By Scott Cohen

Introduction

The hospitality sector continues to be one of the world’s fastest expanding industries – with global estimates reaching $1.6 trillion in 2018. The market is being driven both by more disposable income from emerging economies and also rising desire to travel more broadly in the developed world. The number of international travelers has doubled over the last 20 years with growth not only in developing countries, but also in established markets like the U.S. which is on pace for another record breaking year in 2018. Further, strong economies also mean a healthy demand for business travel so the sector is seeing increased revenue from multiple areas. The opportunity for hospitality companies is clear – the challenges lie in changing consumer behaviors and stiff competition for traveler interest.

One of the biggest consumer shifts contributing to hospitality industry success is a focus on experiences rather than products. As experience providers, hospitality brands – restaurants, transportation, hotels and resorts – are well-positioned to benefit from this trend. Leading companies are evolving that idea to leverage the entire traveler lifecycle, expanding customer touchpoints and personalization to build consumer loyalty. In its 2018 Hospitality Industry breakdown, Deloitte Consulting frames the hospitality opportunity as “data-centric personalization” – know me, engage me, empower me, hear me and delight me. Per Deloitte, “innovation will inevitably spark growth and change across the sector in 2018. Established industry players should stay nimble, alert—and perhaps even a bit daring.”[1]

So, how can leading brands stay ahead of the competition? The answer is by listening to customers – both within hospitality and also in adjacent spaces that impact the industry (e.g. healthy living, family needs, etc.). Social listening is uniquely suited to inform an overall traveler strategy and the individual personalization needed to help hospitality companies differentiate from the competition. Specifically, social listening complements other research with unfiltered consumer opinions, immediate feedback on traveler experiences (both your own and competitors), and insight into broader category trends.

This guide focuses on helping you get more out of your customer experience initiatives. The analyses highlighted focus on industry leaders using social data to:

- Identify category and audience trends to improve experience offerings

- Analyze the entire traveler lifecycle to build lasting customer relationships

Remember, beyond the specific insights, this guide provides analysis frameworks that can be repeated for any hospitality brand looking to get more out of social analytics.

Who this guide is for:

- Digital Marketers build brands and drive more engaging campaigns

- CX and Customer Care teams looking to improve digital and travel experiences

- Operations teams looking for product trends and customer feedback

Category & Audience Segmentation

As mentioned above, health and fitness are only increasing in importance for hospitality companies. Further, wellness offerings drove the highest level of positive sentiment across all brands. Rather than approaching this analysis from the brand perspective, social listening provides hospitality companies a way to better understand consumer needs, identify new trends and enhance product offerings. Specifically, we can analyze the category (fitness, health, wellness, etc.) or the audience (fitness lovers and/or domains where they congregate).

Hotel Spotlight: Westin

The Westin hotel chain has long been associated with providing excellent fitness options including gear lending and the chain’s partnership with New Balance. How can Westin use social listening to continue to innovate in this area?

First, we can take a look at consumer needs in the fitness category. When looking at a category, there is often a lot noise, unwanted or less interesting conversation. To help narrow down to actionable insight, we suggest a few approaches:

- “Personal narratives,” people talking in the first-person

- Original posts, which helps remove shared articles and retweeted conversation

- Sentiment drivers, key emotions and behaviors related to wants and needs

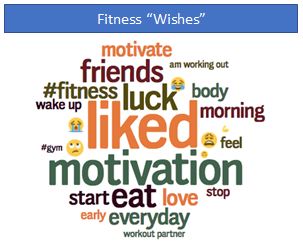

Taking this category view, an interesting trend emerges. What consumers “wish” is that someone else “liked” going to the gym with them. The concepts of motivation, workout partner, and friends are all related – even fitness enthusiasts are looking for a companion to workout with.

This idea is one that Westin is already leveraging in multiple ways. Westin offers “well-being” experts, “a globally diverse group of wellness experts to guide and inspire [the] guest experience.” Westin has over 200 of these experts, who “are now doing evening runs in addition to morning group runs because they noticed more travelers, especially business travelers, wanting another opportunity for networking that wasn’t just limited to hitting the bar.”[2] Westin recently took that partnering mentality even further, signing a deal with Peloton, the popular connected cycling company, to provide virtual group fitness.

