of roughly 27%, reflecting a 66% drop from 2019. ADR for these hotels contracted less substantially, ending the year down 17.5%. With occupancy levels falling to single digits in April and May of 2020, many of Nashville’s full-service hotels temporarily ceased operations from April to July.

Greater Nashville 2021–2024 Lodging Performance Forecast

Source: STR (Historical Years) and HVS (Forecast)

As Nashville’s popularity as an international travel destination grew over the past decade, the lodging market became one of the hottest travel and tourism destinations in the country. Numerous construction projects were completed or underway within nearly every asset class. Major investments were made by companies such as Amazon, Ernst & Young (EY), SmileDirectClub, and AllianceBernstein, among many others.

However, the robust economic growth taking place in the market did not protect the lodging market from the impact of the pandemic beginning in March 2020. The Music City Center, as well as dozens of convention hotels in the market, faced hundreds of cancellations, representing hundreds of thousands of anticipated room nights. Firms including UBS, AllianceBernstein, and EY shifted employees to remote work for the majority of 2020. Anticipated new job growth temporarily slowed, as new employees planning to move to Nashville began working remotely from all over the country. At the same time, a number of hotels that were already under construction opened in the market. This steep demand decline, coupled with exorbitant new supply, culminated in some of the lowest market-wide performance metrics in the country in 2020.

Road to Recovery

The recovery of tourism and demand is well underway in 2021; in fact, based on the activity in Lower Broadway on a Friday night, it is hard to tell that we were ever in a pandemic. But that snapshot of activity is not a full representation of the overall state of the city’s tourism and lodging industries. Conventions and corporate travel represent significant portions of the city’s demand base and have served as major catalysts for the rapid growth of the local lodging market in recent years. However, the pandemic’s restrictions, coupled with the consumer hesitations that ensued, suppressed convention and corporate travel in 2020 and through the first half of 2021. Now, with the lifting of the citywide mask mandate and event capacity restrictions, as well as widespread distribution of the vaccines, the booking pace of conventions is growing, and some corporate travel is returning to the city.

Despite this trend, some major events for the city have still been postponed or canceled in 2021. CMA Fest, the largest event in the city that is held every June, was canceled in 2021 for the second year amid concerns about conducting the event safely. Bonnaroo Music & Arts Festival also typically occurs in June but has been postponed to September. Other events are still expected to take place, but some of the major events that drive room-night demand for peak weekends in the summer will not be returning until 2022. Corporate travel is anticipated to pick up significantly in the fall and winter, fully rebounding in 2022.

Major Developments

Some of the largest development projects Nashville has ever experienced have taken place over the past decade, and the development pace is not slowing despite the pandemic. Nashville Yards, the $1-billion development between Church Street and Broadway, is still ongoing, albeit with a few minor setbacks. Amazon is set to open the first of two towers in the project at the end of 2021, while the apartment, retail, and other office portions are expected to be completed over the next several years. MGM’s planned hotel and entertainment venue has been put on hold, but the development is still anticipated to take place. Additionally, Pinnacle Financial Partners announced in June that it would be relocating from the Lower Broadway tower to a new facility in the Nashville Yards development.

Most recently, Oracle Corporation closed on a $253-million purchase of over 60 acres of land in Nashville’s East Bank. The historically industrial area of the city will be developed with an 8,500-employee tech hub. This planned development is one of the largest in the city’s history and will comprise a $1.2-billion investment over the next decade. The anticipated economic impact on the greater Nashville area is difficult to measure, but the company would become one of the largest employers in the county once the project is complete.

Progress also continues on the Nashville International Airport Expansion, of which the new Concourse D was recently completed, while the new terminal entrance and “Grand Ole Lobby” are currently under construction. Site work on the proposed 297-room Hilton hotel has also begun, and both phases of the project are expected to be completed by the end of 2023.

Source: Nashville Yards, Southwest Value Partners

The new Nashville SC Stadium is also well underway in the Wedgewood-Houston neighborhood of Nashville. The stadium is poised to be one of the largest soccer stadiums in the country, with nearly 30,000 seats. Despite numerous controversies and setbacks, the project is slated for completion mid-year 2022. Moreover, developers recently announced plans for a new, $300-million amusement park in Nashville dubbed Storyville Gardens; the project will include a variety of attractions and retail, to be designed by Storyland Studios, which worked on developments for Disney, Marvel, and Universal Studios. Despite the setbacks of the COVID-19 pandemic, Nashville continues to boom, reporting a record $5.3 billion in construction permits issued in the 2020/21 fiscal year.

