By Marcus Lee

Following the COVID-19 pandemic and the significant decline in market performance, hotel demand levels in Greater San Diego[1] have rebounded. Some factors supporting the recovery included the following:

- Stability within the government and military sector

- Increased business activity, including growth in the biotechnology and life-sciences sectors, as six San Diego-based companies, including Janssen and Pfizer, worked on the production of the COVID-19 vaccine

- The strong rebound in leisure travel and the popularity of the region as a tourist destination

- A quick rebound in passenger traffic at San Diego International Airport by year-end 2022

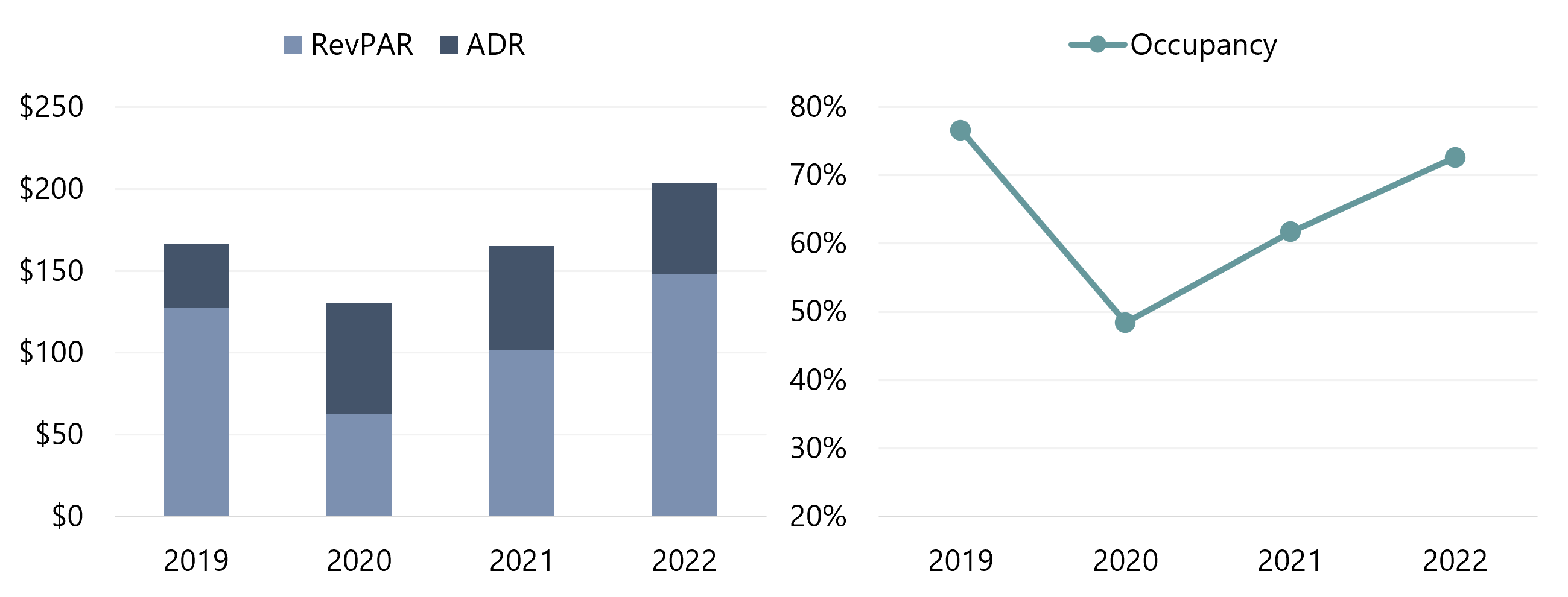

According to data released by the San Diego Tourism Authority, year-end 2022 RevPAR surpassed 2019 levels by approximately $20 (14%), led by ADR increases. ADR for the county in 2022 was approximately $37 higher than the same period in 2019. Notably, year-end 2022 market occupancy levels did not reach pre-pandemic levels, moderated by new supply.