Beyond looking at the category for insights, we can also dive into the audience – a key part of building an authentic connection with travelers.

One way to analyze an audience is look at specific domains where that segment talks online. Usually, this takes the shape of several domains related to the category. Alternatively, Reddit forums are an excellent way to understand what is trending in a community. Within NetBase, we analyze trends by combining both the total volume of the conversation and the change in conversation versus the prior period into a “trend score” – that way, a change from 50 to 200 is counted as more significant than a change from 1 to 10 (as an example). Looking at trends within the Fitness Sub-Reddit, we can see a couple potential opportunities for Westin – Examine.com and the Greyskull workout, the former is a site for supplement information and the latter is a dumbbell workout. While this Reddit thread is different than Westin’s core audience, it does provide a window into understanding new opportunities and potential partnerships to reach that audience.

Another way to analyze an audience on social is to build a query only based on the authors themselves. In this case, we can take our workout enthusiasts from step 1 and turn that into a segment – analyzing everything they talk about, not just fitness. The audience for this analysis includes nearly 50K fitness enthusiasts with a full year of conversation. For each analysis, we can compare the segment versus the general population to see what makes them unique.

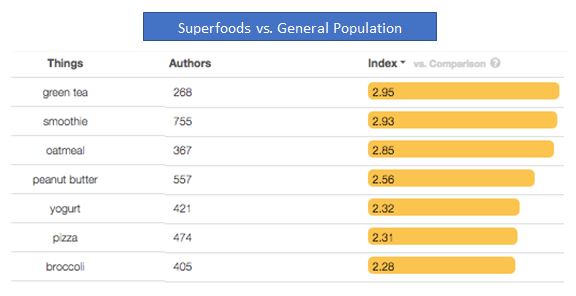

Starting closer to home, we can analyze the audience to tailor menus to those that are fitness conscious. One theme to analyze is common ingredients or healthy options. A few potential options emerge, particularly green tea and oatmeal. Both of these items significantly over-index versus the general population and are accessible at a Westin – green tea as an in-room option and instant oatmeal for the health conscious traveler on the go.

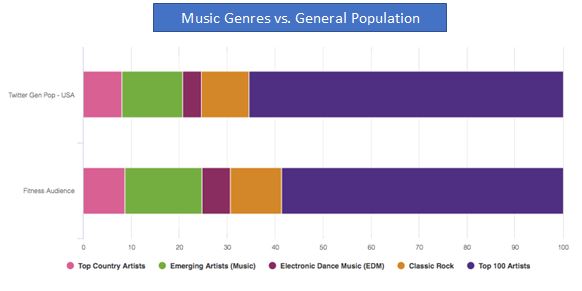

Moving more broadly, we can analyze the audience’s tastes across a variety of categories including popular content, music, and even travel. Examining fitness enthusiasts’ music taste, it’s interesting to see their choice in genre – over-indexing on both emerging artists and EDM. This could help to inform overhead music in hotel gyms, potential workout playlist recommendations, and other unique forms of personalization.

Finally, we can broadly look at the travel category and how fitness enthusiasts discuss their travel plans. Unsurprisingly (but also validating!), “gym” is the most over-indexed travel term. “Anxiety” is an interesting insight with most of the worries related to night before departure, navigating airports, and airplane travel. Another interesting finding is who the audience talks about traveling with – their “girls” followed by their parents (dad, mom, parents). The fitness audience on social does lean more female (1.3x vs. general population) and the intersection of “girls’ trips” with fitness/wellness offerings is a natural fit.

Summary

Wrapping up all of these analyses, social listening allows hospitality brands to look beyond their own walls and find insights to better engage target segments and drive authentic traveler experiences. In this case, Westin is able to continue to build on its industry leading fitness positioning, but other brands can just as easily leverage a tech-savvy audience, a foodie identification, an entertainment specialty, etc. For effective social listening on category and audience trends:

- Filter out the noise by focusing on consumer posts and sentiment drivers.

- Identify communities of interest and monitor their active forums for growing trends.

- Build custom audiences to identify unique offerings tailored to your target segments.