New Hotel Supply

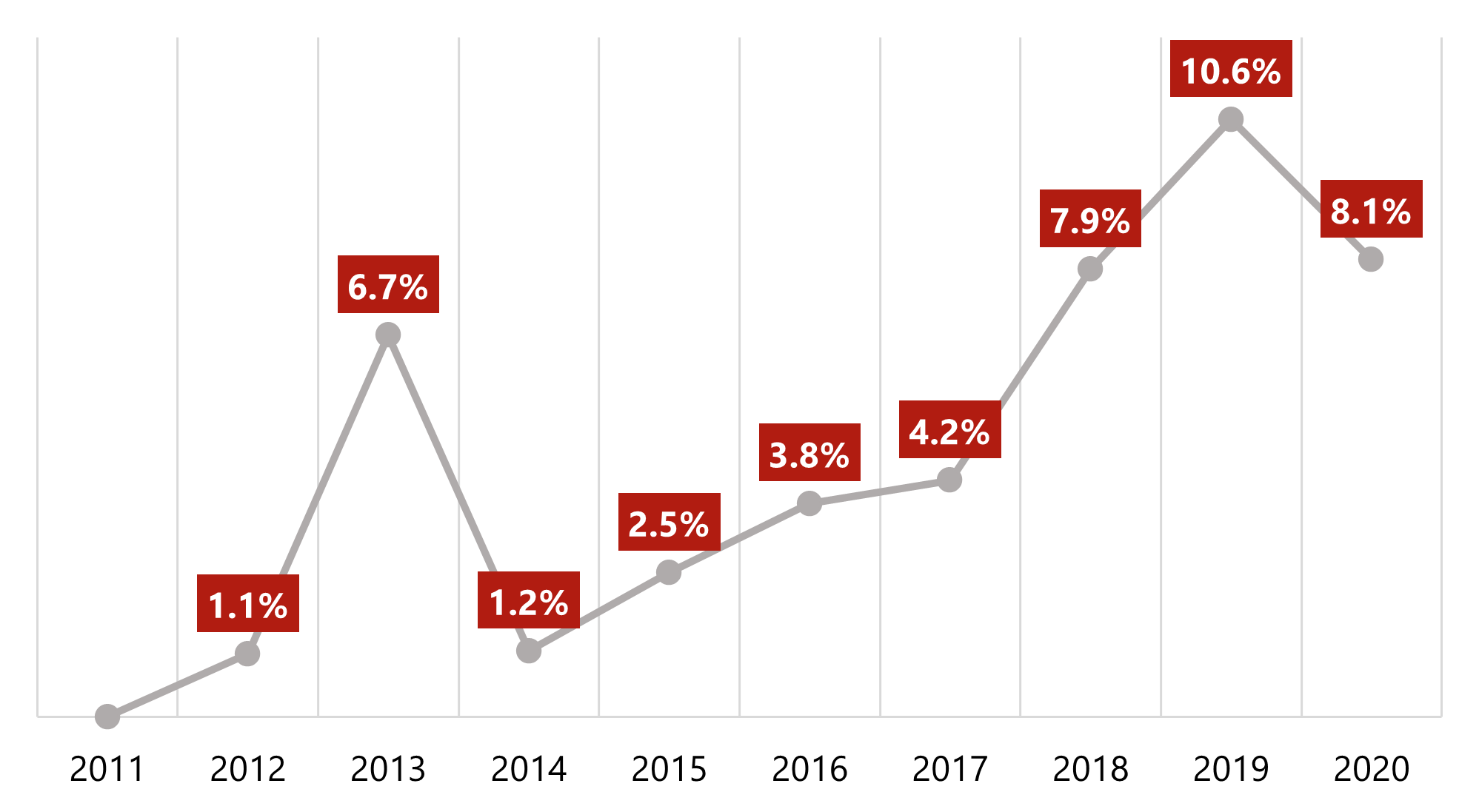

Many new hotels have been developed across the city over the past ten years. The total supply within the Nashville city limits has more than doubled over the past decade, while suburban markets including Franklin, Mt. Juliet, and Goodlettsville have also realized notable supply growth. This trend can be attributed to Nashville’s growing popularity as an international tourism destination, the expansion of meeting and convention space, and corporate relocations and expansions. An illustration of the total supply growth in Nashville over the past decade is illustrated below.

Hotel Supply Growth within Nashville-Davidson County (% Change)

