By Katy Black

Lake Tahoe’s economy is anchored by the tourism industry, which experienced significant growth post-COVID given its proximity to major cities such as Sacramento, San Francisco, and Reno, as well as the array of outdoor activities. The Lake Tahoe Basin is home to a growing population of year-round residents, and the popularity of second homes and investment properties in the area has resulted in soaring home prices and an affordable housing crisis. To preserve the area’s natural beauty, local governments and the Tahoe Regional Planning Agency have implemented strict development and short-term rental restrictions. Despite these restrictions, new lodging developments and redevelopments are underway, which are expected to reshape the mix of lodging supply going forward, particularly in the luxury segment.

Lake Tahoe Short-Term-Rental Ordinance Updates

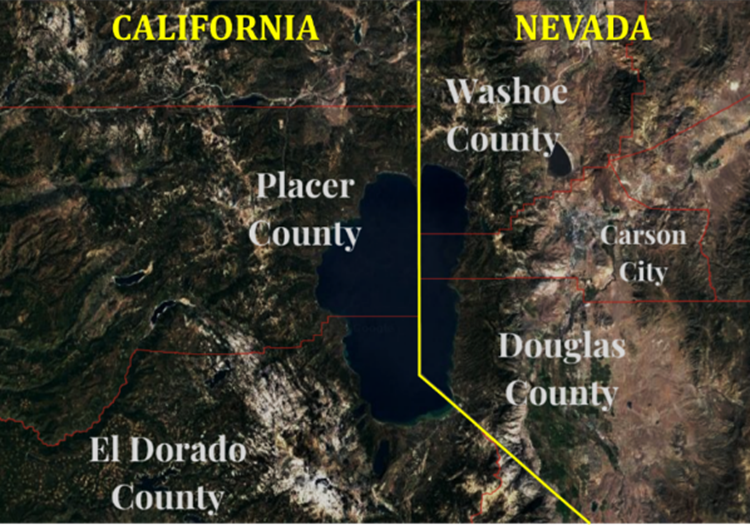

The regulations surrounding short-term rentals (STRs) of vacation-home rentals (VHRs) in the four counties that encompass Lake Tahoe vary greatly. As illustrated on the map below, the Nevada counties of Douglas and Washoe lie to the east of the lake, while the California counties of Placer and El Dorado are located to the west of the lake. These counties’ differences in regulation have a significant impact on the local housing market and the communities in which these rentals exist.

Douglas County

In Nevada, Douglas County (which includes the cities of Stateline, Zephyr Cove, and Glenbrook) has a VHR permit cap of 600 and limits the number of vacation-home rentals in detached-residence communities to 15% and in tourist/multi-residence communities to 20%. This cap, which went into effect mid-year 2021, helps to ensure that a balance is maintained between residential and vacation-home rentals, avoiding the over-commercialization of certain areas. However, it may also limit the supply of available rentals and raise prices for those that are available.

El Dorado County

El Dorado County in California (outside of South Lake Tahoe city limits) has a VHR permit cap of 900 and requires a 500-foot buffer between vacation-home rentals, which was introduced in October 2021. This regulation aims to minimize the impact of vacation-home rentals on residential communities and reduce the risk of nuisance from overcrowding and noise. However, it may also limit the number of available rentals and make it difficult for property owners to rent out their homes.

