By Maxime Gauthier, Alexandra Dumoulin

The City of Light enjoys a well-balanced blend of business and leisure demand resulting in both a broad seasonality and strong average rates. Since 2015, Paris has faced multiple challenges which highly disrupted hotel performances. As the city was recovering from the 2015-16 terrorist attacks, the ‘yellow vests’ movement and pension reform strikes of 2018-19, as well as the transportation strike of 2019, the COVID-19 pandemic hit the world. The market has since shown remarkable resilience and has gradually recovered, reaching record levels of RevPAR in 2023. Despite and throughout this tumultuous period, Paris has maintained its status as one of the most sought-after destinations for hotel investment, owing to its robust underlying fundamentals.

Source: HVS Research

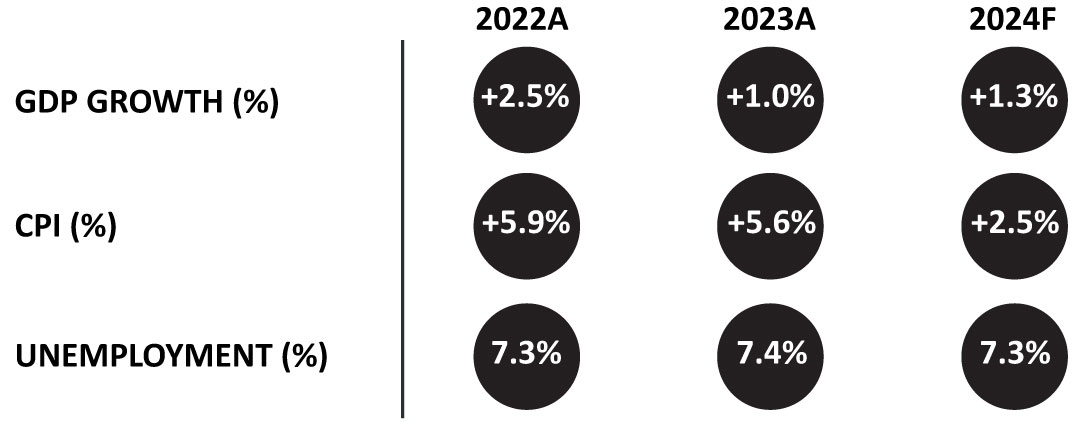

Economic Indicators – France

Source: IMF

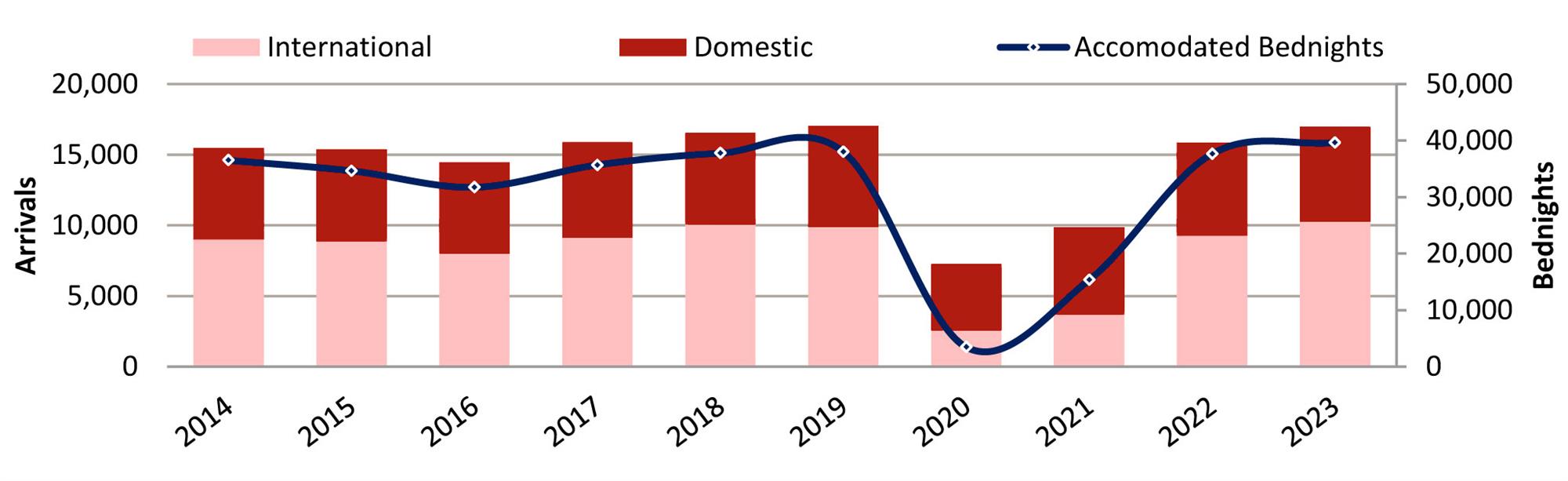

Tourism Demand

Paris visitation numbers have historically been strong, regularly reaching around 15.5 million a year. Approximately 40-45% of demand is domestic, with international visitation led by the USA, the UK, Germany, Italy and Spain. Owing to the string of impactful events from 2015 onwards, visitor numbers started to decrease and dropped below 15.0 million in 2016. However, by 2017, visitation reached record highs; although, owing to a decrease in length of stay and an underlying increase in inventory, occupancy continued to lag slightly behind levels reached pre-2015. We understand that rates also struggled to rebound, with 2019’s nominal ADRs still below 2014 levels. The ensuing COVID-19 pandemic brought any signs of progression to a halt. Nonetheless, in contrast to other major tourist hubs, Paris saw a notable resurgence in visitor interest from June 2021. The dynamics of a well-balanced customer mix, underlining a strong weekly and monthly seasonality, boosted the rapid ramping-up of visitation figures. By the end of 2023, the number of bednights recorded by INSEE was the highest ever. Large sporting events, such as the Rugby World Cup, and the boost from countries such as the UK, the Netherlands, Switzerland and Italy helped 2023 visitation reach pre-pandemic levels. With Paris hosting the 2024 Olympic Games, visitor numbers are forecast to reach new records.

