December 11, 2014 – BETHESDA, Md. – Pebblebrook Hotel Trust (NYSE:PEB) (the “Company”) today announced that it has acquired Union Station Hotel, Autograph Collection (“Union Station Hotel”) for $52.3 million. The 125-room iconic historic landmark hotel is located on Broadway, in the center of downtown Nashville, Tennessee. The property will maintain its association with Marriott’s Autograph Collection and will be operated by Sage Hospitality (“Sage”).

“We’re thrilled with the acquisition of Union Station Hotel and the opportunity to further expand our growing portfolio into the high-growth Nashville market,” said Jon Bortz, Chairman and Chief Executive Officer of Pebblebrook Hotel Trust. “This iconic hotel represents our first hotel investment in Nashville’s central business district. The property is adjacent to the Frist Center for Visual Arts, down the street from the recently opened and well received Music City Center Convention Center, and just blocks from both Vanderbilt University and the city’s financial district, downtown Nashville’s most prominent demand generators. The hotel’s excellent accessibility and irreplaceable, historic architecture, including its spectacular lobby and public spaces, make this acquisition an impressive addition to our high-quality portfolio.”

Union Station Hotel is a 125-room, upper-upscale, full-service hotel located on Broadway, in the heart of downtown Nashville. The hotel is within easy walking distance to the various existing and proposed attractions in the Southeast’s fourth largest city, including the 1.2-million-square-foot Music City Convention Center, the Frist Center for the Visual Arts, Vanderbilt University, Bridgestone Arena, Honky Tonk Row, The Gulch, Ryman Auditorium and the State Capitol. The hotel’s excellent location places it nearby many major area corporate tenants in downtown Nashville’s 8 million square feet of office space, including AT&T, HCA, WEB MD, BMI, Johnson & Johnson and regional banking headquarters for Regions Bank, Bank of America and SunTrust Bank. The recently constructed convention center is projected to further strengthen Nashville’s visitor industry along with producing significant additional demand. Furthermore, Nashville is home to many major leisure attractions including the Country Music Hall of Fame and Museum, Opry Mills shopping mall, Bridgestone Arena, Tennessee Performing Arts Center and the 11-acre Riverfront Park and Amphitheater, which is currently under development.

The hotel, a National Historic Landmark, first opened in 1900 as the L&N Railroad Station. The property was converted to a hotel in 1986, underwent an $11.0 million renovation in 2007, and benefitted from an additional $1.9 million renovation to convert the property to an Autograph Collection by Marriott hotel in 2012. The hotel features the Grand Lobby, with a 65-foot-high, barrel-vaulted ceiling, and the Veranda, an outdoor covered terrace. Union Station Hotel has 125 guest rooms, including 12 suites, and 12,000 square feet of meeting and event space. The property’s restaurant, Prime 108, is a Forbes Four Diamond winning restaurant and offers a wide array of signature cocktails and an extensive wine list. Prime 108 lounge features premium cocktails and is located directly off the Grand Lobby. Union Station Hotel also features a fitness center, business center and valet parking.

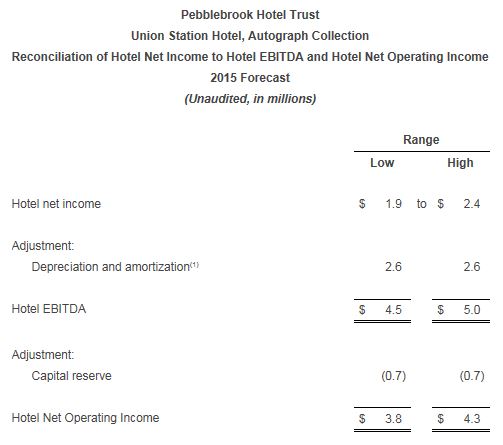

For the trailing twelve months ended October 2014, Union Station Hotel operated at 82 percent occupancy, with an average daily rate (“ADR”) of $249 and room revenue per available room (“RevPAR”) of $204. In 2015, the Company currently forecasts that the hotel will generate earnings before interest, taxes, depreciation and amortization (“EBITDA”) of $4.5 to $5.0 million and net operating income after capital reserves (“NOI”) of $3.8 to $4.3 million.

The Company expects to invest $5.0 to $7.0 million of capital to refresh the guestrooms and public areas, which it anticipates completing by no later than the middle of 2016.

Union Station Hotel will be managed by Sage under a new hotel operating agreement, and the Company will assume the hotel’s existing franchise agreement with Marriott’s Autograph Collection. The Company will own a leasehold interest in the property through a ground lease which will expire in 2105.

“We’re thrilled to be growing our successful relationship with Sage Hospitality,” continued Mr. Bortz. “The acquisition of Union Station Hotel marks our second Sage-managed hotel, and we believe their extensive experience in operating unique boutique properties gives us confidence in the long term value and growth opportunities of this hotel.”

“We are pleased with the opportunity to expand our relationship with Pebblebrook Hotel Trust,” said Sage’s Co-Founder, President and CEO, Walter Isenberg. “We believe the hotel has tremendous long term growth potential, and we look forward to unlocking additional value at this iconic property.”

