By Tareq Bagaeen

It is no secret that The Kingdom of Saudi Arabia is changing. Over just the past five years the change has been staggering, both socially, and politically as well as a dramatic shift in its economic vision.

Oil & Gas has been the foundation of its strength, and it continues to be but the shift to diversify is massive. Great festivals bolster their main cities and act as significant drivers of local tourism; Formula E has been lighting up Riyadh since 2018; Formula 1 since 2021 in Jeddah, along with a host of significant political and business conferences. Of course, Hajj & Umrah are another major stream of inbound travel.

At the beginning of March 2024, The Saudi Ministry of Tourism released its 2023 statistics with an announcement of 106.2 million visitors. This figure marks a 56% increase compared to 2019 and a 12% rise from 2022; 24.2 million of these are international arrivals and 79.3 million are domestic.

If we were to break it down by city, there is slightly less clarity due to the way numbers are tracked, but in terms of the most visited by international arrivals, none of the destinations in Saudi feature, while Dubai sits in third position with around 17 million, it is very clearly not a fair comparison between it and Riyadh or Jeddah. But when looking at UAE Vs. Saudi Arabia as a whole, it’s a much closer picture.

This gap will continue to shrink as Saudi Arabia plans to invest USD800 billion in tourism by 2030, with the goal to attract 150 million tourists a year by 2030, with about 70 million coming from abroad. And they have the resource to deliver: Saudi’s GDP in 2023 was USD1.1 trillion while that of UAE was USD415 Billion.

And domestic tourism, which has a big impact on hotel performance is also not a fair fight with Saudi’s population at 37 million while UAE is at 10 million. The advantages seem to be stacked in their favour.

Looking more closely at occupancy levels for the two nations, between 2019 and 2023 we see that UAE has grown by 1.5% while Saudi Arabia has over triple the percentage growth at 5% In Total Revenue per Occupied Room (TRevPOR) both nations match each other closely at just under 15% growth. When compared to places like Oman & Qatar you can more easily understand the significance of this number as those two nations have dipped in occupancy by 10% and 15% respectively while their TRevPOR has shrunk by 12% and 5%. Qatar showing less pain due to higher achieved average rates than Oman.