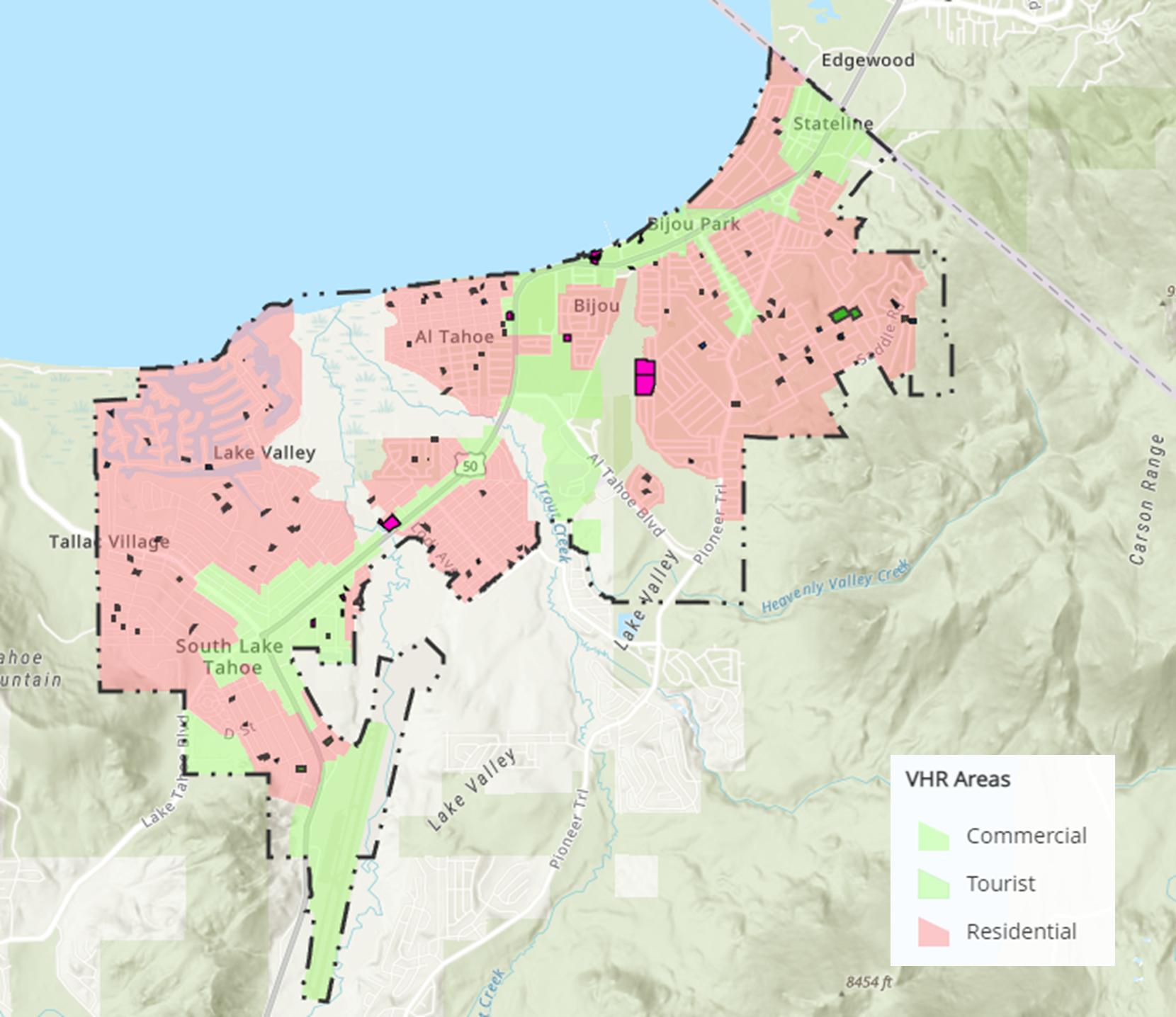

The City of South Lake Tahoe prohibits STRs in the pink-shaded areas shown on the map below.[1] This policy was implemented in late 2018. As shown, nearly all of the neighborhoods and residential areas are not eligible. STRs are still permitted in the tourist core and more commercial areas, which are indicated by the green shading.

Source: City of South Lake Tahoe Vacation Home Rental Map Series

Placer County

Placer County, California (including the cities of Northstar Village, Kings Beach, and Tahoe City) has a much higher permit cap of 3,900. This allows for a greater number of vacation-home rentals, providing more choices for tourists and generating more revenue for local communities. However, a significant housing crisis for the local workforce in Eastern Placer was caused by the shortage of affordable long-term rental opportunities. According to the Eastern County Short-Term Rental Economic Study,[2] from 2010 to 2021, there was a 43% increase in STR units in this area, a 47% increase in condotel/timeshares, and roughly no change in hotel/motel units. Placer County is optimistic that the adoption of a new STR ordinance in February 2022 will safeguard homeowners and resolve any nuisances caused by STR operations.

