By Sebastian Colella

After a long and grueling 12 months, spring has finally arrived in New England and with it, renewed hope for its lodging markets seems widespread across all six states. Although very little improvement has materialized through Q1 of 2021, there are many indicators that growth in lodging demand is around the corner. The national lodging market has begun to see improvements as hotel occupancy for the week ending March 20 increased to its highest level since early March of last year, according to STR. There are many reasons to believe New England lodging markets will experience similar trends once tourism season is underway.

The Pandemic’s Varying Impact

Lodging demand from state-to-state is very different depending on its demand drivers, segmentation, seasonality, accessibility, the make-up of its hotel supply, among other elements. When considering the variables associated with the pandemic, primarily case counts and restrictions put in place by state governments, the six New England states were all impacted to varying degrees.

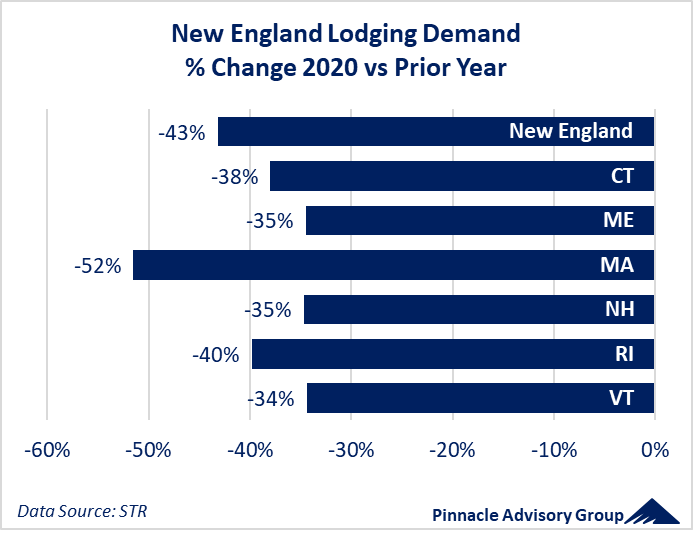

New England experienced a decline of approximately 43% in demand, or occupied roomnights, in 2020. By comparison, the impact was more than the United States as a whole, which had a decline of 36%. While no state lodging market was able to avoid the damage created by the pandemic, some were hit much harder than others. Occupied roomnights in Massachusetts were reduced to less than half their levels the prior year. The Bay State relies more on corporate and group travel and welcomes more international travelers through its airport than any other New England state. Although its restrictions to travel, gatherings, and non-essential businesses could be considered less severe than Vermont, it had a higher level of case counts and experienced the spread of COVID-19 earlier in the year. On the other end of the spectrum, Maine, New Hampshire, and Vermont all managed the pandemic very differently, but given their more rural and leisure-oriented characteristics, each experienced declines in demand in line with the country, between 34% to 35%.

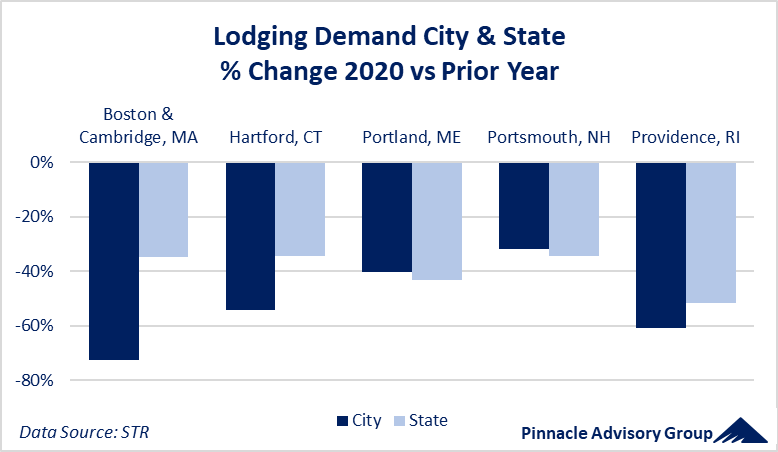

With very little corporate and group travel taking pace through 2020, major cities have been impacted more so than suburban markets and leisure-oriented destinations, a trend being seen throughout the country. This trend held true in Boston and Hartford and to a lesser degree in Providence. Portland and Portsmouth actually outperformed their respective states with declines of 40% and 32%, a direct result of their ability to attract leisure travelers through much of the summer and fall as they normally do.

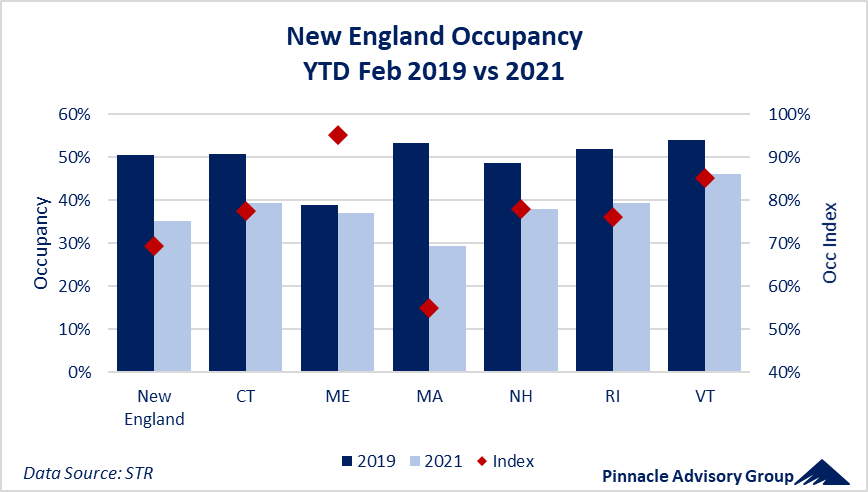

Through February of 2021 the varying impact continues when looking at the state-by-state recovery when compared to 2019, the benchmark for pre-pandemic performance metrics. Outlined below is the occupancy through February for each state comparing 2021 to 2019, with the comparative index shown in red. The index reflects its measure of recovery to pre-pandemic occupancy levels in which achieving a 100% index represents a full recovery.