The Company expects to incur approximately $0.3 million of costs related to the acquisition of the hotel that will be expensed as incurred.

The acquisition of Union Station Hotel brings the total number of properties in the Company’s portfolio to 34 and marks the Company’s first investment in Nashville, Tennessee.

This press release contains certain “forward-looking statements” relating to, among other things, potential property acquisitions, hotel EBITDA, hotel net operating income after capital reserves, acquisition costs and projected demand. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “seek,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” “forecast,” “continue,” “plan” or other similar words or expressions. Forward-looking statements are based on certain assumptions and can include future expectations, future plans and strategies, financial and operating projections or other forward-looking information. Examples of forward-looking statements include the following: projections of hotel-level EBITDA and net operating income after capital reserves; projections of acquisition costs; descriptions of the Company’s plans or objectives for future operations, acquisitions or services; forecasts of future economic performance; and descriptions of assumptions underlying or relating to any of the foregoing expectations regarding the timing of their occurrence. These forward-looking statements are subject to various risks and uncertainties, many of which are beyond the Company’s control, which could cause actual results to differ materially from such statements. These risks and uncertainties include, but are not limited to, the state of the U.S. economy, supply and demand in the hotel industry and other factors as are described in greater detail in the Company’s filings with the Securities and Exchange Commission (“SEC”), including, without limitation, the Company’s Annual Report on Form 10-K for the year ended December 31, 2013. Unless legally required, the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

For further information about the Company’s business and financial results, please refer to the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” sections of the Company’s SEC filings, including, but not limited to, its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, copies of which may be obtained at the Investor Relations section of the Company’s website at www.pebblebrookhotels.com and at www.sec.gov.

All information in this release is as of December 10, 2014. The Company undertakes no duty to update the statements in this release to conform the statements to actual results or changes in the Company’s expectations. The Company assumes no responsibility for the contents or accuracy of the information on any of the non-Company websites mentioned herein, which are included solely for ease of reference.

For additional information or to receive press releases via email, please visit our website at www.pebblebrookhotels.com

(1) Depreciation and amortization have been estimated based on a preliminary purchase price allocation. A change, if any, in the allocation will affect the amount of depreciation and amortization and the resulting change may be material.

This press release includes certain non-GAAP financial measures as defined under Securities and Exchange Commission (SEC) Rules. These measures are not in accordance with, or an alternative to, measures prepared in accordance with U.S. generally accepted accounting principles, or GAAP, and may be different from non-GAAP measures used by other companies. In addition, these non-GAAP measures are not based on any comprehensive set of accounting rules or principles. Non-GAAP measures have limitations in that they do not reflect all of the amounts associated with the hotel’s results of operations determined in accordance with GAAP.

The Company has presented forecasted hotel EBITDA and forecasted hotel net operating income after capital reserves, because it believes these measures provide investors and analysts with an understanding of the hotel-level operating performance. These non-GAAP measures do not represent amounts available for management’s discretionary use, because of needed capital replacement or expansion, debt service obligations or other commitments and uncertainties, nor are they indicative of funds available to fund the Company’s cash needs, including its ability to make distributions.

The Company’s presentation of the hotel’s forecasted EBITDA and forecasted net operating income after capital reserves should not be considered as an alternative to net income (computed in accordance with GAAP) as an indicator of the hotel’s financial performance. The table above is a reconciliation of the hotel’s forecasted EBITDA and net operating income after capital reserves calculations to net income in accordance with GAAP.

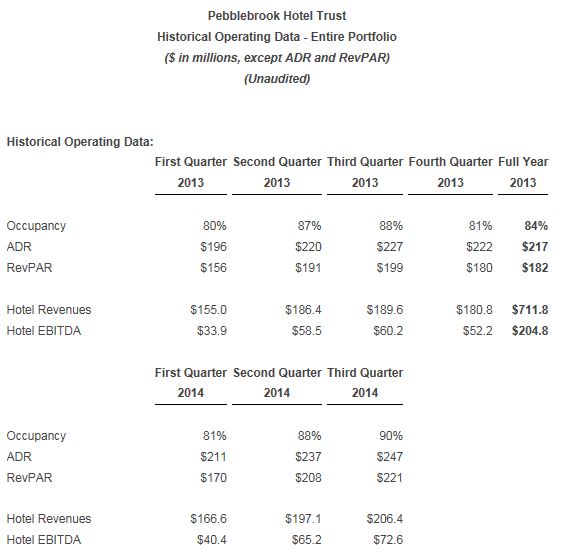

These historical hotel operating results include information for all of the hotels the Company owned as of December 10, 2014. The hotel operating results for the Manhattan Collection only includes 49% of the results for the 6 properties to reflect the Company’s 49% ownership interest in the hotels. These historical operating results include periods prior to the Company’s ownership of the hotels. The information above does not reflect the Company’s corporate general and administrative expense, interest expense, property acquisition costs, depreciation and amortization, taxes and other expenses. Any differences are a result of rounding.

The information above has not been audited and has been presented only for comparison purposes.