By Erich Baum

As recently as the 1980s, Portsmouth, New Hampshire, was a rowdy military town with empty storefronts. Construction of the Sheraton Harborside (completed in 1988) required subsidies to pencil out, and another twenty years passed before the Hilton Garden Inn followed, without help from the public. In the years since, the downtown hotel market has continued to mature, adding affiliates of Residence Inn by Marriott in 2010 and Hampton Inn in 2014, followed by an AC by Marriott, which had the bad luck to open in January 2020.

Three years and one pandemic later, the AC by Marriott has been absorbed, and the market thrives again. Along with the elevated hotel pricing one expects of a coastal drive-to destination in New England, Kalibri Labs’ data indicates that the current annual occupancy rate is finally approaching the 80% peak recorded pre-pandemic.

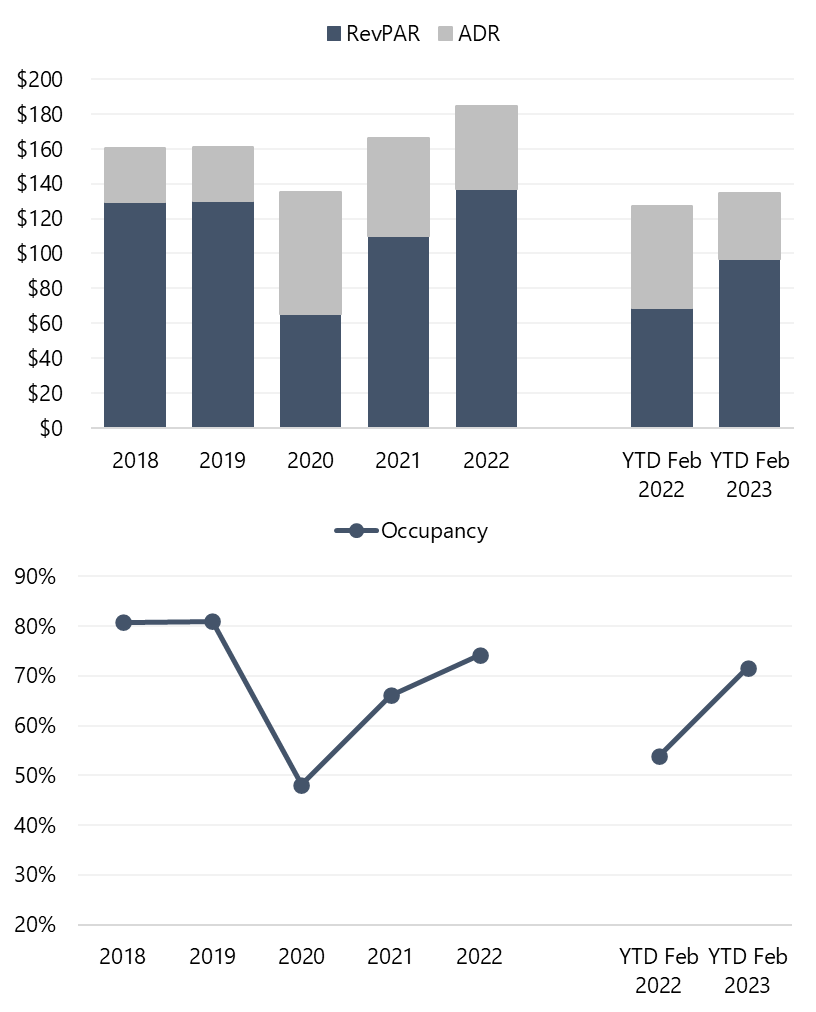

The following table details historical trends in occupancy, average rate, and RevPAR, provided by Kalibri Labs. The survey includes the city’s ten highest-quality hotels, including the downtown district’s five branded hotels and another five branded hotels located on the margins or in other submarkets.

Portsmouth, NH Hotel Trends

Source: Kalibri Labs

The historical data illustrates the market’s full recovery in average rate levels, such that a 15% premium was realized in the 2022 pricing versus 2019. Nevertheless, the Portsmouth hotel market’s recovery from the pandemic has been somewhat muted as compared to other drive-to leisure destinations along the New York/New England coast. In this region, RevPAR growth has been more dramatic, and in some cases explosive, including markets such as The Hamptons; Newport, Rhode Island; and Down East Maine. The Portsmouth market’s 2022 RevPAR of $137 is only 5.4% higher than the 2019 RevPAR; after accounting for inflation, the performance is considered below peak.

The difference is attributable to Portsmouth’s more diverse demand base, which includes a significant business traveler segment. Key commercial demand generators, such as Lonza Biologics and Sig Sauer, are clustered in the Pease International Tradeport (a former Air Force base). Although the presence of this demand segment explains the market’s ability to achieve atypically high year-round occupancy rates, it has also acted as a bit of a damper on the market’s return to pre-pandemic performance levels. The 2022 occupancy rate of 74% represents a continued depressed level relative to the 80%-plus occupancy rates realized pre-pandemic.

Nevertheless, as business travel continues to normalize, the market’s prospects for a complete occupancy recovery are strong. Year-to-date 2023 results through February suggest as much. The market’s occupancy level for the first two months of 2023 grew by nearly 18 percentage points, pacing an exceptional 41% gain in RevPAR relative to the same period of 2022.

The strong market conditions have continued to attract developers, but the coveted downtown district has limited opportunities for new construction. A long-planned Hyatt Place with 144 rooms was delayed by the pandemic but remains a viable and fully permitted development site. Additionally, XSS Hotels and Procon are making steady progress on their plan to redevelop the land at the intersection of Maplewood and Raynes avenues with a mix of uses, including a 124-room hotel. The developers recently won a victory over local residents appealing the project’s site-plan approval.

While new ground-up construction remains a challenge due to the lack of developable sites and increasing public opposition to the pace of downtown’s expansion, many local developers have turned their focus toward adapting existing buildings into small, luxury inns, as follows:

- The 15-room Hotel Thaxter opened in December 2022, converted from a former church.

- The eight-room Davenport Inn is being redeveloped from a former office building, planned for completion in time for the peak summer season of 2023.

Apart from these two properties, the downtown district offers four other small inns offering between 6 and 32 rooms, including two Lark Hotels properties.

As the market continues to shake off pandemic-era rust, Portsmouth represents a highly coveted real estate market for good reason. With demonstrated success and a constrained capacity for new supply, returns on downtown hotel real estate investment hold tremendous promise for the foreseeable future.

For more information, contact Erich Baum with the HVS Boston office.