By Rod G. Clough

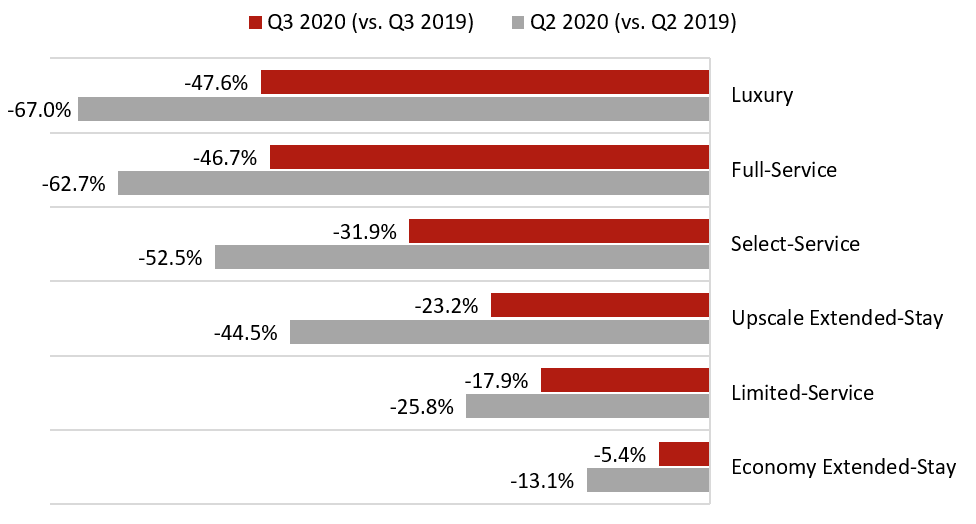

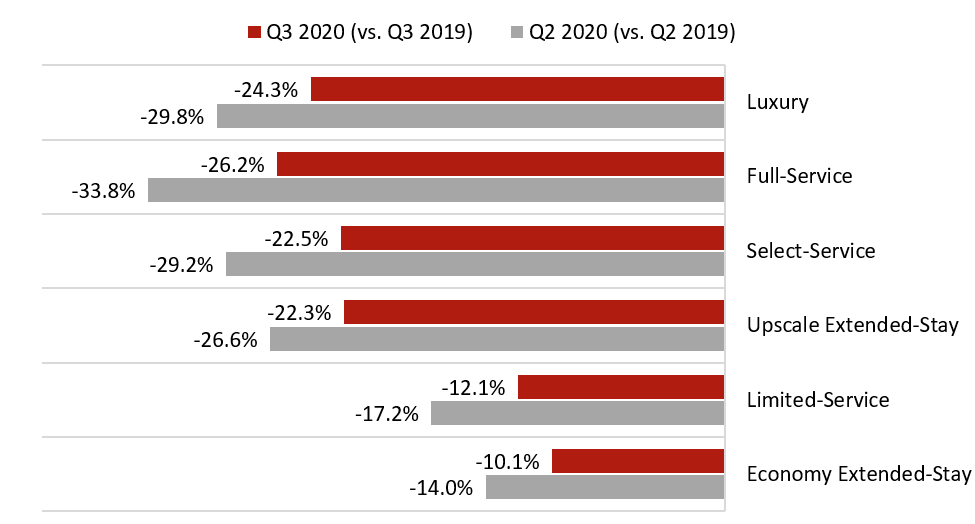

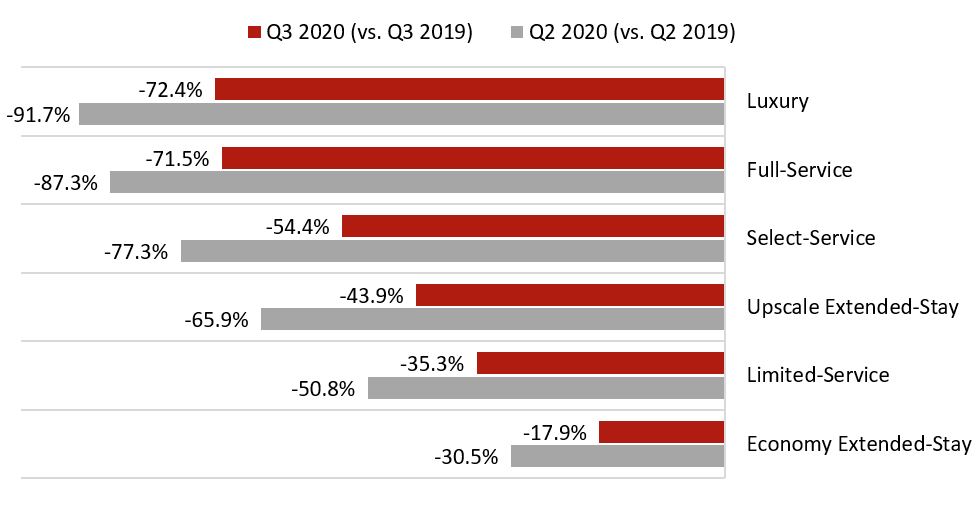

Third-quarter results for public company brands showed marked improvement from the lows of the second quarter, which included widespread lockdowns, strict gathering restrictions, and extreme curtailing of corporate travel. Moreover, during this early-in-the-crisis period, the public at large was generally more willing to reduce or eliminate any travel plans and stay at home. As the summer took hold, COVID-fatigue began to sink in, and more and more travelers emerged from their homes to book vacation travel. More time could be spent outdoors, and restaurants and other leisure-related venues reopened with adjustments for COVID regulations; consequently, more vacations and staycations were booked. Some commercial travel resumed, as well, together with some smaller group bookings. All of these factors together allowed for notable gains in occupancy, versus Q2 data, with less improvement registered in average rate (ADR), as illustrated in the following graphics.

Average Occupancy Decline: Q2 vs. Q3 (Points of Occupancy)

Average ADR Percentage Decline: Q2 vs. Q3

As shown above, economy extended-stay brands nearly reached the same Q3 occupancy achieved in 2019, but with ADR reflecting a 10% discount. Other segments were not quite as lucky, but registered improvement, nonetheless. The greatest improvement in occupancy occurred within the upscale, extended-stay and select-service segments. Some of these hotel assets, which experienced full closures in April and part of May, were again open and acclimating to the new operating environment, inclusive of new contracts with local government agencies, particularly for first responders and healthcare workers. This was followed by contracts with academic institutions to accommodate quarantined individuals in the late summer/early fall.

Average RevPAR Percentage Decline: Q2 vs. Q3

This trend line will not hold, unfortunately, as we live through Q4 and head into Q1 of 2021. COVID infections and hospitalizations have been spiking; accordingly, regulations are intensifying. The heightened spread, lockdowns, and closures or restrictions on the restaurant industry are reducing the appeal of leisure travel, and corporate travel remains largely shut down. We expect the bars in the above graphs to dip further during these next two quarters, although not as low as Q2.