Washoe County

Washoe County in Nevada on the northeast side of the lake has the most permissive regulations, with no cap on the number of STR permits. This “free market” approach to the STR industry allows supply and demand to dictate the number of rentals available. This policy can lead to a higher number of rentals and greater revenue for local communities but can also have a negative impact on the quality of life in residential areas because of over-commercialization and overcrowding.

Short-Term Rental Supply

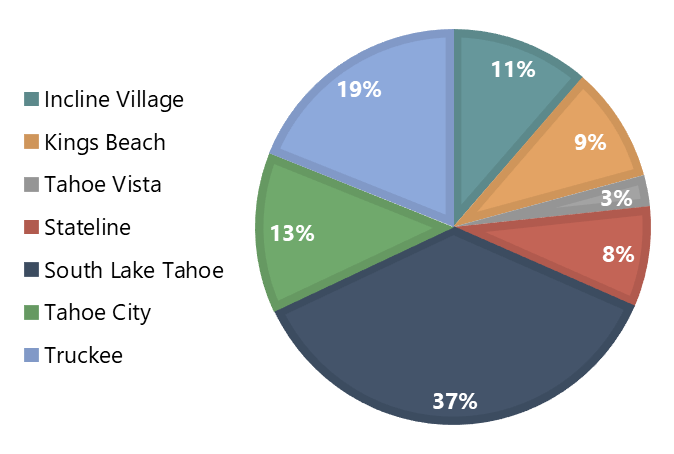

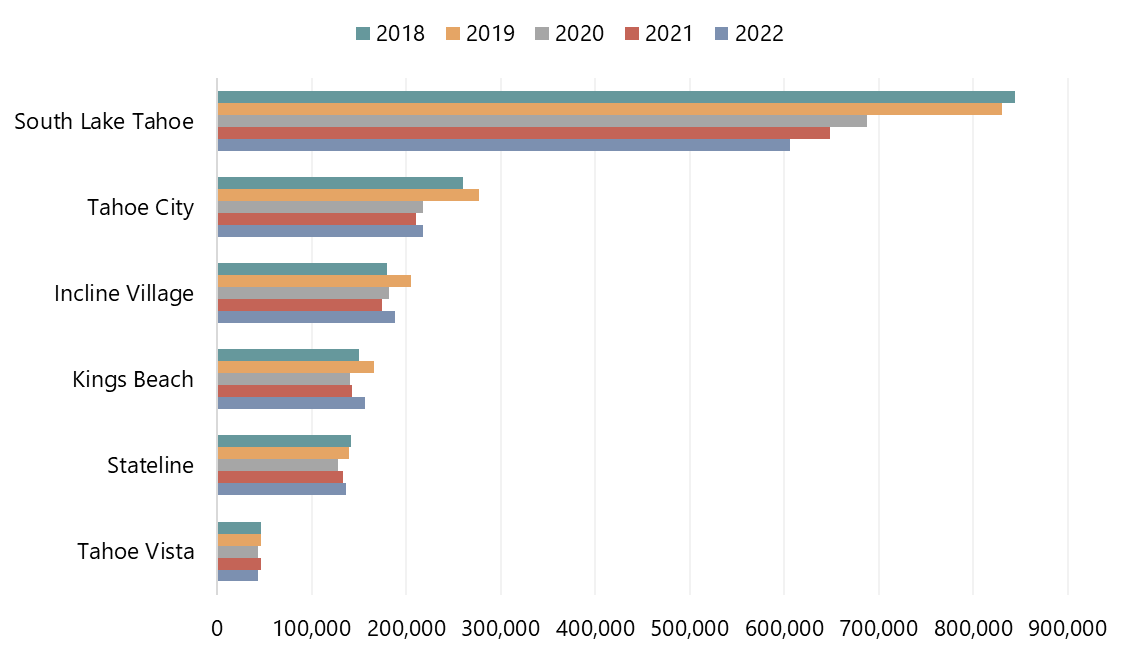

The following charts illustrate the mix of supply (listing nights) between the primary rental cities around the lake, as well as the change in listing nights for each city over the past five years.