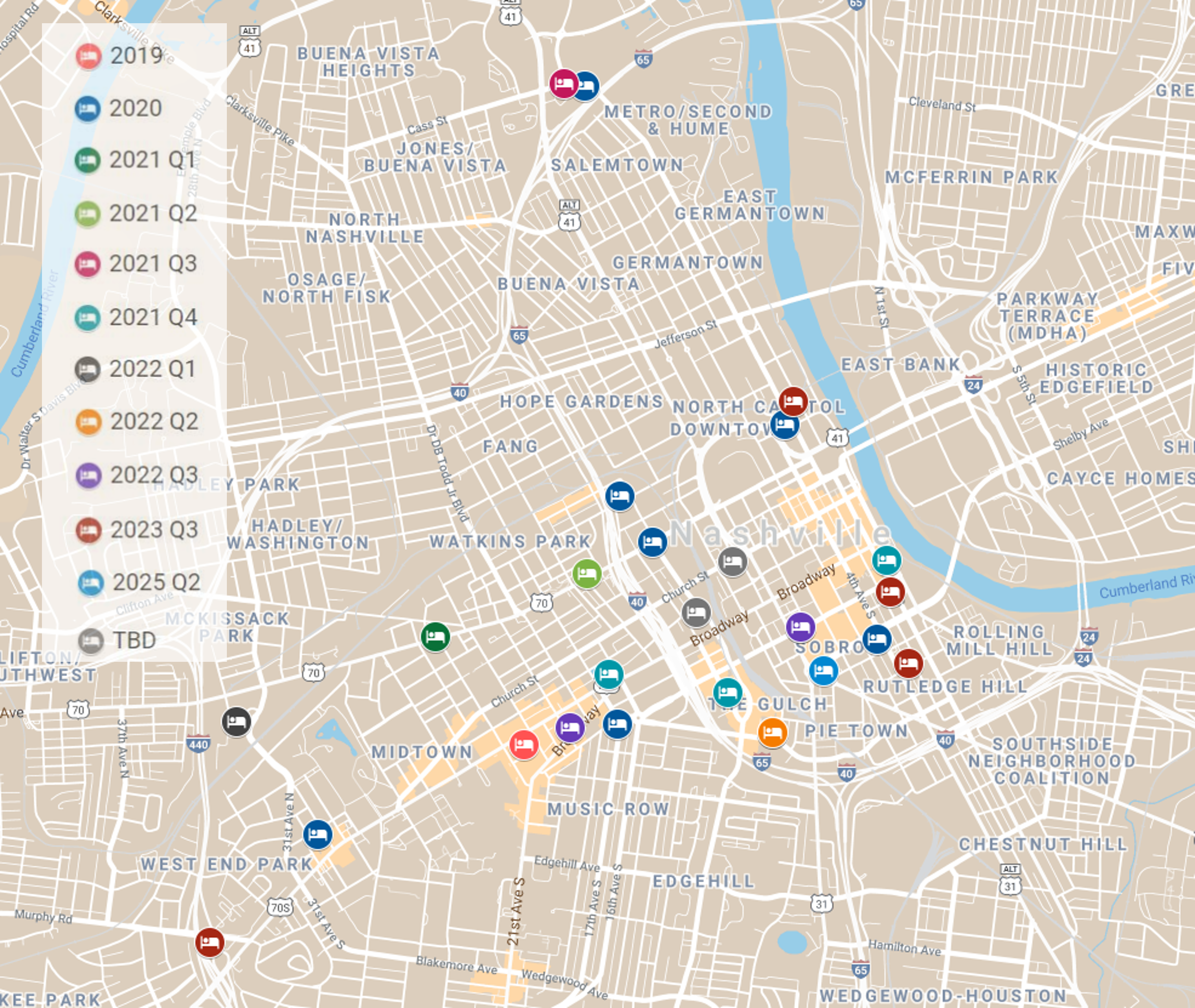

The much-anticipated Four Seasons Hotel & Private Residences was topped out in June 2021, while work continues on the dual-branded 1 Hotel and Embassy Suites by Hilton; The W Hotel; Conrad Hotel; and The Fraye, a Curio Collection by Hilton affiliate. Multiple other lodging facilities are also under construction around the city, while dozens of additional hotels are in earlier development stages. Most recently, the development of a Ritz-Carlton Hotel & Private Residences at the Music City roundabout was announced, which will expand the luxury segment within the market. The map below illustrates notable hotels that have opened in the Downtown Nashville area in the past two years, as well as properties expected to open over the next three years, shown by opening quarter and year.

Source: STR

This map is a snapshot of recent and incoming new supply in the market; for a more detailed new supply analysis, contact HVS Nashville.

The number of new hotel developments announced has slowed since the onset of the pandemic, and the ones that are announced tend to be in the upper-upscale or luxury segment. This trend is primarily due to the pre-pandemic ADR increases in the market, which were some of the highest in the country. Many projects that were rumored, in the preliminary planning stages, or speculative have been postponed or canceled; for example, the MGM Grand hotel and entertainment venue at Nashville Yards was put on hold after the onset of the pandemic. Moreover, no announcements have been made for projects like the proposed EDITION in the Gulch since before the pandemic, and these developments are likely being postponed until the market recovers further. Other hotel construction continues despite the onset of the pandemic, and as the lodging market recovers in the coming years, projects that were in preliminary development stages may still move forward. However, the number of new hotels entering the market will likely slow over the next three to five years.

Conclusion

Although the effects of COVID-19 caused a setback for the Nashville lodging industry, the economy continues to experience dynamic growth and expansion. It will take a few years for demand to fully rebound and absorb the expanding inventory of hotel rooms, but the long-term outlook for the city and its hotel market is one of positivity and optimism. Investors, visitors, and residents believe in the longevity and breadth of opportunities the city has to offer, as illustrated by the swift recovery already taking place. As corporate travel rebounds and conventions return to the city, the future is expected to be as bright as ever. We continue to watch the factors affecting the Nashville lodging market, and our many consulting engagements throughout the metropolitan area allow us to keep our finger on the pulse of the market.

For more information, contact either member of our Nashville team: Marc Greeley or Daniel P. McCoy, MAI.