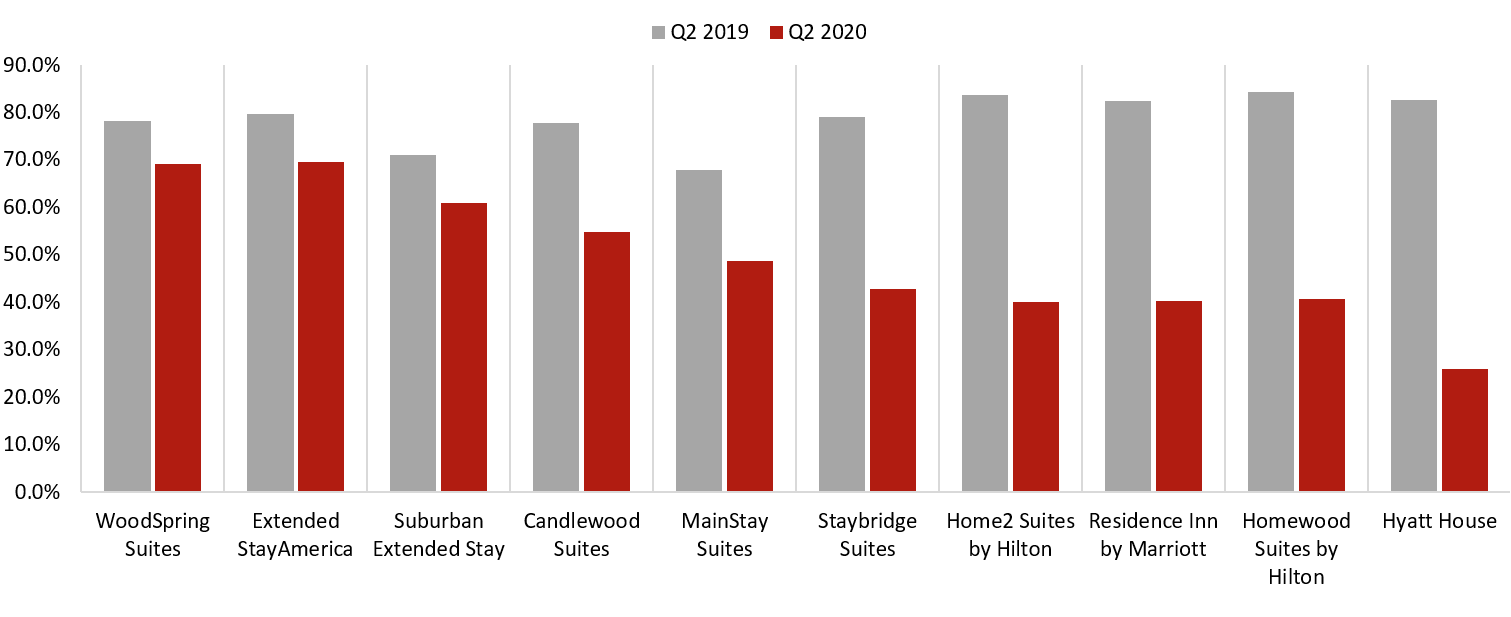

Given the continued strength of the economy extended-stay segment, we illustrate a breakdown of this group’s data by brand in the following graphs.