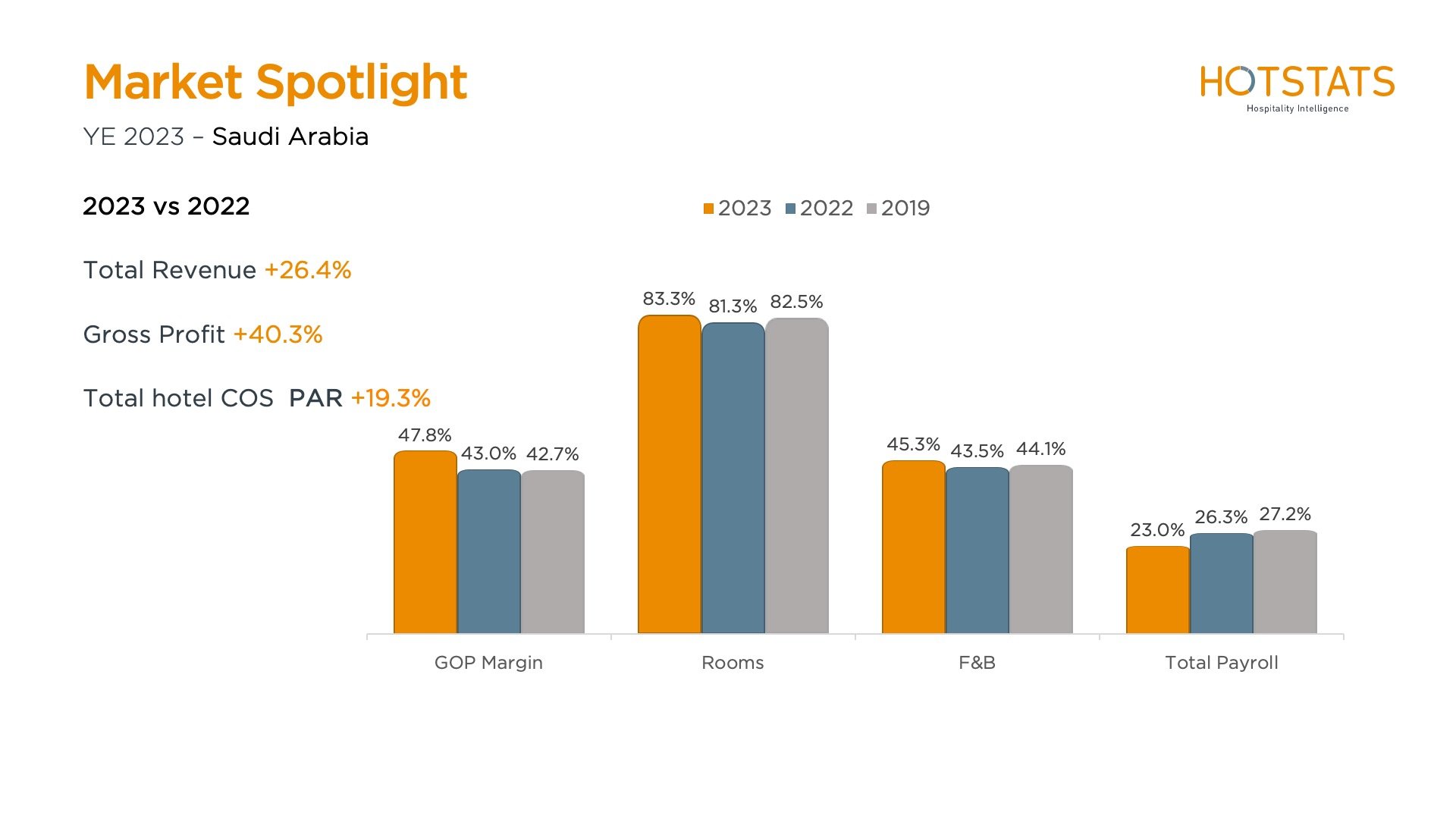

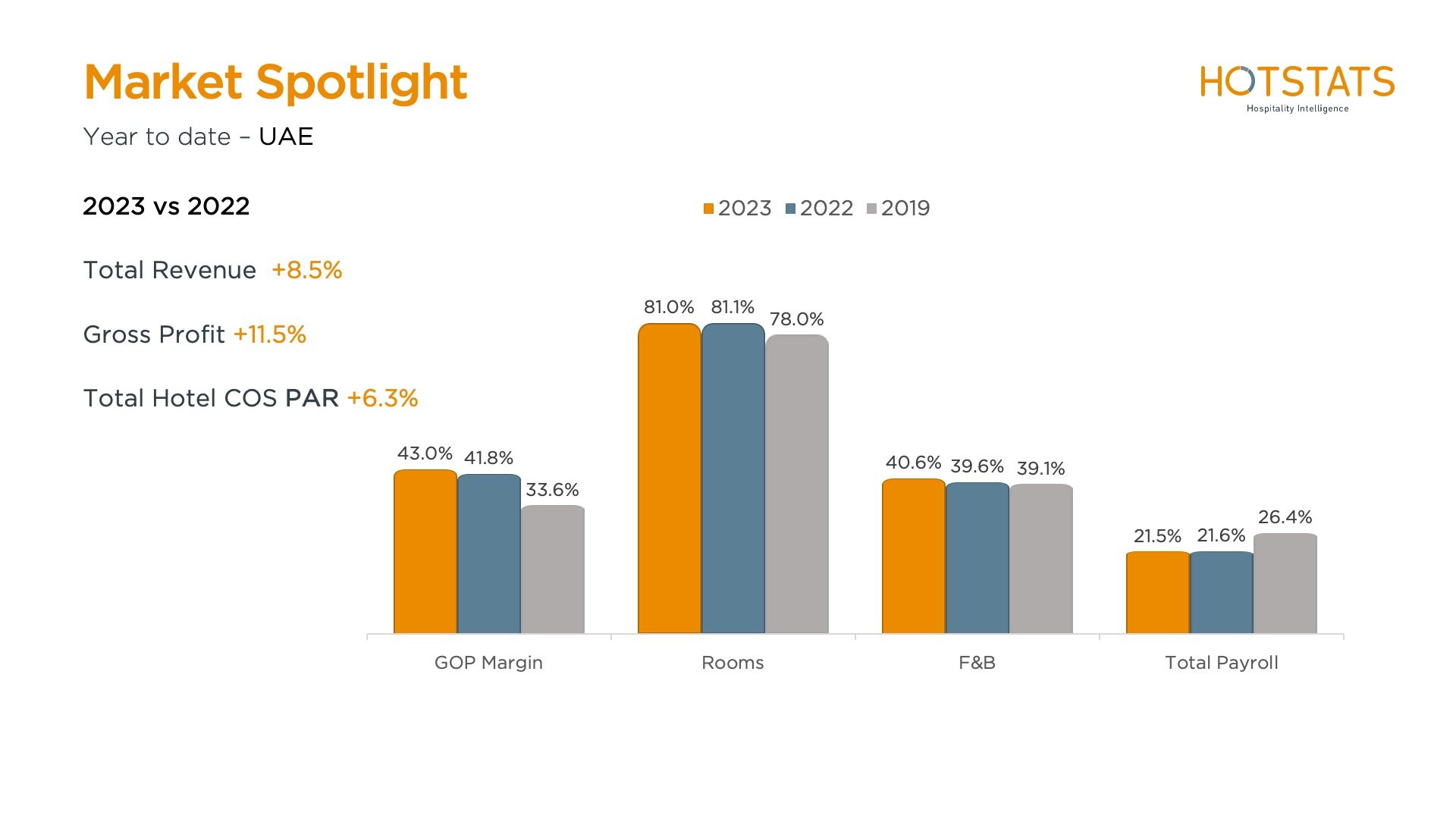

Digging further into the performance and looking at the profitability indexes paints an even more interesting perspective. From 2019 to 2022 and then 2023, UAE Gross Operating Profit (GOP) margins climbed from 33% to 41% and 42%; which are respectable levels. While Saudi started at a higher base of 42% in 2019 and moved up slightly to 43% and by 2023 it now sits at 48% which is the highest in the whole of the Middle East and one of the highest in the world.

What is particularly interesting is to examine the key revenue streams of hotel operations – rooms division as well as food & beverage – and compare the two nations together. Here, Saudi is ahead of the UAE by a couple of points in 2023 within the rooms department and this is part of their GOP lead, but the driving force is clearly F&B margins where Saudi Arabia is managing an average of 45% while UAE is at just over 40%. What makes this even more perplexing is that there is no alcohol being served in The Kingdom while the majority of UAE does and typically, alcohol margins are quite high.

Energy costs play a role as in the Kingdom, the government tariff is fixed at .05 USD per kWh while in Dubai for example, it is a sliding scale in terms of consumption and does start at similar prices to Saudi but ratchets up very quickly. The same applies to the price of petrol for cars where the UAE is 25% more expensive than Saudi Arabia.

