by Scott Smith, MAI, and Gary McDade

U.S. hotels have realized significant increases in occupancy, average daily rate (ADR), and top-line revenue over the past five years. Because of an improving economy, increased levels of international travel, a recovery in the total number of people working and limited supply growth in the majority of U.S. markets, PKF Hospitality Research (PKF-HR), a CBRE company, is forecasting a protracted period of prosperity for the U.S. lodging industry. Based on the September-November 2014 edition of PKF-HR’s Hotel Horizons® forecast report, hoteliers will enjoy well-above average levels of revenue growth through 2018, driven primarily by increases in ADR. The increase in revenue, however, is only a part of the story.

The results of PKF-HR’s current annual survey of roughly 7,000 hotel operating statements, Trends® in the Hotel Industry reveal that U.S. hotels have substantially improved their bottom lines, with net operating income (NOI) increasing more than 10 percent each year from 2010 to 2013. Based on the revenues projected in the September-November 2014 edition of PKF-HR’s Hotel Horizons® forecast, hotel NOI will continue to increase by double-digit percentages through 2016.

Meanwhile, according to the annual PKF Hospitality Investment Survey, the overall capitalization rate for hotels has steadily declined during the same period. Because of the low cost of debt, higher loan-to-value percentages, and lower perceived risk on equity investments, capitalization rates are now at their lowest levels since the inception of the PKF Hospitality Investment Survey in 2000.

What does this mean for hotel investors? Have nominal (actual dollar) hotel values returned to their pre-recession levels?

NOI and Cap Rate Influences

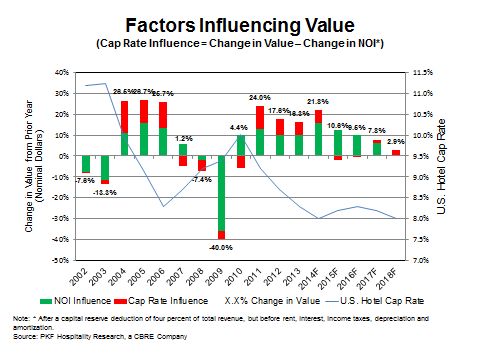

The amount an investor is willing to pay for a hotel is a function of the income that the property will generate and the perceived risk and cost of capital associated with future income expectations. To gain a better understanding of how changes in NOI and changes in capitalization rates influence changes in hotel values, we tracked NOI from our Trends® database and capitalization rates from the Hospitality Investment Survey going back to 2001.

For purposes of this analysis, NOI is calculated after a capital reserve deduction of 4 percent of total revenue but before rent, interest, income taxes, depreciation, and amortization. We then develop projections of NOI for the period 2014 to 2018 based on the forecasts provided in the September-November 2014 edition of PKF-HR’s Hotel Horizons®.

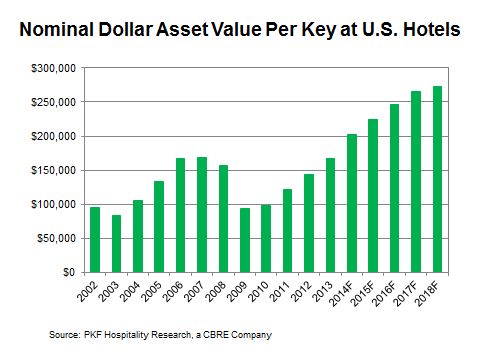

We also develop capitalization rate forecasts for 2014 to 2018 based on historic data from Real Capital Analytics and Real Estate Research Corporation. Using this information, we calculate an asset value per key. The asset value per key is estimated by applying the forecast capitalization rate to the NOI for every year of the period studied. It should be noted that the asset value per key that we develop is not based on any actual hotel sales transactions, and the capitalization process implicitly assumes a prolonged investor holding period (i.e., no terminal value calculation is included).

During years of asset value growth, NOI increases explain the majority of the lift in value, with the balance resulting from a decrease in the capitalization rate. During periods when the national economy contracted, the resulting NOI decreases were the primary driver of the decline in asset values; the change in capitalization rate had less of an influence. In 2007 and 2010, NOI levels increased, but asset values essentially remained flat. During these years, the capitalization rate increased as a result of the limited availability of debt financing, an increase in the cost of capital, and an elevated perception of equity risk.

If investors purchased hotels at the 2007 pre-recession high of $169,173/key nominal dollar asset value, the investments would have been worth $166,502/key in 2013, thus yielding a compound annual return of -0.3 percent. In terms of the compound annual growth rate (CAGR), NOI declined by a -1 percent during the same period. Conversely, if the investment occurred in 2009, the investment would have appreciated at a 15.4 percent annual rate by the end of 2013, driven primarily by a CAGR of 11.8 percent in NOI during the period.

Future Outlook

Increasing ADRs, record occupancy levels, low inflation, and the continued presence of effective cost-control practices will contribute to double-digit growth in NOI through 2016. Lodging industry fundamentals are expected to remain strong in the near-to-midterm with balanced growth in supply and demand, favorable pricing power, and only modest upward pressure on labor costs. These positive factors may be enough to overcome an expected increase in interest rates in the coming years. Therefore, we expect capitalization rates to remain stable through 2018.

The estimated 2014 nominal asset value of $202,789/key is forecast to increase at a 7.7 percent annual rate through 2018. This increase in asset valuation will be almost entirely the result of increases in NOI. With increasing NOI and stable cost of capital, hotel dividends should be quite attractive relative to other investment opportunities.

Timing Is Key

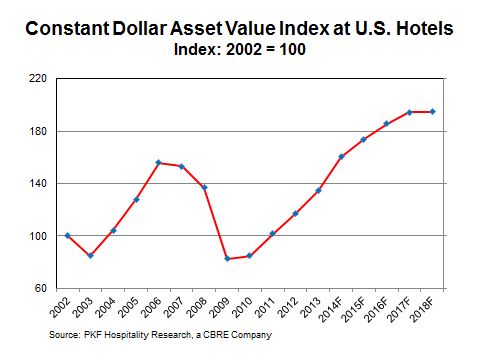

To eliminate the effect of inflation on asset values and assess the timing of the market, we convert all historical and future NOI amounts to 2013 constant dollars. For each year, we calculate the constant dollar asset value by dividing the constant dollar NOI by the overall capitalization rate.

In real terms, asset values in 2014 of $199,007/key will surpass the 2006 high of $193,302/key. Therefore, if investors had invested in 2006, the real annual appreciation on the investments would have been 0.4 percent by the end of 2014. In real terms, hotels NOIs decreased slightly during this period; the lift in value is attributable solely to a small contraction in hotel capitalization rates. Alternatively, a hotel investment made in 2009 would have appreciated at an annual rate of 14.3 percent by the end of 2014, primarily because of a 10.7 percent annual increase in in NOI.

Looking forward, investors can expect a real annual return of 4.9 percent from 2014 through 2018. Since we expect capitalization rates to remain flat, the return will entirely be a function of real increases in NOI. The constant dollar asset value is forecast to grow from $199,007/key in 2014 to $241,352/key by 2018.

Economic and hotel fundamentals indicate that profits and values of a hypothetical “generic” U.S. hotel are rising; however, the degree of growth varies by market and property type. Hotel investors should conduct a thorough analysis of their hotel portfolio mix to assess whether it meets their optimal investment horizon. For investors that purchased when values were low and have met their return goals, now may be the best time to sell in order to realize those gains. Investors primarily interested in dividend returns should ride the coming wave of strong profit growth.