Visitation and Accommodated Bednights

Source: HVS Research

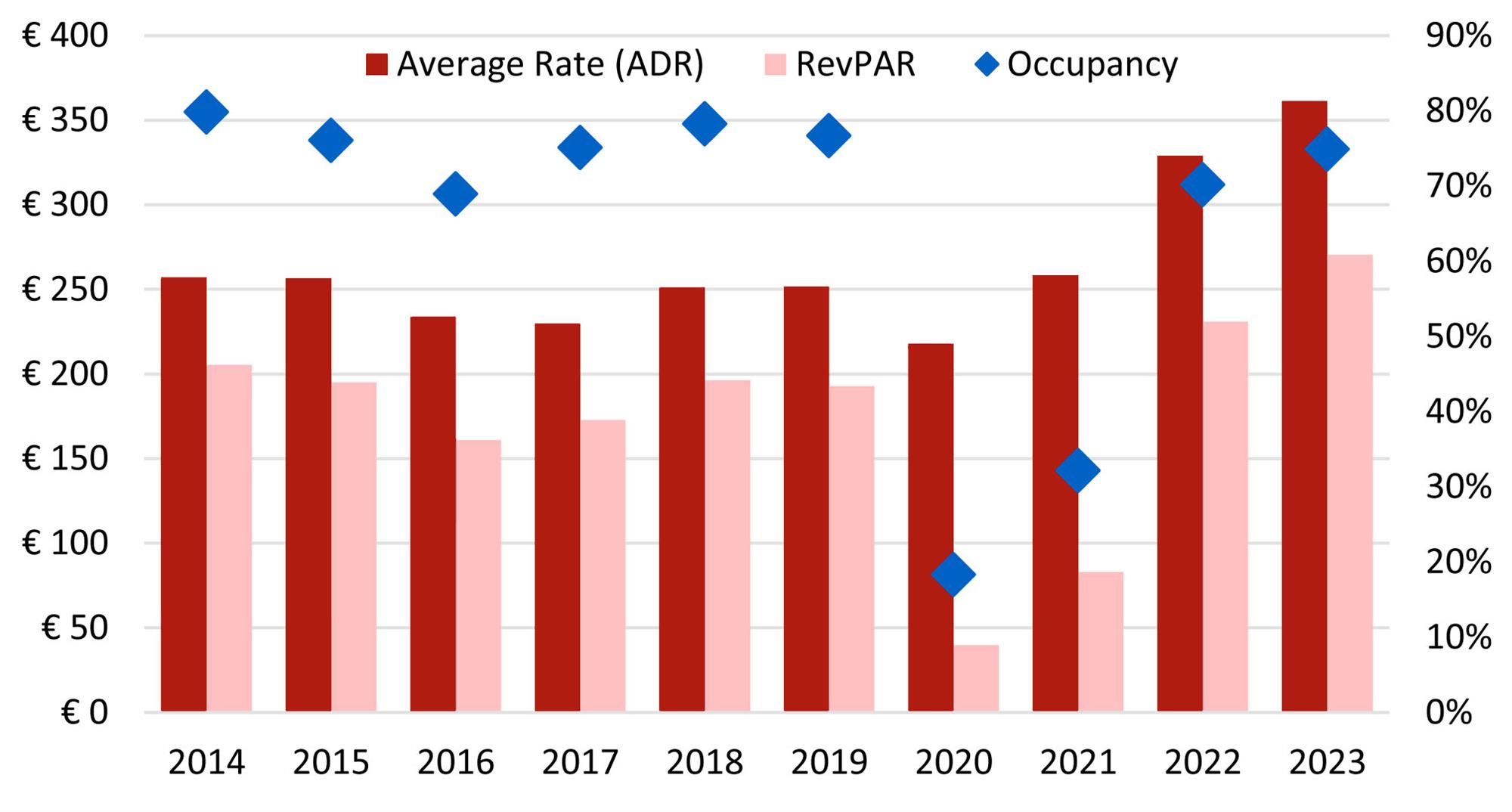

Hotel Performance

Between 2014 and 2023, and despite a near stand-still in 2019 and an inevitable decrease in 2020, we estimate that ADR increased by 40%, a compound annual growth rate (CAGR) of 3.8%. This is well above inflationary growth and highlights the higher yields due to improving demand and the sky-rocketing rates observed in Parisian palace hotels and luxury properties. We believe that the rest of the market has remained more price-sensitive with rates growing in line with inflation since 2014.

Whilst overall occupancy in 2023 was close to that of 2019, we note that the shoulder seasons, typically boosted by meetings and events, showed marginally lower levels. We expect that the return of face-to-face meetings and larger conferences, together with a full return of visitors from source markets such as the USA, Japan and China, will help further revive the Parisian market’s performance and compensate for the risk of the luxury rate lift being temporary.

