Fourth Quarter Data Indicates Major Rebound Across All Travel Segments, Despite Slight Rate and Booking Declines Overall in Third Quarter of 2017

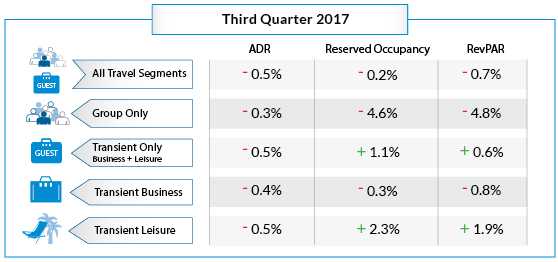

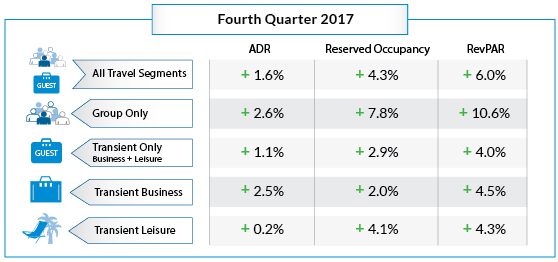

NEW YORK – September 28, 2017 – Heading into the last quarter of 2017, fourth quarter data is showing healthy gains across the board, despite slight declines in average daily rates (ADR) and bookings in the third quarter across all travel segments, down -0.5 percent and -0.2 percent respectively, according to new data from TravelClick’s September 2017 North American Hospitality Review (NAHR).

While group travel is down -0.3 percent in ADR and -4.6 percent in bookings during the third quarter, the same segment is up 2.7 percent in ADR and 3.6 percent in bookings for the fourth quarter. Similarly, transient business travel is down -0.4 percent in ADR and -0.3 percent in bookings in the third quarter, but the segment is up 2.3 percent in ADR and 0.9 percent in bookings in the fourth quarter.

“Over the past 60 days, there has been a noticeable increase in advance reservation pace, lasting well into 2018,” said John Hach, TravelClick’s senior industry analyst. “This uptick is welcomed news for hoteliers who have endured inconsistency throughout most of 2017. With ADR up 1.0 percent and bookings up 3.8 percent in the fourth quarter across all travel segments – in fact, bookings are up 6.2 percent for transient leisure travel in particular that quarter – this is encouraging data to round out the year.”

Twelve-Month Outlook (September 2017 – August 2018)

For the next 12 months (September 2017 – August 2018), transient bookings are up 3.6 percent year-over-year, but ADR for this segment is down -0.5 percent. When broken down further, the transient leisure (discount, qualified and wholesale) segment is up 5.9 percent, but ADR is down -0.5 percent. Additionally, the transient business (negotiated and retail) segment is up 0.6 percent, but ADR is slightly down -0.3 percent. Lastly, group bookings are up 1.8 percent in committed room nights over the same time last year, and ADR is also up 0.4 percent.

“While a number of markets are currently facing unforeseen challenges, especially those affected by recent weather events, it becomes even more important for hoteliers to carefully analyze their advance reservation patterns during these upcoming months,” added Hach. “These disruptions will undoubtedly alter the transient segment in particular, especially in top destination vacation markets in Florida and throughout the Caribbean. Business intelligence can be a great tool to have on hand when working through these issues moving forward to get back on track.”

The September NAHR looks at group sales commitments and individual reservations in the 25 major North American markets for hotel stays that are booked by September 1, 2017, for the period of September 2017 to August 2018.

*Committed Occupancy – (Transient rooms reserved + group rooms committed) / capacity

The third quarter combines historical data (July and August) and forward-looking data (September).