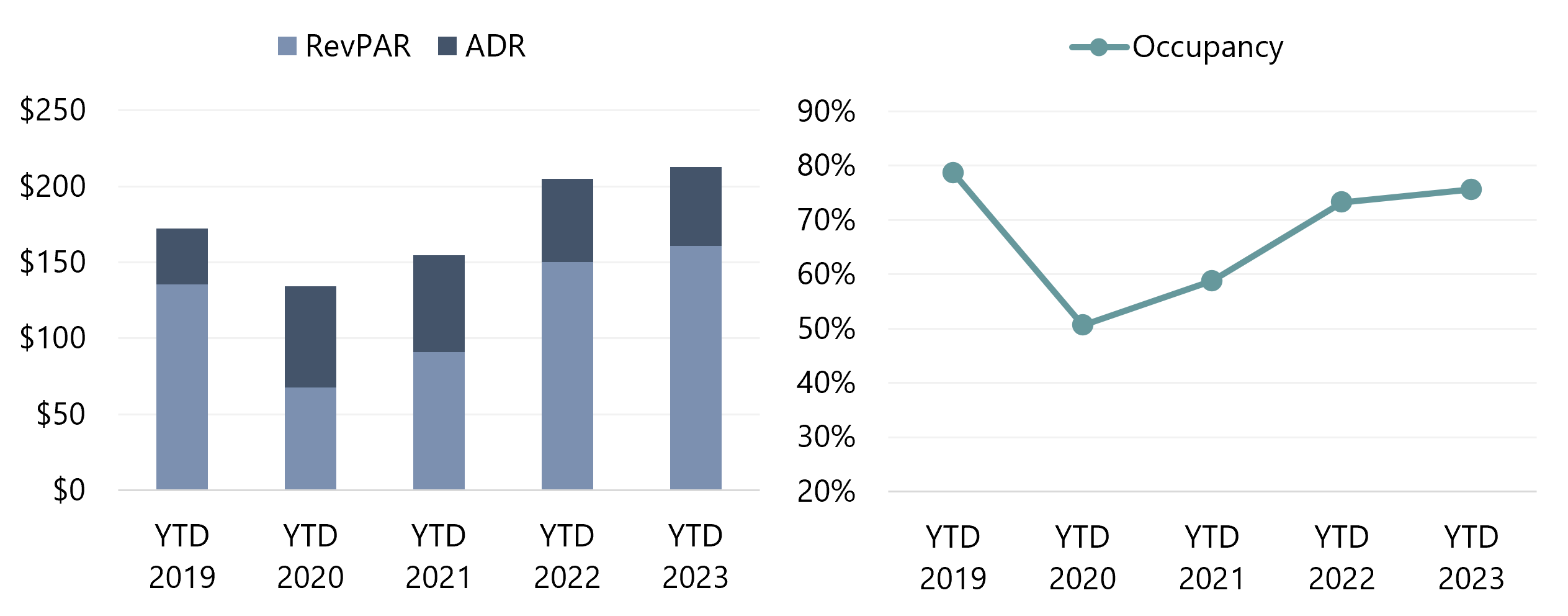

Despite accelerating recessionary concerns, the San Diego lodging industry grew significantly in the first half of 2023, similar to nationwide trends. Year-to-date data through July 2023 show continued strengthening of RevPAR levels, which were 7% higher than the same period last year and 16% higher than the same period in 2019.

The city’s convention and meeting demand continues to recover following the disruption of the pandemic. The 2022 report for the San Diego Convention Center (SDCC) indicated that 91 events were hosted at the SDCC between July 1, 2021, and June 30, 2022, drawing over 300,000 visitors and filling over 583,000 hotel room nights for local hotels. The regional impact of the SDCC in the fiscal year ending June 30, 2022, was estimated at $863 million. This impact remains below pre-pandemic levels, as 143 events and over 836,000 attendees were hosted at the SDCC between July 1, 2018, and June 30, 2019, generating a regional impact of $1.3 billion. The continued recovery of convention and meeting business should bolster the city’s hotel performance metrics.