Key Metrics

Sources: HVS Research

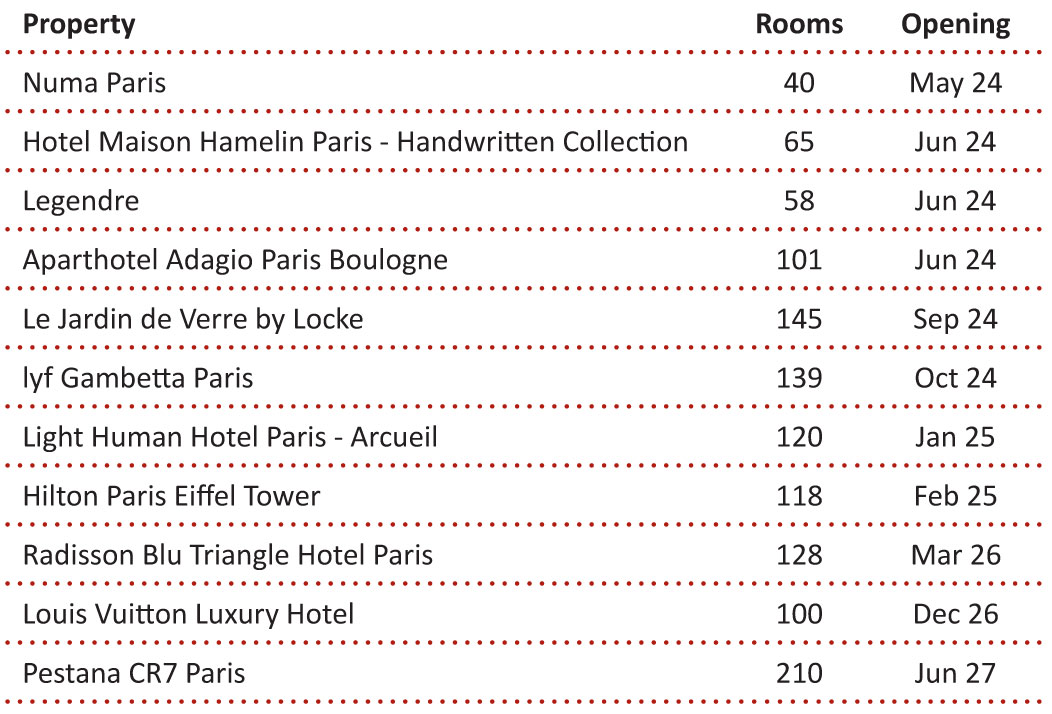

Hotel Supply

At the end of 2023, Paris had 1,680 hotels and some 92,800 rooms. In the last ten years, the number of hotels has remained stable, and the inventory has increased by a little over 5,200 rooms (at a CAGR of 0.7%). The main changes have been observed in the shift towards the upscale and luxury segments, which have had multiple renovations and openings. With a high proportion of independent hotels remaining in the market, representing 55% of the room inventory in 2023, the share of branded properties has progressively decreased. High-profile openings in 2022 and 2023 included the 162-room So/Paris (August 2022), the 23-room Maison Proust Hotel & Spa La Mer (January 2023), the 84-room CitizenM Paris Opera (March 2023) and the 94-room Hilton Garden Inn Paris La Vilette (June 2023).

