Atlanta – November 20, 2019 – CBRE Hotels Research forecasts that revenue growth will continue to diminish, but the U.S. lodging industry will remain strong through the next two years. As outlined in the December 2019 edition of Hotel Horizons®, U.S. occupancy levels will dip slightly, but remain above 65.5 percent through 2021, 300 basis points greater than the STR long-run average. Concurrently, rooms revenue per available room (RevPAR) is forecast to increase at less than 1 percent per year during the same timeframe.

“Throughout the recovery from the Great Recession, we have seen the U.S. lodging industry deviate from economic norms,” said R. Mark Woodworth, senior managing director, CBRE Hotels Research. “Despite an economy that has supported strong growth in lodging demand and record occupancy levels, hoteliers have been unable to achieve gains in average daily rate (ADR) commensurate with what we have seen during equally strong market conditions. We believe an environment of high occupancy with low ADR growth will persist for the foreseeable future.”

U.S. lodging industry performance in 2019 exemplifies the new marketplace. The CBRE forecast for the change in lodging demand during the year has improved from a 1.8 percent gain in the September 2019 edition of Hotel Horizons®, to a 2 percent increase in the current edition. The updated outlook calls for the national occupancy rate to remain at the 66.1 percent record level achieved in 2018. This marks the 10th consecutive year without a national occupancy decline.

While supply and demand appear to be balanced, room rate growth potential remains limited. CBRE now is forecasting the annual ADR for U.S. hotels in 2019 to be $131.08, just 0.9 percent over the $129.97 national average in 2018. The net result is a RevPAR increase of only 0.8 percent for the year.

“We’ve researched this ADR challenge and have not been able to identify one unique cause for the separation between high occupancy levels and slow ADR growth,” said John B. (Jack) Corgel, Ph.D., professor of real estate at the Cornell University School of Hotel Administration and senior advisor to CBRE Hotels Research. “Instead we have found several factors that influence ADR change, and the mix of these factors differ among markets.” CBRE determined some factors that have slowed ADR growth include, but are not limited to, growth in local market supply, low inflation, competition from the sharing economy and the expansion of intermediaries in the sales process.

Cycle Within the Cycle

Beyond 2019, CBRE forecasts occupancy levels to decrease in 2020 and 2021, but at a slower pace than forecast 90 days ago.

“We believe that uncertainty, tighter lending requirements and escalating construction costs will mitigate the volume of new supply and risk of oversupply. Concurrently, the economy continues to support the demand for lodging accommodations, thus perpetuating occupancy levels above 65.5 percent,” Woodworth noted.

CBRE reduced its forecasts for ADR growth to below 1.5 percent through 2022. Not only does this result in a lack of real ADR gains, but the low ADR gains limit RevPAR growth to under 1 percent through 2021.

“Like other industries, hotels historically have followed the traditional business cyclical performance pattern: peak, contraction, trough, expansion, and back to peak. By our measure, the U.S lodging industry reached the peak of its current cycle in 2018. History calls for a downturn in 2020 or 2021. However, because the forecast declines in occupancy and real ADR are minimal, we are seeing a slight rollback in performance, which leads to sustained expansion starting in 2022. We expect to see a mini-cycle within the cycle,” Woodworth explained.

CBRE forecasts nominal RevPAR growth rates of 2.1 and 3.5 percent in 2022 and 2023 respectively. This will represent real RevPAR gains of 0.3 percent in 2022 and 1.5 percent in 2023.

Profit Challenges

In a low revenue growth environment, hotel operators’ ability to expand profits will be tested. Low levels of unemployment continue to put upward pressure on salaries and wages which make up half of the expenses at the typical U.S. property.

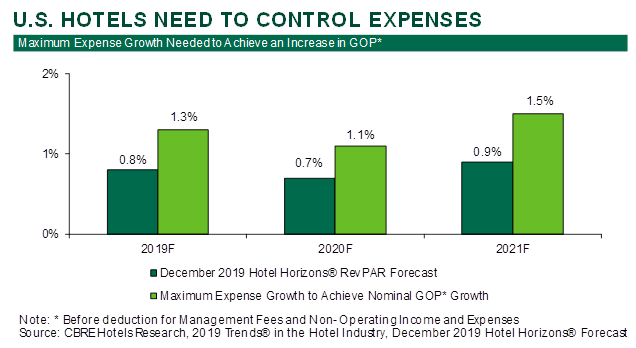

CBRE’s inflation forecasts remain below 2 percent through 2022, controlling the cost of the goods and services other than labor. However, with RevPAR growth limited to less than 1 percent, hoteliers must keep expense growth to under 1.5 percent to achieve nominal gains in gross operating profits. “Considering expenses have increased at an average annual pace of 4 percent since 1960, the challenge ahead is clear,” Corgel added. “Of course, this is all tempered by the fact that GOP margins are near their all-time high.”

“Despite the 2020 and 2021 forecast performance slowdown, U.S. hotels are operating at near record levels of occupancy and efficiency. The growth story is not great, but we expect the U.S. lodging industry to circle back to 2018 performance levels, and beyond, starting in 2022,” Woodworth concluded.

The December 2019 edition of Hotel Horizons®for the U.S. lodging industry and 60 major markets can be purchased by visiting: https://pip.cbrehotels.com

CBRE Hotels is a specialized advisory group within CBRE providing capital markets, consulting, investment sales, research and valuation services to companies in the hotel sector. CBRE Hotels is comprised of more than 385 dedicated hospitality professionals located in 60 offices across the globe.