Through the first two months of 2021, New England has an occupancy of 35% compared to its 2019 level of 51%, equating to an occupancy index of 69%. Maine and Vermont have occupancy indexes through February of 95% and 85% respectively. These states are outperforming the other New England states in their recovery so far as they have been able to rely on winter tourism driven largely by skiing, snowmobiling, and other outdoor activities. With much of its performance driven by the Greater Boston area, the recovery in Massachusetts is currently moving at the slowest pace with an occupancy index of only 55%.

Recovery Beginning to Take Shape

Despite hotel occupancy in New England still only being approximately 70% of its levels in 2019, there is much to be hopeful now that the spring season has arrived. Certain trends and achievements in the month of March should pave the way for the recovery to begin.

- Case counts improving – COVID-19 cases peaked in mid-January across much of the country including New England. Despite the most recent increases experienced, case counts have since declined dramatically across all six New England states. Each state, with the exception of Vermont, has dropped their case counts over 65% from their peaks just eleven weeks earlier. Although still quite high, especially in Massachusetts and Connecticut, case counts are expected to improve as a result of the ongoing vaccination efforts.

- Vaccinations increasing – Slow to start, the vaccination roll-out across New England seems to have hit a stride. As of March 26th, all six states have at least 15% of their population fully vaccinated. Connecticut and Rhode Island ranked third and fourth respectively as states with the highest percentage of vaccinated adults in the country.

- Restrictions eased – State officials determine what restrictions, if any, should be imposed and how and when they are eased. While most of the New England states have remained fairly strict compared to most states around the country, they have begun to relax their restrictions as more residents become eligible to receive the vaccine and case counts decline. The ability to gather indoors and outdoors is pivotal to many hotels which rely on group and meeting business, especially during the peak season from May to October. As restrictions on gatherings are eased hotels and event venues will begin to welcome back social groups like weddings as well as corporate meetings. As a result of Massachusetts’ recent update to its phased reopening, The Boston Convention & Exhibition Center will host its first large event in over a year in May as it welcomes back the Mizuno Boston Volleyball Festival, an event which could represent up to 8,500 roomnights.

- Domestic travel on the rise – Passenger traffic at New England’s largest airport, Boston Logan International Airport, has begun to see considerable month over month increases. As of mid-March, the airport serviced an average of 17,500 passengers per day, representing a 50% increase from January. Although still a third of its pre-pandemic levels, the passenger statistics are in line with national trends. Since March 11th, the Transportation Security Authority has reported throughput of over one million passengers daily, a milestone not reached since March of 2020. Also encouraging, domestic carriers have increased their capacity over 50% since September.

- Economy on the mend – While unemployment is still high, the job market is recovering and the number of people filing for unemployment is decreasing. The $1.9 trillion American Rescue Plan includes unemployment aid, direct payments, tax credit expansions, vaccine distribution funds, and state and local government relief, all of which should help to spur economic growth. Many economists now forecast GDP to grow 6.5% this year, a considerable increase from the 3.5% decline in 2020.

- Personal saving rates peaked – As consumer spending fell in 2020 due to lockdowns and quarantine efforts, Americans began to save a greater percentage of their money than ever before. While distribution of this savings is not equally distributed across all income levels, it does bode well for those able to travel in the near-term.

- Consumer confidence surging – Consumer sentiment has increased to its highest level in a year. Much of this has been prompted by the government rescue package, vaccine efforts, and the most recent round of stimulus checks. As this confidence rises it will spark more spending, which is likely to include travel.

- New England leisure – The region is a fantastic destination for tourism and leisure activities. Each state boasts areas with outdoor recreation, attractions, and unique experiences to be enjoyed throughout the year. In addition to certain cities, some areas in New England are expected to see a demand levels increase considerably as the weather improves including Coastal Maine, the Green Mountains, Lake Champlain, Cape Cod, Newport, among many other areas.

There are still many unknowns when it comes to the COVID-19 virus and how the world’s travel habits may be altered as a result. The positive changes listed above will begin to shift consumer’s confidence as the ability to travel opens in the coming months. Prompted by the region’s warmer weather in the coming months, New England’s leisure base will allow for a steady recovery for the region. Pinnacle Advisory Group expects lodging demand in New England to ramp up beginning in Q2 driven almost entirely by leisure travel. While demand levels are not expected to reach the highs experienced in 2019 without the return of corporate, group, and international travelers, market performance will be much improved from 2020, the worst year on record for the lodging industry. The length of the recovery to pre-pandemic performance levels, expected to take two to four years, will vary from market to market and from state to state. Some of New England’s major metropolitan areas will likely lag in recovery, specifically Boston/Cambridge, Worcester, Providence, Springfield, and Hartford which have historically relied more on mid-week, corporate and group related demand.

Stay vigilant as the weather improves. Where it is permitted… travel, patronize hotels, dine in restaurants, visit attractions… but do so safely while maintaining public health measures. New England’s travel and leisure industry anxiously awaits your return!