Development Pipeline Remains Robust Despite Rising Costs

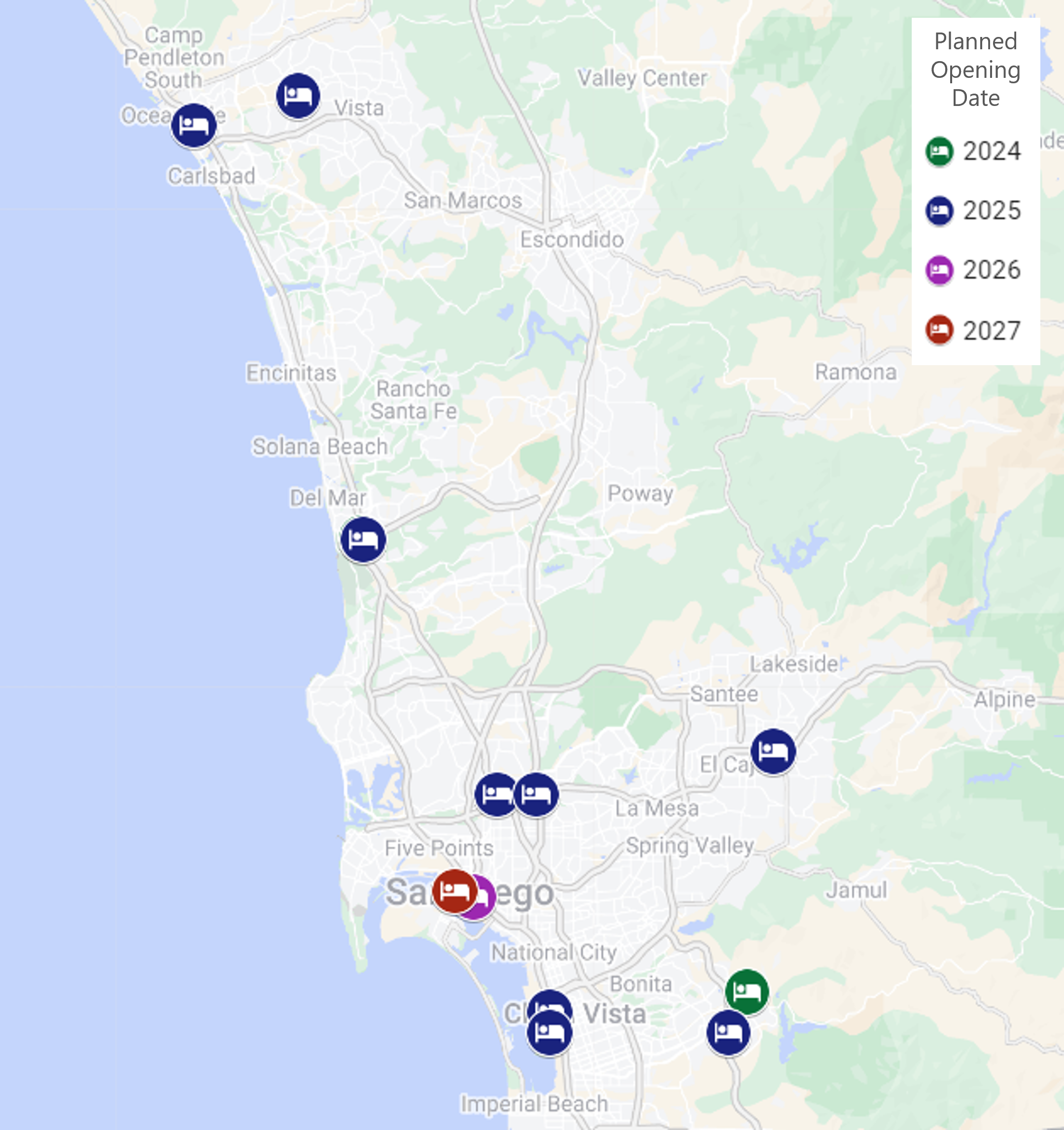

Across San Diego County, the development pipeline is robust, with approximately 2,500 rooms across 33 hotel development projects anticipated to enter the market through 2027. We have highlighted some of the notable development projects on the map below:

Of the 33 hotels under development, as tracked by HVS, more than half are limited- or select-service hotels. The popularity of these product types is primarily due to the high development costs in the last five years, coupled with the proven return on investment for limited- and select-service hotels in the last decade. Furthermore, eleven of the planned hotels, or 33.3% of projects in the development pipeline, are in the extended-stay segment, a nod to this segment’s resilience, particularly at the height of the COVID-19 pandemic.

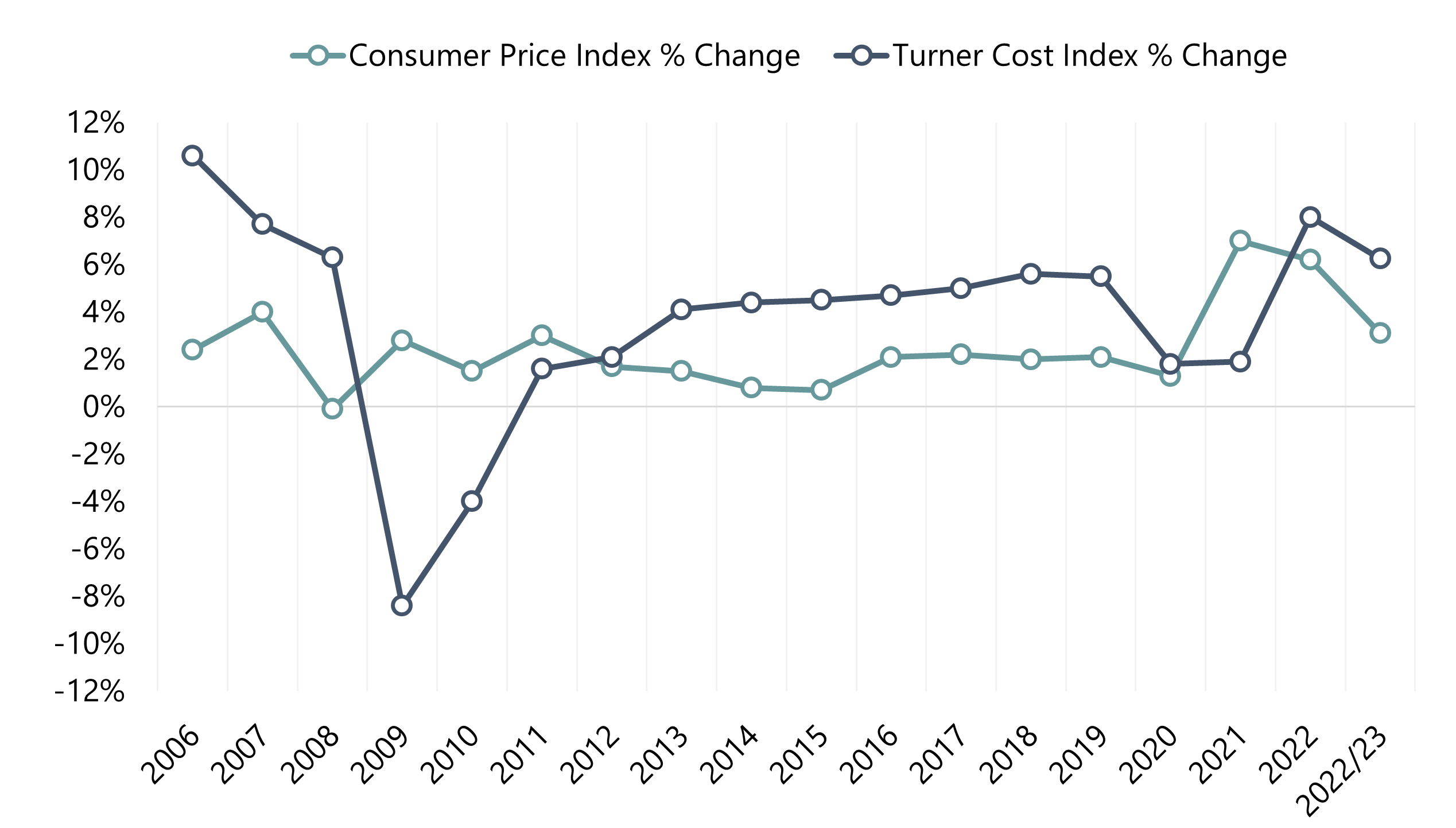

The following chart illustrates the changes in construction costs nationwide, represented by the Turner Building Cost Index,[2] set against the annual change in the Consumer Price Index (CPI). The construction cost index surged 8.0% in 2022 and increased a further 6.25% in the 2022/23 trailing-twelve-month period ending June. This significant growth was due to factors such as labor issues, supply-chain disruptions, and other challenges.

Source: U.S. Bureau of Labor Statistics, Turner Building Cost Index

Due to the rapid increases in construction costs, some development projects within the San Diego area have been modified in recent years. InterMountain Management’s approved Embassy Suites by Hilton Liberty Station project was revised to two smaller-scale hotels, a Fairfield Inn by Marriott and SpringHill Suites by Marriott. Reportedly, Sunroad Enterprises’ plans to build a 450-room resort adjacent to the Hilton San Diego Airport/Harbor Island have been changed to a dual-branded Hyatt Place and Hyatt House. As of mid-year 2023, the project has yet to break ground.

Transaction Market Remains Strong

The transaction market remained robust between July 1, 2022, and August 1, 2023, with 20 hotels changing hands across San Diego County during this period. Comparatively, 27 hotels traded in 2021, 15 hotels in 2020, and 17 hotels in 2019. Some notable transaction trends and transactions are listed below.

- The majority of transactions (approximately 50%) in San Diego County represent limited-service hotels within the economy or upper-midscale STR chain scale. Limited-service assets are popular among buyers in light of the high-operating-cost environment given their more nimble operating model and ability to adapt to changing market demands.

