Will the next few years belong to resorts in leisure destinations or to big city hotels that are driven primarily by commercial demand? Should investors focus on resorts or on business hotels? In an evolving hotel industry such as India’s, such questions do not have one conclusive answer. This notwithstanding, some exciting trends have been observed in hotel development, operation and consumption, which point to the serious emergence of resorts as a credible investment class.

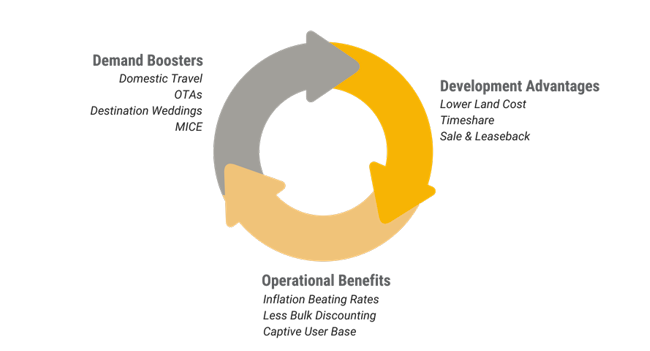

1) Consumption versus Investment – The Indian growth story has always hinged on two aspects: investment-led growth (linked to private capex which is still soft) and consumption-led growth (directly linked to the demographic profile). While business hotels depend on the former, the business model of resorts is largely centred upon domestic travel. As tourism is an income-elastic activity, rising incomes have enabled Indians to travel more and use resorts in leisure markets.

2) Land cost factor – Emerging or obscure leisure destinations are not hamstrung by land cost in the same way as city hotels are. Hotel projects in urban locations need to plan up to 50% of their project cost towards land acquisition, while resort locations are typically seen to limit their land cost component to around 10-20% of the project cost. The benefit of lower per unit land cost is a clear starting advantage for resorts.

3) Room rates linked with quality of experience – Travellers on vacation are more amenable to the idea of a discretionary spend for differentiated experiences. Leisure markets offer opportunities to investors to choose from both ends of the market: a distinct experience-based stay (low volumes, high rates, high development cost) or commoditised lodging (large volumes, low rates, low development cost). Either way, resorts are better positioned to grow room rates in-line with or ahead of inflation.

4) Bulk buying means large discounting – The demand segmentation of city hotels leans heavily towards the corporate and airline segments. These segments jointly contribute close to 60% of the accommodated demand, with large discounts on the best available rate. Resorts, on the other hand, have 25-30% of their accommodated demand from groups, and the largest share of room nights from the Free Independent Traveller (FIT) segment.

5) Online sales as the X factor –Travellers are discovering new leisure markets and ‘hidden’ resorts, thanks to the immensely powerful reach of online travel agents and metasearch engines. Around 50% of hotel bookings in western markets are made online but India is still an early adopter, with 17% online bookings (International Telecommunication Union, 2015)*. The once ubiquitous 50% occupancy mark associated with the seasonality in leisure markets has been steadily increasing, with Agra (61%), Jaipur (65%) and Goa (72%) leading the way.

6) Better utilisation of in-house guests – Usage by captive clients in resorts allows for higher revenue realisation from restaurants, spas and other paid amenities. Gross revenue per available room in resorts is observed to be higher than in city hotels. Resorts, therefore, generate a better return on the cost they incur to acquire their customer.

7) Destination Weddings & MICE – Destination weddings are a confluence of vacation, family celebration, haute cuisine, high fashion and social networking. This specialised event type has re-energized and de-risked the otherwise dull and touristy markets of Udaipur and Jaipur, while adding muscle to established leisure markets like Goa. Large-format resorts across the country have recognised and benefited from the immense potential of social gatherings and business events.

8) Timeshare as an alternate capital model – Resorts can raise cheaper equity capital from the market via deeded timeshares. A typical timeshare buyer will pay an upfront fee for the 1/52th share of a room for a week-long ownership. To offset the impact of high debt cost, resort owners have in some cases, chosen to raise equity capital by allocating a third or more of their inventory towards timeshare arrangement. Lesser debt allows the resort investors to de-risk the hotel investments, at least partially.

9) Sale and Leaseback – Hotel developers are mostly impacted by the high cost of capital while end-investors are dissatisfied with low rental yields from residential real estate (around 2%). In the sale and leaseback model, the title is transferred and then leased back to the existing seller as a tenant under a master lease. Proceeds from the hotel are shared between the lessor (end investor) and lessee (the developer). Globally, leisure resorts are considered to possess an ideal constitution for sale and leaseback deals. Despite its rather chequered history, this model offers efficient and patient capital for resort development in an emerging market like India.

These major advantages notwithstanding, resorts in leisure locations have their own pain points. Key issues faced by investors in India include high barriers to entry, low quality of data, unresponsive local governments, high GST and weak infrastructure. While these are all relevant concerns, investors would be well advised to look out for a few critical conditions to set up a healthy and scalable business around the bourgeoning leisure travel and stay market of India:

i) Air connectivity – Only 75 out of 400 airports in India are currently operational, most of which are concentrated in commercial centres and state capitals. However, multiple initiatives by the government are helping this scenario to change. Resort markets like Puducherry, Coorg, Gangtok, Mount Abu and many others will open up as investment grade markets, once they gain adequate flight connectivity.

ii) Distance from feeder market – Affluent travellers are money-rich but time-poor. Regional markets located within a 300km driving distance to key feeder markets also tend to be favoured for quick weekend travel. Proximity to retail and MICE demand makes such short-haul markets good investment cases. Such markets include Agra, Shimla, Nainital, Mussoorie (New Delhi); Lonavala, Matheran, Mahabaleshwar (Mumbai); Coorg, Mysuru, Yercaud, Ooty (Bengaluru); and Puducherry, Mahabalipuram (Chennai).

iii) Size and scale – Well-sized resorts with 100+ rooms can amortize high capex and high fixed expenses over a larger inventory. But at the same time, only deep markets can support such large resorts. While a 40-room resort in Coorg or a 15-tents resort in the hills may well be profitable businesses, such properties may not be suitable for investors seeking scalable businesses with strong returns.

For far too long, resort projects have been driven by passion instead of astute commercial sense. We believe that some of the positive socio-economic conditions discussed above have opened an investment-worthy environment for resorts. Independent investors, family offices and even some hotel management companies are actively reviewing investments into leisure destinations. Hotelivate Investment Advisory expects approximately USD300 million investment to flow into leisure markets over the next five years in greenfield projects and secondary sales deals.

*BCG Google Demystifying the Indian online traveller – June 2017

For more information, please contact Saurabh Gupta on saurabh@hotelivate.com