The rate of growth in occupancy, average daily rate (“ADR”) and revenue per available room (“RevPAR”), while strong, continued to decelerate as the market moves on a path towards stabilization. Lower-priced hotels benefited from the customer’s level of rate fatigue being felt in the market, with ADR growth levels for midscale properties triple that of higher-priced hotels in Q4. 2023 RevPAR experienced a year-over-year increase of 16.5 percent, with Q3 seeing an increase of 13.6 percent and Q4 being up 11.5 percent.

“The Manhattan hotel market maintained an occupancy level above 80 percent in each month of the final three quarters of 2023, a first since 2019. While return to office and resultant office vacancies remain a concern as it relates to continued growth in individual business travel, minimal hotel room supply additions over the next several years should benefit existing hotels and increasingly result in price compression in the market.”

Warren Marr, Managing Director, PwC

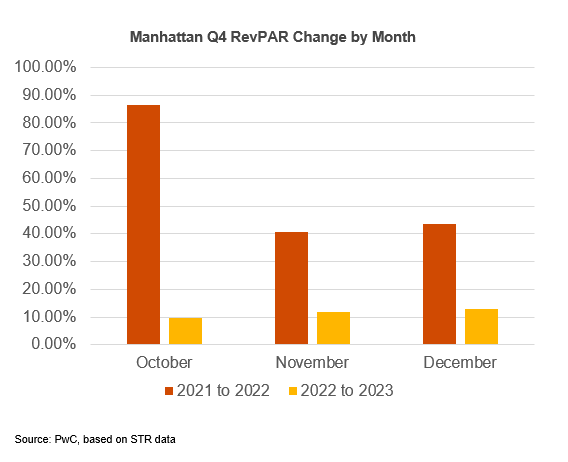

RevPAR increased 11.5 percent year-over-year during the fourth quarter of 2023. Occupancy and ADR continued to advance, with group and corporate continuing to re-stabilize. Year-over-year increases in occupancy were highest in November – up 5.7 percent, and lowest in October – up 2.6 percent. With overall occupancy and ADR up to 86.1 percent and $390.18, respectively, Manhattan RevPAR jumped from $301.44 in Q4 2022 to $336.14 in Q4 2023.

Of the four market classes tracked, upper midscale properties exhibited the most significant year-over-year increase in RevPAR – up 14.7 percent for the quarter, primarily driven by a 12.8 percent increase in ADR from $255.83 in 2022 to $288.59 in 2023, with occupancy increasing 1.7 percent from 85.1 percent to 86.5 percent.

For upscale properties, occupancy grew 4.8 percent and ADR by 8.5 percent year-over-year, resulting in a year-over-year RevPAR increase of 13.7 percent. Upper upscale properties experienced an 8.3 percent increase in RevPAR, with occupancy up 3.7 percent and ADR up 4.4 percent. Luxury properties posted the smallest increase in RevPAR up 6.2 percent, attributable to an increase in occupancy of 5.1 percent and the lowest increase in ADR among the market classes – up 1.0 percent.

Of the five Manhattan neighborhoods, Lower Manhattan had the largest increase in RevPAR – up 13.2 percent, driven by a 6.1 percent increase in ADR and a 6.7 percent increase in occupancy year-over-year. Midtown West RevPAR grew 11.5 percent, with a 7.6 percent increase in ADR and a 3.6 percent increase in occupancy. Midtown South and Upper Manhattan posted RevPAR increases of 9.3 and 8.5 percent, respectively. Midtown East RevPAR increased 8.1 percent over Q4 2023.

During the fourth quarter, growth in occupancy at full-service hotels outpaced that of limited-service hotels, with year-over-year increases of 4.9 and 1.8 percent, respectively. RevPAR increased 11.4 percent for full-service properties while limited-service hotels saw an increase of 11.7 percent over the same period, driven by more robust ADR growth for limited-service hotels of 9.7 percent versus 6.2 percent for full-service hotels.

RevPAR in the fourth quarter increased 14.8 percent year-over-year for independent hotels and 9.4 percent for chain-affiliated hotels. The improvement in independent hotels was driven by increases in both occupancy and ADR – up 4.1 and 10.3 percent, respectively. Chain-affiliated hotels experienced a more moderate increase in ADR of 4.9 percent, but slightly stronger occupancy growth of 4.3 percent.