- The 80-key Inn at Rancho Santa Fe was purchased by GEM Realty Capital in July 2023 for $100,000,000 ($1,149,425 per key). Prior to this sale, hotelier Steve Hermann purchased the property in May 2022 for $42,680,000. Hermann, owner of Palm Springs’ famed Colony Palms Hotel and L’Horizon Resort and Spa, is in the process of redeveloping the 20-acre property into a luxury resort similar to his other properties and other famed California resorts, such as El Encanto, a Belmond Hotel in Santa Barbara and the San Ysidro Ranch in Montecito. GEM Realty Capital acquired the asset with the expectation that the transformative renovation would be completed by Hermann by the end of 2023.

- The full-service Marriott San Diego La Jolla and Hyatt Regency La Jolla at Aventine traded in October and July of 2022 for $561,700 and $520,000 per key, respectively. The Marriott transaction was part of Watermark Lodging Trust’s sale to Brookfield real estate funds; the transaction also included 23 other hotels. The Hyatt Regency transaction was the second-largest sale to take place in San Diego within the last five years, at $216,250,000. This sale was between Host Hotels & Resorts (seller) and Rockpoint Group, a Boston-based private equity firm.

The recent increases in interest rates muted the transaction market somewhat in the first half of 2023. Nevertheless, we expect transaction volume to remain robust, as the San Diego hotel market is one of the premier lodging and investment markets in the United States.

HVS continues to monitor the various factors influencing the outlook for the greater San Diego lodging market, including regular conversations with participants in the regional market. For more information about the San Diego market or to inquire about a specific hotel project, please contact Marcus Lee.

[1] The Greater San Diego Hotel Market, as defined by STR, includes all hotels located within San Diego County.

[2] The Turner Building Cost Index has tracked costs in the non-residential building construction market in the United States since 1967. The index is determined by the following factors on a nationwide basis: labor rates and productivity, material prices, and the competitive condition of the marketplace.