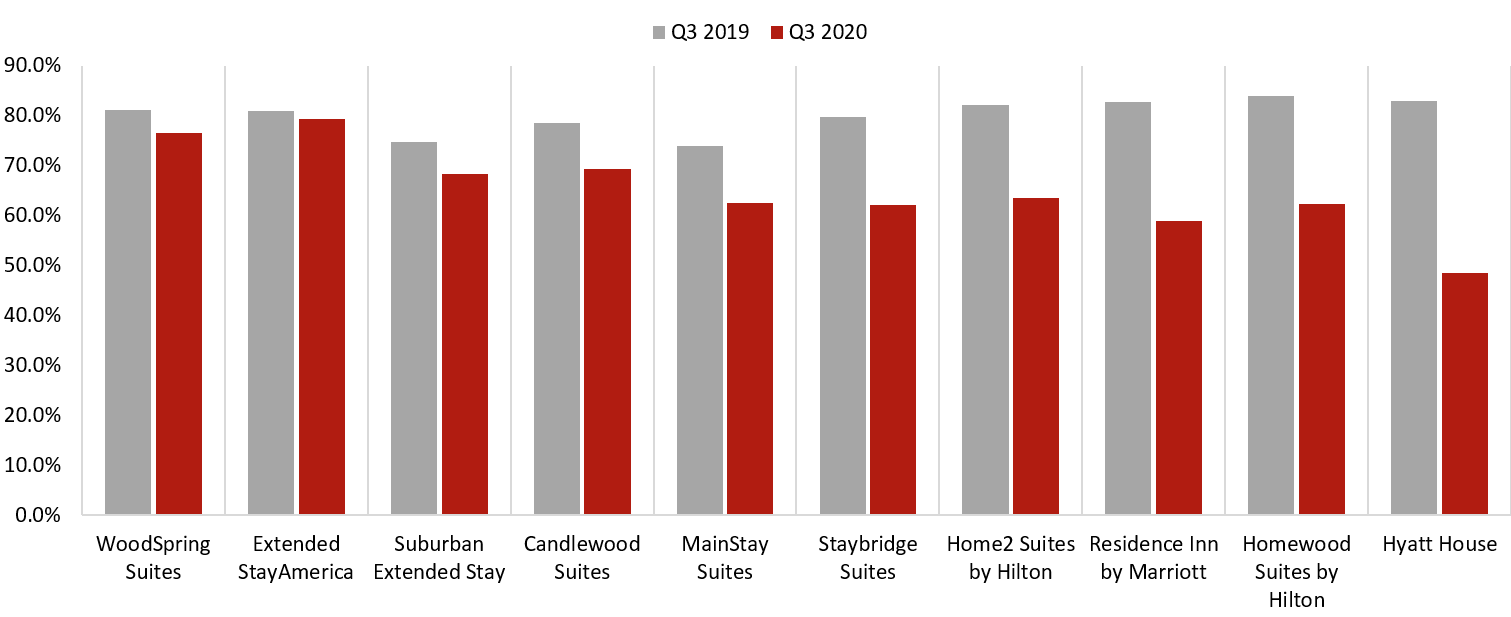

Q2 Occupancy Holds Most for Economy Extended-Stay Brands

Q3 Occupancy Gaps Start to Close

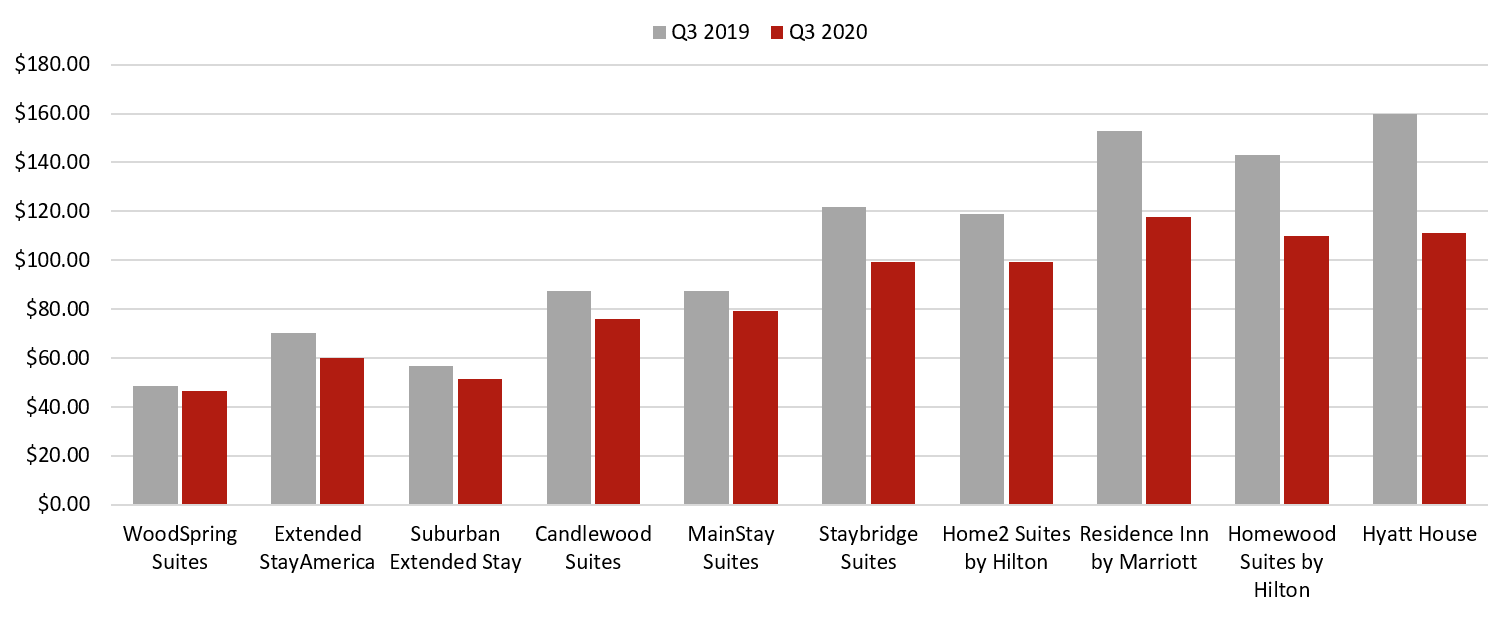

The data reflect that WoodSpring Suites and Extended Stay America (ESA) nearly closed the gap in Q3 occupancy performance in 2020, versus Q3 2019, with ESA showing almost no decline in occupancy. Average rate held steady for WoodSpring Suites in Q3 2020, versus Q3 2019, while ADR did not fare as well for ESA, registering a roughly $10 decline; although, the $10 decline was not as significant as some of the remaining brands’ declines.