Traveler Lifecycle & Attribute Analysis

Whether a boutique hotel or global brand, part of the key to success is understanding traveler perceptions at each stage of the lifecycle – from awareness to booking to anticipation to on-trip and finally post-travel. Social listening provides actionable data for your brand in two ways: competitive comparison at each stage of the journey and brand associations/attributes relative to other brands. For the former, your brand can identify where you are driving the most conversation and whether it is supporting or diminishing the brand. For the latter, social data provides feedback to marketing strategy to evaluate branding effectiveness.

Hotel Spotlight: Marriott

Always an industry leader, Marriott does particularly well in the areas of understanding consumer experience by hotel type and aligning brand attributes to each target segment. David Beebe, the company's VP of global content, “job 1 is getting inside the heads of each hotel chain's customers and offering them the experience that fits their lifestyle.”[3] To understand part of Marriott’s effectiveness, we can compare the hotel’s master brand versus Hilton and Hyatt across the travel experience.

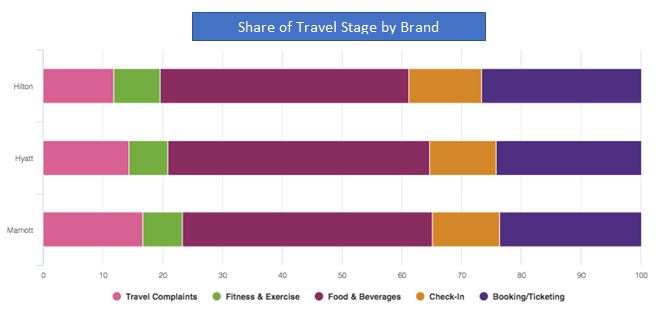

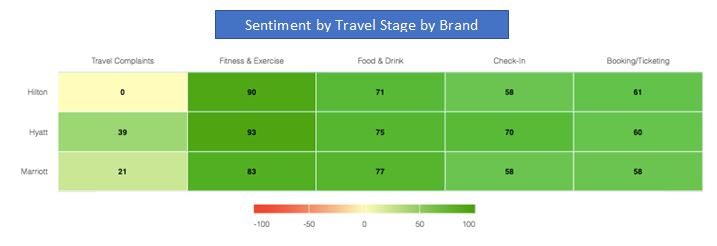

This analysis provides a couple of key insights – what do travelers talk about the most and where is Marriott doing well versus competitors. Interestingly, food and drink is a major conversation driver regardless of brand. Analyzing the common keywords – coffee and wine were the most used across brands – either customers referencing their start to the morning (coffee in their rooms) or having a happy hour drink after work. These trends are reflected in Marriott’s new tailored services – notifications to guests about local coffee shops and partnerships with Food & Wine.

Marriott does have a larger share of travel complaints – is this a concern? Digging further, we can see that sentiment is actually relatively positive – with Hilton having the lowest sentiment amongst the group. One of the main drivers for Hilton’s negative sentiment is policy related – new, stricter cancellation timeframes. While Marriott introduced the policy first, it is talked about 4X more often within the Hilton conversation so may be a bigger pain point for their audience. One final point on the lifecycle – we can see that sentiment is highest across all brands for the fitness component of the hotel experience. That represents an opportunity for the sector generally and we show how social can dive into that audience in the next section.