Paris has a pipeline of around 1,800 rooms entering the market in the next four years, representing around 2% of the existing supply. Approximately 80% of the new supply is under construction, and nearly half is due to open in 2024. Notable hotels in the pipeline include the 65-room Hotel Maison Hamelin – Handwritten Collection (June 2024), an Accor brand that launched in 2023; the 139-room Lyf Gambetta Paris (October 2024), launching the co-living brand in Europe; the 118-room Hilton Paris Eiffel (February 2025); and the 128-room Radisson Blu Triangle Hotel (2026), located in the soon-to-be landmark Tour Triangle at Paris Expo Porte de Versailles. Furthermore, a 100-room Louis Vuitton hotel is to open in the company’s Paris headquarters by the end of 2026.

Hotel Pipeline

Sources: HVS Research

Investment Market

The Parisian market has historically been one of the most desirable destinations for hotel investments in Europe. Despite several challenging years since 2015, investors trust the general resilience and strong fundamentals of the market. The city’s transactions volumes, which are regularly amongst the highest in Europe, demonstrate investors’ confidence in the market. In 2023, Paris took over London as the most liquid city in Europe. Our Hotel Valuation Index has placed Paris on the highest platform of the podium for the last ten years. For the latest value trends, please refer to our annual European Hotel Valuation Index, which shows that Paris maintains – by a significant margin – the highest value per room compared to other European markets.

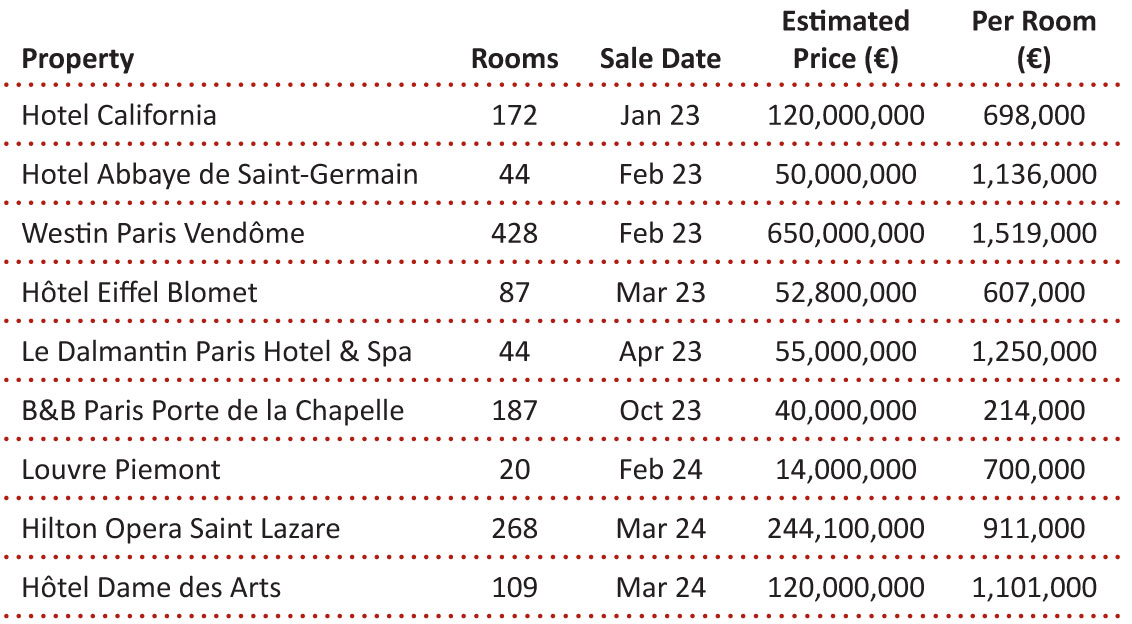

Hotel Transactions – Last 12 Months

Sources: HVS Research

Outlook

Paris is one of the most popular cities in the world, drawing millions of visitors each year in search of iconic attractions and landmarks, renowned museums and a vibrant artistic scene. The history, culture, gastronomy and shopping make the city an unmissable destination. As the capital of France, Paris is also a strong economic hub, making the city attractive for business and meetings. The recent improvements in hotel performances are a testament to these strong and varied demand generators. We expect the combination of a modest hotel pipeline and the momentum from the Olympic and Paralympic Games in the summer will stabilise demand closer to levels reached prior to 2015 and help maintain the rate growths observed recently. Overall, the outlook for this market is, in our opinion, very strong.

Value Trends 2023 vs 2022

Sources: HVS Research