In the pre-COVID environment, occupancy trended near 80% for most extended-stay brands. Economy brands are returning to this level the fastest, while the midscale extended-stay hotels recovered closer to the 70% mark for the third quarter. Occupancy levels are trending closer to the 60% mark for the more upscale extended-stay brands.

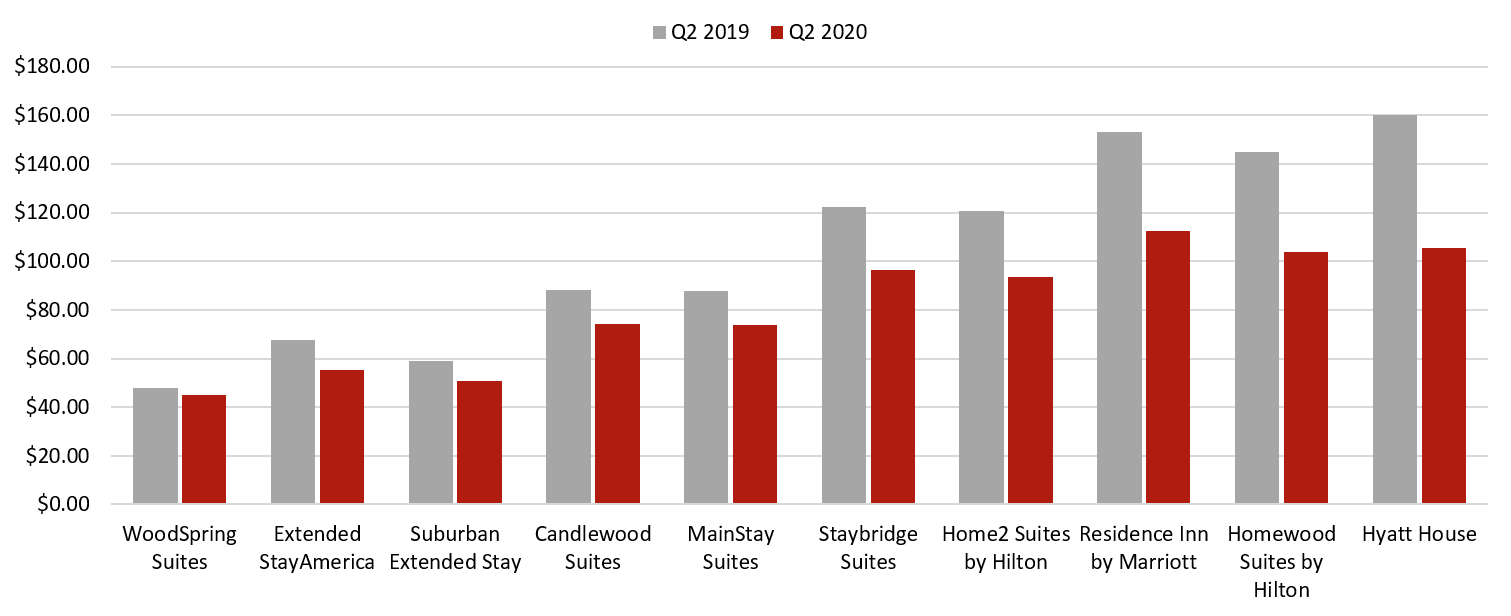

The data indicate that, in this COVID environment, economy-driven extended-stay hotels are achieving average rates bracketing the $50 mark, midscale extended-stay hotels are accommodating demand near the $70 mark, and the upscale extended-stay hotels are trending closer to the $100 level. Average rates are off by $20 or more at the upper end of the asset class, while rate gaps are $10 or less at the opposite, economy end of the scale.