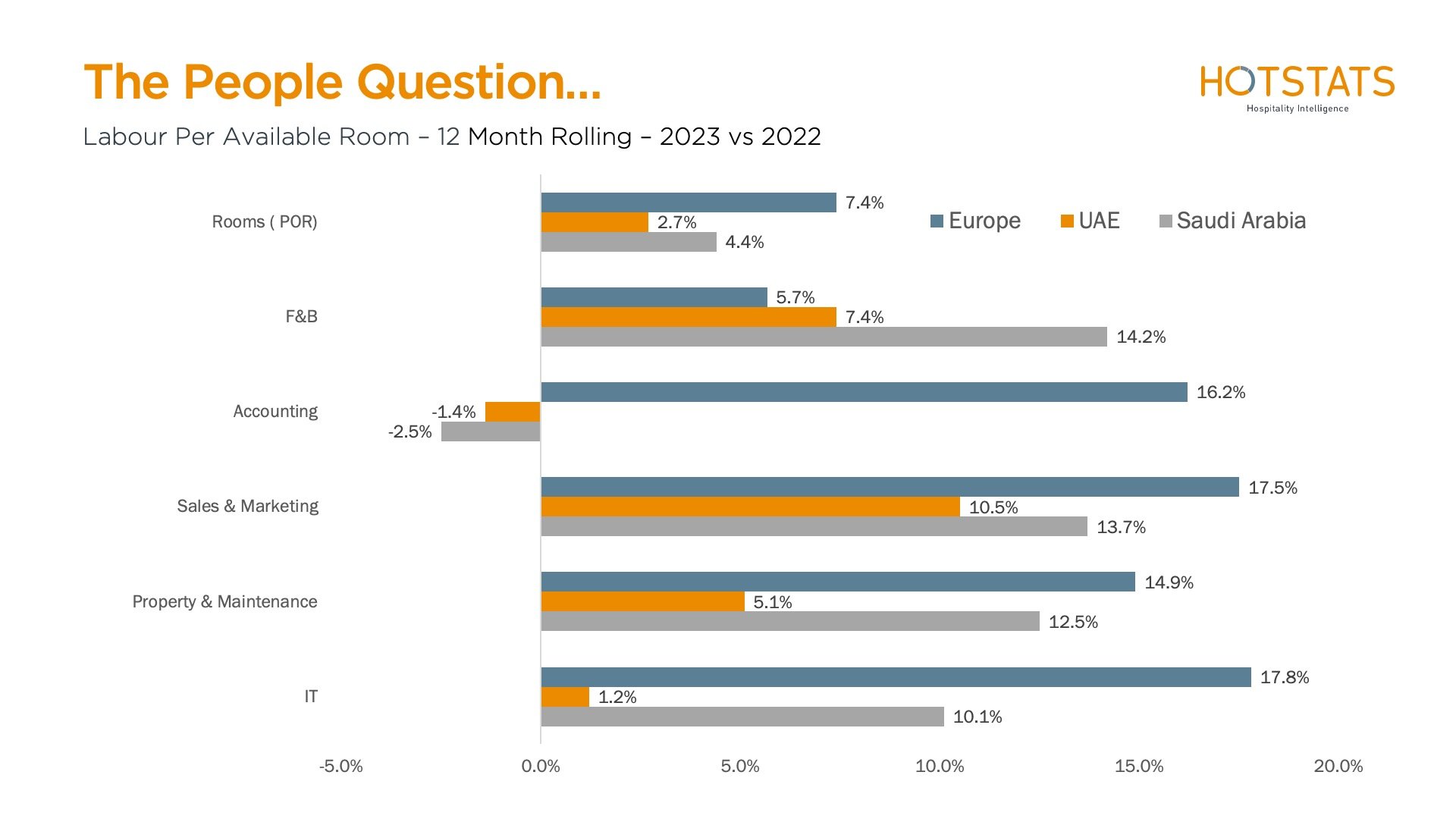

The UAE doesn’t really utilize local labour in comparison with Saudi. The kingdom has been pushing through with its ‘Saudization’ model for many years now and when visiting hotels, you will not find any non-Saudi employees in places of guest interaction, commercial teams, operators and similar. This of course carries a heavier labour cost when compared to the full expat teams that The UAE utilizes in its operations. Even though Saudi Arabia carries a higher labour cost per occupied room as clearly indicated in the below chart, overall, due to the other operating costs, it still comes out ahead in terms of profitability.

What does the future hold? When talking to hospitality professionals in Dubai and elsewhere within the UAE, there is optimism. There is still plenty of business to go around and The Emirates not standing still. It still leads the way with theme parks, family attractions, ease of visa entry, and flight connectivity and is pushing the envelope yet again with its move to open casinos. The Ras Al Khaimah Wynn property is slated to open in 2026 at a cost of USD4 billion and Dubai is also building a casino Island on Jumeirah beach.

Everything is moving quickly, and Saudi Arabia is very determined to build up the nation as a major tourism hub over the next few years. This is a very exciting time for the region and the only way is up. I am looking forward to what is coming….

Story contributed by Tareq Bagaeen, founder of aQedina.com and a senior consultant with HotStats.

Unlock the hidden profit potential in your hotel business by leveraging the power of data. With our data-driven approach, we provide you with the tools to make informed decisions that can significantly boost your bottom line. Find out more about Hotel Benchmarking now.

photo by Aleksandar Pasaric