2022 Lake Tahoe STR Supply (Listing Nights) by City

Source: AirDNA

Change in Listing Nights from 2018–2022

Source: AirDNA

The largest decline in STR supply by far has occurred in South Lake Tahoe. Since 2018, the number of available listing nights in South Lake Tahoe has declined nearly 30%, which is strongly tied to the increase in restrictions discussed earlier. The changes in other cities are less significant; however, some area restrictions have recently been implemented. Despite the stagnant or lower supply levels, the average annual rate of change for STR demand from 2018 to 2022, as reported by AirDNA, is over 3% for all cities except South Lake Tahoe, which is 0%.

Short-Term Rental Conclusion

The differences in STR regulation between the four counties of Lake Tahoe can have significant impacts on the local housing market and the communities in which these rentals exist. Balancing the need for revenue with the well-being of residential communities is a complex issue, and each county has taken a unique approach to addressing it. The restrictions, or lack of restrictions, on STRs will ultimately affect underlying values and limit growth within this sector.

Lake Tahoe Lodging Boom

Waldorf Astoria Lake Tahoe

The expansion project at Edgewood Tahoe, which is a 250-acre lakefront resort in Stateline, Nevada, is well underway. Half of the proposed 14 multi-bedroom villas were completed in late 2022, with the remainder slated for completion mid-year 2023. These villa suites range in size from 1,875 to over 4,000 square feet and are designed to provide guests with the ultimate Lake Tahoe experience, as each room faces the stunning shoreline of South Lake Tahoe. This expansion is expected to meet the needs of luxury multi-generational travelers or those seeking a more exclusive experience. With the resort’s location near the Tahoe Blue Center (under construction) and its onsite facilities and amenities, such as golfing, the resort is well positioned to continue catering to the luxury traveler on the south shore.

Tahoe City Lodge is a fully approved resort hotel that has been highly anticipated, as it marks the first new hotel development within Tahoe City in the last 50 years. The full-service resort hotel will feature a total of 40 hotel rooms and 65 condominiums, offering stunning views of the lake and easy access to the mountains and the beach. Set to break ground in the spring of 2023, the Tahoe City Lodge is expected to bring new energy to this community on the west shore. Completion is slated for 2024/25.

Proposed Kings Beach Resort (39°N)

Situated in the heart of Kings Beach, California, 39°N will feature a total of 153 hotel units, 10,500 square feet of restaurant and retail space, as well as a large community outdoor gathering space. The resort will also include 74 workforce rental housing units reserved for locals serving the Tahoe Truckee Unified School District, as well as 36 three- and four-bedroom townhomes for purchase. The design is expected to be “mountain modern,” with encouraged walkability throughout the complex. The brand (if any) and asset class of the hotel, as well as a timeline, have yet to be announced.

The Tahoe Blue Center is a much-anticipated event center in Stateline, Nevada, on the southeast side of the lake. Construction began in 2020, and the center is slated to open in July 2023. It is expected to have a significant impact on the local economy thereafter. The $100-million facility is expected to host up to 130 events per year, attracting a steady stream of visitors from around the world. The new facility will not only help fill the shoulder season in the area, when room rates are lower and business slows, but will also provide a major boost to the local tourism industry.

The Tahoe Blue Center will boast a modern and versatile design, featuring 5,500 seats and 10,000 square feet of meeting space. This design will make the facility ideal for hosting a wide variety of events, from concerts and sports games to conventions and trade shows. The center’s versatility and capacity will be major draws. According to the Tahoe Douglas Visitors Authority, the center is expected to increase annual room-tax revenues between $810,600 and $1.2 million for Douglas County. The county is also anticipating an increase of $200,000 to $300,000 in annual sales-tax revenue.

Looking Forward

With STR restrictions increasing, condo-hotels are slated to be an alternate option for potential second homeowners or investors seeking to generate income from residential real estate in this region. A significant number of new hotels or condo-hotels, which are typically not subject to county or city STR restrictions, should support the growing tourism generated by projects such as the Tahoe Blue Center, as STR supply will likely remain stable or decline in the near term.