Highlights from a selection of recent stock filings are excerpted here:

“While COVID-19 is still significantly impacting our business, our results for the third quarter showed continued improvement in demand trends around the world. Worldwide RevPAR declined 66 percent in the quarter, a nearly 19-percentage point improvement from the decline in the second quarter. Greater China continues to lead the recovery and demonstrates the resiliency of travel demand, with third-quarter occupancy of 61 percent, and RevPAR recovering to down 26 percent, a 35-percentage point improvement compared to the decline in the second quarter. Third-quarter occupancy at our hotels in North America reached 37 percent, nearly double occupancy in the second quarter, primarily driven by leisure, drive-to demand, with business and group recovering more slowly. Globally, 94 percent of our hotels are now open and welcoming guests.” – Arne M. Sorenson, President & CEO, Marriott International, 8-K Stock Filing, November 6, 2020

“Nearly 90% of our domestic hotels are located along highways and in suburban and small metro areas. Our brands in the economy and midscale segments are utilized by the truckers, contractors, construction workers, healthcare workers, emergency crews, and others who still need overnight accommodations even in this COVID-19 crisis. These travelers are looking for well-known service providers they can depend on for quality and enhanced safety measures. Our recovery is less reliant on air travel or international travel demands, which now factor in additional safety concerns for guests or group business. While we believe our hotels will be able to quickly recover once the pandemic abates, the ultimate timing of any recovery remains uncertain.” – Wyndham Hotels & Resorts, Inc., 10-Q Filing, October 29, 2020

“During the nine months ended September 30, 2020, the COVID-19 pandemic significantly impacted the global economy and strained the hospitality industry due to travel restrictions and stay-at-home directives in place at various times during the period, resulting in cancellations and significantly reduced travel around the world. The reduction in travel has resulted in complete and partial suspensions of hotel operations in many of the locations where our hotels are located, for an indeterminate duration, which, outside of China, largely began in mid-March and included approximately 20 percent of our global hotel properties for some portion of the reporting period. As such, it had a material adverse impact on our results for the three and nine months ended September 30, 2020, and, based on the potential impact of further restrictions and health and safety concerns, we expect it to continue to have a material adverse impact on our results in future period.” – Hilton Worldwide Holdings Inc., 10-Q Filing, November 04, 2020

“As of November 2, 2020, 97 percent of our global hotel properties were open, while approximately 190 hotels had temporarily suspended operations. However, in late October, certain geographic areas re-imposed additional travel restrictions, which may result in further adverse impacts to our hotel operations. Hotels that have reopened have generally experienced significantly lower occupancy, compared with periods before the onset of the pandemic. In response to this global crisis, we have taken actions to prioritize the safety and security of our guests, employees, and owners, and we support our communities. During the summer, we launched Hilton CleanStay to deliver a new standard of cleanliness and disinfection to our properties worldwide as well as Hilton EventReady, which focuses on cleanliness and customer service specific to meetings and events. We also found alternative uses for certain of our hotel properties, including providing housing for first responders and healthcare workers, and provided financial assistance to organizations helping those affected by COVID-19 through our Hilton Effect Foundation. Additionally, we have taken several steps to help our business withstand this uncertain time.” – Hilton Worldwide Holdings Inc., 10-Q Filing, November 04, 2020

“Third-quarter results reflect Hyatt’s ability to adapt to a continuously changing and uneven demand environment. In the third quarter, we doubled the number of room nights sold compared to the second quarter of 2020. I am exceptionally proud of our hotel teams who gained transient demand market share in the segments and geographies of strongest demand globally as they continue to discover and secure demand from many different sources. I am also very encouraged that we opened 27 new hotels representing over 4,300 new rooms, a record number of hotel openings for any third quarter in our history, while sustaining our pipeline for future growth during this disrupted time.” – Mark S. Hoplamazian, President and Chief Executive Officer, Hyatt Hotels Corporation, 8-K Filing, November 04, 2020

