West Coast Markets Lead the Way

December 9, 2015, Atlanta, Ga. – U.S. hotel occupancy will remain at record levels through 2017 according to PKF Hospitality Research | CBRE Hotels (PKF-HR). In the recently released December 2015 edition of Hotel Horizons®, PKF-HR forecasts that the growth in demand for lodging accommodations will exceed the change in supply during each of the next two years. The result will be a national occupancy rate of roughly 66 percent in both 2016 and 2017.

“The fundamental characteristics of the economy remain relatively unchanged, as the labor market continues to improve and GDP growth remains steady if moderate,” said R. Mark Woodworth, senior managing director of PKF-HR. “Accordingly, our forecasts for demand and average daily rate (ADR) growth remain above the long-run average in both 2016 and 2017.

“We are not blind to current events and realize that non-economic risks do exist given the current international security environment. However, these are events which we are unable to forecast. Based on what we do know and feel comfortable forecasting, the probability of an economic downturn in U.S. hotel industry performance remains remote,” Woodworth stated.

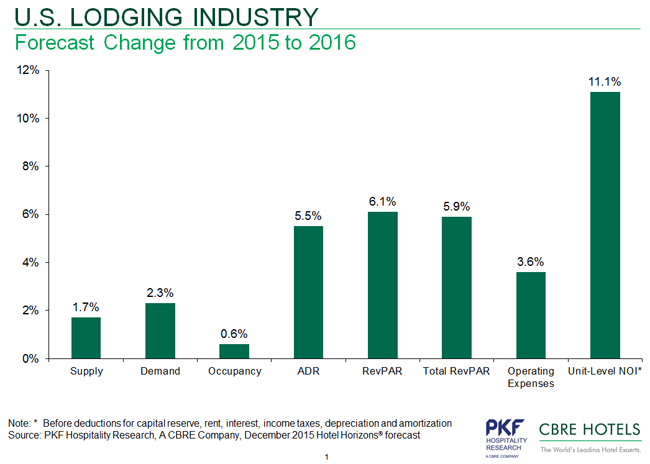

ADR and Supply Growth The projected record occupancy levels also means pricing power will remain with property managers. For 2016, PKF-HR is projecting room rates to increase by 5.5 percent, followed by an even greater 5.8 percent rise in 2017. “Given the modest growth projected for inflation, real ADRs are now returning to their previous peak,” Woodworth noted.

During historical cycles, a real ADR recovery has triggered a surge in new supply, and PKF-HR is seeing an uptick in development. National supply change increased by 1.2 percent during the third quarter of 2015, marking two consecutive quarters of supply growth exceeding one percent for the first time in this cycle. While concerning, the rate is still well below the annualized long-run average of 1.9 percent.

“With rising room rates and record occupancy levels, many developers are able to get better financing terms, and more projects either are beginning construction or reaching the final planning phase in the development pipeline,” said John B. (Jack) Corgel, Ph.D., the Robert C. Baker professor of real estate at the Cornell University School of Hotel Administration and senior advisor to PKF-HR. “Fortunately, demand continues to outpace supply throughout most of the country, and the new construction is not yet a cause for alarm.”

Roughly 132,000 rooms are currently under construction nationally, according to STR, Inc., up from 129,000 rooms during the second quarter of 2015. Over two-thirds of these properties are in the Upscale or Upper Midscale chain categories and are represented by a handful of Hilton and Marriott brands, such as Hampton Inn & Suites, Courtyard, Fairfield Inn and Hilton Garden Inn.

West Coast Bias in the Third Quarter Thirty-nine of the fifty-nine markets covered by PKF-HR saw year-over-year occupancy growth in the third quarter of 2015. It is notable that several secondary markets were among the top 15 cities for occupancy increases. “At this point in the cycle, the top tier cities are approaching all-time highs, limiting the potential for continued occupancy gains,” said Woodworth. “A classic example is the San Francisco market, where occupancy declined by 0.9 percent in the third quarter, but the occupancy level achieved was 90.3 percent.”

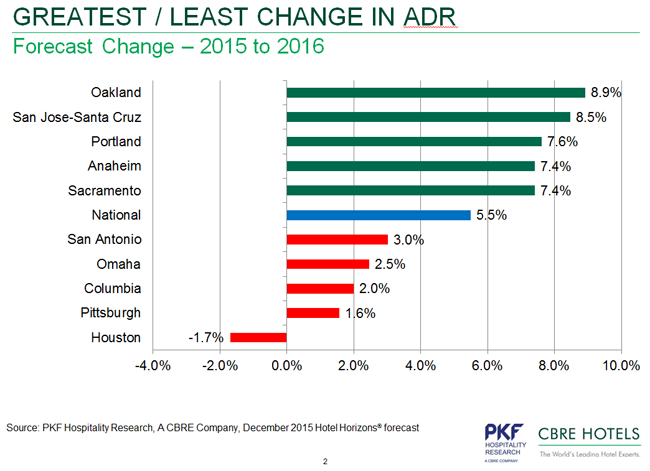

Hotels located in the West Coast and Mountain West regions continue to lead the nation in ADR growth. “Nine of the top fifteen ADR growth markets were located in the western region of the country where employment and income gains have continued to outperform the country as a whole,” Woodworth reported.

By location, Airport and Resort hotels experienced the strongest RevPAR growth during the third quarter of 2015. Airport hotels posted an 8.0 percent gain in RevPAR, driven by a 6.6 percent increase in in ADR. Resort hotels achieved strong RevPAR growth (7.6 percent), as well, mostly attributable to a slight 0.1 percent supply increase. Urban and Interstate hotels were laggards in terms of RevPAR growth, seeing increases of 3.9 percent and 4.1 percent, respectively.

Sustainability With forecasts of demand increases exceeding the change in supply, PKF-HR is projecting eight consecutive years of rising occupancy through 2017. This eight-year stretch of continuous occupancy growth is the longest streak since STR, Inc., began its reporting in 1988.

The good news flows through to the bottom line, as well. With ADR gains contributing 80 percent of the RevPAR growth, PKF-HR also is forecasting net operating income increases exceeding 10 percent through 2017. This current seven-year, strong profit growth trend also is an all-time record.

“With lodging performance at all-time record levels, the industry is well positioned to absorb unexpected adverse demand shocks should they occur,” Woodworth concluded.