Strong Transient Booking Growth is Welcomed News for Hoteliers in Q1

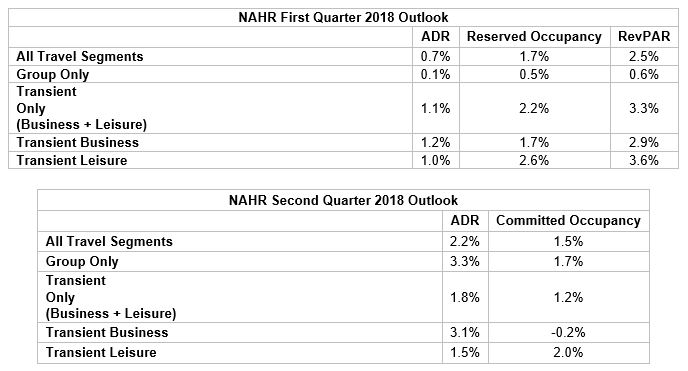

NEW YORK – March 27, 2018 – TravelClick, a leading global provider of data and revenue-generating solutions for hoteliers, today released new data from the Company’s March 2018 North American Hospitality Review (NAHR). According to this data, North American hoteliers are continuing to see growth across all travel segments, up 0.7 percent in average daily rates (ADR) and 1.7 percent in bookings during the first quarter of 2018. This marks an ongoing positive trend from the beginning of the year.

Transient travel in particular is experiencing solid growth in bookings, up 2.2 percent overall, 1.7 percent in transient business and 2.6 percent in transient leisure. This segment is also seeing a boost in revenue per available room (RevPAR), up 3.3 percent for transient travel overall, 2.9 percent for transient business and 3.6 percent for transient leisure.

“With the spring travel season kicking off, the improved month-over-month performance across business and leisure transient bookings is very encouraging news for hoteliers,” said John Hach, senior industry analyst, TravelClick. “Additionally, as we head into the second quarter of 2018, the data shows that both rates and occupancy are continuing to hold steady for now.”

Twelve-Month Outlook (March 2018 – February 2019)

For the next 12 months (March 2018 – February 2019), transient bookings are up 3.4 percent year-over-year, and ADR for this segment is up 2.3 percent. When broken down further, the transient leisure (discount, qualified and wholesale) segment is up 4.7 percent in bookings, and ADR is up 2.2 percent. Additionally, the transient business (negotiated and retail) segment is up 1.4 percent in bookings, and ADR is up 2.8 percent. Lastly, group bookings are slightly up 0.4 percent in committed room nights* over the same time last year, and ADR is up 1.3 percent.

“Hoteliers today have a number of available tools in their toolbox to differentiate themselves from the competition,” added Hach. “At the same time, consumers are becoming increasingly sophisticated in selecting hotels that cater to very specific and time-sensitive needs. Therefore, it becomes especially important for hoteliers to actively invest in digital marketing and forward-looking business intelligence solutions to maximize online exposure and revenue throughout the upcoming peak travel season.”

The March NAHR looks at group sales commitments and individual reservations in the 25 major North American markets for hotel stays that are booked by March 1, 2018, from the period of March 2018 – February 2019.

*Committed Occupancy – (Transient rooms reserved + group rooms committed) / capacity

The first quarter combines historical data (January and February) and forward-looking data (March).