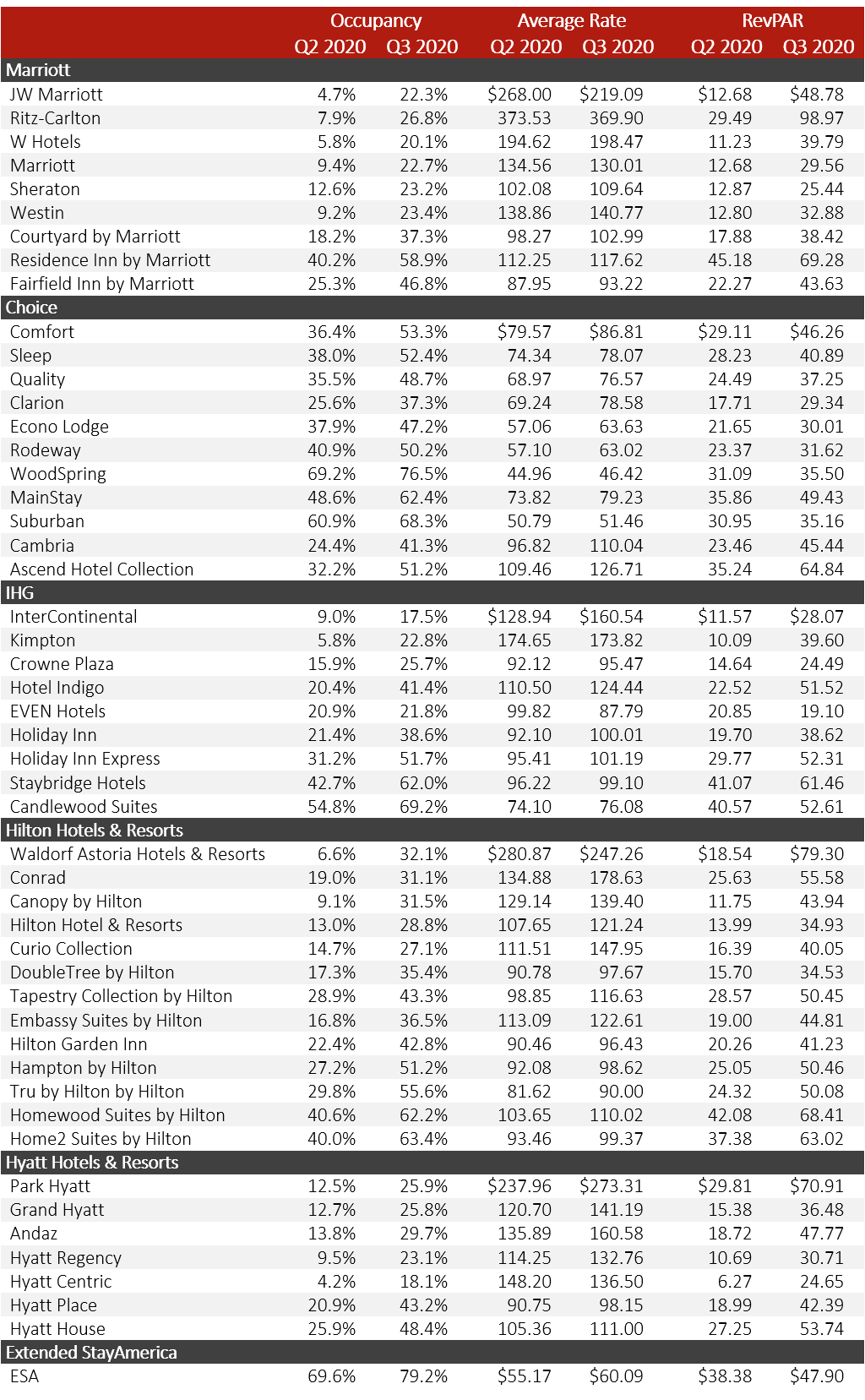

Arranged by parent company, in no particular order, a summary of brand occupancy, ADR, and RevPAR performance for the second and third quarters of 2020 is illustrated below.

HVS continues to monitor hotel performance and trends in hotel values. We look forward to the industry’s recovery in the coming years, as the U.S. population remains eager to travel, meet, and experience destinations across the country.