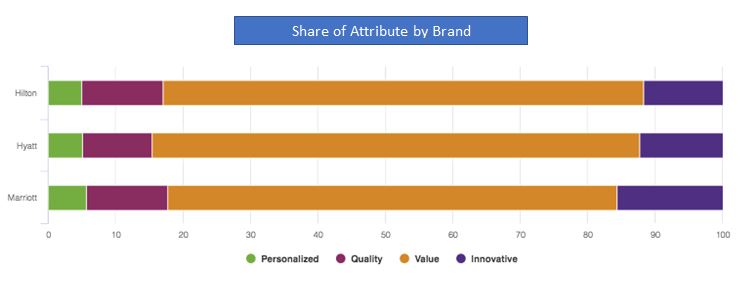

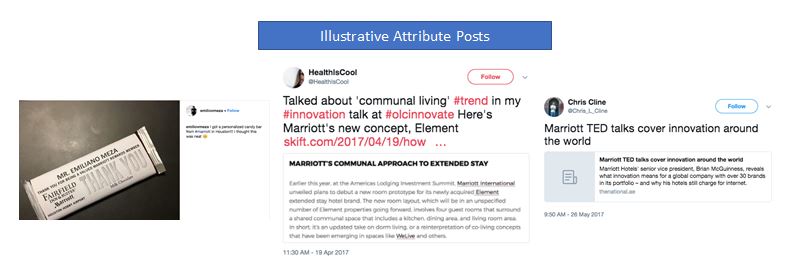

Beyond analyzing each stage of the traveler journey, hospitality brands can also use social listening to validate and optimize brand positioning by tracking attributes relative to the competition. In this case, we can look at some of the trends facing the industry – ones that Marriott is leveraging particularly well. Over the last few years, Marriott has made major investments in its technical concierge services, diversified product portfolio and content focused on different traveler types – but is that working?

Using the same share of voice analysis, we can see that Marriott is winning in two of the areas impacting hospitality most – personalization and innovation. Share of each attribute has grown within the Marriot conversation over the last year as well, from 4% to 6% and 12% to 18%, respectively. Both consumers and industry professionals are recognizing Marriott’s success in each area – engaging with content and associating the brand with industry leading trends.

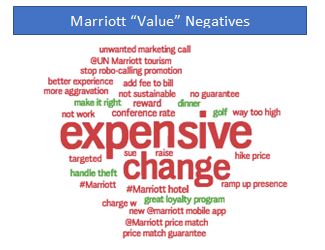

Interestingly, there was one area that Marriott did less well – sentiment towards value was lower than other brands. In this case, we can look just at negatives to see what is driving that conversation. Beyond the generic “expensive,” a few insights emerge. First, “change” is related to the Marriott/SPG merger – consumers have noticed that significantly more hotels are “changing” to a higher hotel category, devaluing their points. While there are economic reasons for the decision, it’s clearly something for Marriott to monitor as this represents a passionate and valuable customer segment. Secondly, marketing messages, particularly the Vacation Club promotions are driving negative feedback. These robo-calls are the anti-thesis of the rest of Marriott’s personalization and likely a tactic to be avoided.

Summary

The analyses above provide a framework for any hospitality brand to measure versus the competition and identify insights to improve both specific experiences and marketing content. While we only touched on a few parts of the traveler journey, use social listening to break out (and consistently tracking) your brand by journey stage and then focus on opportunities for differentiation (positives) or areas for improvement (negatives). Remember, when setting up this analysis:

- Select the relevant competitive set for your brand – matching apples to apples on low-cost versus luxury offerings.

- Segment each stage of the journey by where you can make an operational impact – and use traveler language to capture as much of the conversation from the consumer point of view as possible. Link social data to other data, particularly market research, by extending brand strategy into social attribute listening.

Conclusion

As consumers become more and more experience-driven, the hospitality industry will continue to be the beneficiary. The analyses above – brand differentiation, audience segmentation, and customer care optimization – all provide ways for leading brands to use social listening to maximize that opportunity. If anything, the universe of social data is almost too broad and one of the common challenges we see for hospitality brands is knowing where to start to find that signal amongst the noise. We typically see a few common traits of hospitality brands that are successful in social listening: clear purpose/brand strategy, a process for putting insight into action, and consistent measurement over time.

Another key driver of success is focusing on a set of primary use cases, showing value, and then expanding to new opportunities. Trying to “boil the ocean” or “democratize” social data is difficult without proof points. There are loads of additional social listening use cases to consider – influencer marketing, location-based targeting, survey/CRM text analysis – just name a few. Start small and increase the odds of social listening success by focusing research on key business objectives (your purpose) and then continually refining marketing tactics (process and measurement).

[1] https://www2.deloitte.com/content/dam/Deloitte/us/Documents/consumer-business/us-cb-2018-travel-hospitality-industry-outlook.pdf [2] https://skift.com/2017/01/09/future-of-hotel-fitness-more-on-demand-tech-driven-and-branded/ [3] https://www.inc.com/adele-cehrs/inside-the-worlds-largest-hotel-chain-6-strategies-for-success.html