Hoteliers Advised to Plan Ahead and Generate Advanced Reservations for Peak Travel Period

NEW YORK – April 21, 2015 – Hotels in major North American markets continued to maintain positive growth in rate according to data from the April 2015 TravelClick North American Hospitality Review (NAHR). TravelClick’s data reports new group reservation pace – up 13 percent year-over-year – is offering an encouraging sign for hoteliers heading into the peak travel season.

“While 75 percent of the top North American travel markets are experiencing growth, hoteliers, need to monitor the pace of transient reservations, particularly business travelers as this segment has dipped slightly in recent months,” said John Hach, Senior Industry Analyst at TravelClick.

12 Month Outlook (April 2015 – March 2016)

For the next 12 months (April 2015 – March 2016), overall committed occupancy* is up 2.1 percent when compared to the same time last year. ADR is up 4.4 percent based on reservations currently on the books.

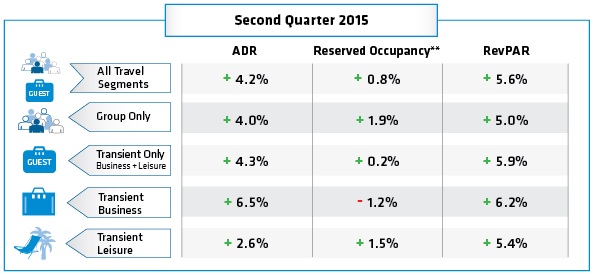

Transient bookings (individual reservations made by business and leisure travelers) are up 1.3 percent year-over-year and ADR for this segment is up 4.6 percent. When broken down further, the transient leisure (discount, qualified and wholesale) segment is showing occupancy gains of 2.6 percent and ADR gains of 2.8 percent. Transient business (negotiated and retail) segment occupancy is down -0.6 percent and ADR is up 6.9 percent. Group segment occupancy is ahead by 2.5 percent and ADR is up 4.0 percent, compared to the same time last year.

Hach continued, “Q2 shows signs of improvement from last month due to an increase in new group hotel booking pace coupled with continued resiliency in overall transient demand. As hoteliers plan rate strategies for the peak travel period ahead, it is especially important that they capture transient demand early with advance booking incentives to stimulate early occupancy gains. To do so, they should be monitoring advance reservation pace with business intelligence.”

The April NAHR looks at group sales commitments and individual reservations in the 25 major North American markets for hotel stays that are booked by April 5, 2015 from the period of April 2015 to March 2016.

*Committed Occupancy – (Transient rooms reserved + group rooms committed)/capacity

**Reserved Occupancy – Total number of rooms reserved/capacity

The second quarter is based on forward looking data (April – June)